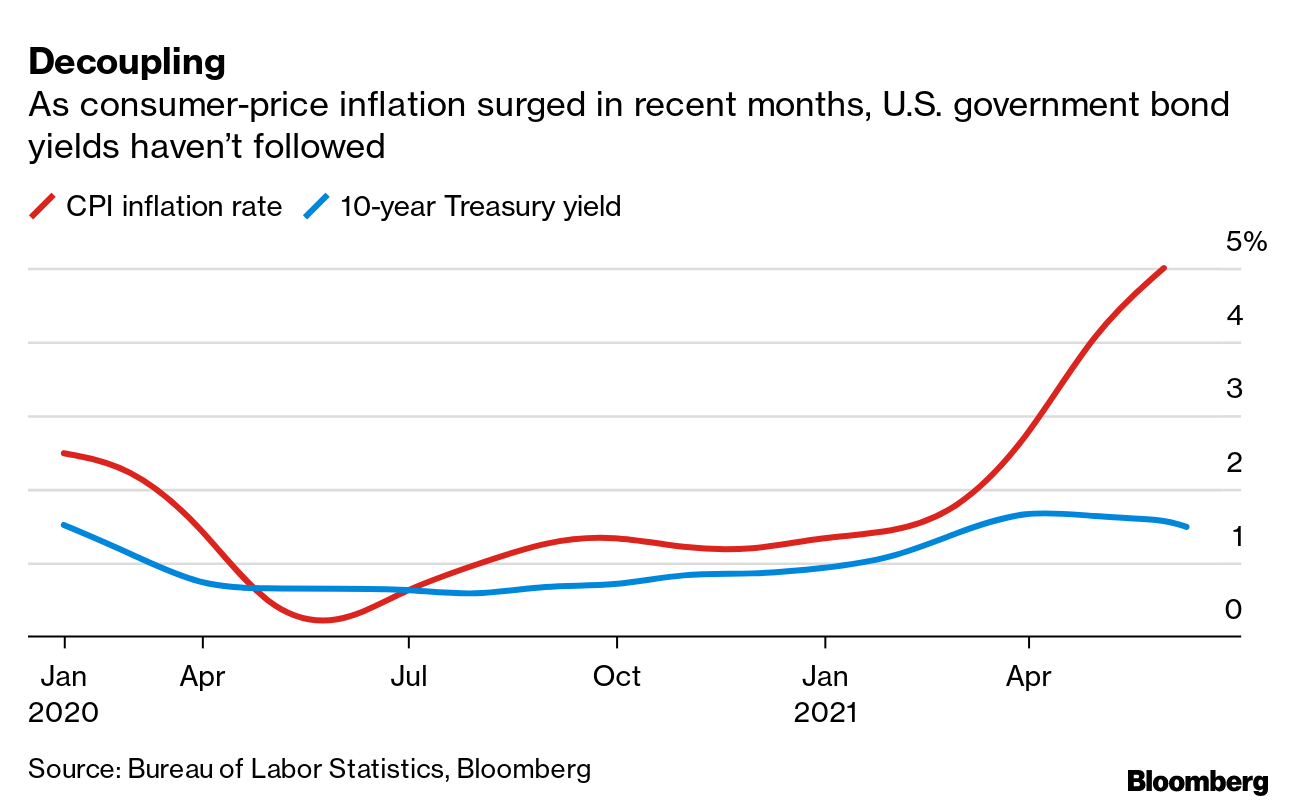

| Hello. Today we look at how bond traders now agree with the Fed, why London's future matters so much for the U.K. economy and which central banks are the most dovish. Street CredWall Street appears to be coming around to the view of Federal Reserve Chairman Jerome Powell and his colleagues on the argument that the current surge in inflation won't last. The trading of U.S. Treasuries suggested as much on Thursday, when the latest reading on the consumer price index showed the third straight bigger-than-forecast monthly climb. After an initial drop, Treasuries rallied, sending 10-year yields to the lowest level in three months. Stocks hit a record high.

That was despite the data showing consumer prices surging 5% in May, the most since 2008, from a year ago and more than forecast from April.  That sanguine reaction is probably welcome news for Fed officials ahead of next week's policy-setting meeting, Rich Miller writes. It eases any market-driven pressures to consider a pace of tightening faster than currently planned. Fed officials have been hammering home the message that higher inflation will mostly be transitory, the result of temporary bottlenecks as the economy reopens and low readings a year ago when it shut down. Indeed, Bloomberg Economics calculated that about half of the latest rise in the consumer price index came from components associated with reopening: - Used cars, rental cars and vehicle insurance

- Lodging

- Airfares

- Food away from home

"A lot of the components that rose were the transitory ones," said Peter Yi, director of short-duration fixed income and head of credit research at Northern Trust Asset Management. "The best thing the Fed has done, the most effective, is that they stayed consistent around the transitory narrative," he said.

Having once questioned that narrative, investors now seem to be signing up.

They could of course be driven by other dynamics, including an abundance of cash in the system. Ultimately the key is whether the public's expectations for inflation become unhinged.

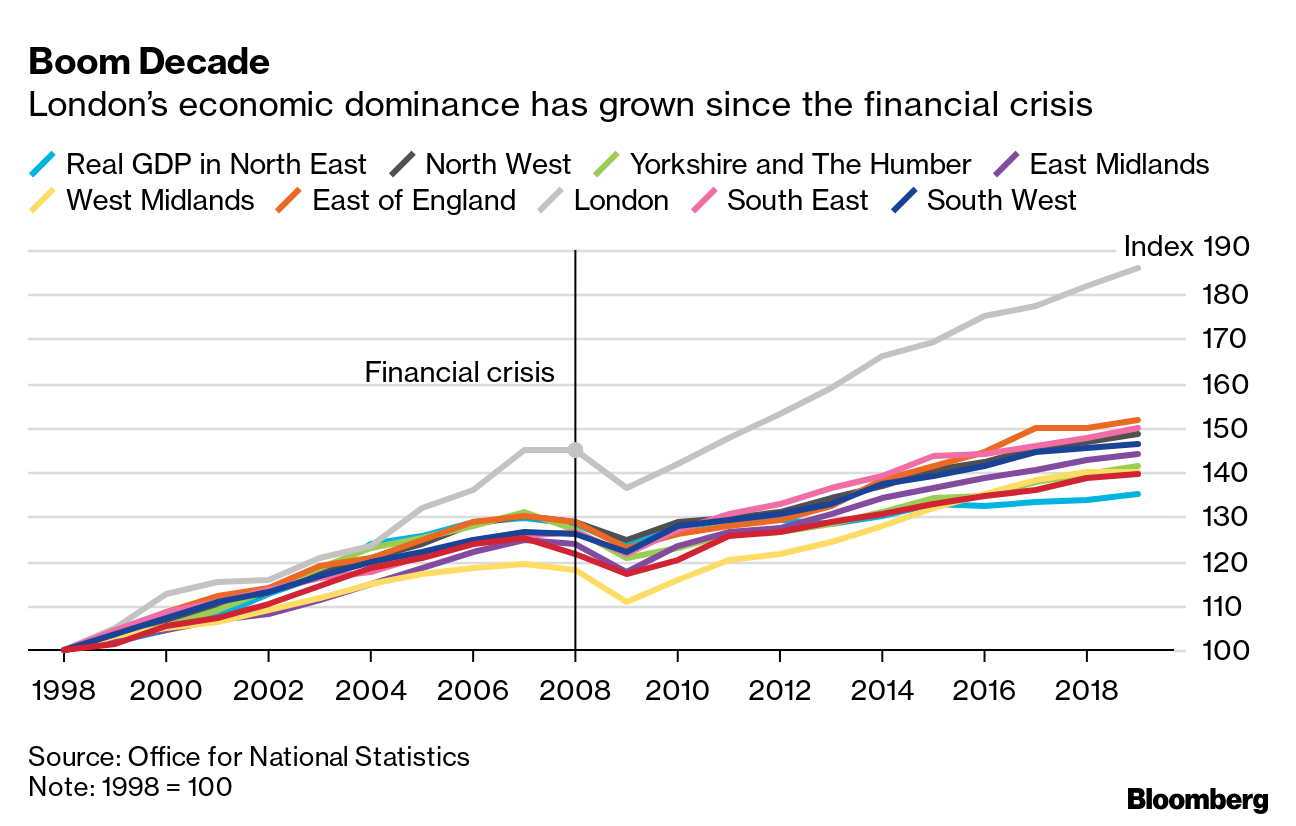

On that score, policy makers will get a fresh reading of consumer inflation expectations on Friday, when the latest University of Michigan survey is due out. —Chris Anstey The Economic Scene Any reversal in the health of London's economy risks having an outsized effect on the nation. The capital accounted for almost 40% of the U.K.'s annual growth pre-pandemic, contributing twice the output of Scotland and Wales combined.

If it fails to thrive, the overall economy could begin to resemble something like Italy, another faded imperial power struggling with debts that are too big, economic growth that's too anemic and a vicious cycle that has it falling further behind its main competitors, according to the independent Resolution Foundation. Today's Must Reads - Euro clash | ECB policy makers differed in their Thursday meeting over how much bond-buying would be needed when liquidity in financial markets is thinner during the summer.

- Climate fight | The world's richest governments get a fresh chance to help poor countries fight climate change at the Group of Seven summit in the U.K. this weekend. Here's a guide to the meetings.

- Olympic worries | With flames scheduled to rise from the Olympic cauldron in just six weeks, the prospect of staging the Tokyo games is still firing up public angst rather than the optimism it did in 1964.

- Double blow | Indians already hurt by the world's worst Covid-19 wave are now being slammed by the debts they've accumulated paying medical bills to keep themselves and loved ones alive.

- Guidance tweak | Peru held its key interest rate at an all-time low, but dropped a commitment to keep it there for "a prolonged period". The Bank of Korea's governor said it will seek to normalize its policy at an appropriate time, prompting a flurry of early rate hike forecast.

- Supply chains | Delays from congestion at southern Chinese ports triggered by fresh Covid-19 outbreaks are rippling through economies. At the same time, a boom in the price of steel is being felt from home builders to appliance makers.

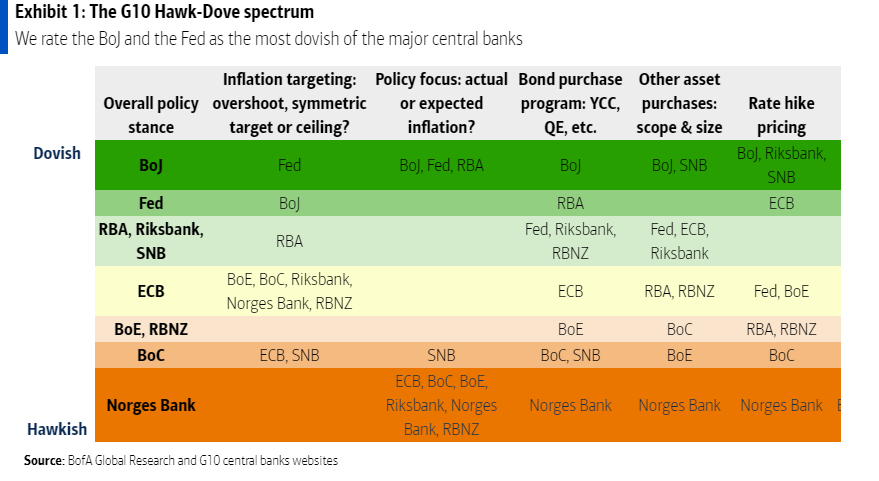

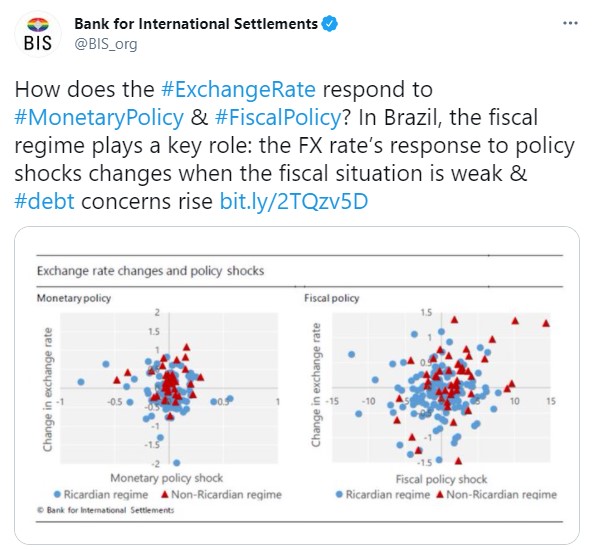

Save the DateWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Need-to-Know Research The Bank of Japan and the Fed are running the most accommodating monetary policies of the major central banks, according to a new index from the economists at BofA Global Research. Based on seven measures of policies, targets, communications and markets, the gauge identifies the Norges Bank as the most hawkish central bank followed by the Bank of Canada. "In a sense the Fed has 'volunteered' to be uber-dovish while the BoJ really has little choice given consistent inflation overshooting," Aditya Bhave, a BofA global economist, said in a report. On #EconTwitterExamining fiscal regimes and the exchange rate.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment