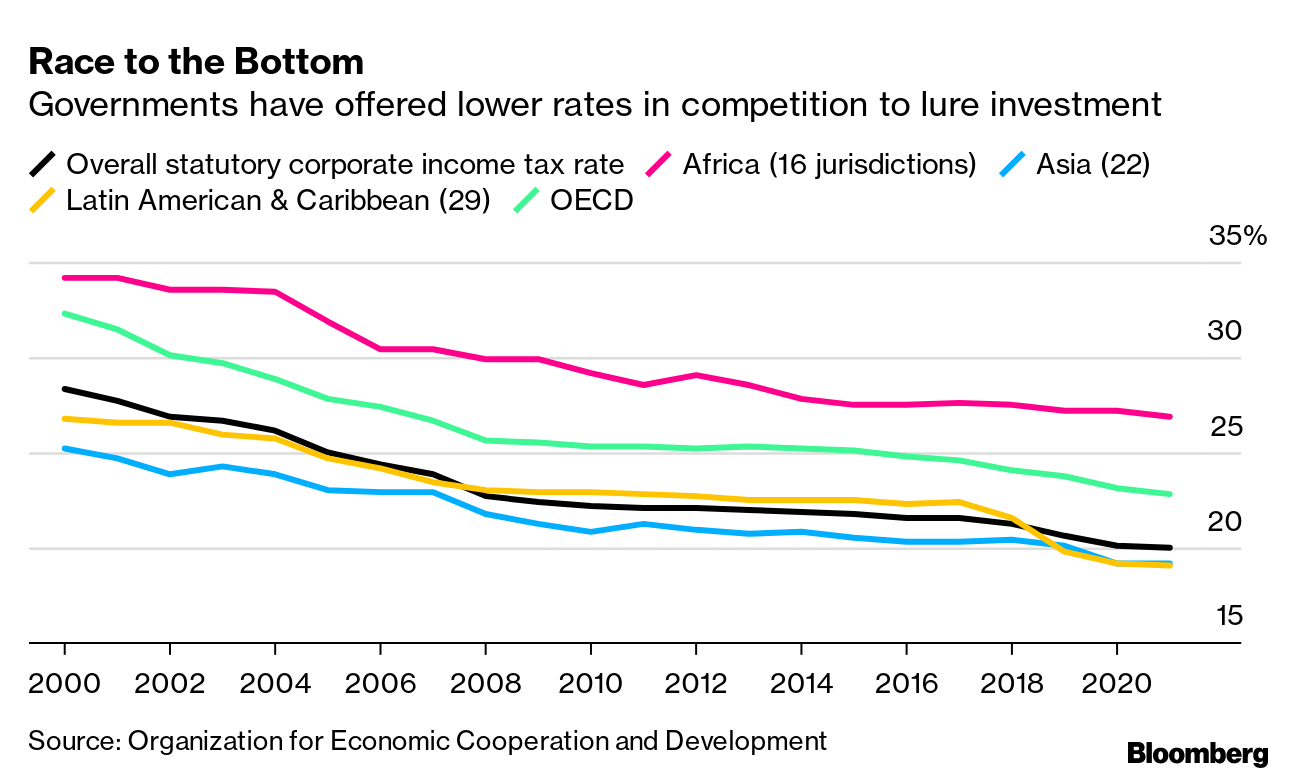

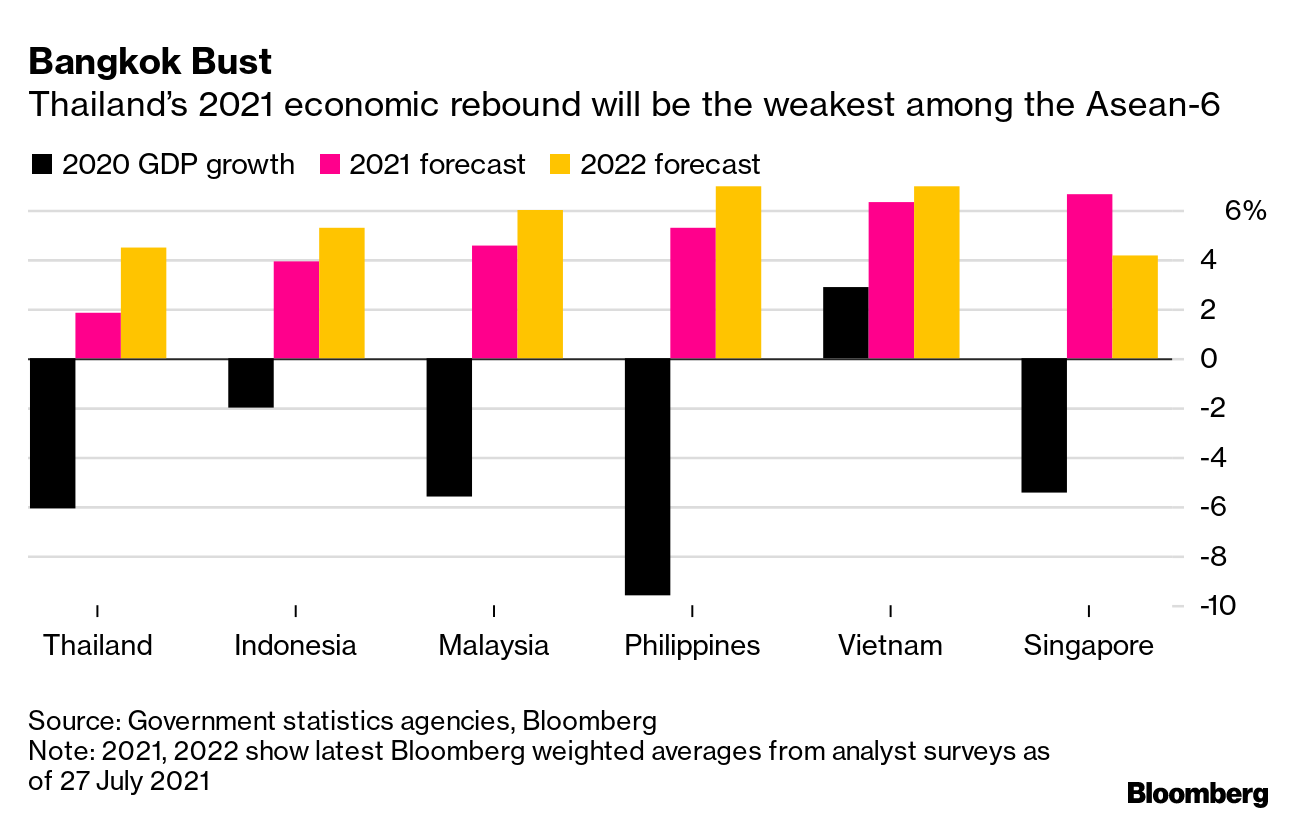

| Hello. Today we look at the latest numbers on global taxes, who is lagging in Southeast Asia and how supply constraints are putting pressure on inflation. U.S. President James Madison had a message that is troubling the world's richest nations two centuries after he left office: "The power of taxing people and their property is essential to the very existence of government." In a world where multinationals with capital dwarfing the size of most economies can shift profits around the globe to minimize their bills, governments are losing that power. Their fear of impotence has now proven great enough for them to overcome the economic antagonism of recent years and cooperate on new rules that would create a global minimum tax and force companies to pay more where they operate. A report by the OECD on Thursday showed just how governments have steadily lost control, in part as they raced to offer lower taxes to lure the investment of large corporations.  According to the research, corporate rates in the last 20 years have fallen in 94 of the 111 countries and territories the Paris-based organization monitors. Over the period, the average statutory rate fell to 20% from 28.3%. Meanwhile, an initiative to crack down on tax avoidance after the financial crisis had another worrying message: The OECD report shows that companies are still parking their profits in places where they have little real presence in terms of staff or tangible assets. More than 130 countries negotiating the new tax rules have given themselves until October to clinch a deal that could change to how much tax companies pay and where as soon as 2023. "Evidence of continuing base erosion and profit shifting behaviors as well as the persistent downward trend in statutory corporate tax rates reinforce the need to finalize agreement and begin implementation," the OECD said. — William Horobin  Thailand will likely be the worst economic performer in Southeast Asia this year, with economists continuing to slash the country's growth forecast amid surging Covid-19 infections, mounting political tensions and fading hopes for a tourism revival. Gross domestic product is expected to grow 1.8%, according to the latest weighted average of 36 economists surveyed by Bloomberg. That's particularly weak after last year's contraction of 6.1%, the most in more than two decades. - Taper talk | Fed officials inched closer to when they can start reducing massive support for the economy. Meantime, Bloomberg Businessweek also takes a look at Powell's reappointment chances.

- Baby battle | A Chinese city will handout cash to encourage childbirth, the first in a nation faced with an aging population. China watchers are also looking for signals from a Politburo meeting.

- London taxis | Despite the lifting of coronavirus restrictions, minicab and courier company Addison Lee says that passenger bookings to and from the capital's financial hubs recovered less than expected. The River Thames, however, is seeing a revival.

- Struggling middle class | Soaring home prices are stoking anger against South Korea's president, with middle-class voters saying government policies have created a class of "overnight beggars."

- India outlook | India's economy is showing signs of cooling amid a slow easing of lockdowns, a factor likely to keep interest rates at record lows.

- Poland policy | We go inside a normally subdued corner of Poland's central bank to show how it could hold the key to rolling back pandemic-era stimulus.

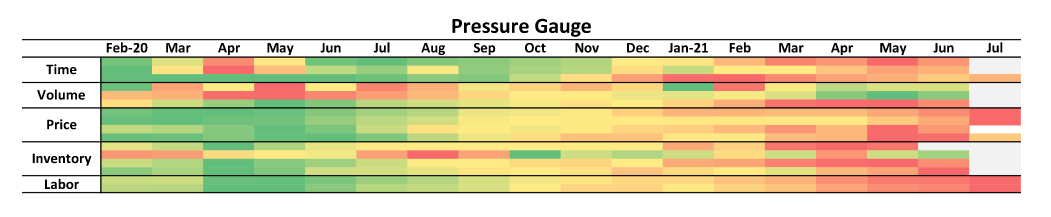

Economists at Wells Fargo are warning that supply constraints are likely to stick around, providing continued upward pressure for inflation. They released what they called a "Pressure Gauge" this week to show "snarled supply chains have yet to abate in any meaningful way."  Inventories continue to worsen and shipping costs are increasing at a double-digit pace, although car prices are set to slip.  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment