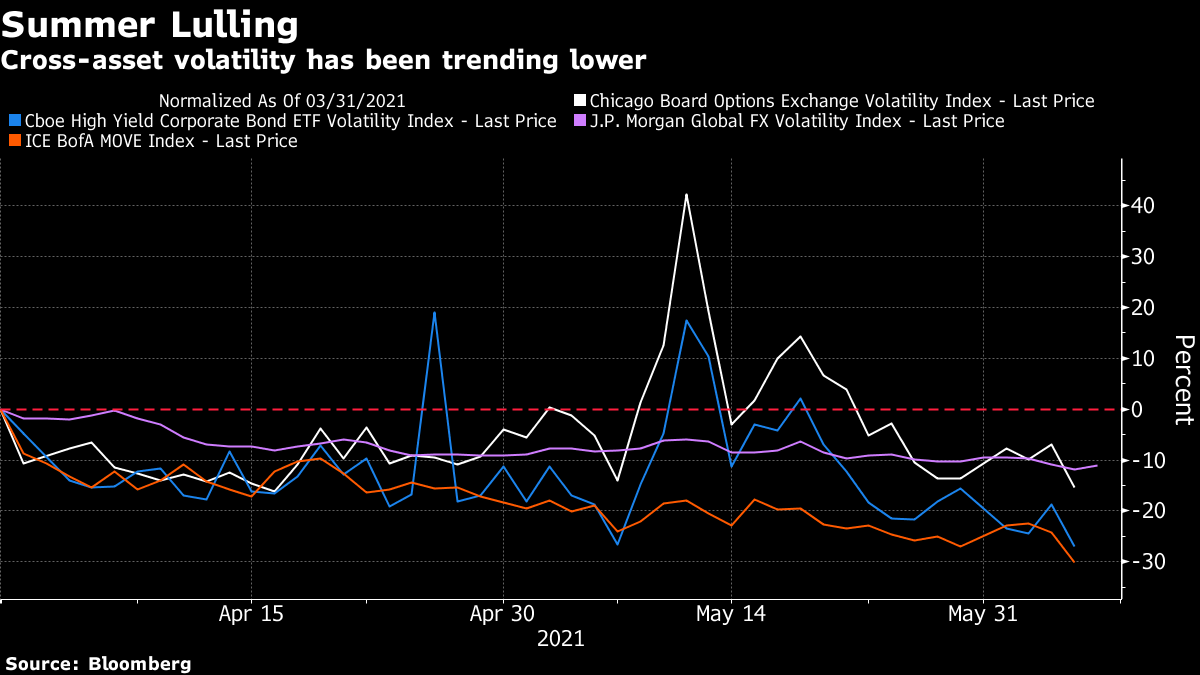

| Good morning. More tensions over Northern Ireland, a landmark drug approval and ripples from the new global tax pact. Here's what's moving markets. Northern IrelandThe European Union is said to be ready to consider tougher retaliatory measures against the U.K. should post-Brexit obligations regarding Northern Ireland not be implemented. The two sides are due to hold talks on Wednesday aimed at finding solutions to prevent any further unrest in Northern Ireland. Over the weekend, Brexit minister David Frost said the current situation over Northern Ireland is "unsustainable" and urged the EU to show a "common-sense" approach. Domestically, the U.K. government will be forced to defend its decision on cutting foreign aid spending at a debate on Tuesday. Alzheimer's ApprovalThe approval from U.S. regulators for the Alzheimer's treatment made by U.S. group Biogen is a landmark moment for the health care sector, a decision which could significantly alter the face of treatment for the brain condition and which follows years of failures. The news sent Biogen shares soaring and lifted other biotechs working on treatments for Alzheimer's, with investors viewing the approval as a potential shift in U.S. regulators' stance on other new medicines. Clinicians and advocates were split, however, over the effectiveness and uses of the drug. Tax RipplesGlobal policy makers are said to be crafting the international tax plan agreed over the weekend to ensure that Amazon is included despite its profit margins not meeting the proposed threshold. The report marks one of the first extra details on the pact, designed to turn the tide on the power held by global tech companies. The deal has created a tougher task for President Joe Biden and his proposed changes to U.S. tax law given the discrepancy between the levels put forward. And the new global regime is unlikely to result in tech companies shifting base, as markets like Ireland still offer more corporate perks than some wealthier countries. Apple PreviewApple's Worldwide Developer Conference focused closely on privacy controls and the tech giant seeking to make ground against rivals in certain areas. There was much attention on improvements made to its FaceTime application, clearly with an eye to challenging the pandemic's teleconferencing darling, Zoom. The next-generation iPhone, iPad, Mac, Apple TV and Watch operating systems were all previewed too, adding a slew of new privacy, health, smart-home, messaging, maps and digital wallet features. Coming Up…European stock futures are indicating a slight drop at the open after Asian stocks erased earlier gains, with investors awaiting more clarity on the outlook for inflation and central bank stimulus. The World Trade Organization will meet to discuss expanding the production of Covid vaccine facilities. The European earnings day is relatively slow, topped by British American Tobacco, while German industrial production data and euro-area GDP leading the economic agenda. Meanwhile, oil is slipping further from recent highs and Bitcoin is facing a renewed selloff. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe benign reaction to Friday's U.S. jobs report suggests global markets have started their summer lull early. As my colleague Joanna Ossinger pointed out, the Cboe Volatility Index dropped 9% on the day, close to pre-pandemic levels, while the ICE BofA MOVE Index -- a gauge of price swings in Treasuries -- slumped 8%. Similar measures for currency markets and junk bonds also declined, extending a trend which has seen the four cross-asset volatility gauges fall between 10% and 30% so far this quarter. While U.S. job growth picked up in May, it was not enough to intensify worries about rising inflation driving bond yields higher, a concern which has buffeted stocks this year. And though a big jump in Thursday's U.S. inflation print might have more impact, it still won't likely be enough to rule out the hypothesis that price pressures are transitory. A miss would even give fuel to what some are calling Goldilocks data -- not hot enough to spark the Fed into action but not too cold either. Investors look to be firmly in wait-and-see mode -- and that could keep activity depressed, at least through the first part of the summer.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment