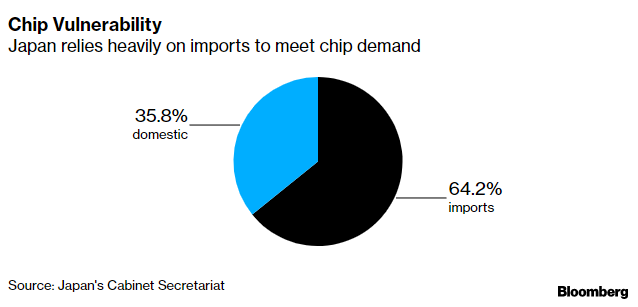

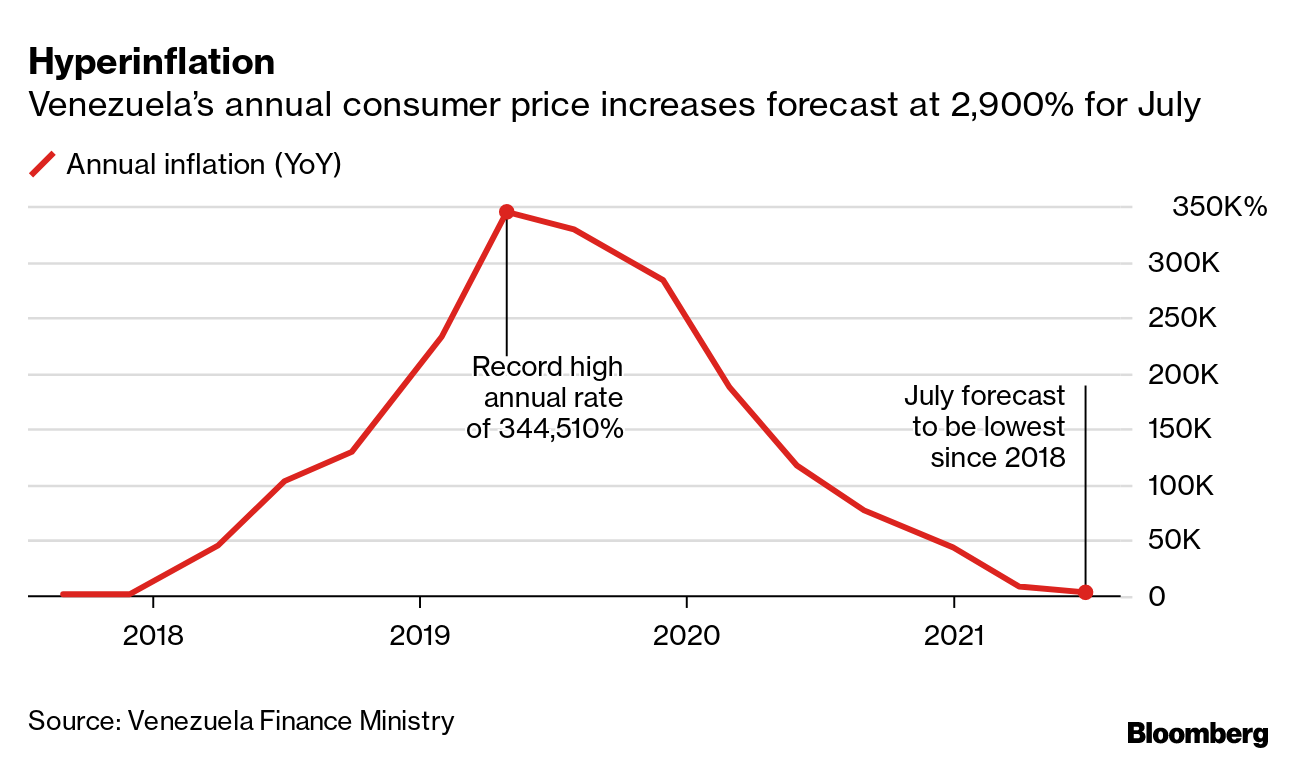

| Hello. Today we look at the heavy cost of trying to stay at the technology frontier, how Venezuela's economy is showing signs of improvement and a new report from the European Central Bank on globalization. Chip WarsMore than half a century after Gordon Moore outlined his eponymous law on the doubling of microchip power every two years, it's not just the width of circuits on silicon wafers that's shrinking. The technological prowess and massive investment needed to produce the newest 5 nanometer chips (that's 15,000 times slimmer than a human hair) has whittled the industry down to just a handful of players, mainly in Taiwan and South Korea. Meantime, the global pandemic has seen demand for chips soar as people retool their home offices and the microprocessor finds its way into more and more items. A resulting chip shortage has wrecked havoc on global supply chains over the past year, adding to inflation pressures and spurring governments across major economies to rethink their reliance on imports of the tiny slithers of silicon that power the new economy. But playing catch up won't be cheap. Tetsuro Higashi, chairman emeritus at gearmaker Tokyo Electron Ltd. and head of an expert panel advising Japan's government, says the nation must put at least a trillion yen ($9 billion) toward chip development this fiscal year and trillions more after that if it's to have any hope of reviving its national industry. "It will not be at all easy to stage a comeback," the 71-year-old industry veteran said in an interview with Bloomberg's Yoshi Nohara and Yuki Furukawa. "If we miss this opportunity now, there may not be another one." Japan is vulnerable because, after decades of under-investment, its manufacturers have to import about two-thirds of their chips.  It isn't alone. President Joe Biden has laid out a $52 billion plan to bolster domestic chip manufacturing, responding in part to China's accelerating blueprint to place semiconductors at the heart of its development. South Korean companies like Samsung Electronics Co. and SK Hynix Inc. are committing $450 billion over a decade on chip research and expansion, while leader Taiwan Semiconductor Manufacturing Co. alone has earmarked $100 billion over the next three years. At stake is dominance of the industries of the future, like artificial intelligence and self-driving cars, which rely on massive computing power and the smallest and fastest chips. "It takes 10 years or more to build a world class industry," Higashi said. "If we don't go forward with the understanding, and we just try to throw money at this in a one-time way, I can see us failing." — Malcolm Scott The Economic Scene Venezuela's economy may have finally hit bottom. Hyperinflation has moderated and President Nicholas Maduro told Bloomberg he's confident that output will expand slightly in 2021 after contracting about 80% since 2012. The turnaround is mostly due to reforms straight out of economic orthodoxy: eliminating price controls, reducing subsidies on essentials such as gasoline and removing many restrictions on foreign exchange. Today's Must Reads - On message | Federal Reserve Chair Jerome Powell will tell lawmakers that inflation had picked up but should move back toward the U.S. central bank's 2% target once supply imbalances pass.

- Hungary to hike | Hungary is set to become the first European Union nation to tighten monetary policy this year, with the central bank widely expected to raise interest rates to curb surging inflation.

- Trade targets missed | China's imports of American goods slowed again in May, putting the purchase targets agreed with the U.S. in the 2020 trade deal even further out of reach.

- Korea imbalances | Deepening financial imbalances in South Korea due to rapid asset price gains and excessive borrowing threaten to hurt the economy, the central bank said, with real estate in particular looking "significantly overpriced."

- China forecasts cut | Barclays and Morgan Stanley cut their forecasts after key indicators in May missed expectations, and now expect full-year growth to be below 9% from levels around 9% or above.

- Ghost towns | The journey back to your desk is shaping up to be slow and indirect. We've taken a look how the return-to-office is going in six cities around the world.

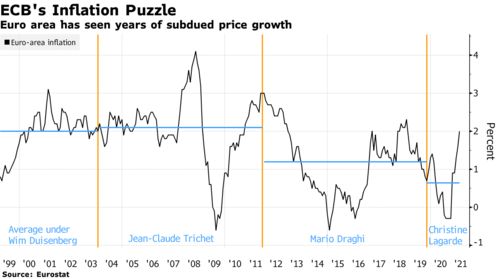

Need-to-Know Research Globalization may not be the deflationary force many assume, according to research published by the European Central Bank. The study concluded that while trade integration, informational globalization and global value chain participation were linked to lower persistent inflation trends, the "effect is economically small." "Looking ahead, a reversal — or further slowdown — of globalization trends could provide only limited tailwinds for inflation trends," the economists wrote. On #EconTwitterBlack and Hispanic/Latino workers were 60% more likely than white respondents to say they anticipate more economic opportunities in the next year.  Read more reactions on Twitter Don't MissWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment