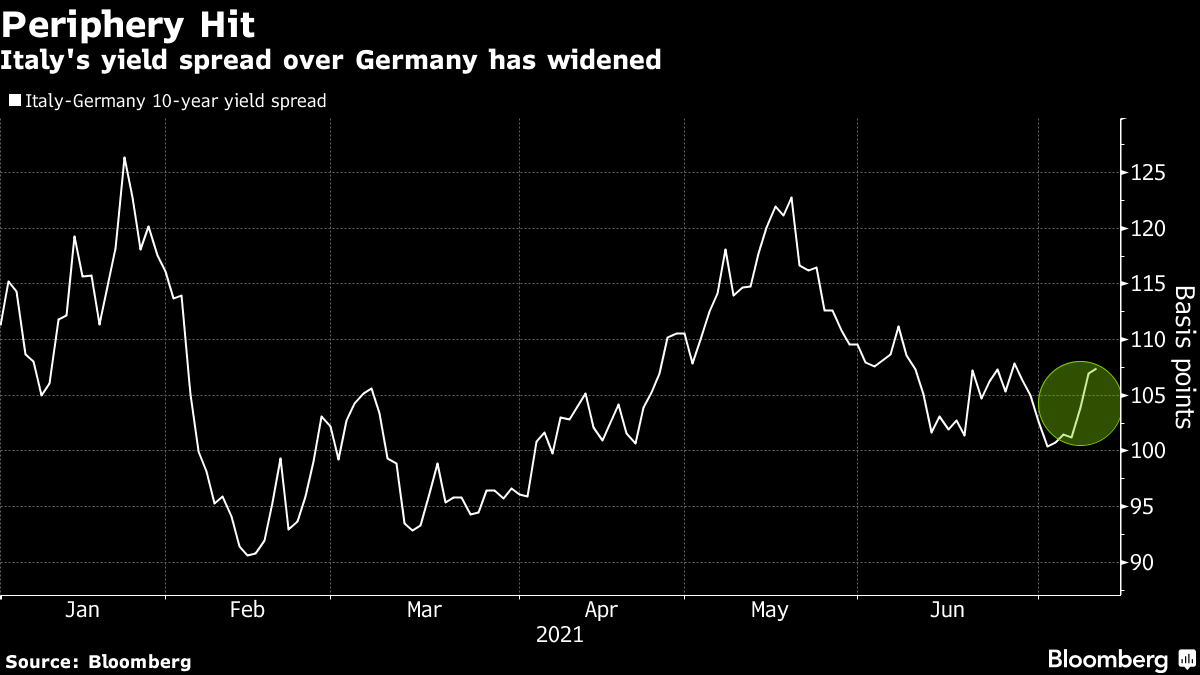

| Welcome to The Weekly Fix, the newsletter that doesn't recommend fighting the Fed, and has a healthy distrust of unreliable narrators — Emily Barrett, Cross Asset Reporter/Editor First rule of FAIT clubThose familiar with the cult '90s book and film will appreciate that European Central Bank Governor Christine Lagarde hasn't broken Tyler Durden's directive ("You don't talk about fight club"). She was quick to point out that the ECB isn't invoking FAIT (the Fed's flexible average inflation targeting) with the strategy revamp it announced Thursday. That hasn't stopped the comparisons. The ECB's review—its first in almost 20 years, and following 18 months' deliberation—did sound a little like it was following the Fed into the ring. European policy makers agreed to nudge up the inflation goal, and tolerate pressures running slightly above it (our Carolynn Look has the finer details). These steps seem in line with a more definitive statement from the U.S. last year, that it will allow moderately higher inflation to offset previous undershoots, with the aim of getting more people back into the workforce. Readers of this newsletter know how fraught this pledge is turning out to be, as U.S. policy makers clearly struggled last month with the urge to tackle evidence of broad-based price pressures… despite their repeated assurances that the recovery-driven boost in inflation was likely to peter out. (As for what that's doing to markets, see here and here and more below...) Fed comparisons aside, there's plenty of skepticism out there to explain the wobbly market reaction to the ECB's message. The euro has pared a modest gain. German yields edged higher, a move outpaced by those in Italy and Spain. That's a buy signal for peripheral markets, say Societe Generale's strategists, who expect the central bank will formalize its commitment to ultra-easy policy (continued asset purchases) at the July 22 meeting.  The gravitational pull on European yields seems likely to prevail, since more central bank support doesn't mean more inflation, as the past decade and more has shown. And how dependable is that support really, ask those who recall the ECB's stunning rate hike in July 2008. The unanimous commitment to boost inflation runs against the grain of the Council's hawks. Germany's Bundesbank President Jens Weidmann said that the central bank risks catering to indebted governments if it doesn't tighten policy when inflation is running above target. Executive Board member Isabel Schnabel warned of a sharper than expected resurgence, questioning "whether it will actually be possible to raise rates as quickly as would be needed." TD Securities' European macro strategy team, which includes Jacqui Douglas, summed up the market's response to the ECB's "damp squib" this way: "We don't believe that the results of the Review will change the ECB's response function in any meaningful way. And with no likely progress toward lifting inflation expectations, we think that it will still be a long slog to reach the inflation target."

Bond bear hopes vs reflationista despairInvestors nursing losses on reflation bets that until recently looked like the trades of the year want answers. The 10-year Treasury yield is on the brink of its steepest two-week decline since all hell broke loose in March 2020. The five- to 30-year curve is still buckled, almost a half-percentage point below its year-to-date peak in February, and breakeven rates point to crumbling inflation expectations. It may be too soon for bond bears to throw in the towel, however. First, a U.S. Treasury supply bump is coming next week, with sales of three-, 10- and 30-year maturities. That helped check the market's advance in Asia trading hours, with the 10-year edging back from overstretched levels, judging by Bloomberg's relative strength index measure.  Our States-side rates maven Ed Bolingbroke offers two more hints of a turnaround. JPM's client survey earlier this week highlighted a drop-off in bearish bets as a possible sign of fading momentum in a short-covering rally. And in options markets, the cost of hedging a Treasury rally has risen above sell-off protection—reflected in the skew of puts relative to calls—for the first time since August last year. Moreover, pockets of Wall Street are starting to challenge the slide in long-end yields and inflation expectations, with strategists at JP Morgan and Barclays among those recommending counter-trades. And Mark Dowding at BlueBay Asset Management warns against a surrender to the secular stagnation argument: "With fixed income markets capitulating on the reflationary theme and re-pricing secular stagnation, firmer data could well see a swing back in the opposite direction in the coming weeks and we continue to believe that if our projections for stronger US growth and inflation are met, this will set the stage for the Fed to taper its purchases in the autumn and for 10-year yields to rise above 2% by the end of 2021."

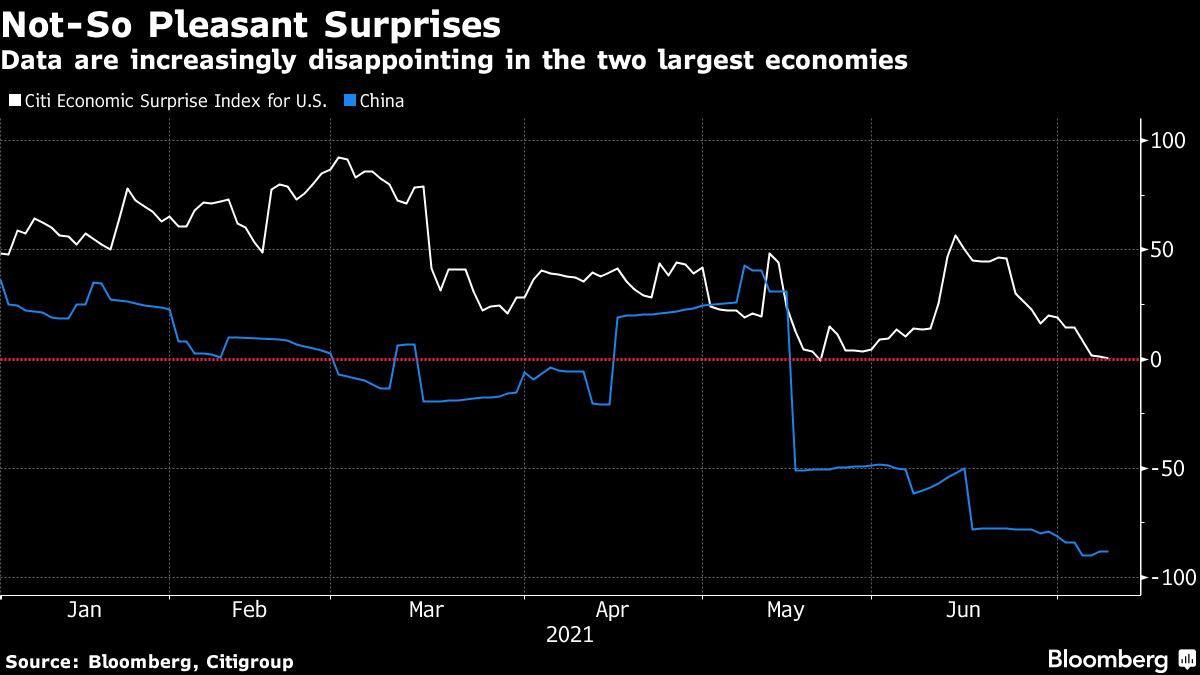

And now the macro case for bond bulls...Strategists and investors see three forces pushing yields lower still. Fading growth optimism is one, as more-infectious strains of the virus force further curbs on activity. A related setback is the loss of momentum in the drive for more fiscal stimulus—the promise of more-generous spending under the Biden administration delivered arguably the strongest blow to government bonds in the first quarter. Add to this, the Federal Reserve's tilt at its June 16 meeting, which unexpectedly flagged a possible interest-rate hike by the end of 2023. That really put the oomph in the market's bullish reversal. TD Securities' global head of rates strategy sees this as the central theme. "The market is questioning the Fed's reaction function" and its commitment to keeping policy loose to allow a fuller economic recovery even as inflation pressures build, said Priya Misra. "The Fed started it so I think they need to stop it." All eyes will be on Chairman Jerome Powell's semi-annual testimony to Congress in the middle of next week. It's also hard to ignore the risks to the growth outlook—which central banks have spent much of this year revising higher—as leaders around the world struggle to reopen their economies.  "The data that's coming out is good, but maybe not good enough," Jim Caron, portfolio manager at Morgan Stanley Investment Management said in this regular message to clients this week. "There's a lot of cash still on the sidelines, so unless we're getting strong, robust data that suggests job growth is really accelerating and inflation is really starting to accelerate beyond the peaks that we've seen in the last month or so, it's just going to be hard for yields to really rise."

That cash glut is still acting as a dead weight on yields, and it's still mounting. While the Fed decides on when to taper asset purchases, it's scooping up roughly $120 billion of bonds a month. The Treasury's adding to the flow with plans to draw down its own mammoth cash pile, as our Alex Harris reports. If that's not enough, the sentiment-busting prospect of a rancorous debt-ceiling debate, with all the hysteria over a possible debt default, is heaving into view. And, in the northern hemisphere, summer beckons traders from their desks, leaving the promise of exaggerated moves in thin markets. Only the brave, or those happily wedded to work/life balance, will actually log off. Bonus pointsWall Street wealth trio sticks to reflation bets amid selloff Central banks risk sacrificing rates flexibility in quest to expand their mission China defaults threaten an eerily calm $12 trillion bond market Jane Austen's fight club |

Post a Comment