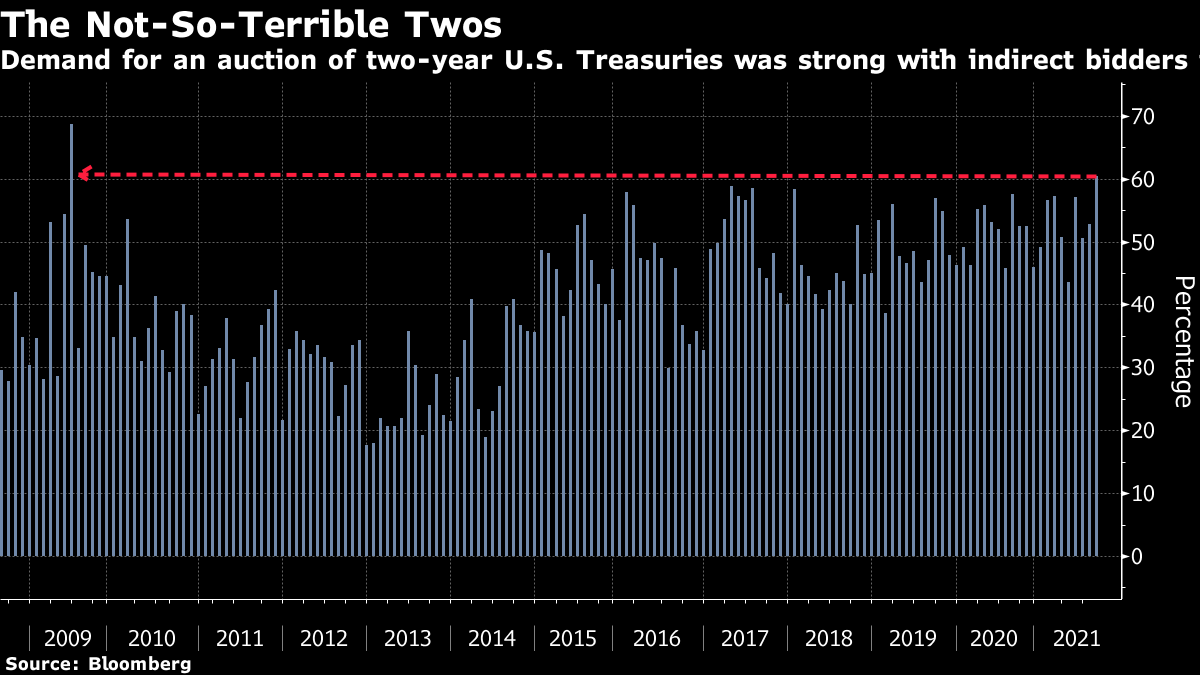

| Biden rebuffs calls to extend Afghanistan evacuation deadline — but he has a backup plan. Chinese companies listed in the U.S. must tell investors about risks they face. Things are looking good for Asian stocks, again. Here's what you need to know this morning. Biden rebuffed calls from international allies and members of Congress to keep U.S. troops in Afghanistan past his August 31 deadline, saying the U.S. is confident it will complete evacuations by then. However, he has ordered his national security team to come up with contingency plans if he determines that a delay is needed.The Biden administration has asked refugee aid organizations to prepare to receive and resettle as many as 50,000 Afghans evacuated under a stopgap program as the U.S. accelerates flights out of Kabul ahead of an end-of-August deadline. Meanwhile, China has its eye on Afghanistan's $1 trillion of minerals essential to modern technology. Asian stocks look set to track U.S. gains as strong corporate earnings and a commodity rally boost confidence in the economic recovery from the pandemic. Treasuries and the dollar declined. Futures rose in Japan, Australia and Hong Kong. U.S. contracts were steady after the S&P 500 and the Nasdaq 100 closed at record highs. In commodity markets, oil extended gains in part on China's success in stamping out virus flare-ups, which is easing some of the concerns about the impact of the delta variant on demand. The Securities and Exchange Commission will demand that the more than 250 Chinese companies trading in U.S. markets better inform investors about political and regulatory risks, expanding a dictate that it recently imposed for firms seeking initial public offerings. SEC Chair Gary Gensler said in an interview that he envisions the enhanced disclosures being included in corporations' annual reports beginning early next year. The new details would likely include information about the businesses' shell-company structures, he added. Investors need "full and fair disclosure," Gensler said. Companies affected include tech giants Alibaba and Baidu. As Fed officials gear up for the Jackson Hole symposium, their response to the pandemic is being criticized as risky by counterparts in Beijing, trying to decouple China's monetary policy from the U.S. The CCP's politburo has pledged "greater autonomy" of macroeconomic policies, signaling a willingness to add stimulus as China's recovery loses steam, even if the Fed starts tapering bond purchases. Meantime, China's central bank is far more worried that America's unprecedented stimulus since the pandemic will lead to a surge in U.S. inflation than the Fed's benign view. And the Hong Kong dollar, one of the dullest currencies in the world, is gaining attention as it's caught in the crosshairs of China's regulatory crackdown and bets on higher U.S. rates. The U.S. House adopted a $3.5 trillion budget resolution after a White House pressure campaign and assurances from Speaker Nancy Pelosi helped unite fractious Democrats to move ahead on the core of President Joe Biden's economic agenda. The 220-212 vote puts to rest, for now, an intra-party rift between progressives and moderates that threatened to derail Pelosi's strategy for shepherding through the budget framework and the separate $550 billion bipartisan infrastructure bill the House plans to pass by the end of next month. House and Senate committees are already at work trying to craft portions of the spending package that will fill in the details of the budget resolution on climate change, tax hikes on corporations and the wealthy, tuition-free community college, a Medicare expansion and more. This is what's caught our eye over the past 24 hours: It's a weird day in markets when stocks reach yet another record while an auction for short-term bonds turns into one of the best in history. The S&P 500 closed up 0.15% to hit yet another all-time high, while a $60 billion auction of two-year U.S. Treasuries was a hit with investors. Indirect bidders — a category which includes foreign central banks — took in 60.5% of the debt offered. According to Bespoke Investment Group, that's the largest share of a two-year auction since June 2009 and a proportion that's been surpassed only two other times since 2003. Yields on two-year Treasuries dropped after the auction as dealers continued to scramble for short-term debt.  All of this is happening in Jackson Hole week, when there's a chance the Federal Reserve could start to outline a path towards tapering. Perhaps demand for both short-term bonds and risk assets suggests the central bank has been able to successfully divorce the idea of "tapering" from interest rate hikes in order to avoid a repeat taper tantrum (an idea that's been floated by Dallas Fed President Robert Kaplan recently). Or perhaps markets really are just weird. |

Post a Comment