| Biden's twin win, Fed taper gets closer and another big day for earnings. President Joe Biden's economic agenda got a shot in the arm on Wednesday as the Senate voted to start work on the $550 billion infrastructure bill and Democrats put their weight behind a broader budget resolution. The 67-32 procedural vote in the Senate is good indication the infrastructure package may pass the chamber by early next week, with cryptocurrency taxes one possible source of funding. A potentially rockier path awaits the budget resolution, aimed at priorities such as climate change, the tax code, health care and immigration. Senate Budget Committee Chairman Bernie Sanders said he has the votes, but Arizona Democrat Kyrsten Sinema complicated matters by saying she wouldn't support spending $3.5 trillion on the package. The Federal Reserve is getting closer to withdrawing some of their massive support for the U.S. economy, though there's still a ways to go. Chair Jerome Powell delivered that message and more at a press conference Wednesday after policy makers held interest rates in a range near zero and maintained asset purchases at $120 billion a month until "substantial further progress" is made on employment and inflation. The Fed also repeated language that rising inflation reflected "transitory factors," a sentiment echoed by U.S. Commerce Secretary Gina Raimondo in an interview on Wednesday. The S&P 500 Index ended the session little changed and Treasury yields fell. U.S. pole vaulter Sam Kendricks, a world champion tipped for a medal at the Tokyo Olympics, tested positive for coronavirus and won't be competing further in the games, as the worst virus surge yet hits the host nation. Tokyo announced 3,865 new cases Thursday, the third record in as many days, while the national daily infection rate also rose to a record of 9,576 the previous day. Meanwhile, in Missouri, where the delta virus variant has been causing Covid-19 cases to soar, doctors and nurses are seeing patients who are younger and seem to be worsening faster than ever before. Apple Inc. and Walt Disney Co. both reinstated mask policies. Global stocks rose as investors took comfort from positive earnings updates and the Fed's message that stimulus still has some way to go. Overnight the MSCI Asia Pacific Index jumped 1.7% while Japan's Topix index gained 0.4%. In Europe the Stoxx 600 Index was up 0.3% by 5:28 a.m. Eastern Time. S&P 500 futures were modestly higher, the 10-year Treasury yield was at 1.26% and oil extended gains from a two-week high. Bitcoin traded around $40,000, holding this week's recovery. Investors get both initial jobless claims and GDP figures at 8:30 a.m. ET, with the latter expected to show the economy grew at a rapid pace during the second quarter, fueled by vaccinations, stimulus and business reopenings. Another mammoth earnings day brings results from Amazon.com Inc., Mastercard Inc., Comcast Corp. and Merck & Co. among many others. Here's what caught our eye over the last 24 hours. - Robinhood prices IPO at bottom of marketed range.

- Tencent is world's worst stock bet with $170 billion wipeout.

- Don't expect to earn yield on Powell's watch.

- The Wu-Tang deal had so much potential.

- Bitcoin mutual fund makes it easier to invest in crypto.

- Kyrie Irving blasts his own Nike shoe.

- These could be the oldest animal fossils ever found.

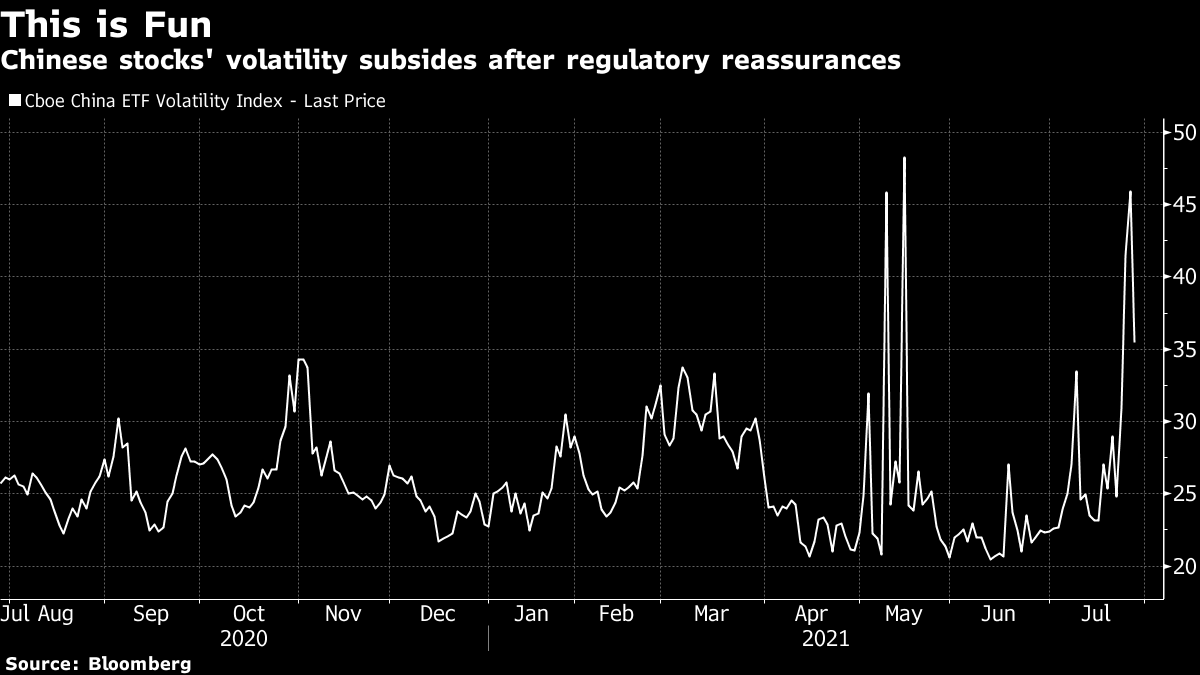

As a former China markets reporter, I was reminded of my younger days this week with all the regulatory drama back there. By now, it appears Chinese policy makers have reached their soothing phase, repeating a common pattern in which they make a move that shocks markets only to then get uncomfortable with the volatility and attempt to contain it. From a call with banks and a cash injection in the money markets to a CNBC report on Chinese firms still being allowed to list in the U.S., it worked. Chinese stocks in the mainland, Hong Kong and the U.S. are all rebounding strongly along with the yuan.  There will always be a bit of a seesaw between Beijing's risk clampdown and desire for stability. Some of this might be down to the fact that because its decisions appear opaque to outsiders, they always come as an abrupt shake-up to markets, triggering asset-price swings far larger than perhaps the regulators expected. Anyhow, even with the reassurances, the takeaway for overseas investors is clear: It's hard to know what you're getting into with Chinese assets. And between the current Chinese regime's laser-sharp focus on political control and its intention to control financial risks, more shocks are likely to come. Follow Bloomberg's Justina Lee on Twitter at @justinaknope Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment