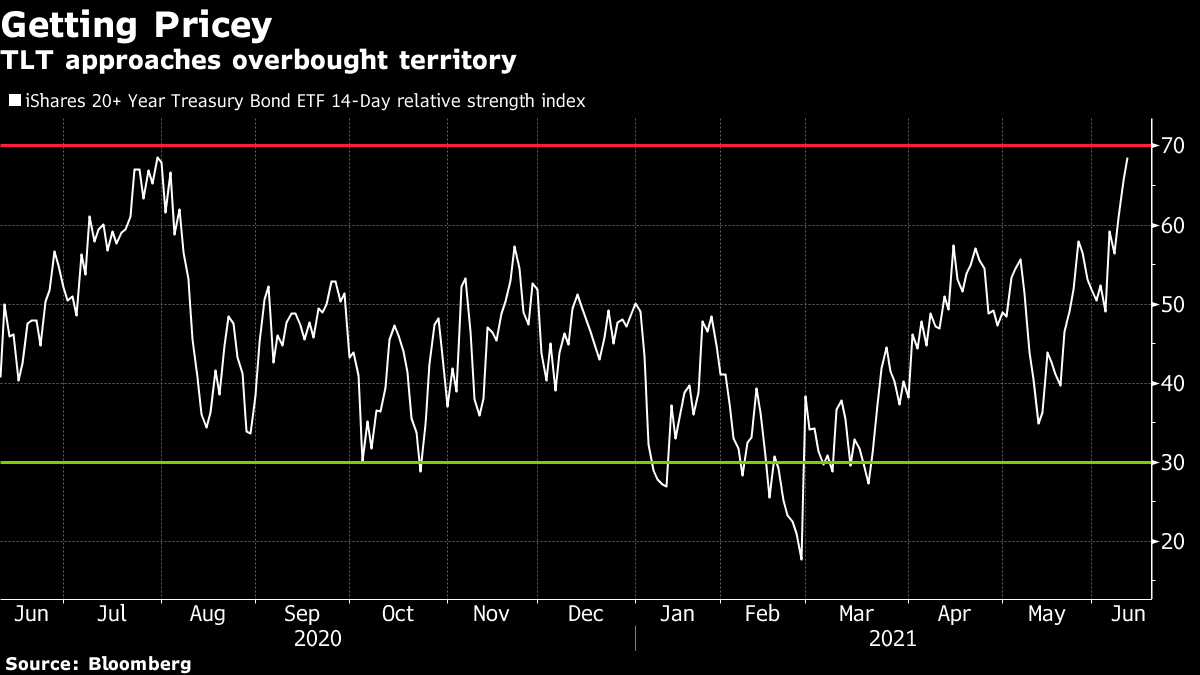

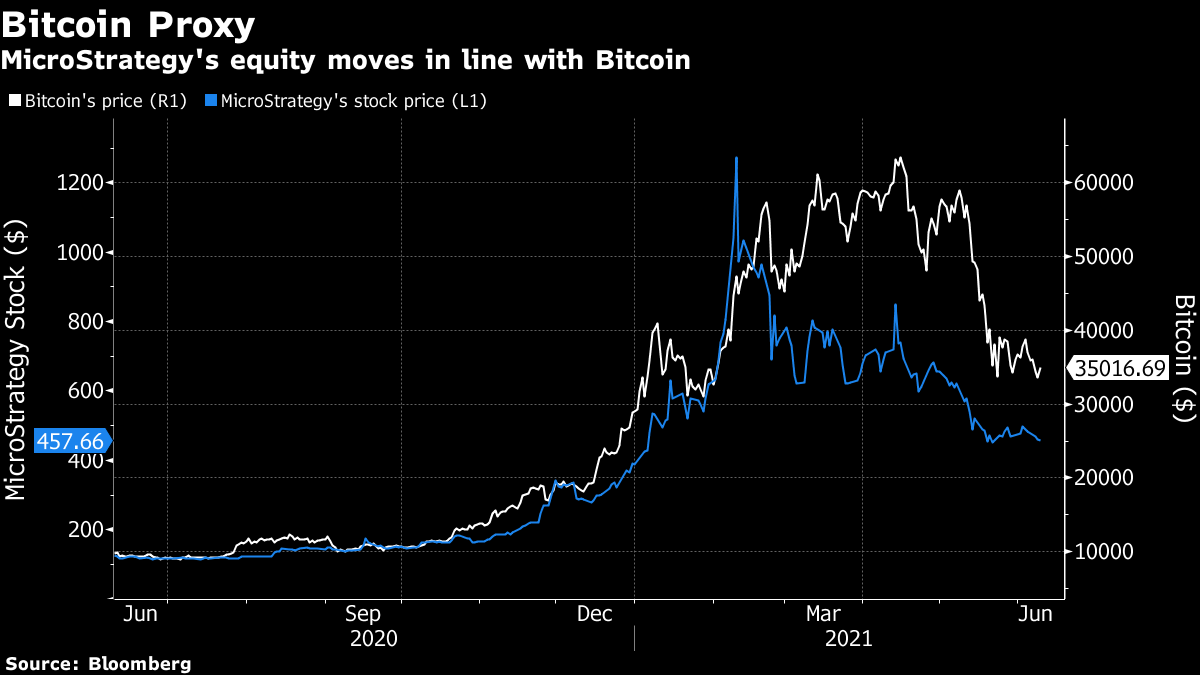

| Welcome to the Weekly Fix, the newsletter that cares about boring things like fundamentals. I'm cross-asset reporter Katie Greifeld. Pensions Squeeze Bond BearsIt's been a counter-intuitive week in the Treasury market. Benchmark 10-year notes are poised for their biggest weekly gain in a year, with yields sinking to 1.43%. That rally picked up steam even after data showed that the U.S. consumer price index surged 5% from a year earlier, and 0.6% on a monthly basis in May. Both measures beat expectations. One way to read that would be to point to the huge increases in used vehicles, airfares, hotels, and label May's numbers as transitory. That's the view of Guggenheim Investments chief investment Scott Minerd, who tweeted that those jumps "won't be sustained" as demand cools and production ramps up. Through that lens, maybe it makes sense that yields dropped in the aftermath.  Bloomberg Opinion columnist and Allianz SE chief economic adviser Mohamed El-Erian thinks it's far more technical. A short squeeze was on display this week in the Treasury market, he told me and Opinion's Brian Chappatta in a Twitter Spaces on Thursday. Liability-matching flows drove the position unwind, he said. "Failing to liability-match is a big deal," El-Erian said. "The more it moved, the more it was going to move." Which brings us to the bond market's sleeping giants: Pensions. Milliman data show that the 100 largest corporate pension plans were almost 100% fully funded in May, up from a funded ratio of 82% in July 2020. Bank of America sees that sparking a "massive rotation" from equities into high-grade debt as pension managers look to lock in gains. That rotation should support credit spreads in the back-end of the curve, according to Bank of America, and it could help explain why we've seen a massive unwind of short positioning in Treasuries as well.  It remains to be seen how long this rally can endure in the face of what's clearly a hot economy. There's reason to think it could slow soon, if you're someone who follows the charts. The iShares 20+ Year Treasury Bond ETF's 14-day Relative Strength Index is the closest to overbought territory since last July—the following month saw a 5% drop. Buying the Bitcoin Dip With BondsBonds and cryptocurrencies collided this week, thanks again to MicroStrategy Inc.—nominally a software maker, better known as the biggest corporate advocate of Bitcoin. The company made waves this week by selling $500 million of junk bonds solely for the purpose of buying more Bitcoin—something that's never been done before. That's on top of the roughly $1 billion worth of convertible notes MicroStrategy issued months earlier, also to fund its crypto binge. Amazingly, the junk bonds pretty much flew off the shelf. MicroStrategy was able to upsize the offering from $400 million and received $1.6 billion in orders, with a "large number of hedge funds" among the bidders, according to Bloomberg News reporting. The 2028 secured notes were sold with a yield of 6.125%, below early pricing discussions of 6.25% to 6.5%.  It may seem nuts that debt issued exclusively so that a company can hoard more of a risky asset—not to say, fund an acquisition or growth—would be so warmly embraced by the market, given that bond traders supposedly care about boring things like fundamentals. But consider the world we live in, where the average yield on junk bonds is hovering near all-time lows of 4%. Not to mention, Bitcoin prices have dropped off a cliff. The world's largest cryptocurrency traded near $36,800 on Friday, down a whopping 43% from its all-time high in April. So in a way, this MicroStrategy offering gives bond investors an avenue to chase yield while effectively buying the dip in Bitcoin. The company behind the bonds is just a detail. "The buyers are likely fully concentrated on the extra carry and are constructive, at these levels, on Bitcoin," said David Schawel, chief investment officer at Family Management Corp. "Buyers aren't looking at it from a fundamental perspective, and are just willing to roll the dice or play for a quick trade."  While the bond market is embracing MicroStrategy, its shine is dimming in the equity market. The stock is still up 31% in 2021, but has plunged roughly 60% from February's high. The Gift That Keeps on GivingAmusingly enough, the Fed may be helping to bankroll MicroStrategy's latest Bitcoin spree. About 0.01% of State Street's SPDR Bloomberg Barclays High Yield Bond exchange-traded fund (ticker JNK) is allocated to MicroStrategy's 2028 debt. BlackRock's iShares Broad USD High Yield Corporate Bond ETF (USHY) owns a small sliver as well. The Fed holds both of those funds—at least, it did on Monday. They were among the $8.6 billion worth of fixed-income ETFs that the Fed purchased as the pandemic descended last year, effectively freezing credit markets. The central bank began offloading its ETFs on Monday, but assuming it didn't dump its holdings in one fell swoop, that means that the world's most important central bank is among the earliest adopters of the first Bitcoin-linked junk bond. That's entertaining for several reasons, chief among them being that policy makers have taken a pretty dim view of crypto. Fed Chair Jerome Powell said in April that they are simply vehicles for speculation, while Fed Governor Lael Brainard said last month that regulation needs to "evolve" and widen with regard to crypto. And here we are! While we're on the topic, it's worth pointing out how remarkably unfazed the fixed-income ETF landscape was by the Fed's unwind. That's because the fact that the central bank bought ETFs in the first place is a gift that keeps on giving.  In effect, the central bank gave its seal of approval to a structure that's long been the subject of skepticism and hyberbole. The bogeyman haunting bond ETFs is that because they trade much more frequently than the debt they hold, a mass exodus from ETFs could exacerbate selling pressure in the underyling cash bonds in a downturn -- the ol' illiquidity doom loop argument. The Fed's foray quieted some of those critics, which matters more than the dollar amount of the purchases. "It was very important that they stepped in and showed they had faith in the structure and the system, and it worked," Dave Nadig, the chief investment officer at data provider ETF Trends, told me earlier this week. "The $8 billion in bond ETFs held by the Fed are really pretty irrelevant to the market as a whole." El Salvador's Bitcoin MoonshotI promise, this newsletter is almost done discussing Bitcoin. El Salvador became the first country to formally adopt Bitcoin as legal tender—a plan President Nayib Bukele announced last weekend at the crypto conference in Miami, to much fanfare. While that got a rapturous reception from the crypto bros in Miami, El Salvador's bondholders aren't as thrilled, with analysts warning that it could hamper the nation's efforts to secure a deal with the International Monetary Fund. El Salvador is negotiating a $1.3 billion extended fund facility program as it seeks to reign in a fiscal deficit that widened to 10.5% of gross domestic product last year. The country's bonds due in 2052 dropped by the most in over a month after lawmakers approved the plan. IMF spokesman Gerry Rice doubled down on Thursday, saying that El Salvador's adoption raises "a number of macroeconomic, financial and legal issues." Ambrus Group co-chief investment officer Kris Sidial sees a silver lining—with a ton of potential land mines. The more "aggressively" El Salvador integrates Bitcoin into its monetary system—say, 50% of the country's balance sheet—the more correlated the country's sovereign bonds will be with the coin, particularly among the shorter maturities.  Of course, that's an extremely sharp double-edged sword. As the past couple months have demonstrated, Bitcoin can easily shed half its value, which could pummel the country's debt if El Salvador goes all-in. But say the cryptocurrency embarked on another meteoric rally, all the way back to $63,000 and then some—the country's Bitcoin gambit turns into a moonshot. "Someone's going to look at this and say, 'I'm going to take a shot.' There's always a market for EM debt because there's always going to be someone speculating," Sidial said. "Unless it's just a complete catastrophe—I think it would be a scenario where the rating drops off, no one's going to want to hold the bond, but they'd end up covering it and issuing more debt." Let's say things work out for Bukele and Bitcoin goes back to the moon. That would boost El Salvador's spending power and enable the country to issue more debt, perhaps to fund a sorely needed infrastructure build-out. To state the obvious, it's risky. And it remains to be seen how enthusiastic El Salvador will actually be about the integration—central bank president Douglas Rodriguez clarified this week that Bitcoin won't replace the U.S. dollar. And El Salvador's sovereign bonds may be sitting directly in the cross hairs. Bonus PointsThe Fed Is Paying 0.00%. Such a Deal! Depositors Are Flocking In the FOMO Economy, Everyone Is Making Money But You Millennials at 40 Are Falling Behind Their Parents in Every Way |

Post a Comment