| Hello. Today we examine where the next crisis may erupt, how Lego can help explain inflation and whether public spending offers a way out of weak consumer prices. Crisis WatchJPMorgan CEO Jamie Dimon was once asked by a daughter to define a financial crisis. "It's something that happens every five to seven years," he replied. With the world economy yet to fully recover from the coronavirus recession and with even some of the scars from the 2008 turmoil still to heal, such a timeframe means it's always worth thinking where the next hot spot will be. That's just what Rob Subbaraman at Nomura is doing. He recalls the late academic Rudi Dornbusch observing "a crisis takes a much longer time coming than you think, and then it happens must faster than you would have thought." To assist clients, Subbaraman updated his early warning model, aptly named Cassandra. His argument is that record-low interest rates and asset purchases by central banks risk leaving the world ripe for debt-fueled asset-price booms that at some point will unwind, perhaps abruptly.  The model's components include measures of outstanding private credit and debt as well as property and equity prices, among others. It correctly indicated two-thirds of the past 53 crises in 40 economies since the early 1990s. So where's next? Subbaraman reports about six economies currently appear vulnerable over the next three years, with the U.S. most at risk. Japan, Germany, Taiwan, Sweden and the Netherlands are also looking worrying. With the results likely influenced by the current easy-money environment, the economist stress-tested them for an interest-rate shock. When that happens, the countries in jeopardy remain the same, but France, Hungary, Romania, New Zealand and Portugal start to look dicey too. Keeping up with the times, Nomura also introduced the threat of a climate change shock to financial stability. Take that into account and Nordic countries appear well placed but 13 emerging market economies are vulnerable. Don't say you haven't been warned. —Simon Kennedy The Economic Scene A still image from an animated video released by the Cleveland Fed. Source: Federal Reserve Bank of Cleveland Inflation has caught America's attention, and the Federal Reserve is reaching for Lego to explain why some price rises will probably prove temporary. As policy makers strive to communicate their approach to keeping inflation in check — a vital step to preserve their credibility with the American public amid a recent surge in prices — the Cleveland Fed is taking a different approach. In a series of three 60-second animated videos, it explains what inflation is, why people should care about it and how the Fed controls it, each using a town and characters built out of the Danish toymaker's colorful plastic bricks. Today's Must Reads - Latin America rates | A shift toward tighter monetary policy is quickly taking shape across Latin America, with Chile signaling it is ready to raise borrowing costs from a record low as soon as July.

- Second hand | The record-breaking rise in used-car prices is probably coming to an end — and with it a key driver of the recent spike in U.S. inflation.

- Big decision | The Bank of England is set to leave monetary policy unchanged on Thursday, but it needs to balance the economic recovery with a mounting inflation risk.

-

Helping companies | The Bank of Thailand sees access to credit for businesses as a more pressing issue for the economy than interest-rate levels, and will stay focused on domestic concerns, Governor Sethaput Suthiwartnarueput told Bloomberg TV. -

First in line | The Bank of Korea looks poised to spearhead Asia's next rate-hiking campaign after Governor Lee Ju-yeol said policy normalization is in the pipeline this year. -

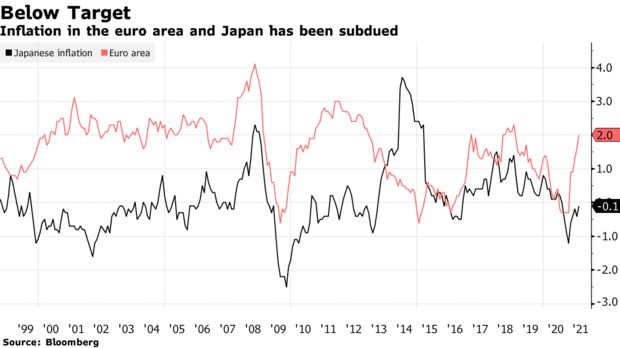

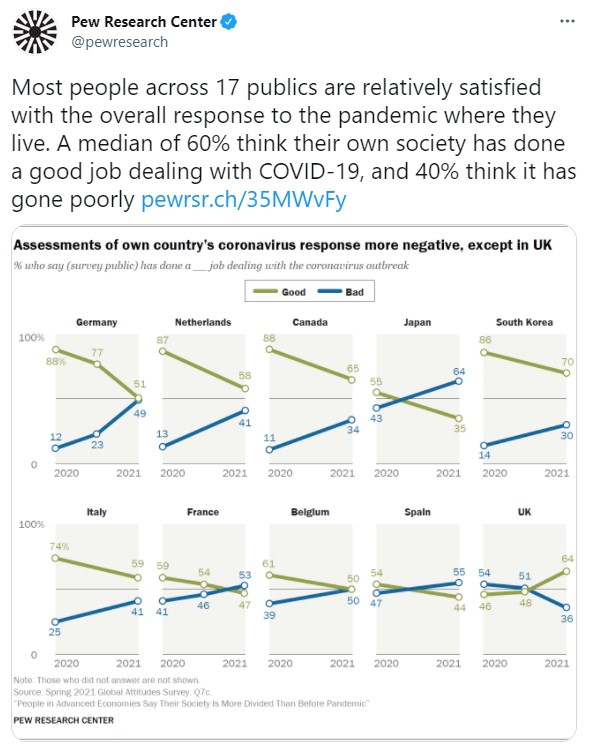

Money tree | Gabon is the world's second-most forested nation, yet its economy is almost fully reliant on revenues from oil extraction. Environment Minister Lee White now hopes to turn some of its trees into a source of income. Need-to-Know Research Advanced economies may need to rely more on fiscal spending if they want to avoid Japan's fate of being trapped with low inflation and an empty monetary toolkit, according to new research from the European Central Bank. Persistently weak pressures threaten to become a "self-fulfilling prophecy" if companies and households stop believing in rising prices and central banks are unable to counteract the pessimism, the study concluded. The Bank of Japan has been trying to reflate the nation's economy for 25 years. But "policy makers are not reduced to inaction," the paper concluded. "When monetary policy has run out of room for interest-rate cuts, decisive counter-cyclical fiscal policy protects the economy from the low-inflation equilibrium." On #EconTwitterAcross advanced economies, most people are relatively satisfied with the overall response to the pandemic where they live, though this has decreased over time in many places.  Read more reactions on Twitter Don't MissWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment