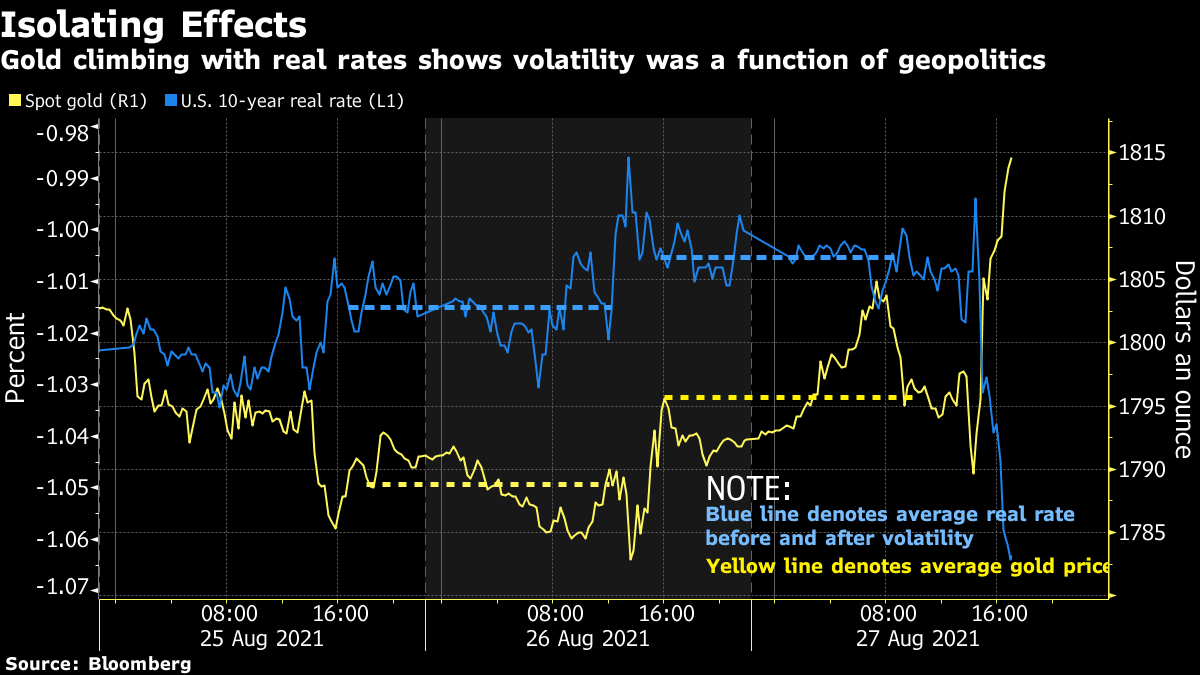

| Good morning. Hurricane Ida, Israel and U.S. on Iran strategy, attack in Afghanistan, booster shots. Here's what's moving markets. Hurricane Ida pummeled New Orleans and the Louisiana coast overnight with lashing rain and ferocious gusts, leaving much of the region without electricity and bracing for widespread floods and devastation. U.S. gasoline futures jumped and oil was steady after the hurricane barreled ashore in Louisiana. This week, traders will weigh the fallout from Ida, as well as the likelihood that OPEC and its allies will go ahead with an increase in output when it meets on Sept. 1. Israel and the U.S. have agreed to pursue a joint strategy to halt Iran's nuclear program, Prime Minister Naftali Bennett said. Bennett, who met with President Joe Biden on Friday, said Israel had made "significant headway" in equipping its military and had also made progress on its bid for visa-free entry for its citizens to the U.S. Following the meeting, Biden said with regard to Iran that the U.S. is "putting diplomacy first and seeing where that takes us." A U.S. drone blew up a vehicle heading for Kabul airport that officials say was carrying several suicide bombers, according to U.S. Central Command, which said it's still assessing results of the strike following reports of civilian casualties. The attack came shortly after U.S. National Security Adviser Jake Sullivan said there was still "serious danger" in Kabul, where a suicide bomber last week killed at least 88 people. Joe Biden's chief medical adviser Anthony Fauci said the door is open to administering booster shots in the U.S. sooner than eight months after a completed Covid-19 vaccination. Israel is also expanding its coronavirus booster drive to all residents age 12 and above, while Abu Dhabi has made booster doses mandatory for people who were inoculated with the Sinopharm vaccine. European stocks are steady ahead of the open, as traders weigh Jerome Powell's signal that Fed support will be withdrawn cautiously. With U.K. markets closed for a bank holiday, Gazprom and Immofinanz are among the biggest names reporting during European hours, while pandemic-era favorite Zoom gives results in the U.S. Most of the day's biggest earnings are coming out of China, where food-delivery giant Meituan reports with investors looking for its efforts to comply with a Chinese regulatory probe. Agricultural Bank of China and Bank of China also report. Meanwhile, the U.S. CDC is set to meet to discuss Covid booster shots. This is what's caught our eye over the past 24 hours. Delta, inflation and central bank policy have dominated the trading narrative in recent sessions. So much so that the steadily growing drumbeat of geopolitical risk in the background had largely been ignored. Until Thursday, that is. Explosions outside Kabul's airport led to some selling in equities and a bid for the dollar. The effect could be isolated from background noise of Federal Reserve speakers who made hawkish noises in the same time frame, and from the Chair Jerome Powell's speech for the Jackson Hole symposium that came after, by the price moves in gold.  See, bullion has an interesting reaction function in these circumstances. As a metal with a proven ability to protect against inflation over millennia, it does poorly when the general pace of price increases falls. At the same time, holding metal in a vault pays no interest, in fact, it carries a small negative yield in the form of storage costs. That means that the investor forgoes income they could earn on bonds if interest rates are high. Or to put it another way, rising real rates increase the opportunity cost of owning gold.

On the other hand, the metal is often seen as a hedge against diversified risks. Quantitative analysis shows that its inverse relationship with other assets rises as those assets become more volatile (for more, see QuickTake). That makes it a great form of insurance when geopolitics strike asset prices. So when gold rallied on Thursday even as real rates pushed higher, it was clear to see that explosions still move markets. Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment