| Welcome to The Weekly Fix, the newsletter that sees method in the madness of the dot plot. — Emily Barrett, Cross Asset reporter/editor Ye of little FAITYou know, it's funny, we were just talking about how the market's finally come around to the Fed's way of thinking on inflation risks (remember how yields actually fell on that blowout consumer price inflation number this month?)...and then, bang. Suddenly, after sweating it out for a couple of months sticking to the script — this is transitory, it's the base effects, it's the reopening — the Fed got all, is it hot in here? And that's it, inflation is maybe not quite so transitory aaaannnd... Framework schmamework. Policy makers now see possibly two rate hikes by the end of 2023, up from none as of their last projections in March. They're also more concerned about inflation than they seemed to be, despite their own freshly-minted forecasts suggesting that it will return close to target after this year's spurt. Roberto Perli of Cornerstone Macro — himself a former Fed staffer — sees this as a setback for the credibility of the central bank's new strategy. "In the grand scheme of things, nothing has changed, yields remain low and are likely to remain low for a host of reasons whether the Fed raises twice in 2023 or not. We can't characterize the Fed's new stance as hawkish by any stretch of the imagination, so it's not that monetary policy has drastically changed. "What it was, was a missed opportunity for the Fed to persuade the market that they are serious about the new framework."

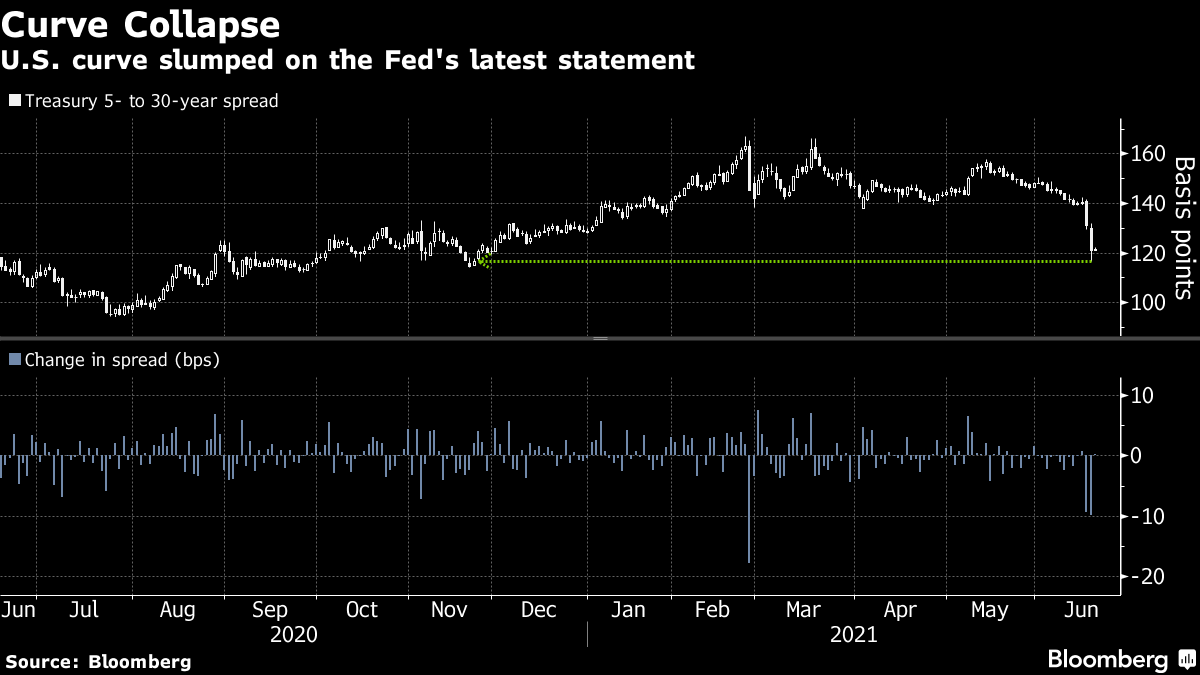

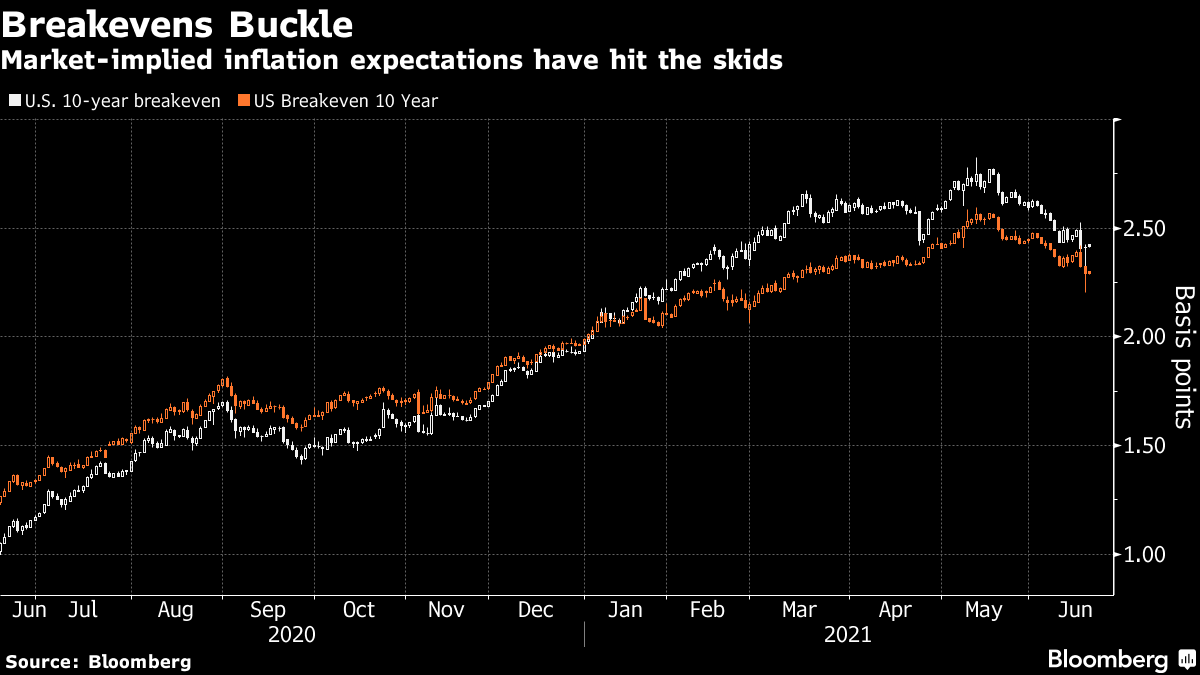

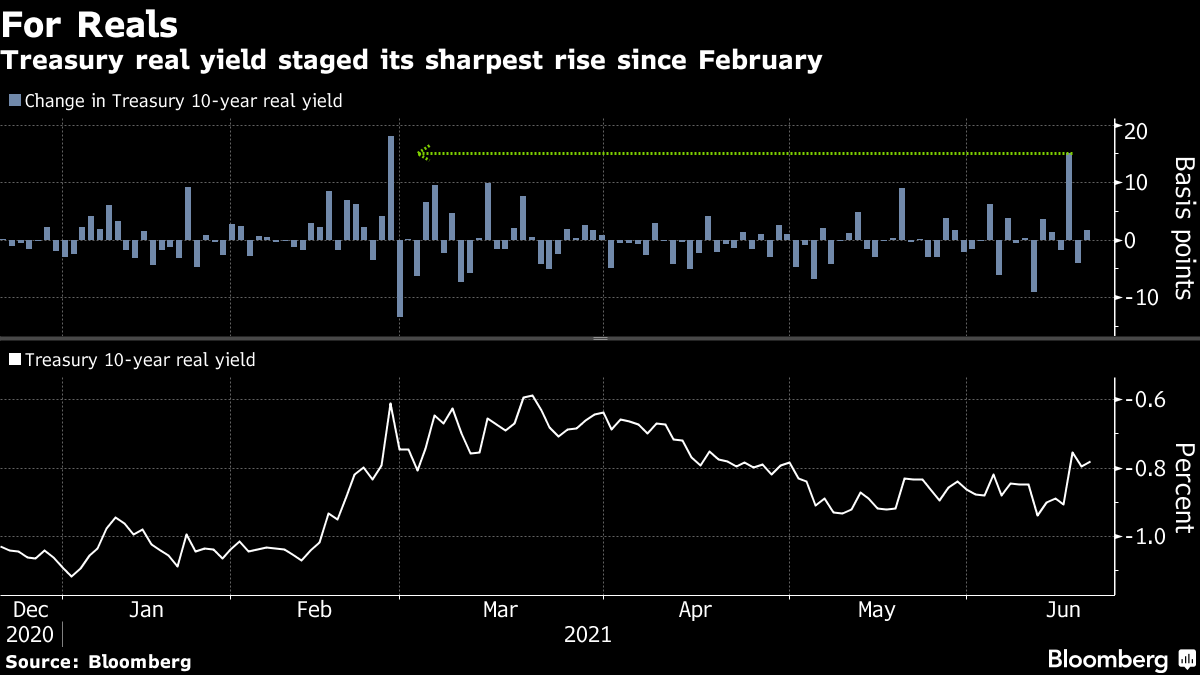

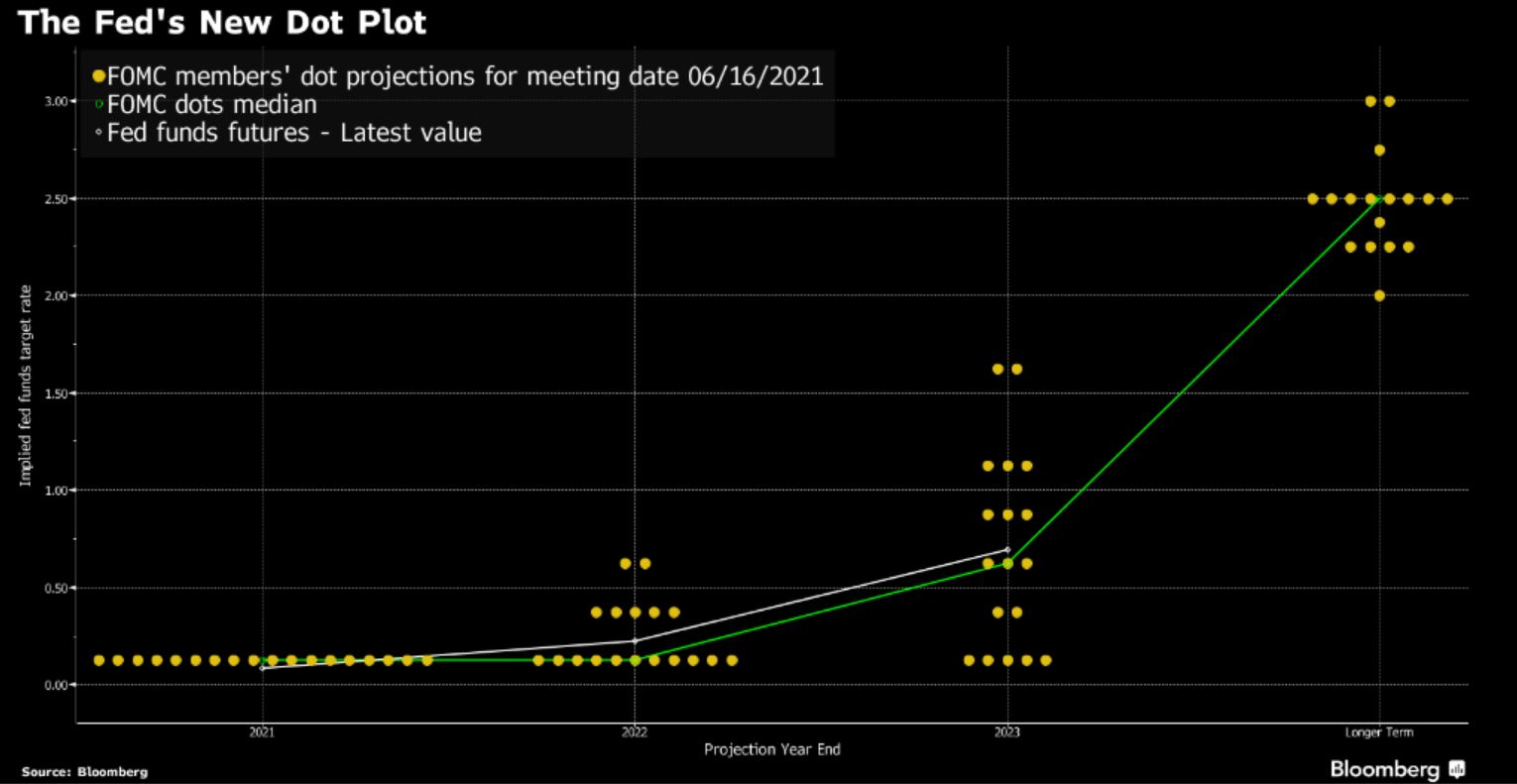

And while that sounds like a kind of technical, policy wonk issue, it's having some big market impacts. First let's consider the curve. As of Tuesday, the steepener trade was your go-to reflation bet. That is, yields on long-dated bonds were expected to rise (in line with stronger growth and price pressures) relative to those on shorter-dated bonds. Those were anchored while the Fed remained committed to another couple of years of near-zero interest rates. The five- to 30-year stretch of the curve was the poster child for this trade. Now look at it.  That's a double whammy of a simultaneous rise in five-year yields and slide at the long end, as investors see the Fed acting to rein in inflation with rate hikes. What about that other reflation trade? Investors who piled into inflation-protected securities (TIPS) on the view that things might just get out of hand haven't had the best week either. Breakevens — a proxy for the market's inflation expectations derived from the difference between yields on regular Treasuries and TIPS — tumbled in the wake of the Fed's statements.  And to cut to the chase: Real yields rose. The Fed's tolerant stance on inflation — the notion that policy would remain accommodative well into a recovery — has been a key underpinning of deeply negative inflation-adjusted rates.  And that is where we get to the middle can in the stack in terms of the global implications of this Fed pivot. Real yields are a strong driver of the dollar. And the dollar has just notched up its longest winning streak since March last year — a rally that's weighed on the prices of commodities (much of which are settled in dollars) and caught some wary eyes across emerging markets. As of Friday in Asia, the Brazilian real was the only major developing-market currency to have gained versus the greenback this week. And that's got a lot to do with the Brazilian central bank's notably aggressive approach to removing stimulus — it just hiked rates 75 basis points and flagged another similar increase in August. But let's keep this in perspective. Monetary policy remains historically easy and that's not getting unwound overnight. Real yields are still pretty negative and their rise — and the dollar's rally — has already shown signs of flagging. The market reaction globally isn't looking like hair on fire, and there's no surge in bond yields to roil risk assets — quite the opposite, as the global borrowing benchmark, the U.S. 10-year, eased back toward 1.50% after its unnerving initial 10-basis-point jump. And what of FAIT? The market has struggled to come to terms with the Fed's new reaction function since its great unveiling last year. If we look at money-market positioning, it's clear that a lot of the trader community was never that convinced by the Fed's pledges of patience in the face of rising inflation. Eurodollar futures contracts have been anticipating three rate hikes by the end of 2023 for months. Now they're pricing lift-off by the end of next year. Basically, the central bank broke with the rule that had kept it missing both its price stability and full employment goals for the better part of a decade. But now investors have no clear metrics to guide their expectations for how global borrowing costs might change with shifts in labor market and inflation data. And this whiff of inconsistency, with policy makers blinking at what's supposed to be a shortlived bump in prices, won't make it any easier, says Cornerstone's Perli. That's not to say that the central bank has compromised its new strategy, as Powell said this week, "we are still a ways from our goal of substantial further progress" in the economic healing. And that much is clear. The Black unemployment rate was 9.1% in May, and the Hispanic rate was 7.3%. These are improvements, but they compare with an overall jobless rate of 5.8%. Cart before the horseThe question on a lot of minds this week was, what's with the dots? The main surprise in the Fed's pivot (we won't call it hawkish, because, well, an openness to talking about trimming $120 billion of bond purchases a month, and lifting rates off zero in two years' time isn't exactly raptor-ish stuff) was the opening it chose. An earlier-than-expected signal on asset purchases was within the realms of possibilities, but few had anticipated a stronger signal on hikes. After all, it's well understood that the Fed aims to move first to trim its bond buying program before taking any action on interest rates. Now, sure, Powell actually did say to take the dots with a large grain of salt (then why publish them? Do we need them?), as they're not forecasts or signals of intent, and they're not governed by any kind of consensus across the members of the committee. The signaling on rates may well reflect a divergence in the thinking of the central bank's top and lower-rung officials.  In any case, the benefits of this back-to-front approach — intended or not — are showing in the market. As laid out in the charts above, the Fed's continued ambiguity on the taper, while pulling forward its projections for lift-off, appears to have kept long-end rates in check, and focused the selloff in the belly of the curve. Meanwhile, the dot furore has made things slightly harder for the Street's readers of the taper tea leaves. Pimco economists Tiffany Wilding and Allison Boxer worked backward from the revised projections for a possible first hike in 2023, to conclude that the Fed could announce the first pullback in asset purchases as soon as September. They're at the more aggressive end of the spectrum, while Goldman is sticking to its view that a formal notification will come in December, with the process getting under way early next year, "though the risks lean toward an earlier start." And the debate over what happens to long-end yields when it does all kick off is likely to get hotter from here. There's a decent case to say yields struggle to rise in the second half of the year. So far, we've few signs of a tantrum. Some market watchers have posed the theory that perhaps the yield surge at the start of the year was the real dummy-spit, and the market is now more sensitive to fiscal than monetary stimulus. According to Columbia Threadneedle's Ed Al-Hussainy: "I think about what it would take to get the 10-year sustainably above 2% and I suspect we will need another fiscal push. The Fed alone will struggle to do it."

Bonus pointsFed ripples hit hardest in Asia as rates outlook suddenly shifts The return to office is pushing even more women out of work Clothes that don't exist are worth big money in the metaverse $213 billion investor targets a whole nation over climate change |

Post a Comment