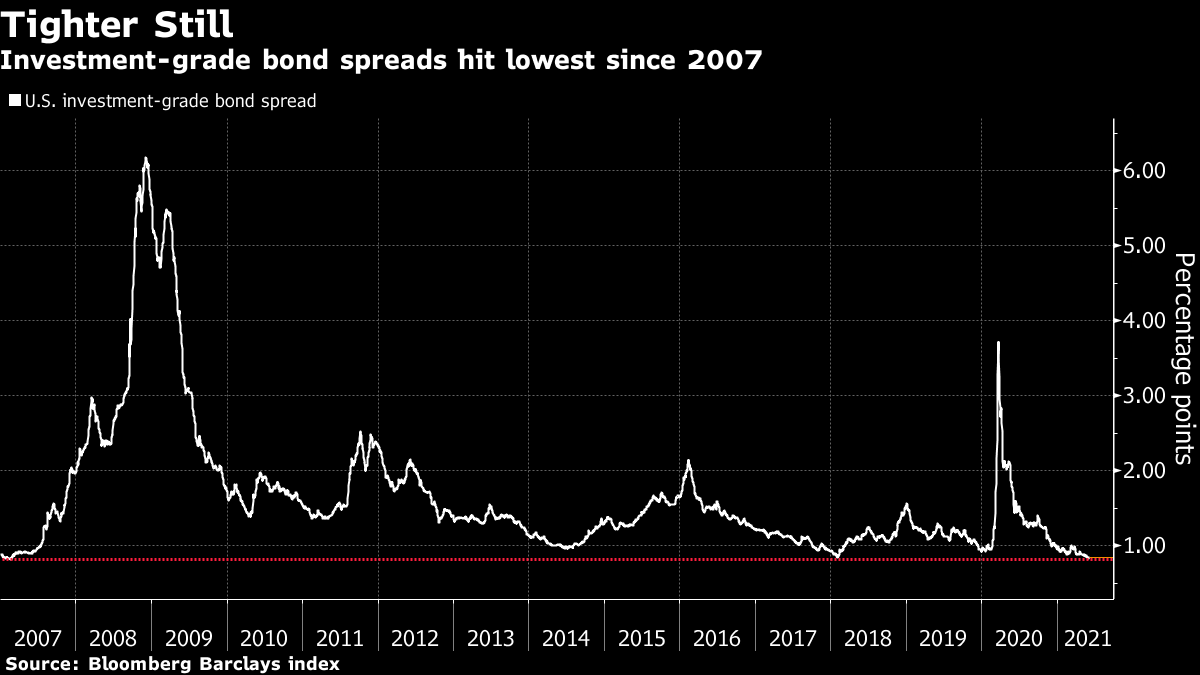

| Janet Yellen makes a case for higher U.S. rates. More bad news buffets Bitcoin. A global tax deal is secured. Here's what you need to know to start your day. Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates. "If we ended up with a slightly higher interest rate environment it would actually be a plus for society's point of view and the Fed's point of view," Yellen said Sunday in an interview with Bloomberg News during her return from the Group of Seven finance ministers' meeting in London. Biden's packages would add up to roughly $400 billion in spending per year, Yellen said, contending that's not enough to cause an inflation over-run. Asian stocks look set to rise Monday after their U.S. peers gained toward a record, bolstered by an American jobs report that eased some fears about economic growth running too hot and stoking troublesome inflation. Futures pointed higher in Japan, Australia and Hong Kong. The S&P 500 closed higher Friday and the dollar fell with Treasury yields, after a report showed U.S. job growth picked up in May but missed estimates. The greenback was little changed in early trading. Oil and gold were little changed after gains Friday. Bitcoin and most other top cryptocurrencies fell on concerns that there may be a further crackdown on the industry in China and as a report from Goldman Sachs Group Inc. served as a reminder that institutional adoption may be a long process. Chinese social-media service Weibo suspended some crypto-related accounts. Meanwhile, a Goldman Sachs note showed that not everyone in finance is eager to jump in, while this $7.5 billion hedge fund says while gold is good, Bitcoin's better. New Hong Kong listings are tracking at their slowest pace since the aftermath of the global financial crisis, as weaker markets and China's clampdown on its biggest tech firms chill sentiment. Just seven companies have gone public in the second quarter so far — on track for the fewest since 2009, according to data compiled by Bloomberg. The muted second-quarter activity stands in sharp contrast to the rush to go public seen last year or even at the start of 2021. China slapped a record fine on Alibaba Group and ordered 34 of its largest tech companies to rectify any anti-competitive business practices. The Group of Seven rich nations secured a landmark deal that could help countries collect more taxes from big companies and enable governments to impose levies on U.S. tech giants such as Amazon and Facebook. The agreement by the G-7 finance ministers in London satisfies a U.S. demand for a minimum corporate tax rate of "at least 15%" on foreign earnings and paves the way for levies on multinationals in countries where they make money, instead of just where they are headquartered. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayLast week, the Federal Reserve surprised the world by announcing it was winding down the Secondary Market Corporate Credit Facility (SMCCF), the bond-buying program it launched during the depths of 2020's market plunge to support corporate credit. But in announcing the end of the facility, the central bank is confirming that it's never really going away. Once the Fed has started a new support facility, the possibility of the facility being restarted in the next crisis remains. (In fact, there's a case to be made that one of the reasons the central bank was able to deal so quickly with the chaos of March of last year, was thanks to the existence of financial crisis-era programs that it was able to pull off the shelf).  "Even as they fade into the sunset, the primary and secondary-market credit facilities stand as a blueprint for future shocks," write Citigroup credit analysts Daniel Sorid and James Keefe. "The program will continue to exert power over the market as long as the corporate bond market remains systemically important to the financial system." They estimate that the Fed's "invisible presence" in corporate bonds now adds about 30 basis points to benchmark investment-grade bond indexes. Another way of thinking about this, is that the Fed creates a permanent market backstop every time it steps in to save a new market. While the program itself might end, the possibility that it could return in an emergency lasts forever. So the SMCCF might be gone, but it certainly won't ever be forgotten. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment