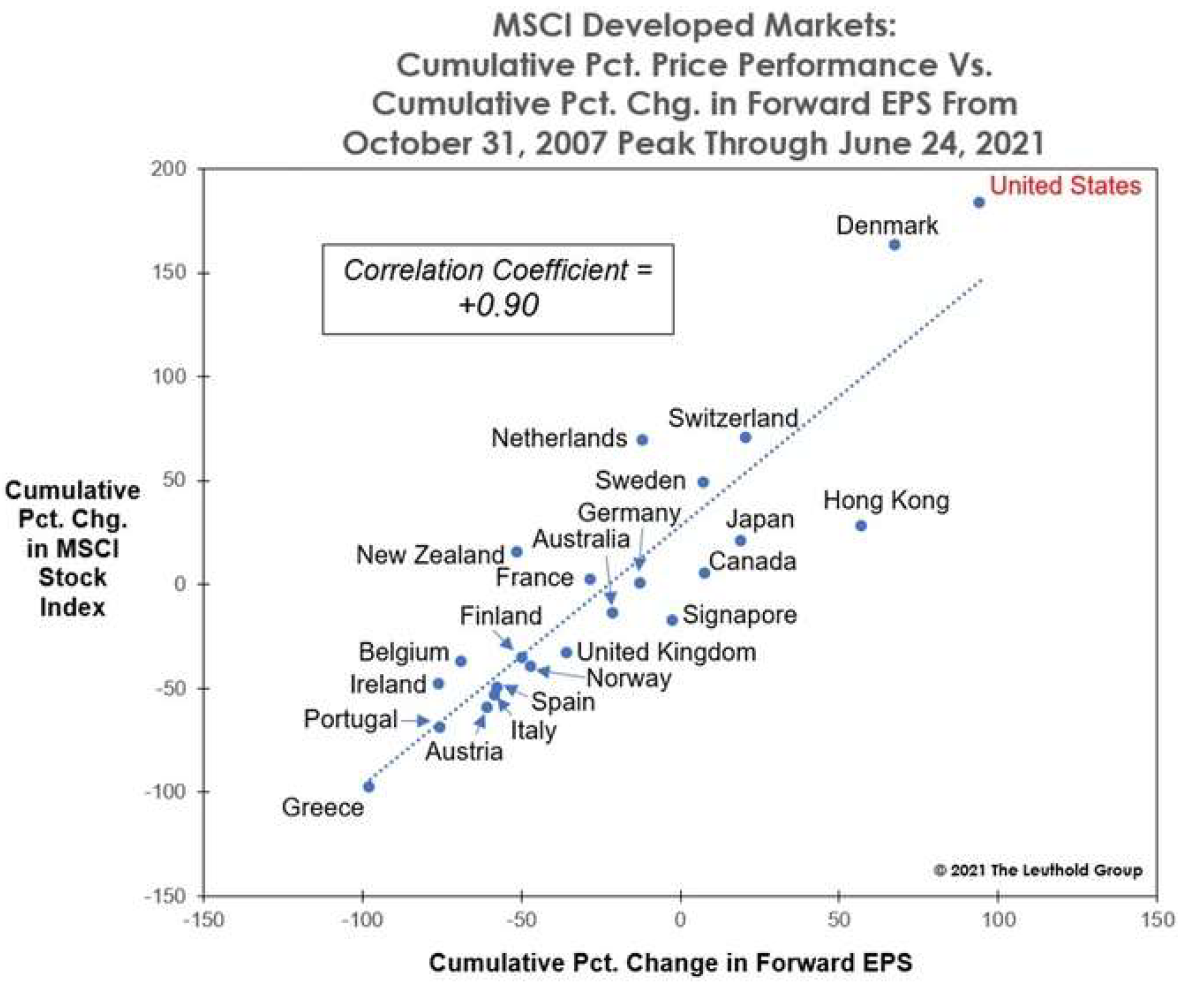

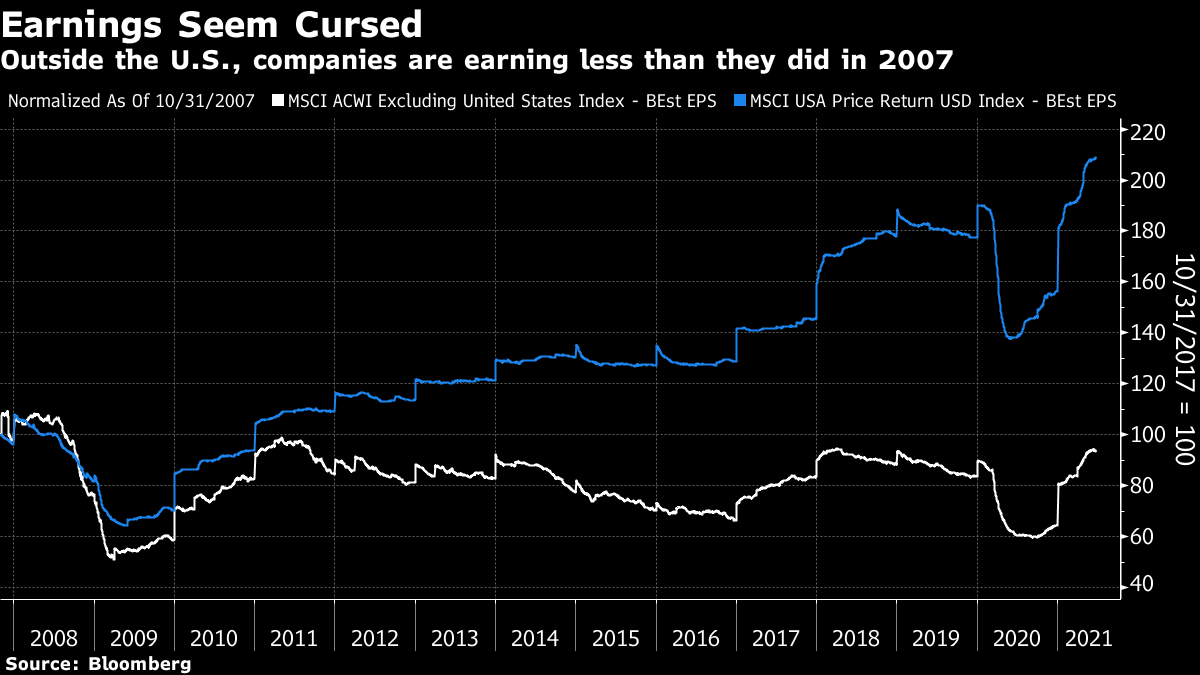

| Somehow or other, the U.S. stock market is at yet another all-time high. The S&P 500 has risen 91.3% from its Covid panic low last March. With the year not quite half gone, it is up 14%. These are very impressive results, particularly with the latest consumer price index data showing the worst inflation in main street prices in almost three decades. The U.S. is also running a long way ahead of the rest of the world. The MSCI World Excluding the U.S. index is somewhat below the high it set earlier in June. In the long run, the difference between the two is extraordinary. It was only a couple of weeks ago that the world excluding the U.S. topped its previous all-time high, set on the ominous date of Oct. 31, 2007. As of Friday's close, the index is 0.18% higher than it was on Halloween 14 years ago. I couldn't be bothered to get the Bloomberg terminal to calculate that as an annualized rate. Here is how the indexes have compared since that pre-global financial crisis peak:  There are some obvious explanations for this. All the biggest winners from the growth of the internet and online commerce have been American; the euro zone inflicted the sovereign debt crisis on itself for much of the last decade; the Federal Reserve was far faster and more enthusiastic to prime the pump with quantitative easing asset purchases. But still, the U.S. economy continues to cause great discontent amid the population at large, and it's not as though the rest of the world has suffered anything like the Great Depression, outside small pockets such as Greece. If there is a long-term driver, it is corporate earnings. The following remarkable chart comes from Doug Ramsey of the Leuthold Group in Minneapolis:  Since that Halloween peak, there has been an astounding 90% correlation between different countries' growth in earnings per share and the change in the value of their stock markets (as measured by MSCI). And, almost equally astoundingly, most developed countries have seen earnings fall over the last 14 years. That means that the U.S. has performed much better than the rest. The only country to come close is Denmark (powered by Novo Nordisk A/S, which has increased sixfold since Halloween 2007). Overall, earnings are down outside the U.S., including developed and emerging markets. This is the same chart I began with, but this time showing Bloomberg's estimate of forward earnings, rather than share prices. The two charts do look similar:  Ramsey points out that a weakening currency will make U.S. companies' profits look even better in dollar terms, so the dominance is unlikely to be shaken any time soon. But the broader point remains: We often joke about the over-optimism of earnings forecasts, but this is ridiculous. In 2021 - with much of the world engaged in QE for a decade or longer and short-term interest rates either at, near, or below zero — most countries are struggling to put up earnings per share levels that analysts once deemed likely for 2008.

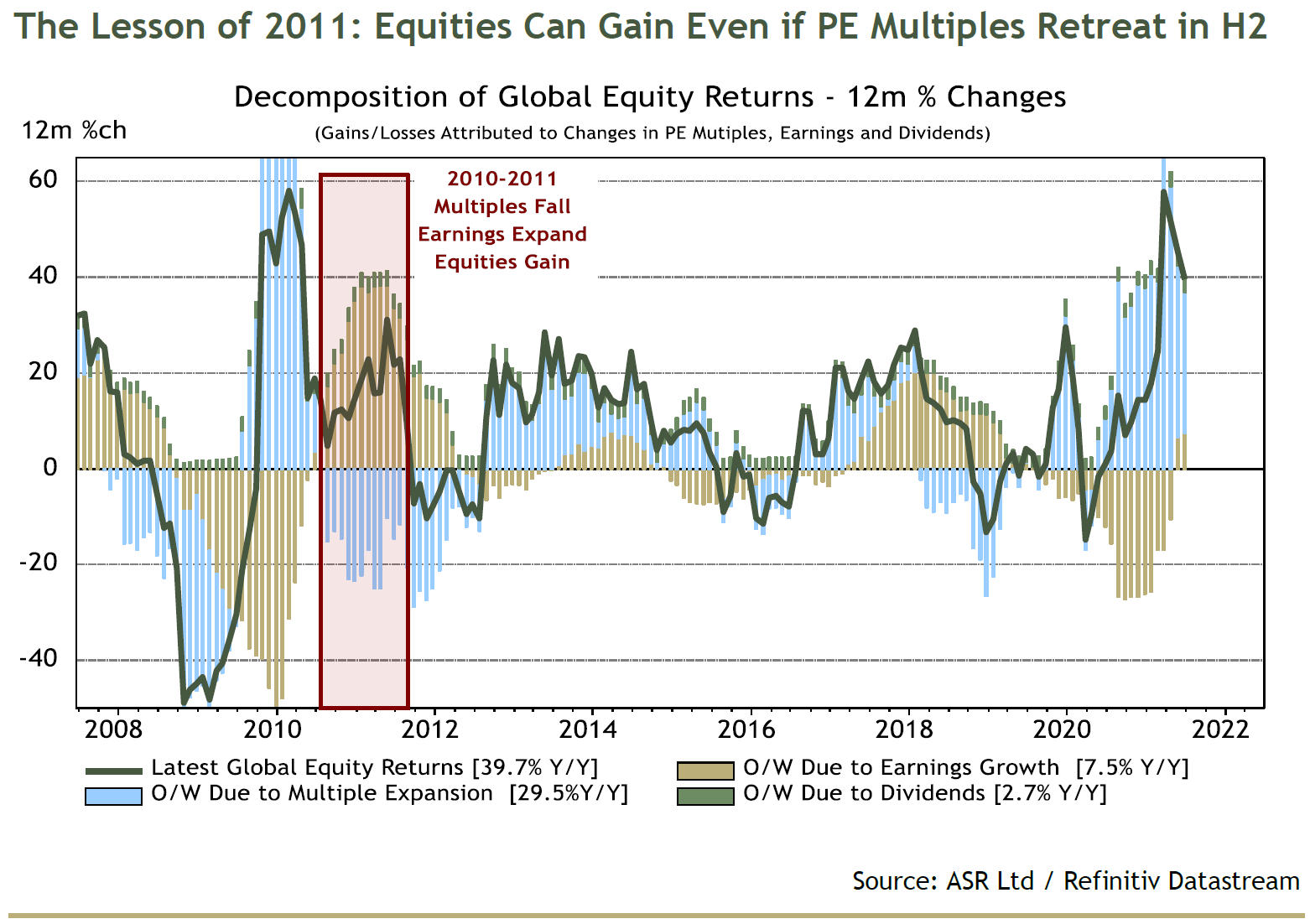

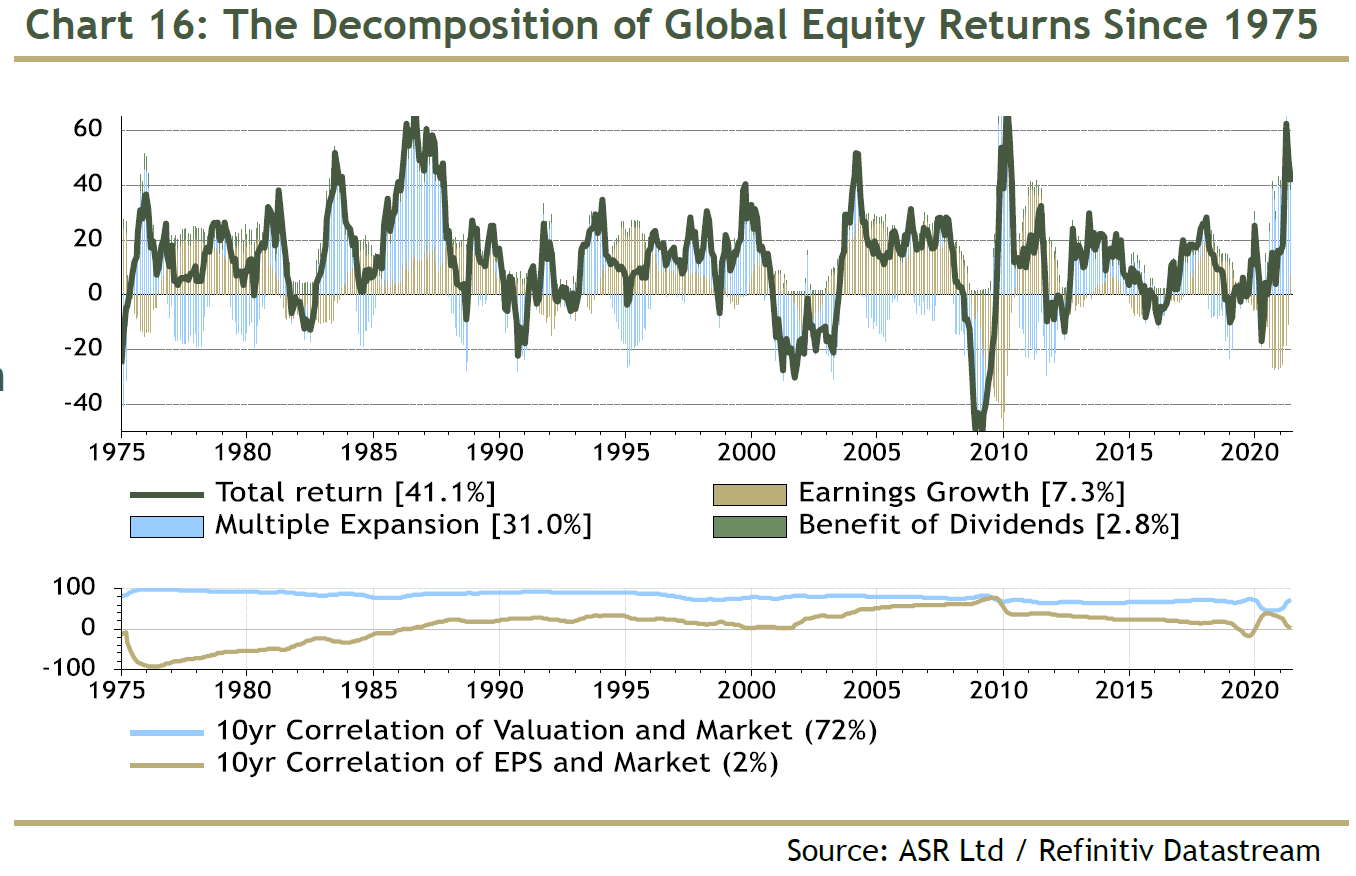

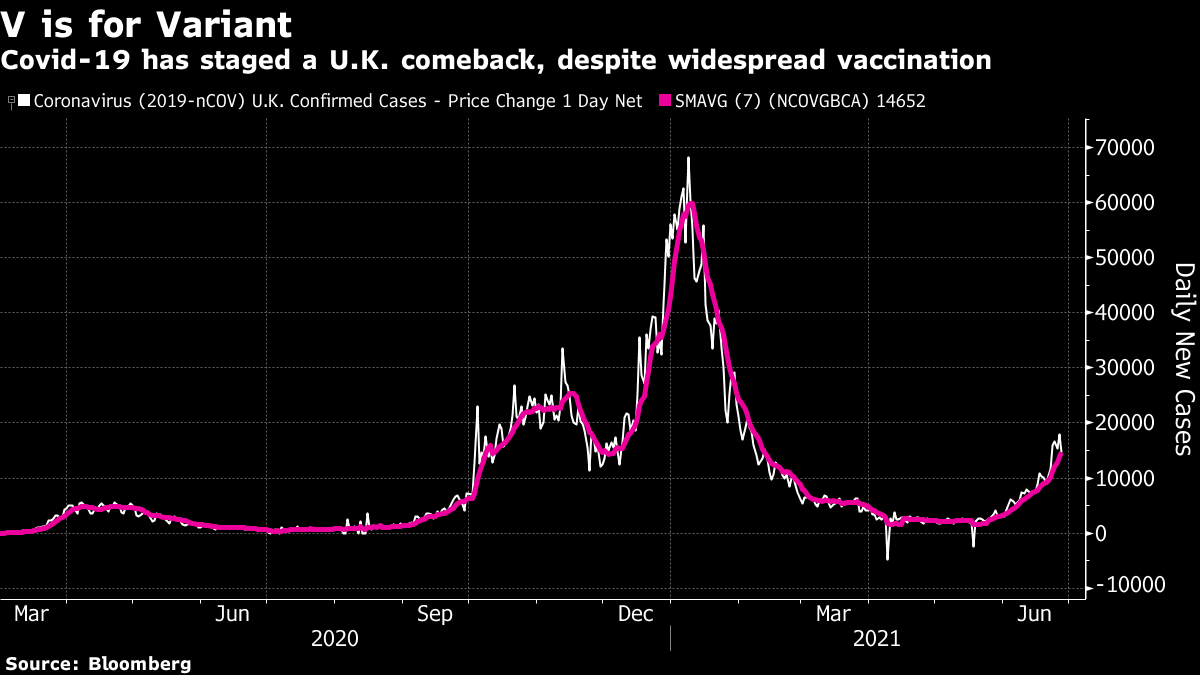

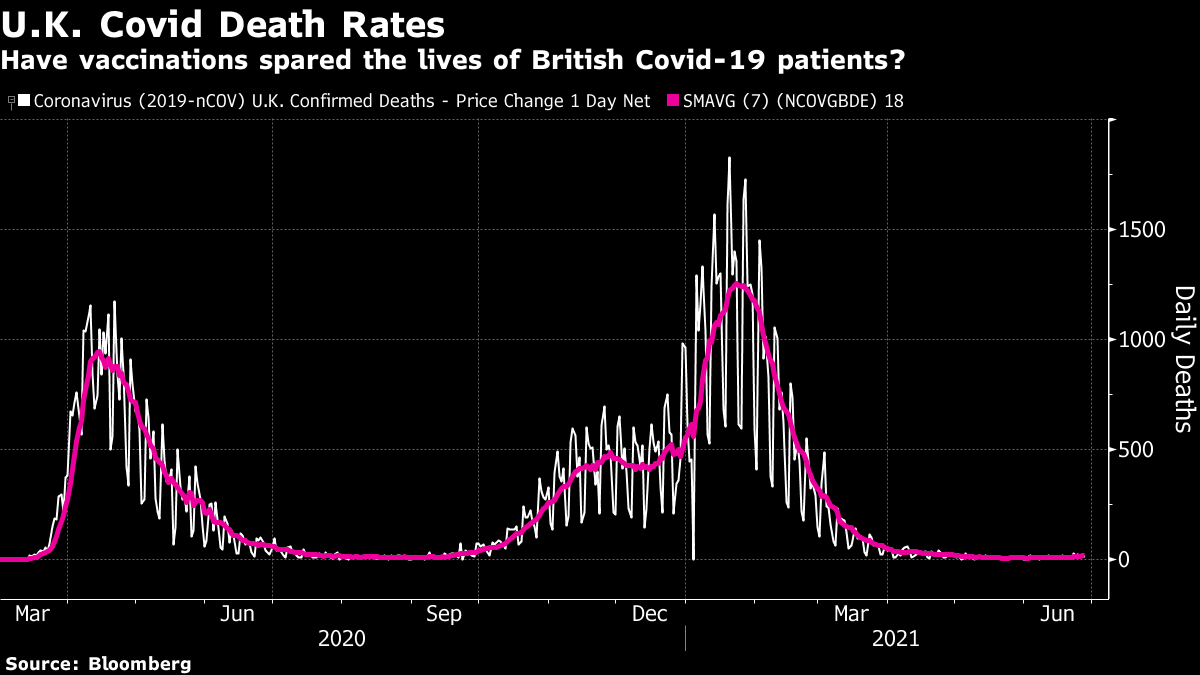

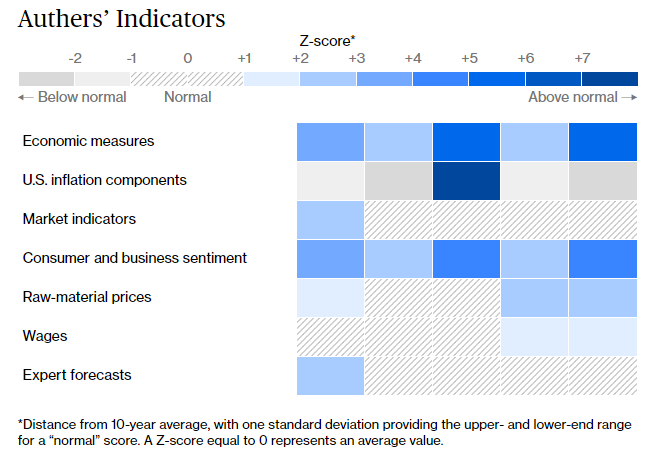

How to explain this? Plainly, this speaks to excruciatingly poor economic performance in much of the world. This may not have been a depression, but growth has been slow since the crisis. There is also an anti-American argument for the many people who want to make it. U.S. authorities have allowed a number of internet groups to buy up their competitors and become deeply entrenched, and they are now busily eating up profits that would once have accrued to companies in other countries. It's no wonder that European competition authorities are getting aggressive about this. And there is a positive American argument: The internet, which originated in the U.S. military-industrial complex, has allowed corporate America to innovate and grow in a way that has eluded everyone else. Leaving that long-term argument to one side, the short-term implication is that even if price-earnings ratios look extremely high (which they do, particularly in the U.S.), it is plenty possible for share prices to rise even as multiples fall, if profits keep expanding. This chart of global equity returns is from Ian Harnett of Absolute Strategy Research Ltd. in London. It decomposes growth due to dividends, earnings growth, and multiple expansion. Over the last 12 months, in which equities have somehow returned 39.7%, widening P/E ratios have accounted for most of the gain:  It is only rational to assume that valuations will come down. However, the experience of 2010-2011, highlighted in the chart, shows that it's still possible for stock markets to gain in these circumstances. The start of that period was a messy year filled with gloom over currency debasement, the debt-ceiling row in the U.S., and the beginning of the euro-zone debt crisis; but earnings still grew by enough to counterbalance the fall in multiples, and stocks rose. A "benign compression" in valuations can happen. If we suffer a liquidity shock or another unexpected blow from the pandemic (of which more below), then valuations make it very hard for stocks to make more progress. But there is a possibility of growth from here. To end with a note of caution, however, Absolute Strategy also breaks down global equity returns since 1975 into earnings and multiple expansion. Differences in earnings in the post-crisis era have determined which markets have won and which have lost, but in the longer term, multiples have been far more influential in driving returns.  The bottom line? Earnings season, three weeks away now, probably matters more for stock prices than the rash of macro data that will start at the end of this week with ISM surveys and U.S. non-farm payrolls. There had better not be too many negative surprises. With valuations so high, it behooves everyone to be aware of the risks of a fall. But it also behooves those (like me) who've been warning about the risks of excessive valuations to accept that there's still a way that markets could gain further from here, if earnings fulfill rosy expectations. Cautionary Tale From HomeThe most dangerous risks are the ones we don't understand, or don't see. All of us, including plenty with medical knowledge, have learned what we don't know about infectious diseases and their effects on the economy over the last 18 months. So I offer the following case with due humility. It would seriously be a good idea to keep an eye on the pandemic in the U.K. in the next few weeks. This is how the trend in daily cases has moved since the beginning of the outbreak last year:  Obviously, the rise in infections should concern everyone. To recap, the U.K. proved to be a test experiment first on the British variant, then on being the first developed country to execute a successful mass vaccination program, and is now the first developed country to host an outbreak of the delta variant. A big vaccination campaign hasn't stopped another wave of infections and hospitalizations. So far it hasn't led to a significant rise in deaths:  What do we need to learn in the next few weeks? The disaster scenario involves the variant gaining further in strength, and hospitalizing and killing more people — even if they have been fully vaccinated, as a significant proportion of current patients have been. If deaths stay this low, and the variant doesn't inflict long-term negative consequences on patients, it could almost be seen as good news; the vaccination campaign has saved the lives of the most vulnerable, and the latest outbreak is most serious among younger people who are less likely to be vaccinated, and also less likely to be in mortal danger. This could be the final stage toward reaching "herd immunity" for the U.K. One alarming implication of the U.K. experience, however, is that even a massive vaccination campaign doesn't get us to herd immunity. At one point there were optimistic projections that only about a quarter of people needed to be infected or vaccinated. Now it looks as though that number is much, much higher. And the longer we wait for herd immunity, the longer the virus has a chance to develop new variants, which may prove resistant to vaccines. As it stands, the base scenario, which many are beginning to regard as a certainty, is that the pandemic is on its last legs. That is still a reasonable prospect. But the British experience has already had real world economic effects. Reopening has been postponed for a month, and the Bank of England might well have tapered its support for markets last month had it not been for this renewed outbreak. There is no reason for terror, but every reason for investors to keep a close eye on Covid figures, particularly for now in the U.K. Authers IndicatorsThe latest update of Authers Indicators (the glorious name, which wasn't my idea, for our inflation heat map) is here. You need to squint to see the changes from last week, as there haven't been many new economic releases. In brief, market breakevens turned up a little, as did commodity prices, to make up for the overreaction to the Federal Open Market Committee meeting the week before. This leaves most of them plumb in the middle of their range for the last 10 years. Among raw material prices, lumber futures are fast coming back down to earth, as predicted and hoped by many, while the CRB RIND index, second from right in the raw-material prices row, continues to rise. This is of interest because it covers commodities that aren't available on futures markets, and therefore should be a purer representation of demand and supply pressures, and not affected by swings in sentiment about the Fed. The one serious extreme square is rental car inflation. It would be disconcerting if that cell weren't much paler blue after the next CPI data. The broad overview remains; the official data are plainly elevated, and consumer and business surveys continue to show concern; investors and economists are relatively unconcerned, while wage growth remains under control. There is inflation, but everything so far is consistent with it proving to be transitory. Keep watching this space.  Risks & RewardsLisa Abramowicz and I held our third livestreamed conversation on the markets on Friday, and we hope that it will help you get ready for next week. Lisa started by commenting that markets seemed to have lapsed into a post-FOMC stupor, as if nothing, even a taper, really mattered. That led to an attempt to trademark the phrase "taper stupor." It's almost as good as "taper tantrum" but slightly harder to pronounce. As you might guess, both of us are rather concerned about complacency, and the difficulty people seem to be having with even imagining what might go wrong from here in markets. There's certainly a reasonable base case that things go well, but it's best to remain humble, particularly when one of the primary risks is biological, not financial or economic. You can find the conversation here.  OmissionsIn last week's discussion of bond factors going back to Waterloo, based on a paper from the quants at Robeco, I forgot to provide a link to the paper. You can find it here. My apologies for the omission. Survival TipsI still have sport on the brain, I'm afraid. As Denmark are proving one of the wonderful stories of the European Championships, let me remind everyone of my favorite Danish export to help me get through the pandemic, the TV series Borgen, which is still streaming on Netflix. It's a fantastic, twisting and turning drama about Danish politics. Imagine a rather strange hybrid of The West Wing and The Girl with the Dragon Tattoo, and you get the idea. Perfect binge viewing. Meanwhile, for those who had never heard of Christian Eriksen before he became famous for suffering cardiac unrest on the field in the Euros, here are some of the goals he scored for Spurs as he became a star. Meanwhile, in baseball the Red Sox have just completed their second successive sweep of the Yankees. A very welcome improvement on last year. I've been lucky to be in Yankee Stadium for some great Sox moments in recent years. So, here are some home runs from Rafael Devers in 2017, Brock Holt in 2018 (to complete the cycle), and Bobby Dalbec earlier this month. I had a great view of all of them. May they never get old. Have a great week, everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment