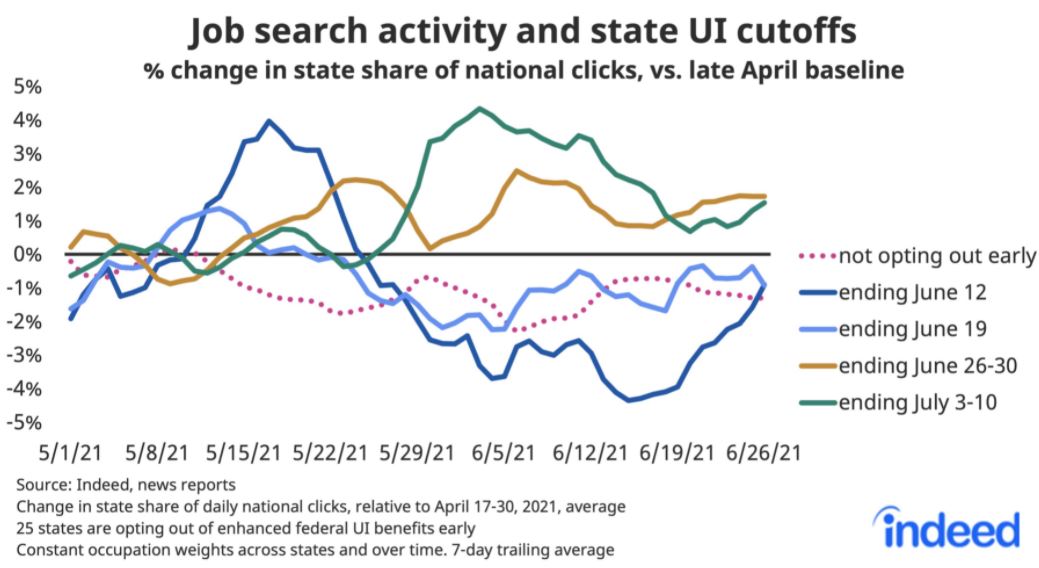

| Banks boost dividends, delta-variant concerns rise, and oil market uncertainties. PayoutsAs expected, Wall Street's big banks are celebrating their success in the most recent Federal Reserve stress tests by announcing higher dividends. Morgan Stanley doubled its quarterly payout and plans up to $12 billion in buybacks, with Goldman Sachs Group Inc., Bank of America Corp. and JPMorgan Chase & Co. also boosting payments to shareholders. Citigroup Inc. was the outlier by holding its dividend steady. While investors welcomed the news, and pushed up bank share prices in after-market trading, there is a risk that higher payouts will lead to more political scrutiny. DeltaClose to half of Australia's population is in lockdown as the nation struggles to contain the spread of the delta coronavirus variant. Indonesia is imposing stricter controls as the more infectious strain spreads. Financial assets in the region are coming under pressure as the growth outlook worsens, with currencies weakening and a gauge of Asian stocks heading for its weakest close in seven months. In Europe, travel and leisure stocks are trading lower this morning after Spain announced it was taking the U.K. off its list for restriction-free travel. In the U.S., the Los Angeles County Department of Public Health strongly recommended people wear masks indoors as the delta variant spreads. Oil meeting Fears over the pandemic resurgence in Asia combined with demand-sapping lockdowns are complicating this week's meeting of OPEC and its allies. The joint technical committee is expected to recommend ministers agree to an increase in production today, with the full OPEC+ meeting on Thursday. The price of a barrel of West Texas Intermediate for August delivery dropped to around $72.50 as the outlook for demand remained uncertain. The demand for immediate oil, however, remains robust with physical markets screaming for supply. Markets mixedWith the end of the second quarter in sight and fears about the delta variant dominating in Asia, investors seem cautious to add more risk. Overnight the MSCI Asia Pacific Index slipped 0.6% while Japan's Topix index closed 0.8% lower. In Europe, the Stoxx 600 Index had gained 0.3% by 5:50 a.m. Eastern Time with very strong consumer confidence numbers helping keep equities in the green. S&P 500 futures reversed earlier gains to point to little change at the open, the 10-year Treasury yield was at 1.480% and gold was lower. Coming up... There's a U.S. house price check at 9:00 a.m. from April's FHFA House Price Index and the S&P CoreLogic Index. June consumer confidence is at 10:00 a.m. Richmond Fed President Thomas Barkin and European Central Bank President Christine Lagarde speak this morning. Alimentation Couche-Tard Inc. is among the companies reporting results. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIt's Jobs Week, and of course everyone is wondering whether Friday's Non-Farm Payrolls report will show the labor market gaining momentum after two disappointing readings. In the meantime, here are three quick thoughts on Unemployment Insurance and the labor market: 1. The first is political. There's this cliche that politicians will always try to shower people with money to win votes. You hear it all the time. In fact it's one of the key premises of central bank independence: If not for some outside entity whose task is to fight inflation, price increases will run rampant because politicians would otherwise love to print money and spend. But the early ending of the UI expansion in several states disproves that. In half the country, politicians are reducing check sizes to the unemployed. Now you can say that there are various political interests at play or ideological, or how the checks only benefited some and not others. But again that's precisely the point. Politics still exists, and obviously in some places, that politics favors reducing UI payouts. 2. In the meantime, it's looking increasingly less likely that the UI expansion is a big contributor to labor market tightness. Jed Kolko of Indeed has been tracking job search activity in states that cut off UI and found the difference between various states to be quite modest. In some states cutting off the expansion, there is above-average search activity, but by and large they're all clustered in the same range relative to an April baseline.  3. Finally, a lot of the labor market shortfall is about two states. Per a note to clients, Andrew Zatlin of Southbay Research notes that leisure & hospitality jobs account for 4% of the payroll shortfall and that over 50% of the jobs deficit in those industries are in New York and California. In other industries and other states, the shortfall isn't that pronounced. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment