| Hello. Today we look at the revolution of economic policy-making, China's shift to a three child policy and working from home's effect on cities. Under New ManagementThere coronavirus spawned a revolution in economic policy-making.

While the pandemic continues, it's already clear the management of key economies has changed for good, Matthew Boesler writes in the latest issue of Bloomberg Markets magazine.

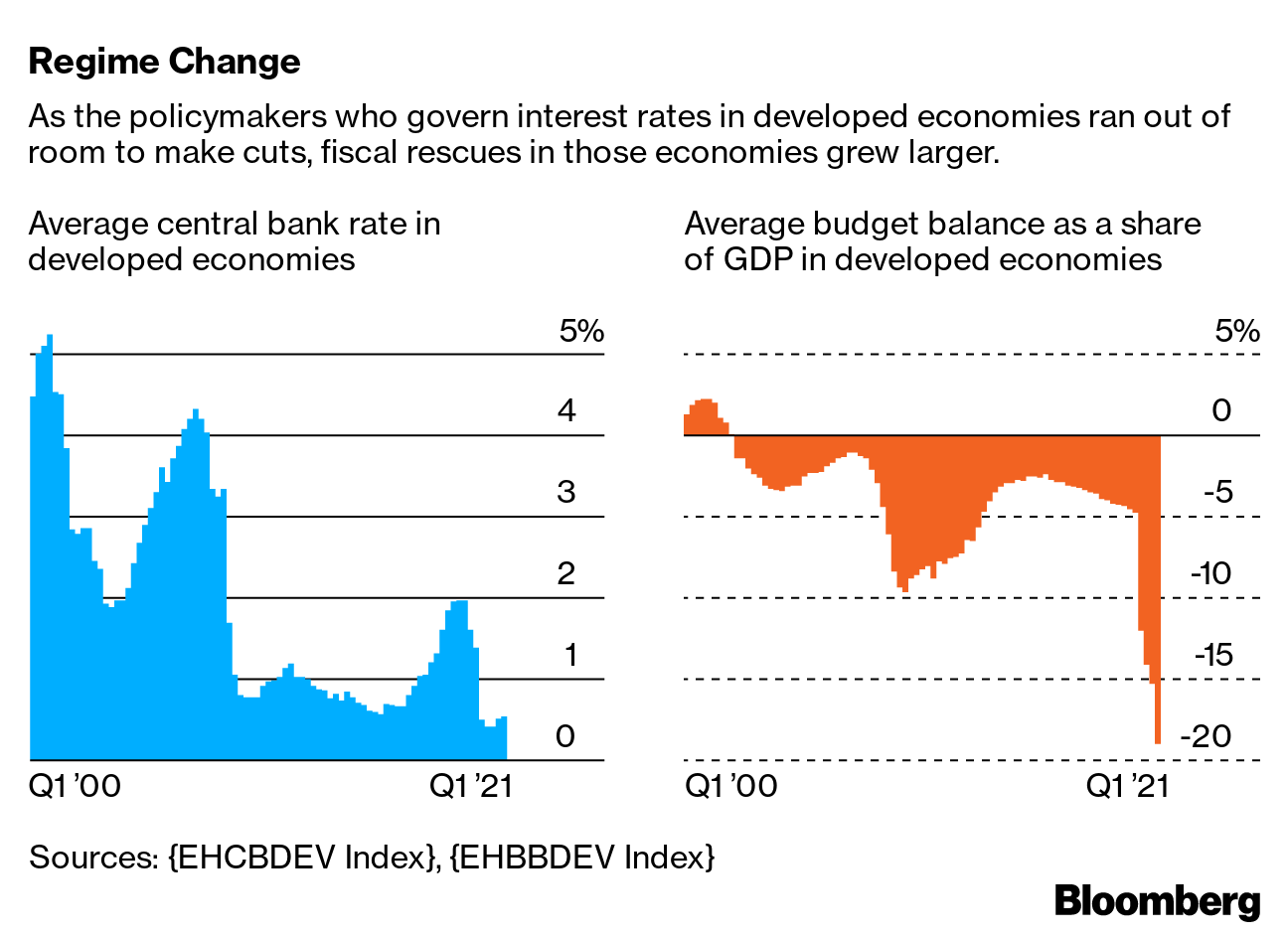

The basics of the new blueprint are: - Governments, especially the U.S.'s, channeling cash straight to households and businesses with less regard than historically for the resulting budget deficits

- Central bankers buying assets to cap borrowing costs, while signaling a willingness to let inflation accelerate faster than previously countenanced

- Policymakers of all stripes looking beyond aggregate metrics to data that show how income and jobs are distributed and who needs the most help

The result in most places has been a faster rebound in activity than initially anticipated when the pandemic struck.  To some extent, officials are showing they learnt the lesson of the last financial crisis. When that hit in 2008, governments bailed out banks but not enough is felt to have been done to help debt-burdened homeowners.

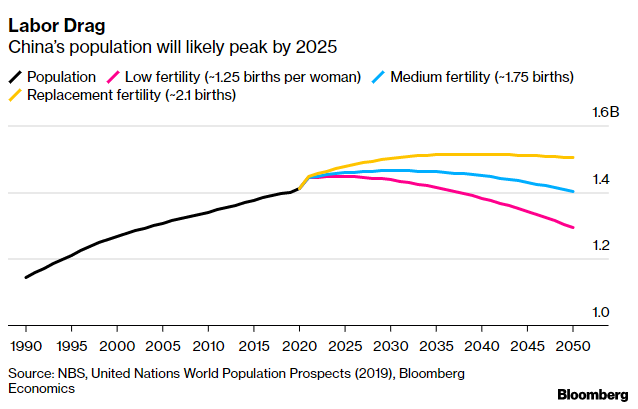

This time families got help, in turn avoiding stresses emerging in the banking sector. The aid looks set to stay — again a change from the last crisis when austerity resumed fairly quickly. President Joe Biden's budget contains more than $6 trillion in spending over the coming fiscal year. And if the boom does turn to bust, there's a new guide to what to do. Direct payments to low-income households could also be a powerful new tool to protect people at the bottom of the economic ladder from the wealth destruction that always accompanies downturns. "If you can replace 100% of the lost income in a crisis like this, why don't we replace 100% of people's lost income in every cyclical downturn?" says J.W. Mason, an associate professor at the John Jay College of Criminal Justice in New York. Not everyone is happy. Some economists and Wall Street investors see a recipe for an old-style inflationary boom or for constraining the ability of future governments to spend in the future. The debate will run hot, just like many of the world's biggest economies. —Simon Kennedy The Economic Scene History suggests China's surprise decision to allow all couples to have a third child won't do much to reverse the slowing birthrate.

The shift to a two-child policy in 2016 did little to reverse a decline, and the example of other east Asian economies such as South Korea shows efforts to spur bigger families rarely work.

The falling birthrate means China's population, currently at 1.41 billion, may begin to shrink before 2025, according to Bloomberg Economics estimates. Today's Must Reads -

Canadian aid. Highest-earning families were the biggest beneficiaries of Prime Minister Justin Trudeau's pandemic relief, potentially sparking complaints the programs were wasteful, according to data provided to Bloomberg by Statistics Canada. -

Euro-area prices. Inflation hit 2%, climbing to the highest level in more than two years after economies across the euro area started to lift coronavirus restrictions and rebounding demand aggravated supply bottlenecks. -

Asian factories. Asia's manufacturing activity continued to advance in May — though at a slightly slower pace — and South Korea's exports surged the most since 1988. -

Womenomics. After 30 years in Japan, former Goldman Sachs vice chair Kathy Matsui, known for research that shifted government policy on women at work, is starting a venture fund that could help put some of her ideas into practice. - School diversity. South African schools that were reserved for White pupils during apartheid should recruit more Black educators, teach more African languages and change admissions criteria, according to the country's central bank governor.

- Bullish Brazil. Analysts and policy makers are striking a more optimistic tone on the nation's recovery, even as the government struggles to contain faster inflation and one of the world's worst coronavirus outbreaks.

Need-to-Know Research

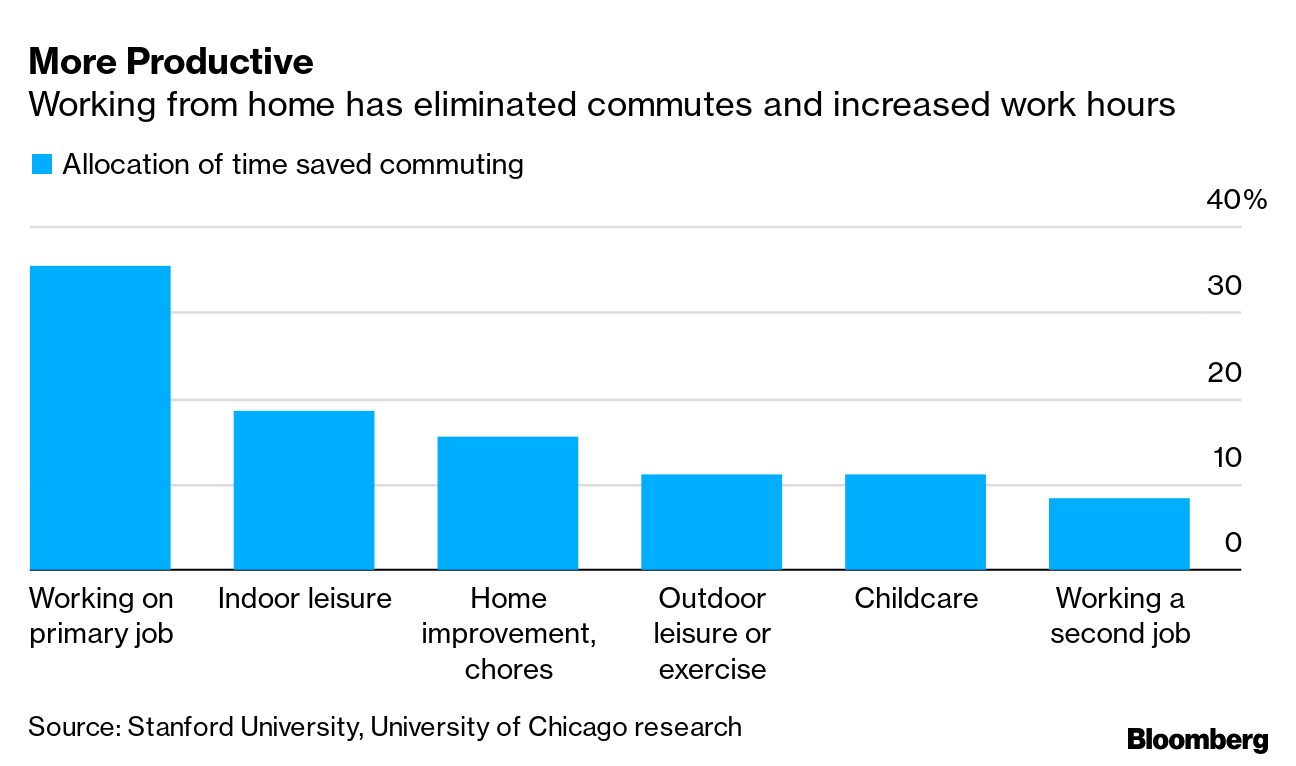

Remote work is another revolution which doesn't appear to be going anywhere, even as the pandemic fades. In a new study, Arjun Ramani and Nicholas Bloom looked at what it means for cities.

They found that a lot of activity in the U.S. has already moved from dense central business districts towards lower density suburban zip-codes. They label this the "Donut Effect." Olivia Rockeman spoke to Bloom, a Stanford University professor who has emerged as one of the most-prominent analysts of what the virus did to the world of work. Read their conversation, here, and the research, here. On #EconTwitterLet's judge some books by their covers.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment