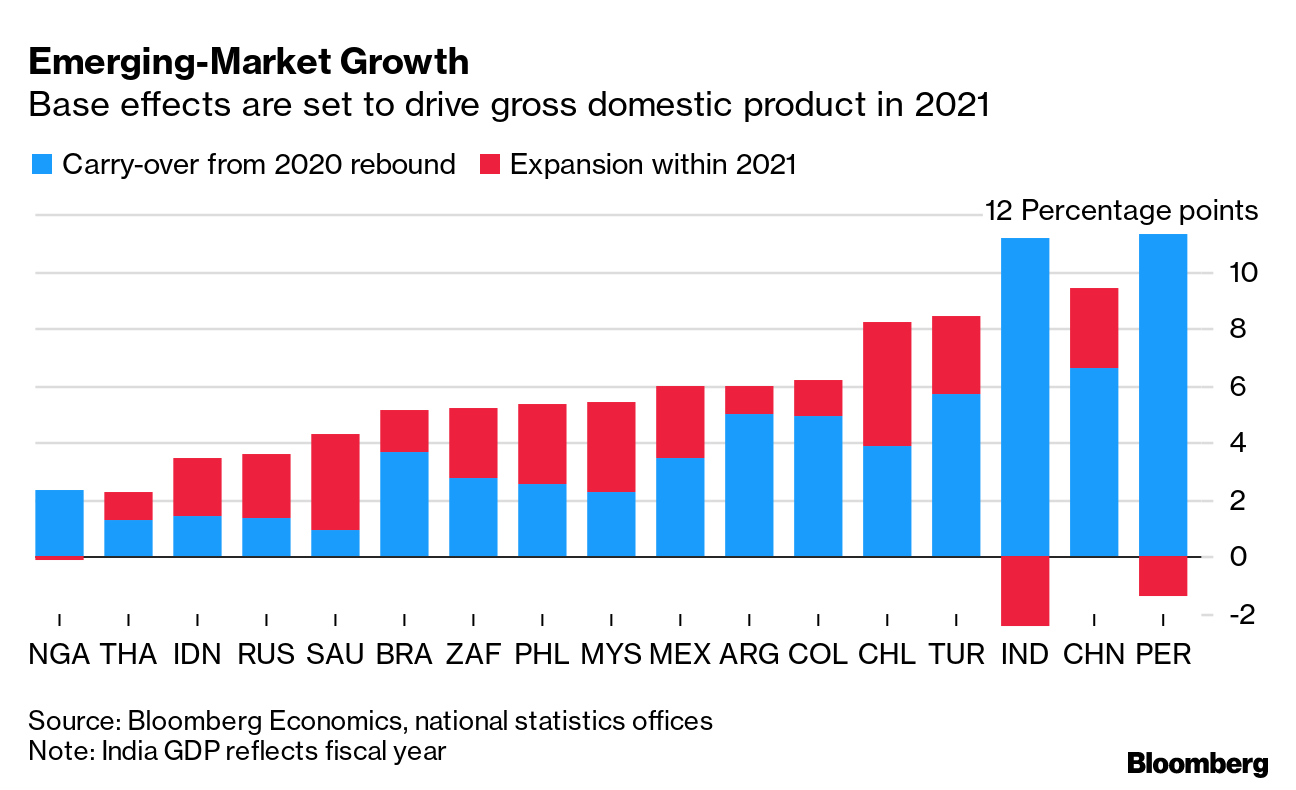

| Hello. Today we look at how China may not power the recovery this time, who is best at forecasting inflation, and the next challenge for the European Central Bank. Switching EnginesThe drivers of the world economy are changing. According to economists at Citigroup, this year will be the first since 2006 in which advanced economies add more to global growth than emerging markets. Among the reasons: bigger fiscal and monetary stimulus and faster vaccinations in the industrial world. It's not all bad news. Rising commodity prices are helping boost the likes of Russia and Brazil, and gross domestic product in major emerging markets is predicted by Bloomberg Economics to expand 8% in aggregate this year after contracting 1.1% in 2020.  But some central bankers are providing an offset, with those in Russia, Turkey and Brazil already tightening monetary policy. Bank of Russia Governor Elvira Nabiullina told Bloomberg on Monday that she's ready to consider an interest-rate hike of as much as 1 percentage point in July. Beyond the short-term, the Citi economists reckon the advanced economy-led recovery may be part of a bigger process in which the world is no longer as reliant on Chinese investment.  From 2010 to 2019, China accounted for 47% of worldwide investment growth on average, contributing even more than its 33% share of the world's overall expansion, according to Citi. That helped power the world out of the 2008 financial crisis and subsequent recession. Change may now be afoot. Not because China will necessarily succeed in refocusing its economy towards its consumer, but because investment may become more evenly spread. The pandemic's shock to supply lines and the recent rise of protectionism are leading companies and governments to spend more on capital at home, with low borrowing costs providing extra fuel. In the U.S. for example, President Joe Biden is trying to splash cash on infrastructure, while non-residential fixed investment already jumped almost 12% in the first quarter. Citi reckons expenditure on intellectual property is now the fastest-growing component of firms' investment spending.

As for Europe, its recovery plan also intends to upgrade infrastructure, diversify and solidify supply chains, invest in high tech and prepare for climate change. The downside is whereas China's previous investment splurge lifted global trade, that may not be the same in the new era because more will be domestic-focused. "What's bad for trade is unlikely to be good for global growth," said Citi's economists. —Simon Kennedy Watch the future unfold on June 30. Register here for Bloomberg New Economy Catalyst, a global, 6-hour virtual event celebrating the innovators, scientists, policymakers and entrepreneurs accelerating solutions to today's biggest problems. We will explore what matters, what's next and the what-ifs of climate change, agriculture, biotech, digital money, e-commerce and space through the imaginations and stories of these ascendant leaders. The Economic Scene European Central Bank officials may find themselves alone soon as other major monetary authorities move on from delivering stimulus. The new challenge for President Christine Lagarde and colleagues is to keep supporting their economy as the Federal Reserve and other counterparts shift gears. That could roil financial markets and push up borrowing costs in Europe too. Today's Must Reads - China improving | The People's Bank of China provided a positive outlook for the world's number 2 economy, saying it's showing signs of stability and strength. Bloomberg Economics says it has found a "sweet spot" for interest rates and will stay on hold through 2024.

- South Africa | Strict new measures to curb the coronavirus may slow but won't derail an economic recovery, and the central bank will keep monetary policy easy, Deputy Governor Kuben Naidoo said.

- Losing out | Second-generation ethnic minorities in Britain fare much better in education than their white majority counterparts, yet are less likely to be employed, new research shows. Meanwhile, U.K. house prices grew at their fastest annual pace for more than 17 years in June as buyers rushed to seal deals in time to benefit from a government tax break.

- Market resilience | The push to buttress the U.S. Treasury market at the heart of the global financial system and help it withstand shocks received fresh impetus on Tuesday with a new study.

- Mexico weather | The worst drought in decades, according to NASA, may have persuaded policy makers to turn hawkish when they raised interest rates last week, central banker Gerardo Esquivel said in an interview.

- Hidden debt | The World Bank warned that South Asia's reliance on state-led development is concealing vulnerabilities to growing levels of unsustainable debt that could lead to financial crises.

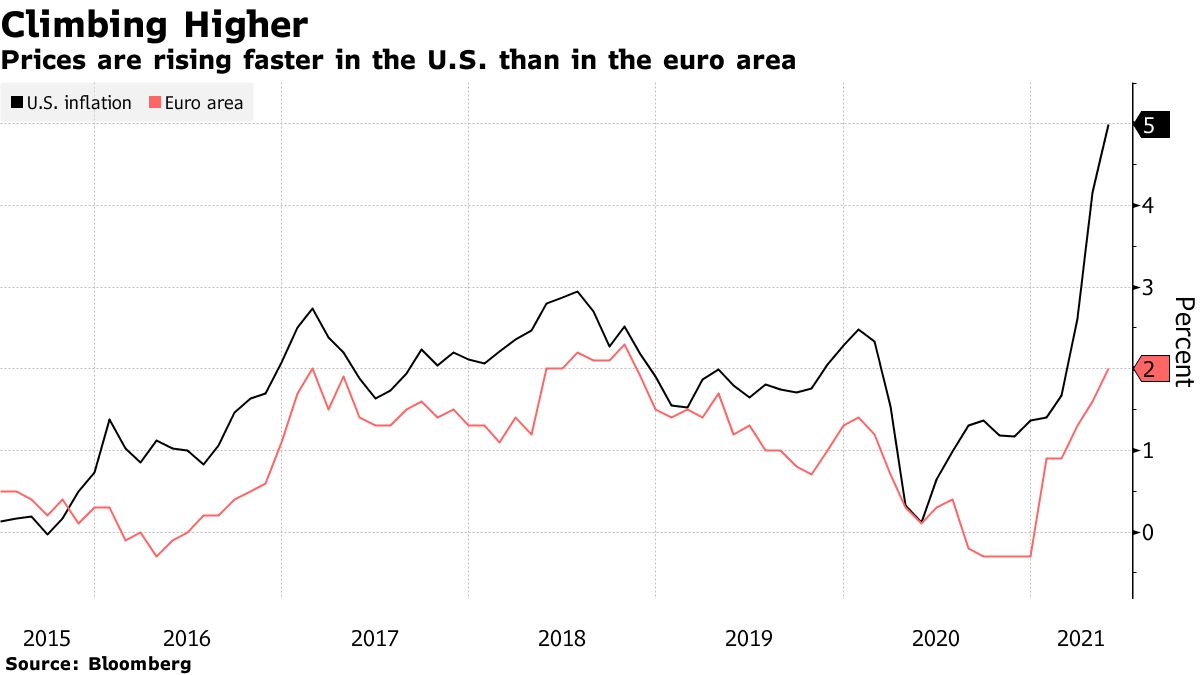

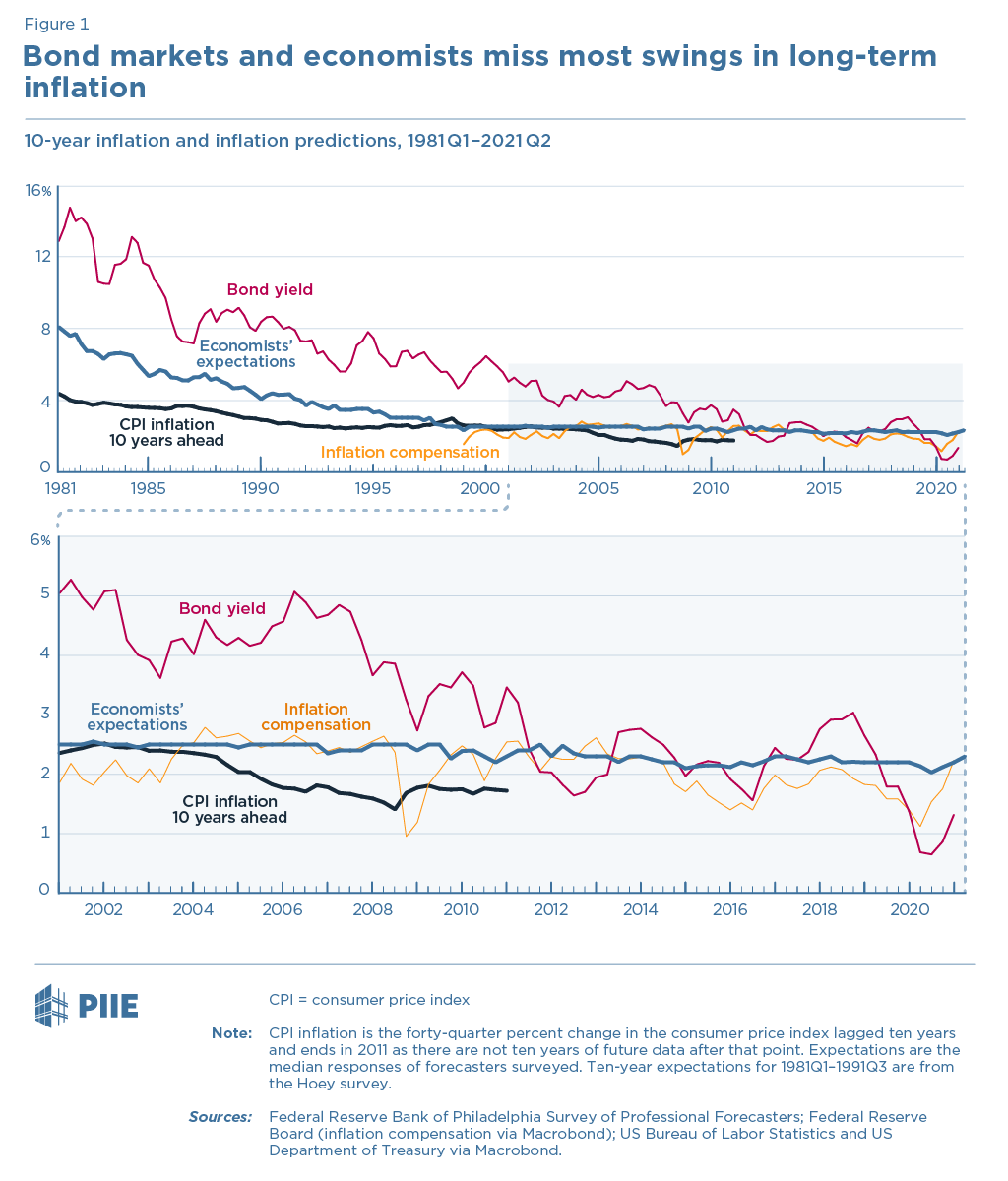

Need-to-Know Research Where inflation is headed is perhaps the biggest question in global economics at the moment. Will the recent surge prove transitory as central bankers hope or linger for longer?

So who out there are the best forecasters? According to a new study by Joseph Gagnon and Madi Sarsenbayev it depends on the timeframe.

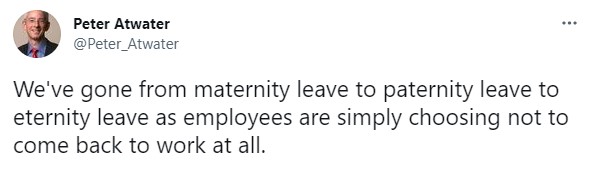

In the short-term, bond traders tend to be more accurate than economists, but the roles are reverse in the long-term, they said. On #EconTwitterAmerica's not working?  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment