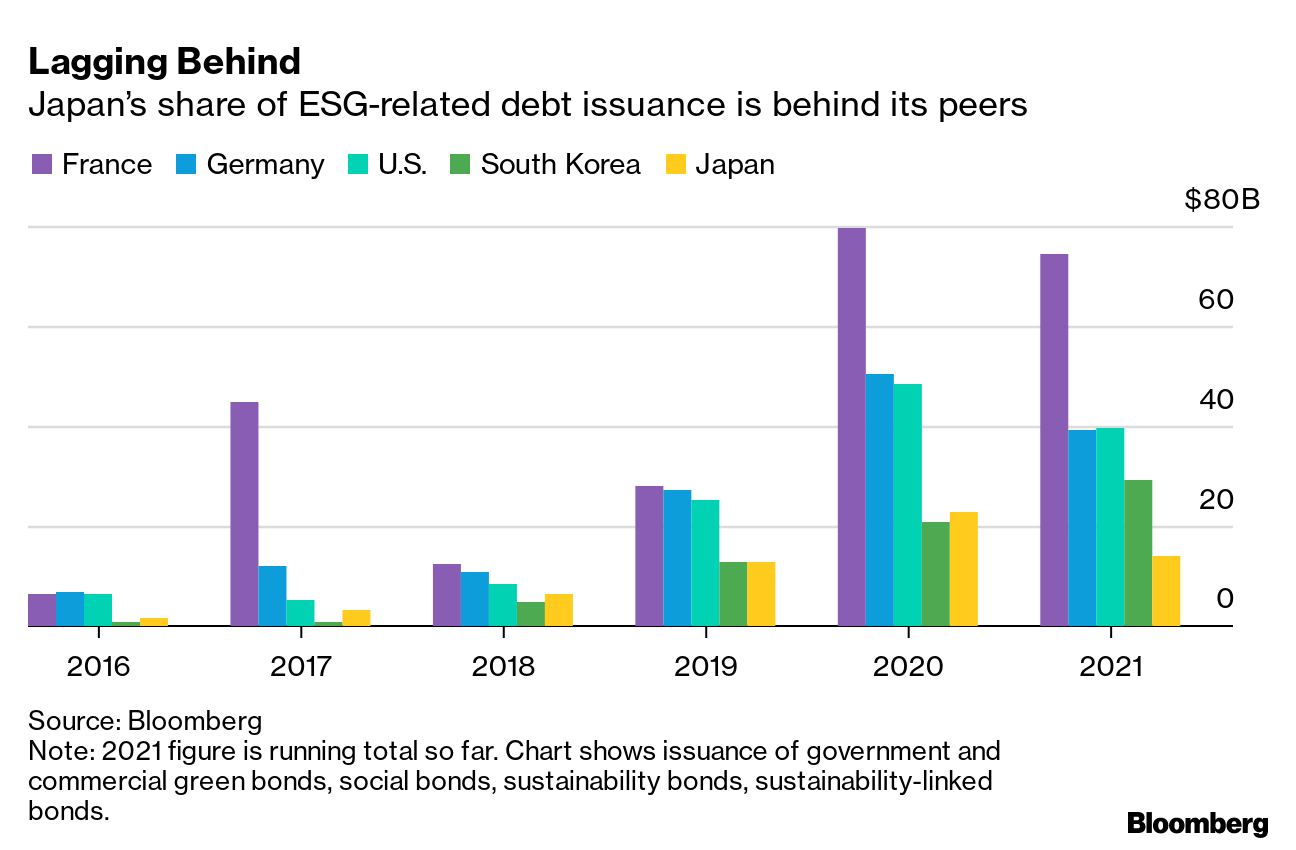

| Hello. Today we look at how central banks are worrying about the environment, the economic challenges posed by the menopause and the impact of the pandemic to accessing finance in emerging markets. Central Banks Go GreenThe Bank of Japan pulled one of its periodic surprises out of the bag on Friday by flagging a new tool to support efforts to address climate change. While Governor Haruhiko Kuroda said the BOJ was mulling what could be done on this front last month in an exclusive interview with Bloomberg News, no one expected an announcement so soon. Details will follow next month, but what we know for now is that the BOJ will soon start providing funds for banks lending to climate-friendly businesses.  Haruhiko Kuroda Photographer: Stefan Wermuth/Bloomberg The move follows a Bank of England announcement last month that it will shift corporate bond purchases toward companies doing the most to fight climate change as its remit now includes environmental sustainability. European Central Bank President Christine Lagarde has also voiced support for the European Union's efforts to transition to a more climate-friendly economy. She and colleagues are currently at a retreat at which the topic will likely be discussed. That leaves the Federal Reserve somewhat of a laggard — Chair Jerome Powell said this month that climate change isn't something it currently considers when setting policy. And it only just signed up to a network of green-minded counterparts. But it may soon need to be more active as the Biden administration in May urged regulators to report on their plans for assessing the threat climate change posed to financial stability. The climate-change battle risks intersecting with the other big global concern occupying traders minds: inflation. Industries from glass to steel to autos are being left with little choice but to change how they make products and ultimately what they sell, and the technical hurdles and investment involved mean it's going to cost much more to make stuff. BOE Governor Andrew Bailey said this month that the green shift needs to start as early as possible to avoid a disorderly move later that would be more damaging, where carbon pricing jumps suddenly, companies have to scrap some assets, bottlenecks intensify and output takes a hit. The BOE estimates inflation in that scenario would accelerate to more than 4%, which compares with an average of 2% this century. More fodder for those arguing the current inflation acceleration will prove far less "transitory" than currently thought.  As for the BOJ's new program, it could help Japan move a little closer to ambitious goals set by Prime Minister Yoshihide Suga for making the country carbon-neutral by mid-century. But it could also invite criticism from those who feel the environment should be left to government policy. — Malcolm Scott - Got tips or feedback? Email us at ecodaily@bloomberg.net

- For a daily digest of climate news and insights on the latest in science, environmental impacts, zero-emission tech and green finance, subscribe to the Bloomberg Green newsletter

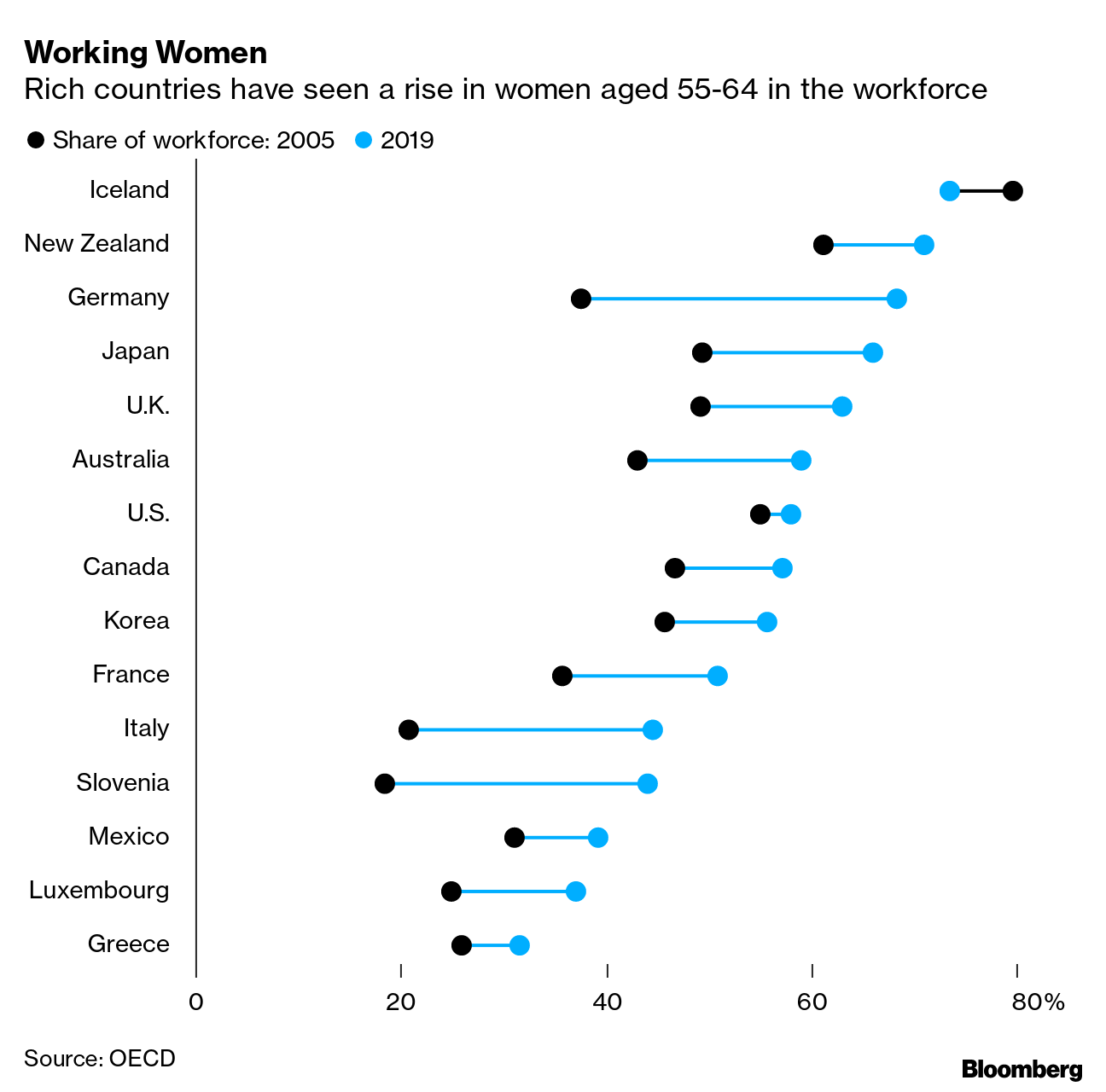

The Economic Scene Governments and companies are beginning to take note of the need to understand the economic implications of menopause. Symptoms start in women between the ages of 45 and 55, who account for 11% of the workforce in the Group of Seven industrial nations. Globally, menopause-related productivity losses can amount to more than $150 billion a year, according to Reenita Das, a partner at consulting firm Frost & Sullivan. Today's Must Reads - The Fed fallout | After markets focused initially on the Fed's decision of Wednesday to pull forward the likely timing of an interest-rate increase to 2023, attention has turned back to when it may start paring its bond-buying program.

- Expat envy | In the financial hubs of Singapore and Hong Kong, businesses and expatriates are starting to question whether they've been too slow to reopen as sustained lockdowns take a toll.

- China credit | While Beijing is putting the brakes on credit expansion, that doesn't necessarily signal slower growth in the economy or demand for commodities because the traditional link between credit and growth isn't as strong as it once was.

- Losing friends | Three years after heralding an end to authoritarian rule and plans to open up Ethiopia's economy to foreign businesses, Prime Minister Abiy Ahmed is alienating allies and frightening off investors.

- Drug crisis | America's opioid-addiction troubles have mounted during the pandemic, exacerbated by millions of job losses.

- Worse than Suez | A partial shutdown of one of China's business ports is snarling trade roots and boosting freight prices.

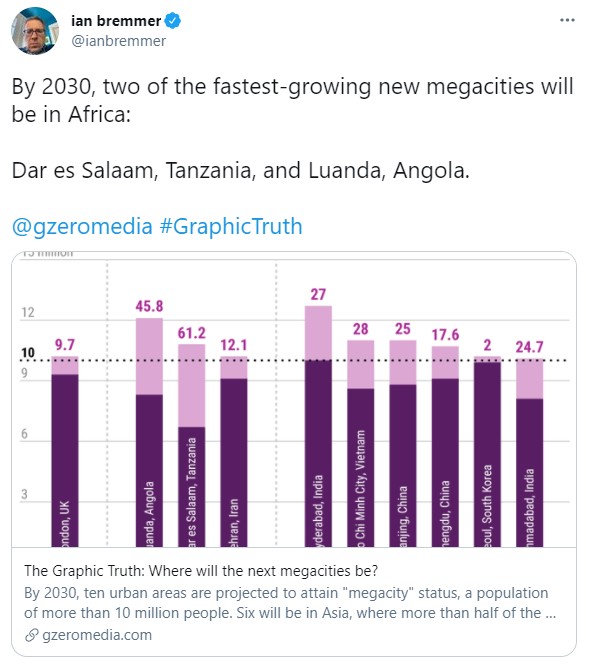

Need-to-Know ResearchThe pandemic is accelerating access to finance in emerging markets, according to economists at HSBC. Pre-coronavirus, such economies used cash more than their industrial counterparts, because of poor technology, low wages, distrust, a lack of documents, and banks being far away. "The pandemic has brought forward much of the infrastructure and programs required for fintech to thrive as governments have had to expand broadband to remote areas, enhance digital identification, and shift antiquated government systems online," HSBC's Henry Ward and James Pomeroy wrote in a report. Brazil, China, Chile and India are among those making strides, they said. On #EconTwitterLooking for the next megacity.  Read more reactions on Twitter Save the DateWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment