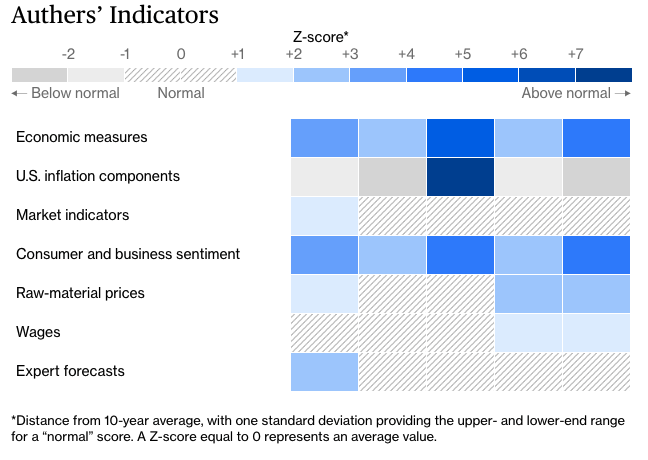

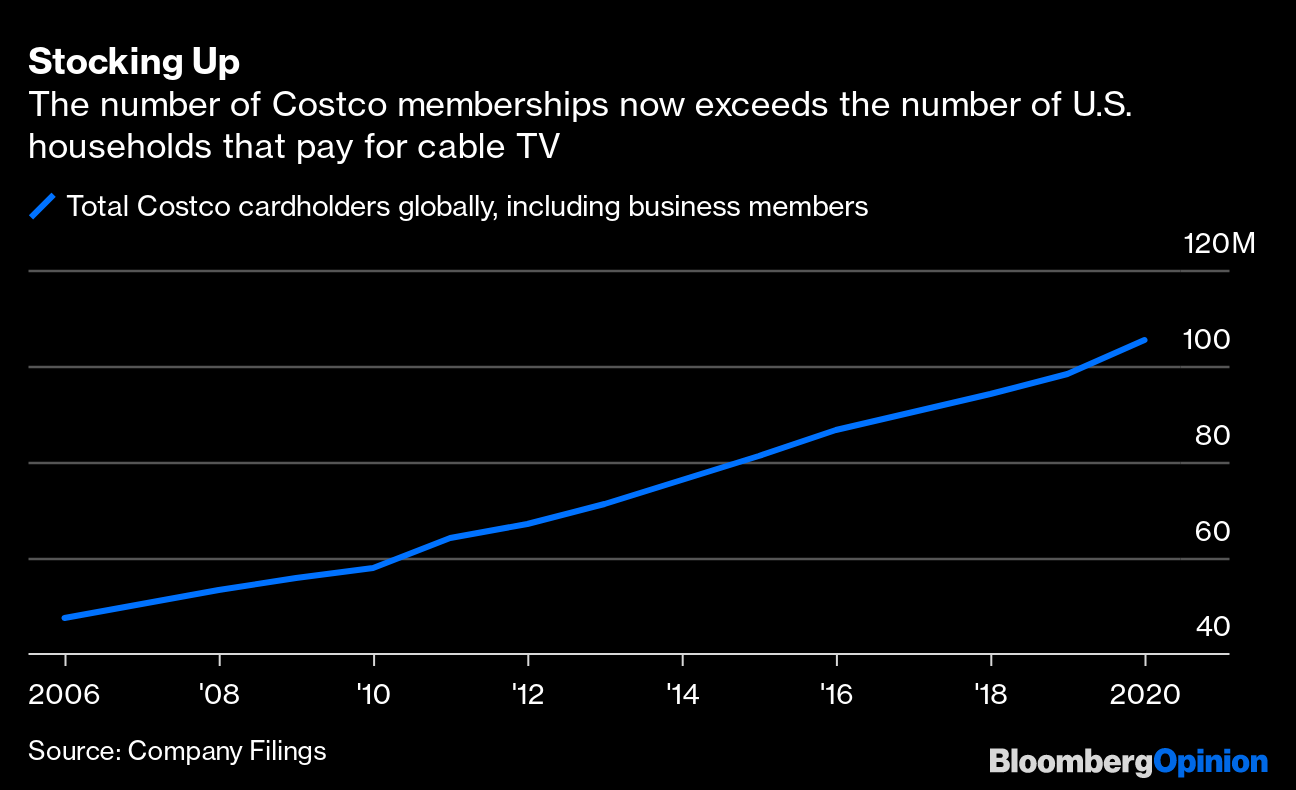

| This is Bloomberg Opinion Today, an impossible yoga pose of Bloomberg Opinion's opinions. Sign up here. Today's Agenda The Supreme Court, seen here dunking on the NCAA. Photographer: Elsa/Getty Images North America The NCAA's Long Reign of Terror Is Nearly OverDespite a 6-3 conservative majority, the Supreme Court keeps delivering shockingly centrist decisions, led by the shockingly centrist Brett Kavanaugh, as the New York Times noted this weekend. Some of this is the court striking impossible yoga poses to find consensus, maybe to avoid naked partisanship. But it's also that some of these cases are just Washington Generals-level pushovers. The Obamacare challenge the high court rejected last week was one such case. Today the court circus-dunked on an even weaker one. The NCAA had asked the justices to uphold its God-given right to milk student-athletes for every drop of their value without giving them anything in return. In an opinion written by Neil Gorsuch, the court responded by updating its stance on this issue from 1984's "OK, then" to 2021's "Get the hell out of my court," roughly echoing the growing consensus in polite society. The case didn't directly open the door to paying players. But as Noah Feldman writes, the NCAA now must face the fact it no longer has an antitrust exemption, meaning it will have to start paying up sooner or later. Joe Nocera points out the court seemed almost bummed the players hadn't asked for that specific relief. But Kavanaugh wrote a concurrence sounding the call for some more lawsuits to get the process started. More slam-dunks may be coming. Further High-Court Reading: SCOTUS term limits could come back to haunt Democrats. — Ramesh Ponnuru Shortages in EverythingJohn Authers noted last Friday the Federal Reserve went squishy on ignoring inflation right after inflation numbers started going squishy, doing its best imitation of a magazine cover indicator. Today he points out financial markets had already started taking off some runaway-reflation bets just ahead of the Fed meeting, in a win for efficient-markets enthusiasts. But however temporary the latest bout of inflation may end up being, another burst of it may be building up. Julian Lee points out the oil-pumping supergroup OPEC+ hasn't been pumping enough oil to keep up with rebounding demand. This might lead to a surge in prices that could flood the recovery. Meanwhile, global shipping is still not right after months of mishaps and misjudgments, writes David Fickling. The Ever Given being stuck in the Suez Canal for six days wasn't even the worst of it, though it was the funniest. Shipping prices are sky-high and could stay there for a while partly because, just like OPEC+, the industry wasn't prepared for a post-pandemic boom. Anyway, for now, inflation indicators have eased since our last dashboard reading:  So we're taking the Bloomberg Opinion Today Inflation Threat Level down to four Volckers out of 10.  Crypto Fans Do Not Understand, How Do You Say, EconomicsThe thing about incorrigible crypto fans is that they sound very smart, what with their blockchain this and decentralized that. But beneath that hard, logical veneer their arguments are often room-temperature tapioca. For example, Tyler Cowen dismantles a couple of crypto tenets with no basis in the laws of economics. One is that the U.S. dollar is on the verge of collapse. Sure, yes, in the year 10191, we will be using SpiceCoin and not U.S. dollars. Everybody knows this. But for a good long while until then, the dollar has fundamental reasons to carry on almost indefinitely as the global currency of choice. The other myth is that crypto will just appreciate in value forever. First of all, this makes it a terrible medium of exchange. Second of all, Tyler writes, that's just not how assets work. Bitcoin may be literally going to the moon, but not figuratively. Further Investment Reading: Telltale ChartsCostco may be the opposite of whatever cool is, but millennial home buyers (they do exist!) will find it irresistible, writes Tara Lachapelle. It's a new growth opportunity for the perpetually growing Costco, which will likely soon raise its subscription rate without losing many members.  Further ReadingPresident Joe Biden might want to stop taking his sweet time picking an FDA commissioner. — Bloomberg's editorial board Biden might regret making his Russian red line on cybersecurity public. — Meghan O'Sullivan The face-mask boom has gone bust. — Brooke Sutherland Chinese society is threatened by a movement of young people opting out of the rat race. — Matthew Brooker Studying how stress hurts animal health can tell us something about human stress. — Faye Flam Joe Manchin must choose between protecting voting rights and elusive bipartisanship. — Taylor Branch There were four big cancer-fighting breakthroughs at the ASCO conference this year. — Sam Fazeli ICYMI Bitcoin Death Cross spotted. The Gates divorce is making Michael Larson uncomfortable. Area billionaire aims to replace Facebook. KickersThe Hubble Space Telescope is on its last, uh, legs? "Slice of Hell" sells above asking. (h/t Ellen Kominers for the first two kickers) Valuable paintings discovered tossed at gas station. Texas is turning up people's thermostats while they sleep. (h/t Scott Kominers for the last two kickers)  Notes: Please send slices of hell and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment