Nasdaq, S&P 500 dip from records | Pros agree with Fed on inflation: BofA survey | Past ‘taper tantrum’ winners

EDITOR'S NOTE

Stocks retreated on Tuesday as investors prepared for the outcome of the Federal Reserve's monetary policy meeting.

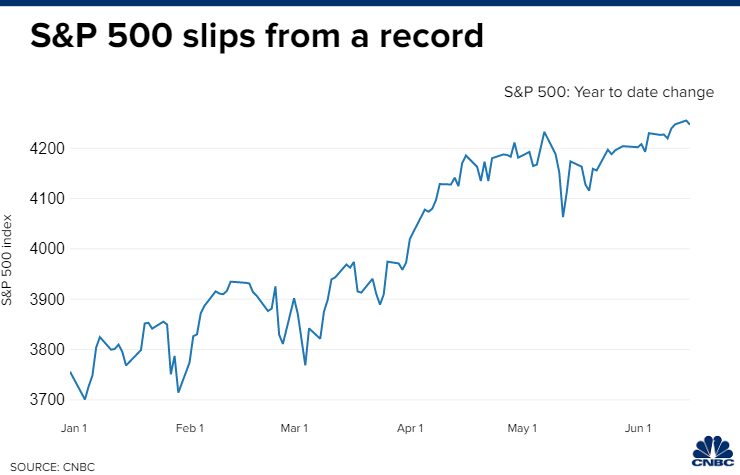

The S&P 500 slipped 0.2%, ending the day at 4,246.59. Meanwhile, the tech-heavy Nasdaq Composite declined 0.7%. Both indexes are down from their latest highs. The Dow Jones Industrial Average lost 94.42 points.

Reopening favorites, primarily airlines and cruise operators, slumped. Big Tech names, which have enjoyed a recent resurgence amid lower bond yields, also dipped.

Energy stocks were the standout performers, as Exxon Mobil and Occidental Petroleum each gained more than 3%. Diamondback Energy leapt 5.1%.  The Fed has started its two-day meeting, and Wednesday is the key moment for markets. That's because while the central bank isn't expected to make any moves, investors will be listening for comments on interest rates and rising inflation.

For now, the impression among participants in the latest CNBC Fed Survey is that the central bank is likely to stay the course with its easy monetary policy for the remainder of the year – despite rising prices and a tighter job market.

Regardless of how the Fed proceeds, market strategists are already drawing up their plays to capitalize on the outcome. Some pros also believe policymakers may just continue to sit tight.

"This is what the Fed has been doing for the last several months — warning that an inflation surge was coming but that it is transitory so no need to taper," Jim Paulsen, chief investment strategist at the Leuthold Group, told CNBC. "Moreover, this is probably the most expected outcome from the Fed meeting." TOP NEWS

TOP VIDEO

CNBC PRO

SPECIAL REPORTS

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Post a Comment