| Hello. Today we look at questions swirling around the Federal Reserve, the big events in the world economy this week and whether the gap in U.S. jobs is linked to working mothers. A Communications ChallengeFederal Reserve Chair Jerome Powell has some explaining to do. Ten months since the central bank overhauled its strategy to seek broad and inclusive gains in the labor market, investors are asking how dedicated it is to that task after last week's decision to raise inflation forecasts and accelerate the pace of projected interest-rate hikes. Powell gets a chance to square the circle on Tuesday, when he appears before lawmakers. Colleagues including New York Fed President John Williams and Boston's Eric Rosengren are among the numerous officials speaking this week who may also provide more clarity. Here's what investors want to know, according to Craig Torres and Catarina Saraiva. - What's up with the dot plot? The median of Fed policymakers added two potential rate hikes in 2023, compared to none when they submitted them in March.

Brett Ryan, senior economist at Deutsche Bank, reckons "Powell acknowledging that we want to be a little bit more balanced in our inflation communication instead of just blankly dismissing everything as transitory." - Is inflation still transitory? Powell and most Fed officials have bet it is, arguing bottlenecks in supply as the economy reopens will be resolved soon. But showing they're aware of the inflation risks offers them some insurance and may help restrain inflation expectations.

- Is full employment really achievable? The Fed's defensiveness on inflation also raised questions about its optimistic forecasts for hiring, which is wants to be as broad as possible.

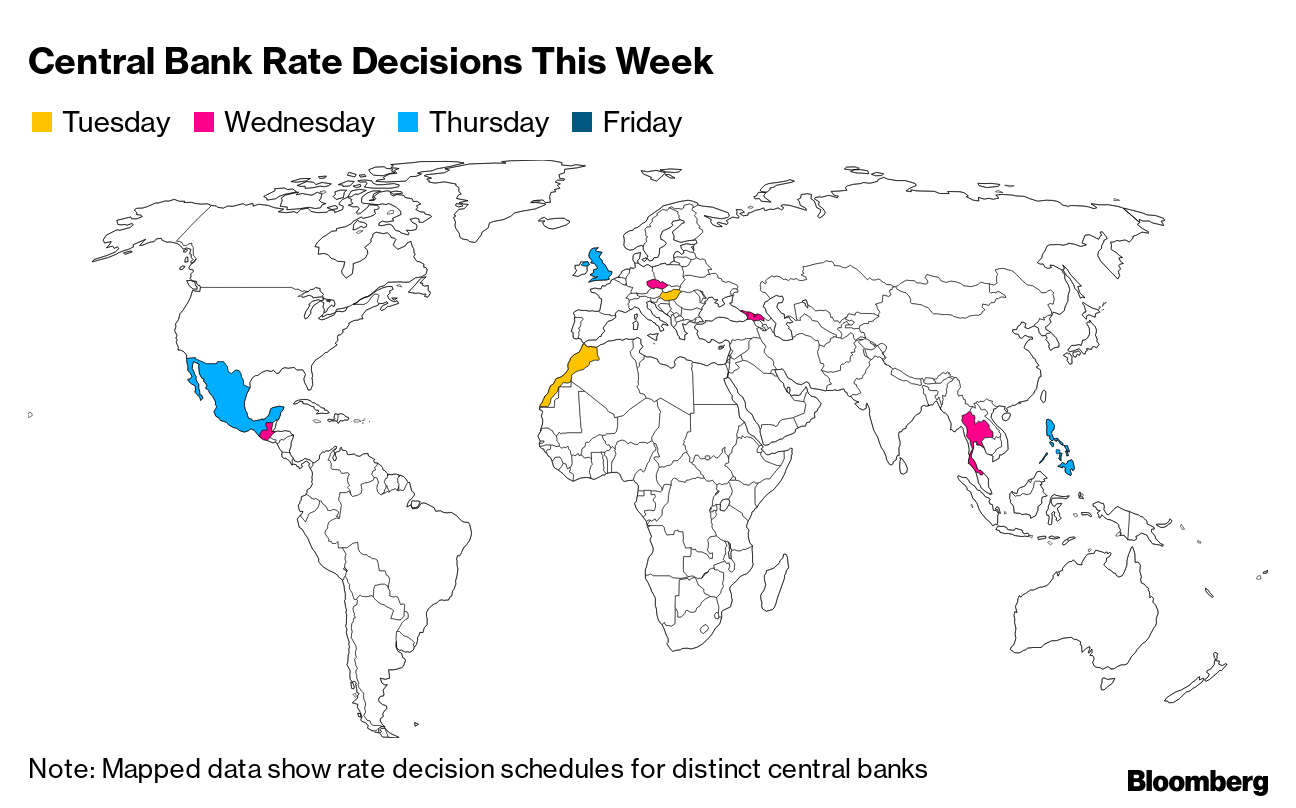

"The low hanging fruit has already been picked and we are now experiencing the frictions of rehiring millions of people," said Constance Hunter, chief economist KPMG. One bright spot for Powell is that his communications of the past week have helped push 30-year Treasury yields back below 2% for the first time since February. As Craig and Catarina note, that's just the kind of outcome a central banker would want to see in a time of rising prices and public inflation expectations. —Simon Kennedy The Week Ahead The Bank of England's chief economist is poised to sound an alarm bell on inflation before he leaves the building. Andy Haldane is likely to emphasize the risk of price growth getting out of control when he attends his final Monetary Policy Committee decision on Thursday. He's been the sole advocate on the panel for dialing down stimulus. Elsewhere, central bankers in Hungary and the Czech Republic are set to raise interest rates. Flash purchasing managers' indexes provide a snapshot of the state of the economy across the world. For a full rundown of the week ahead, click here. Today's Must Reads - Hidden problems | China's unemployment rate has dropped from last year's pandemic peak, though a lack of jobs for graduates and a shortage of skilled manufacturing workers point to imbalances.

- Never going back? | Almost half of London companies whose staff can work from home expect them to do so up to five days a week after the pandemic finishes, a survey showed.

- Seeing red | Australia will appeal to the World Trade Organization regarding China's imposition of anti-dumping duties on the country's wine, the latest move in spat that has worsened relations.

- Kuwaiti cash | A $600 billion sovereign wealth fund is caught in the crosshairs of a political power struggle since its board's tenure expired two months ago.

- Bellwether | South Korea's exports are set to climb by double digits again in June as the global economy shakes off the effects of the pandemic, though a slower pace from recent months suggests the days of outsize gains have passed.

- Emerging markets | Currencies hit by a hawkish Fed may restart their record run against the dollar on bats that developing central banks may outpace their U.S. counterpart in policy tightening.

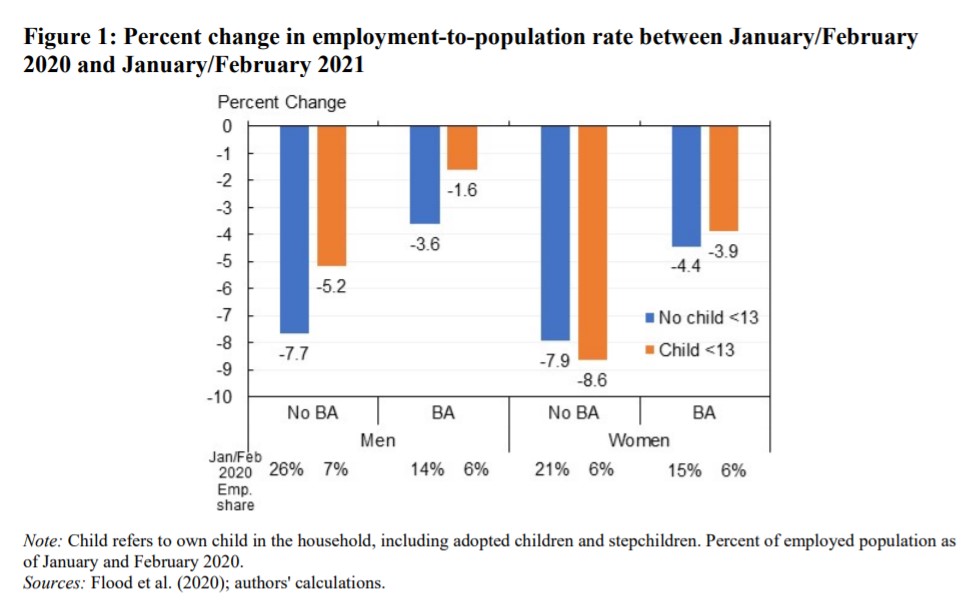

Need-to-Know Research Almost all the shortfall in U.S. jobs related to the coronavirus is due to broad issues rather than challenges specific to working parents, according to a new paper co-written by Harvard University's Jason Furman, a former advisor to President Barack Obama. The research nevertheless confirms that mothers with young children have experienced a larger decline in employment as compared with other adults. On #EconTwitterThe European Central Bank is still working on its strategy overhaul.  Read more reactions on Twitter Don't MissWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment