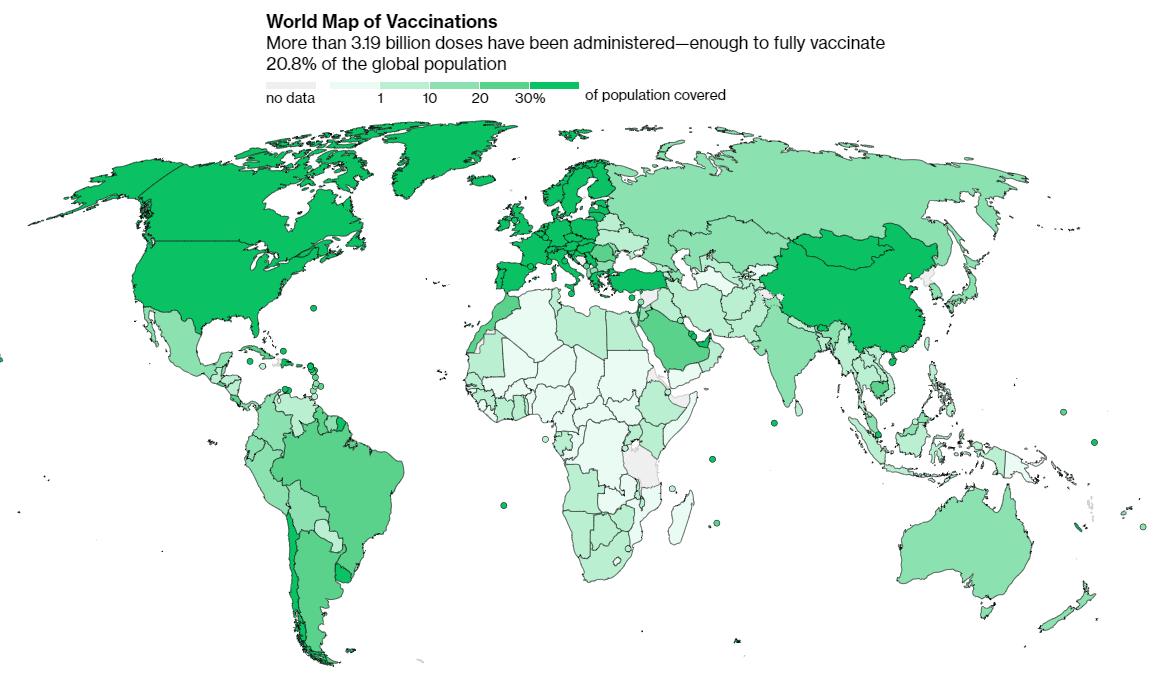

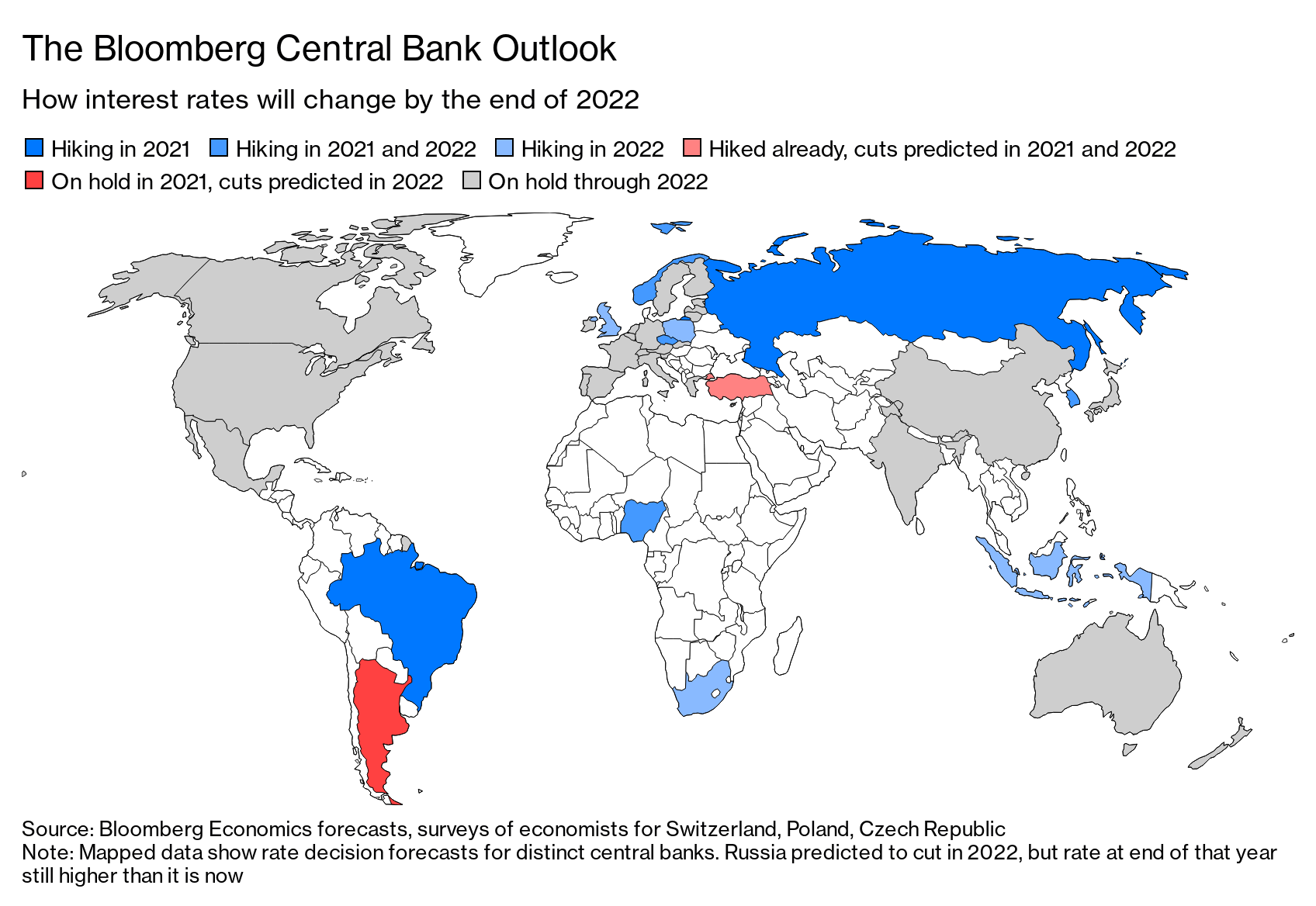

| Hello. Today we look at the economic risks posed by the delta variant, what to watch for in the week ahead, and the pros and cons of working from home. A New Worry Any optimism about global economic growth from Group of 20 finance chiefs this week is likely to be delivered with crossed fingers that a rapidly evolving virus can be kept at bay. The challenge includes the delta variant of the coronavirus, a more-transmissible mutant that's spreading worldwide. The worry is the emergence of this new variant before the world got fully vaccinated risks slowing the reopening of economies, hurting demand and pushing up inflation. "A delta variant that spreads quickly is an uncertainty, and it is an uncertainty that will weigh on the balance of risks today," European Central Bank President Christine Lagarde said last week. While conceding the variant remains an immediate threat to their forecast for 6.7% global growth in the second half of the year, economists at JPMorgan Chase said in a weekend report that the economic consequences should remain limited.  European policy makers aren't signaling they will re-impose domestic restrictions and may even allow more continental travel. Indeed, the U.K., which witnessed the delta variant earlier than elsewhere in the region, is set to lift most of its curbs the week after next. As often the case with Covid-19, emerging markets are on rockier ground. Only a few — Chile, China, Israel, the UAE and the Central and Eastern European countries — have inoculated close to half of their populations, the level seen as needed to curb the spread of the delta variant, Bank of America said in a report Friday. Most major emerging markets should get there by year-end, including Brazil, India, Indonesia, Mexico, Russia and Turkey, said David Hauner, head of cross-asset strategy at BofA. South Africa is the outlier, he said, with only about 5% of its population vaccinated. At the current rate, it would take until 2023 for the nation to reach 50%. In Colombia, only 11% of the population is fully vaccinated — a lower proportion than in Chile, Mexico and Brazil. While the G-20's central bankers and finance ministers are supposed to be rubber-stamping a new minimum corporate tax rate at their weekend meeting in Venice, they will be keeping a wary eye on the outlook. —Simon Kennedy The Week Ahead The Federal Reserve and ECB publish minutes of their most recent monetary policy meetings on Wednesday and Thursday respectively. Central bankers in Israel, Poland and Australia will set interest rates. While all are expected to leave them on hold, Australia on Tuesday is expected to gently rein in its emergency stimulus program by not rolling over its three-year yield target to the November 2024 bond from the current April 2024. For a full rundown of the week ahead, click here. Today's Must Reads - Policy shift | Central banks are starting to tip-toe away from the emergency stimulus they deployed to fight the pandemic-driven global recession. See our quarterly guide to the policy outlook.

- OPEC standoff | Saudi Arabia and the United Arab Emirates cranked up the tension in their OPEC standoff, leaving the global economy guessing how much oil it will get next month.

- Debt rollover | Local governments in China have more than doubled bond sales to roll over maturing debt this year, helping to ease their repayment risk, but also heralding slower infrastructure investment.

- Gender divide | Cities across Europe are reworking transport links that have traditionally focused on the needs of the male commuter.

- China embrace | Philippine President Duterte's embrace of Chinese investment is being questioned by his would-be successors.

- Raising prices | European firms are pushing up prices as supply disruptions lift costs and hamper their ability to match surging demand, executives say.

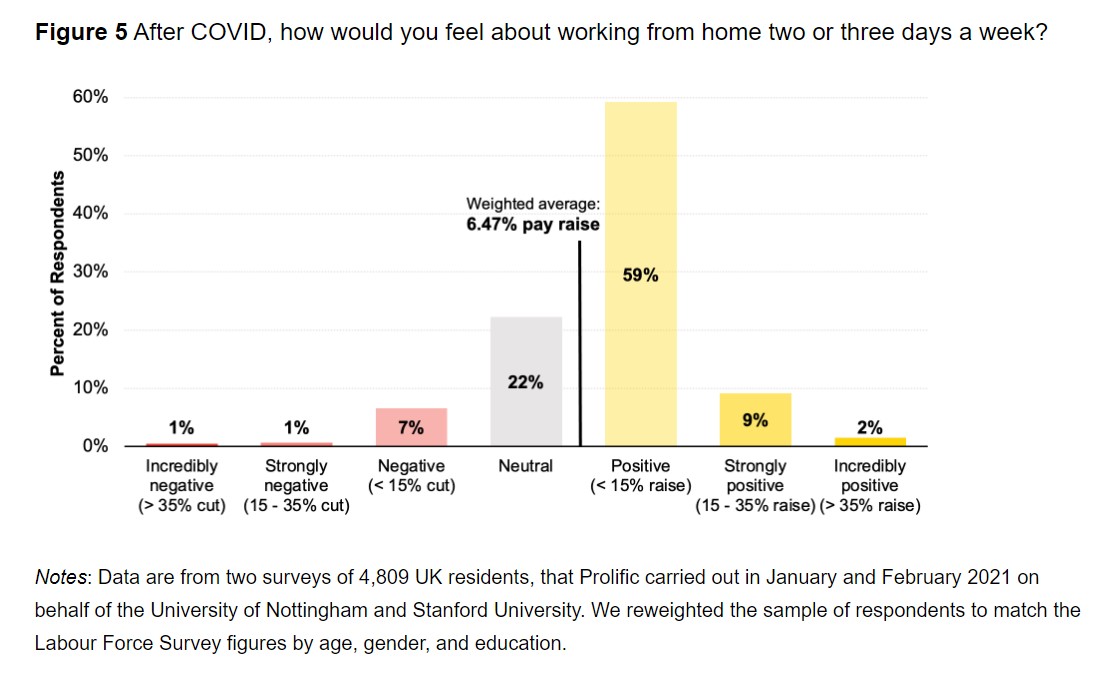

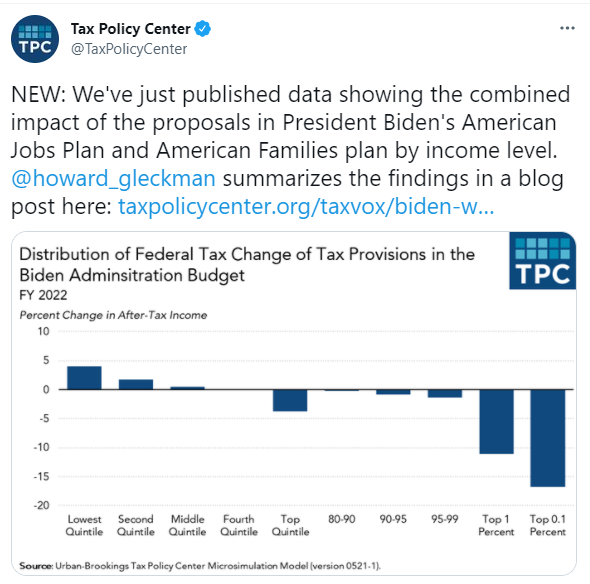

Need-to-Know Research Working from home can lift productivity for many workers, so long as they go to the office a few days a week, Bank of England staff said in a blog post that reviewed academic research on the issue. The findings indicate that isolation from co-workers over longer periods reduces the effectiveness of staff and eats away at relationships forged through face-to-face contact. More complex, less interdependent jobs benefited from the peace of solitary working, they found. The work feeds into a debate about how much home working companies should allow as governments loosen rules aimed at controlling the coronavirus. For almost half of the U.K. capital's companies, a shift back to five days a week in the office is already off the table, according to a survey by the London Chamber of Commerce and Industry. On #EconTwitterTaxing times ahead for the top 1% in America on Independence Day:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment