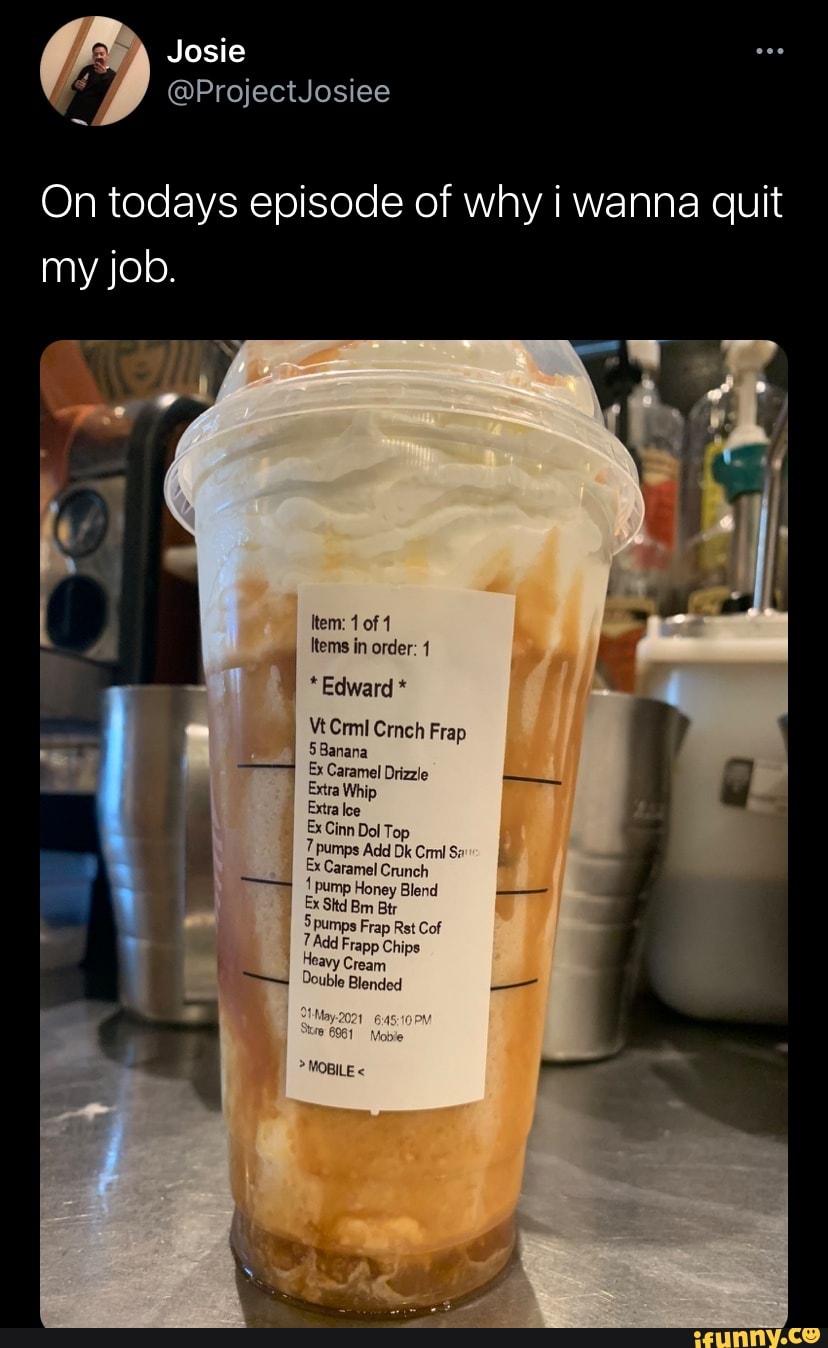

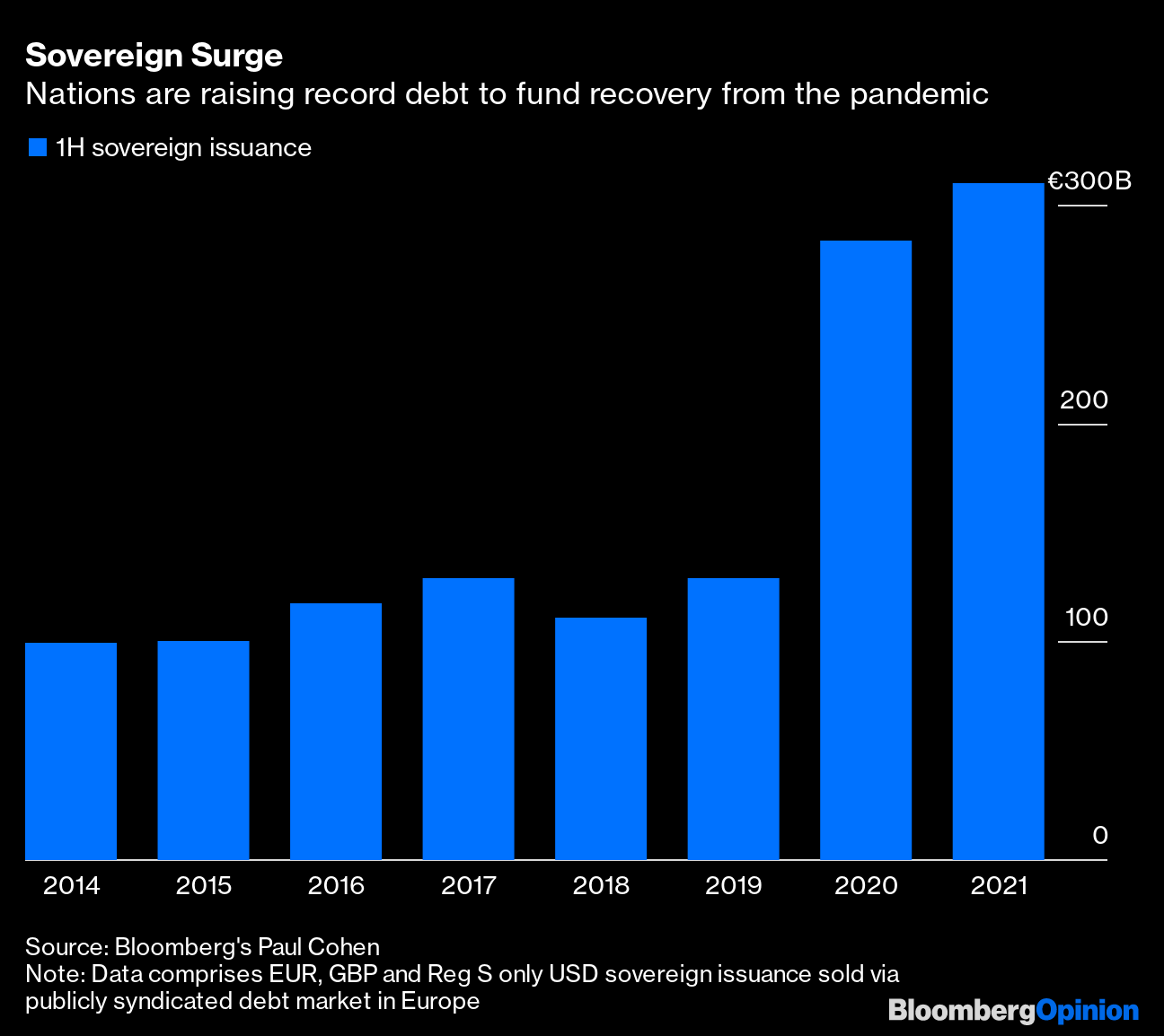

| This is Bloomberg Opinion Today, a Financial Stability Oversight Council of Bloomberg Opinion's opinions. Sign up here. Today's AgendaYou're Gonna Need a Bigger MalletFighting financial crises lately has been like a decades-long game of Whac-A-Mole. Regulators knock down one kind of crisis only to see a different kind pop up 10 or so years later. It might help to have a bigger, or smarter, mallet. After the financial crisis of 2008, the Dodd-Frank financial reforms tried to build that mallet, to prevent crises and avoid another costly rescue effort. And in the pandemic crisis of 2021, it did a pretty good job of whacking the banking-sector mole that had caused all the problems in 2008. But it was no good for a bunch of non-banking stuff, from money markets to Treasury bonds. Back to the mallet-drawing board. Glenn Hubbard and Donald Kohn head up a thing called the Task Force on Financial Stability, which we will call "TAFFS" just to annoy people who don't like pointless acronyms. It recently studied the problem and found that two big Dodd-Frank agencies, the Financial Stability Oversight Council (FSOC) and the Office of Financial Research (OFR), had been rendered mostly inert by years of lobbying and (cough — Donald Trump — cough) neglect. These were supposed to knock down new crises before they popped up, but they failed. Hubbard and Kohn have some ideas on how to give them more punch. We don't want to be doing this again in another decade. Further Insomnia-Fuel Reading: Markets are too quiet. Here's everything investors have to worry about. — John Authers  The Facebook of drink orders. Facebook: How Big Is Too Big?Americans have a love-hate relationship with corporate bigness. We resent the reach of such companies as, say, Starbucks. But we also demand our Venti Caramel Ribbon Crunch Frappuccino be exactly the same in Toledo as it is in Poughkeepsie. We're suspicious of Facebook's power over our lives, but then we drive its market cap to $1 trillion when lawsuits seeking its breakup get dismissed, as happened yesterday. Tae Kim points out the dismissal was really more of a technicality. The federal and state governments that brought the suits hadn't fully baked their arguments, so a federal judge sent them back to the kitchen. Tae expects them to come back soon, meaning a breakup is still possible. Of course, "possible" is not the same as "likely." Matt Levine points out Facebook doesn't quite fit the legal definition of a monopoly that would typically require a breakup. The ultimate goal of FTC chief Lina Khan might be to highlight antitrust law's inadequacy to deal with an omnipresent $1 trillion company, inspiring a push for new antitrust laws. Clive Crook argues this is a misguided goal; because Facebook probably can't raise prices on its free product without triggering a rush back to MySpace, it's not hurting the consumer. If Facebook does other bad things, then it should be stopped, Clive maintains, but mere bigness isn't the problem. We may soon enough find out. Flying May Get Less TerriblePlane rage has soared in the pandemic, as we wrote on Friday, mostly because of anti-maskers throwing tantrums. But commercial airplanes were roiling pots of anger long before Covid. People can only take getting crammed into smaller and smaller spaces and paying more and more for such luxuries as "having luggage" before they boil over. That's why it's encouraging to see United Airlines, long one of America's least beloved carriers, dropping a bunch of cash on buying big new planes and making old ones less awful, Brooke Sutherland writes. It's a sign the company knows it needs to show some consumer value for its bailout money. The whole industry might follow suit, making flights a little less enraging. Telltale ChartsThe EU just keeps dumping debt on the market, and the market just keeps eating it up, writes Marcus Ashworth. There are no signs that the pandemic-era surge in sovereign borrowing is crowding out any other borrowing.  Further ReadingAmerica's voting system needs fixing, and Joe Manchin's compromise plan would go a long way. — Bloomberg's editorial board Bank stocks yield more than junk bonds, but investors aren't biting. — Lisa Abramowicz JPMorgan Chase's new Paris office is the latest sign Brexit is luring bankers away from London. — Lionel Laurent General Mark Milley doesn't deserve praise for his critical race theory comments. — Ramesh Ponnuru Investors will watch China's Communist Party birthday celebrations to see which billionaires are in and out. — Shuli Ren China's desperate quest for food self-sufficiency drove its purchase of a Swiss agribusiness. — David Fickling Regenerative agriculture can help farms stay productive in the face of droughts, erosion and disease. — Adam Minter ICYMIModerna's vaccine protects against the delta variant. Under-vaccinated U.S. regions are vulnerable to delta. Home prices jumped the most in 30 years. KickersA Picasso stolen nine years ago was recovered. Need to get your stuff back from your ex? There's an app for that. It's so hot, bears are breaking into pools. (h/t Scott Kominers for the first three kickers) Area redwood is 1,081 years young.  Notes: Please send Picassos and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment