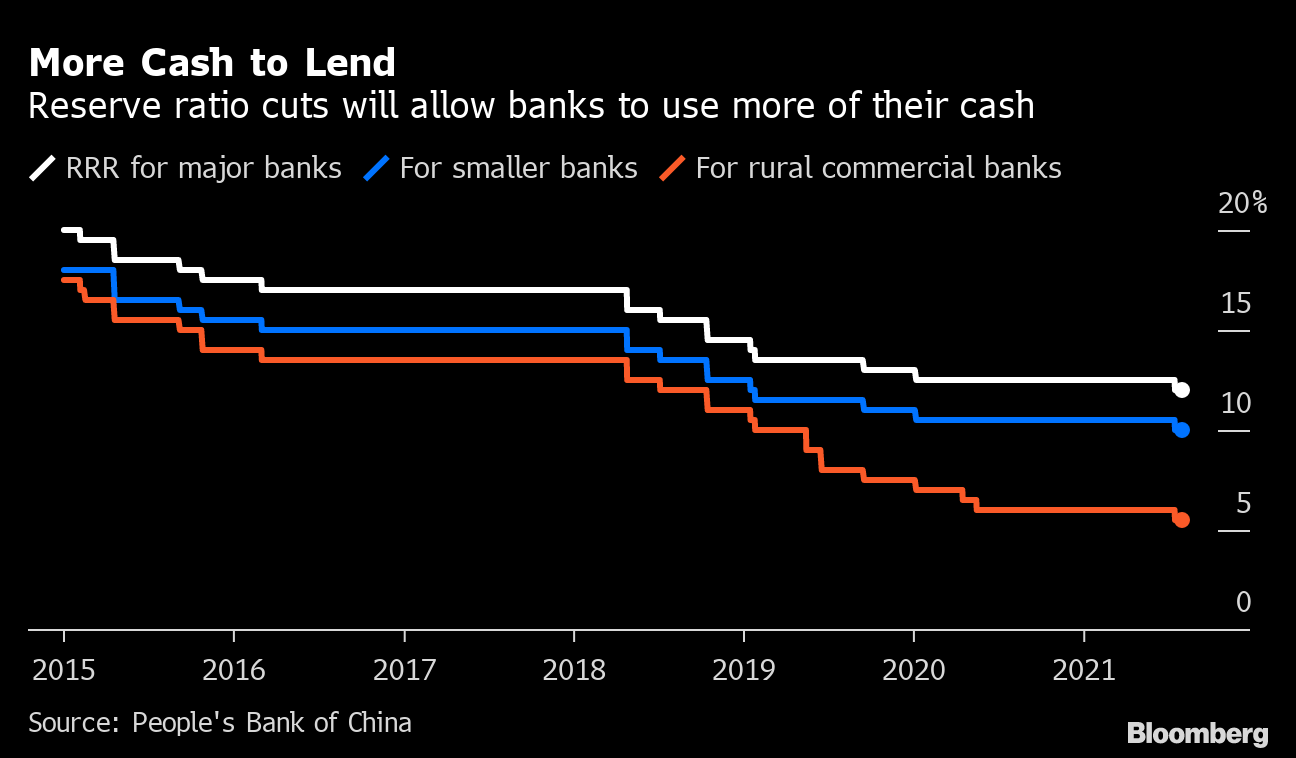

| Chinese vaccine developers will sell shots to the global Covax program. The U.S. cites China's Xinjiang as being at risk of atrocities and crimes against humanity. Virgin Galactic shares tumble after Branson's historic flight. Here's what you need to know this morning. Chinese vaccine developers Sinovac and Sinopharm agreed to sell their shots to the WHO-backed Covax program, pledging millions of doses that will give the global distribution effort a much needed boost. Sinopharm agreed to provide 60 million doses from July through October. Meanwhile, Singapore's daily tally of coronavirus cases rose to the highest in two weeks; Johnson & Johnson revised its Covid vaccine factsheet to warn of the risk of a rare immune-system disorder; England faces up to 200 deaths a day after pandemic restrictions are lifted; and the low rate of vaccinations for seafarers globally is threatening to prolong trade disruptions and potentially open up loopholes at container ports that the virus can slip through. TikTok owner ByteDance is working to ensure it complies with data security requirements after meetings with Chinese government officials over the issue earlier this year. The tech giant, whose apps also include TikTok's Chinese twin Douyin and the news aggregator Toutiao, had kicked off initial preparations for an IPO of its domestic assets, Bloomberg News reported in April. ByteDance's considerations about going public had been in flux even before Didi 's IPO in New York sparked a regulatory backlash. Here's all you need to know about that debacle. Asian stocks looked set to open firmer after their U.S. counterparts notched yet more all-time highs as investors awaited second-quarter earnings season. Treasury yields were steady as the U.S. sold debt. Futures climbed in Japan, Australia and Hong Kong. Financials and communication services shares led the S&P 500 to another record, while Tesla, Nvidia and Google parent Alphabet helped push the tech-heavy Nasdaq 100 to new highs. The dollar gained against most major peers. Oil dipped for the first time in three days. The U.S. State Department cited the Chinese government's crackdown on ethnic Uyghurs in the Xinjiang region as one of six places in the world that are witnessing or are at risk of atrocities and crimes against humanity, as the U.S. explores new ways to try to prevent such violence. The seven-page report cited a wave of actions the U.S. has taken to punish China for its actions in Xinjiang, including sanctions, visa restrictions and export controls. It also highlighted atrocities in Myanmar, Ethiopia, Iraq, Syria and South Sudan. Virgin Galactic filed to sell as much as $500 million in shares following a rocket-powered test flight by founder Richard Branson that won Wall Street praise as a "marketing coup." The success of the hour-long mission to more than 50 miles (80 kilometers) above Earth boosted Virgin Galactic's plan to start offering tourism trips next year. But shares tumbled 17% — the most in almost seven months — after the disclosure of the potential stock sale, which suggested the company's need for additional funds as it prepares its commercial debut. Read the full story of Branson's jaunt to the edge of space here. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayLast week China surprised the market by cutting its reserve ratio requirement (RRR) by 50 basis points just days before the release of second quarter data. There are two key questions that now stem from the move, the first being the degree to which it presages a slowdown in China's economy, and the second being whether the RRR cut will end up being the first move in a wider monetary easing by the central bank. China has so far been relatively conservative when it comes to stimulating its economy during the Covid crisis, keen to avoid overheating and adding more debt. To that end, Wang Yiming, a policy advisor to the People's Bank of China, emphasized over the weekend that the RRR cut did not mean there had been a change to the central bank's prudent monetary policy. There are those who think China's conservatism will hold, with Michael Pettis noting that while RRR cuts have historically led to more RRR cuts, this time "may be different" given China's focus on restraining leverage.  But there are others who think a wider push towards easing has already begun, with Bank of America analysts noting that a recent jump in money and credit growth implies "the monetary authority may have already eased the credit control on commercial banks. It is also consistent with what we heard from commercial bank channel checks that loan quotas were relaxed starting from May, due to weak credit demand." Expect a lot of focus on this question as the RRR cut comes into effect this Thursday. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment