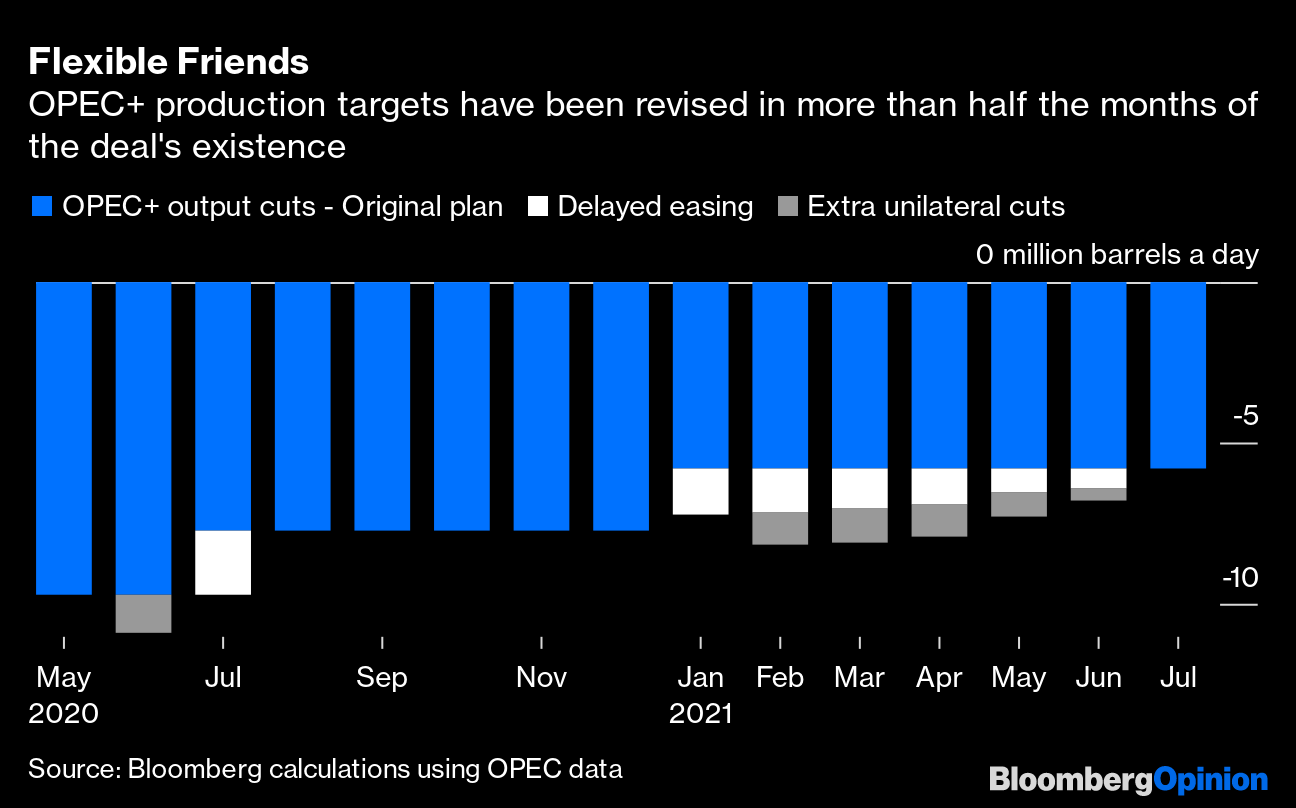

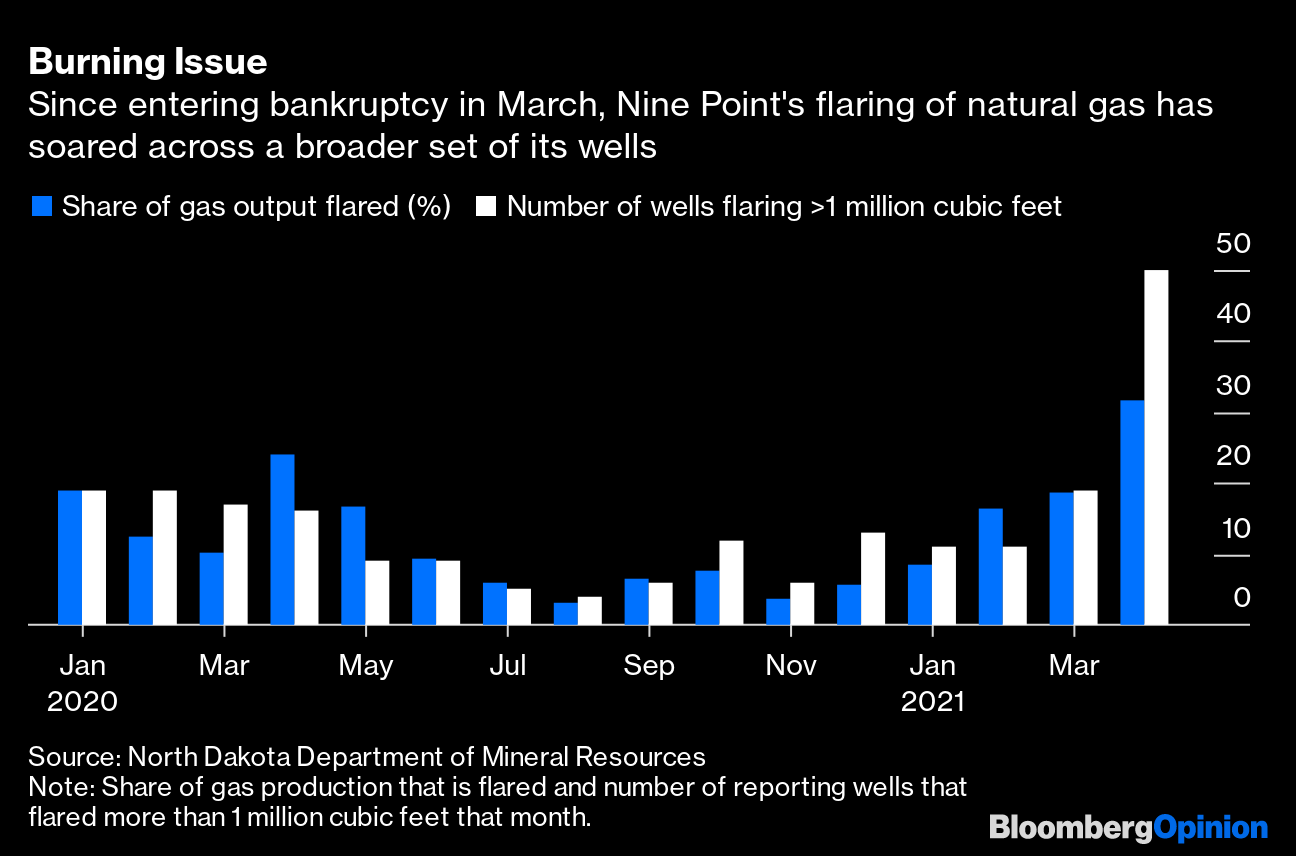

| This is Bloomberg Opinion Today, a hybrid work arrangement of Bloomberg Opinion's opinions. Sign up here. Today's AgendaFlex Work Is Real WorkAs we've written before, there are reasons to go into the office, believe it or not. You remind your coworkers you are a real, 3-D human person and not an AI construct. You show you care enough about your job to shower and leave the house every now and then. Most importantly, there's more free food these days than ever. But let's not kid ourselves: There's also much to be said for working from home on the regular. You'd think this would be consensus by now, but in boss circles it's still taboo. That may not last. Amazon recently ordered all of its office workers back full-time, and the result was a bunch of angry workers, writes Joni Balter. Fellow Washington state employer Microsoft, in contrast, offered hybrid-work options. And what do you know: no angry workers! Amazon and Microsoft are great places to work, but they're not exactly hot electric-flying-taxi startups. They may need some extra pieces of flair to attract new talent. Demanding everybody drag themselves to the office is the opposite of flair in 2021. Wall Street may feel exempt from this trend, but it's probably not. As Anjani Trivedi recently wrote, banking is even further from flying-taxi territory these days than Microsoft is. Mere ludicrous compensation for 120 desk hours a week is no longer enough. Citigroup's Jane Fraser seems to get this, Tara Lachapelle writes. She's offering flexible work arrangements, in contrast to her counterparts at JPMorgan Chase, Goldman Sachs and other banks. These are attractive not just to the youths, but also to older employees who are caregivers, which are often women. You hear a lot about worker shortages these days. Anything that can attract the broadest, most diverse pool of talent should be good for any industry. Further Corporate-Culture Reading: JPMorgan's tree-planter deal doesn't make it greener. It must put real money at risk. — Anjani Trivedi RIP Hong KongAside from the coronavirus pandemic, which it has weathered relatively well, Hong Kong has suffered no city-leveling natural disaster recently. Yet the Hong Kong we've known for several decades has been eradicated, writes Matthew Brooker on the eve of three anniversaries: the Chinese Communist Party's birthday (100 years young), Hong Kong's handover from Britain (turning 24) and last year's national security law, which was a dagger in the heart of the old city. Beijing's interference has turned a free, thriving (if muggy) global financial hub into an autocrat's dream, sending people and capital fleeing. It's a loss for the world, but it also continues a depressing world trend. In another example, democracies are crumbling throughout Latin America, writes Hal Brands, replaced by ever-stronger strongmen. This is due not only to the anti-democratic energies constantly pulsing in these countries but also the retreat of the liberal global order that helped keep them in check. Trust-Busting ExerciseWith America's Big Tech companies bigger and more powerful than many sovereign nations, much of our focus has been on their bigness: whether or not it's good, what to do about it, et cetera. At the same time, the growing urge to confront China and its stable of national champions has some wanting to defend America's behemoths as counterweights, in a sort of battle of the corporate mechas. Noah Smith argues both attacking and defending corporate bigness is a waste of energy. Instead, Noah suggests, America should turn its energy to incubating tomorrow's giants. History is littered with omnipotent companies that collapsed under their own weight. Innovation, meanwhile, has set the U.S. apart from its rivals so far. Further Tech-Regulation Reading: Forcing Apple to open up to outside app makers could create security risks for consumers. — Tae Kim Telltale ChartsOPEC+ was shockingly flexible in cutting output when oil demand fell, writes Julian Lee. It must be flexible in the other direction now that demand is surging.  A North Dakota fracker is burning off natural gas just to save itself a little money, writes Liam Denning. All the rest of us are paying for it.  Further ReadingSoaring home prices could fuel inflation if they persist. — John Authers Paying student athletes could result in more-valuable benefits being cut elsewhere, including education. — Allison Schrager Nancy Pelosi has some choices to make about which Republicans to let onto the Jan. 6 investigation. — Jonathan Bernstein Making $1 million last in retirement isn't as simple as it might sound. — Teresa Ghilarducci ICYMIDonald Rumsfeld has died. Bill Cosby is free. Allen Weisselberg is in trouble. KickersRejected at 10, 70-year-old woman is now a Yankee bat girl. (h/t Ellen Kominers) $10,000 flute is back after a nine-year cab ride. (h/t Scott Kominers) "Sopranos" prequel trailer just dropped. All the U.S. presidents, ranked.  Notes: Please send presidential rankings and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment