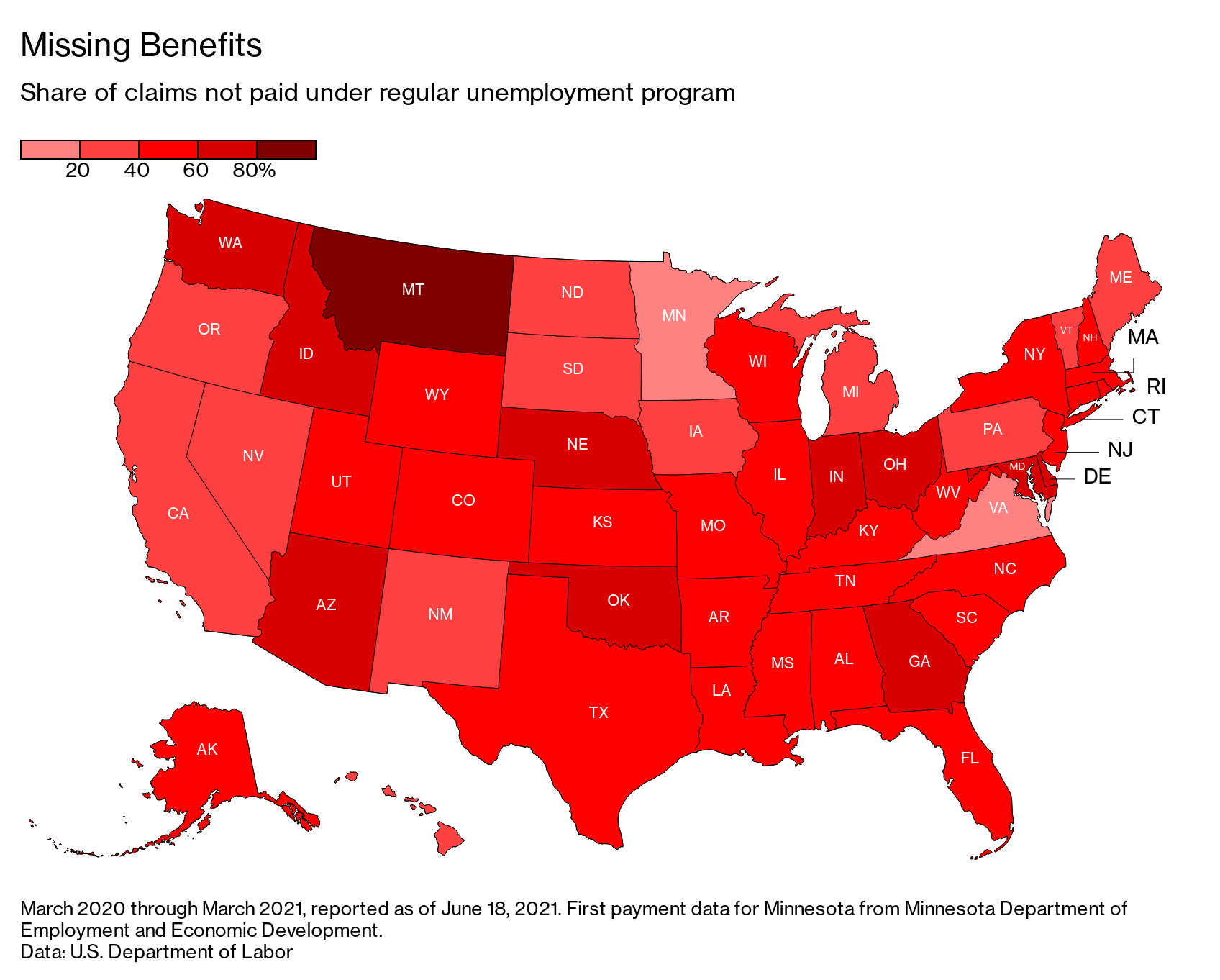

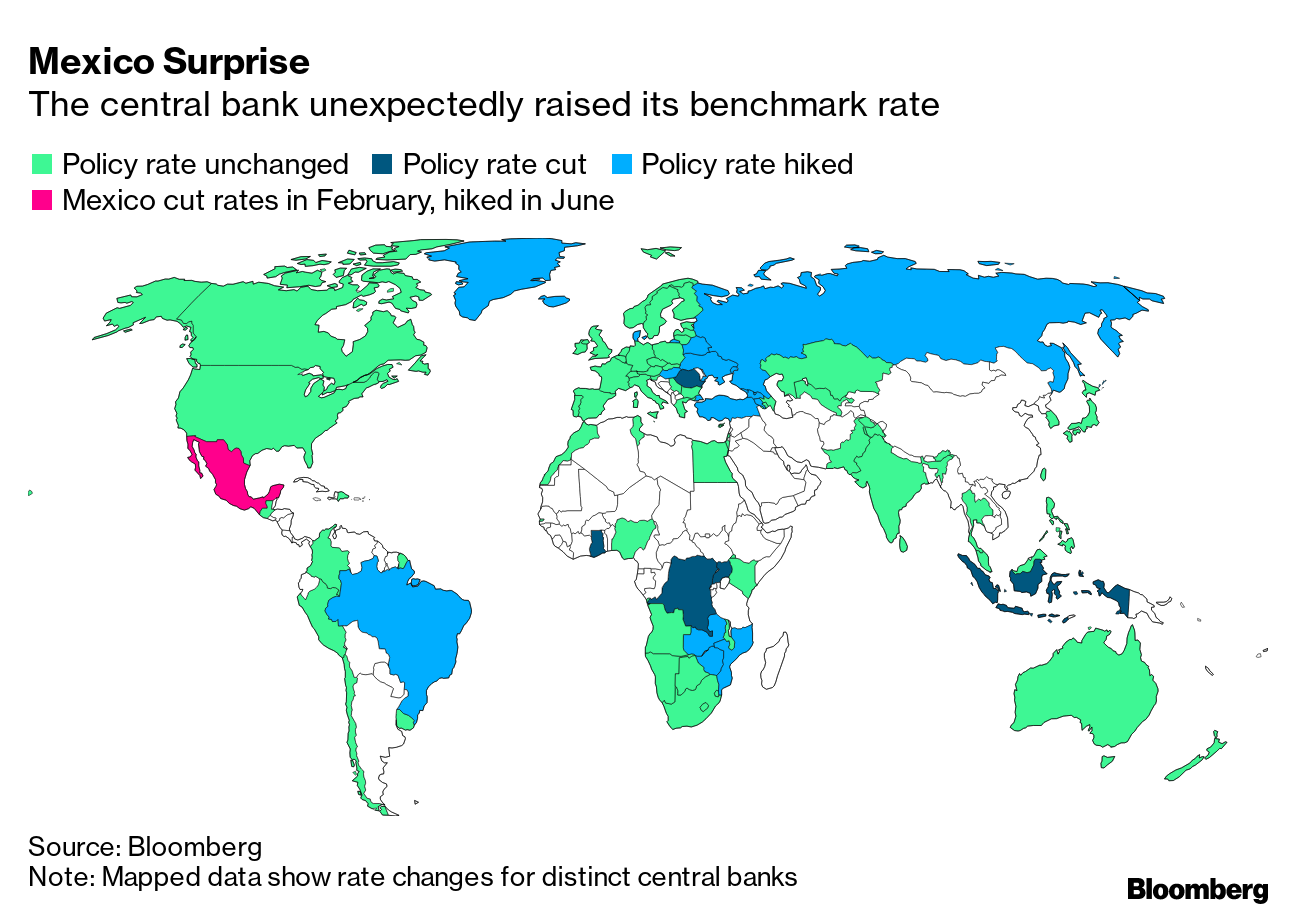

| Hello. Today we look at the Americans who were unable to secure aid during the pandemic, the state of Latin American central banking and at the unequal distribution of child care during the pandemic. Left BehindOne of the big economic stories of the Covid-19 pandemic has been the overwhelming fiscal response by the U.S. and other major economies. What gets less attention is the holes in that response. In a Bloomberg Businessweek story, Reade Pickert and I look at the millions of Americans who fell through the cracks of the unemployment assistance system — at least nine million, based on a review of more than a year's worth of U.S. Department of Labor data. That's the population of New Jersey or Virginia.  The numbers show half of the 64.3 million people who applied for what's known as "regular" unemployment assistance did not receive any money under that program. It's roughly akin to everyone in the labor force in California and Texas combined losing their jobs and not getting any help, with devastating economic consequences. Special programs created on the fly by Congress were good at filling part of that gap. But they were also inefficient and subject to delays and fraud. (On fraud, the numbers are not in yet. By the end of March, states had reported paying out less than $2 billion in fraudulent unemployment claims during the pandemic, or 0.3% of the total.) A lot of the attention now is focused on the mostly Republican-led 26 states that this month started pulling out of special federal programs, arguing that the benefits were contributing to labor shortages. But the bigger long-term question now is whether there'll be a patch for the immense hole in the U.S. safety net. The Biden administration and congressional Democrats are on board, but there are big questions over how much they can get done without Republican support and how much of a priority it is for the White House. Meantime, the data make it hard not to agree with Senate Finance Committee Chair Ron Wyden: "The unemployment system is broken." —Shawn Donnan The Economic Scene Mexico joined the hawkish band of Latin American central banks by unexpectedly raising interest rates. Brazil has already hiked too this year and Chilean policy makers this week considered acting as well. Traders are now bracing for more aggression as inflation pressures pickup. Today's Must Reads - Fed coalition | The group of policy makers who agree with Federal Reserve Chair Jerome Powell's view that the inflationary surge will fade appears to be intact although some officials do worry there will need to be rate hikes next year.

- Biden win | President Joe Biden secured a political victory by sealing a bipartisan $579 billion infrastructure deal, but it now faces hurdles in Congress.

- China leads | The People's Bank of China is a step ahead of the Fed in reining in it's Covid-19 emergency stimulus and has already started curbing credit growth.

- Business advice | Julian Richer, author of the "Ethical Capitalist" and a retail entrepreneur who handed control of his company to his employees, said the U.K. government should collect on the loans it made to support Covid-stricken businesses

- Sneaky crustaceans | Australia's rock lobsters — a long-prized delicacy among Chinese consumers — may be finding their way onto mainland menus through a backdoor that circumvents a worsening diplomatic and trading dispute between the two nations.

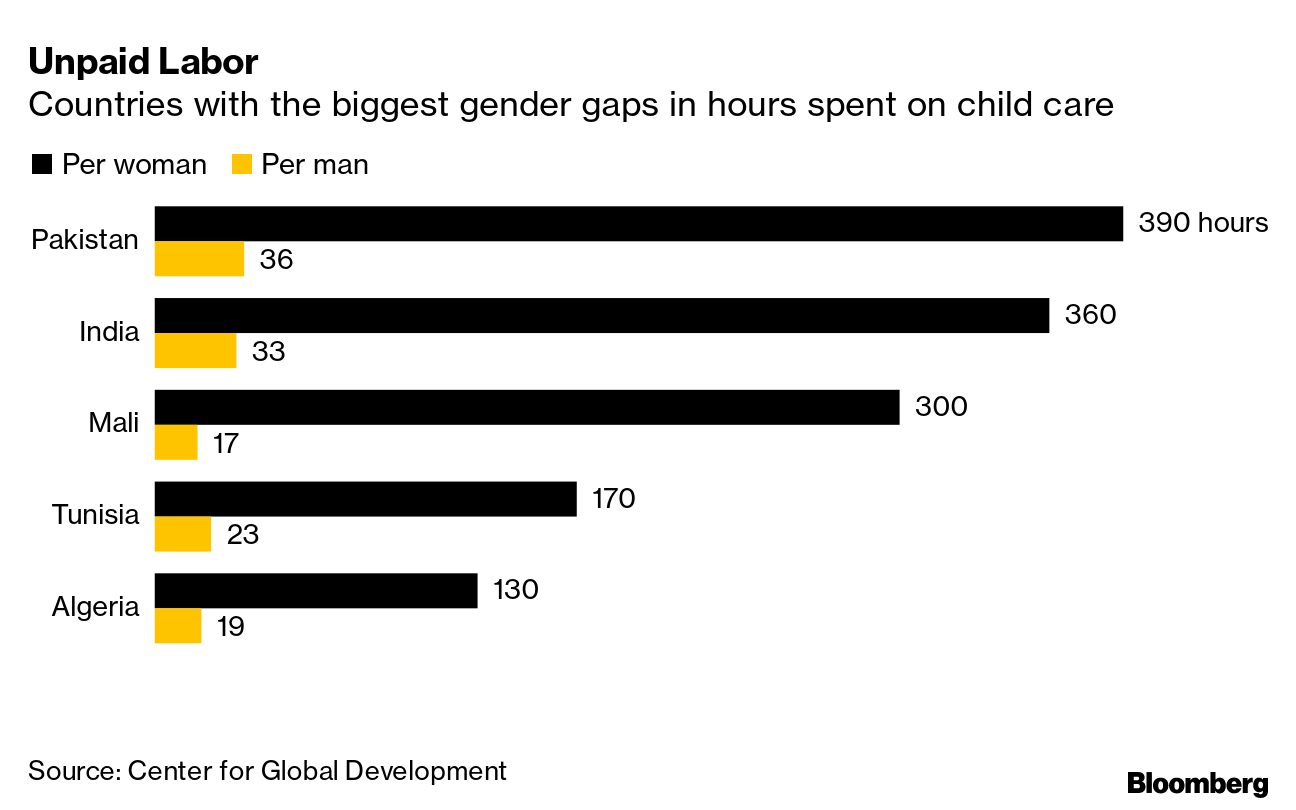

Need-to-Know Research Child care demands at home skyrocketed during the pandemic, but men and women did not split the burden equally. Globally, women took on 173 additional hours of unpaid child care last year, compared to 59 additional hours for men, a study by the Center for Global Development, a poverty non-profit, found. The gap widened in low- and middle-income countries, where women cared for children for more than three times as many hours as men did. - For the latest on how companies and institutions are confronting gender, race and class, subscribe to the Equality newsletter

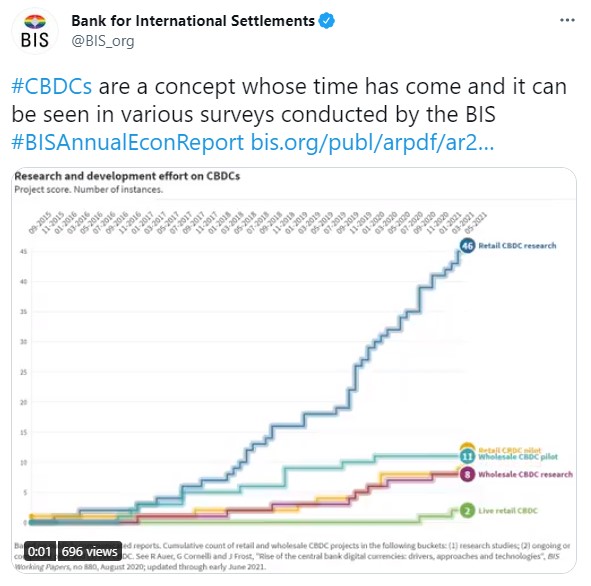

On #EconTwitterCentral bank digital currencies offer the unique advantages of central bank money in digital form, according to the Bank for International Settlements.  Read more reactions on Twitter Don't MissWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment