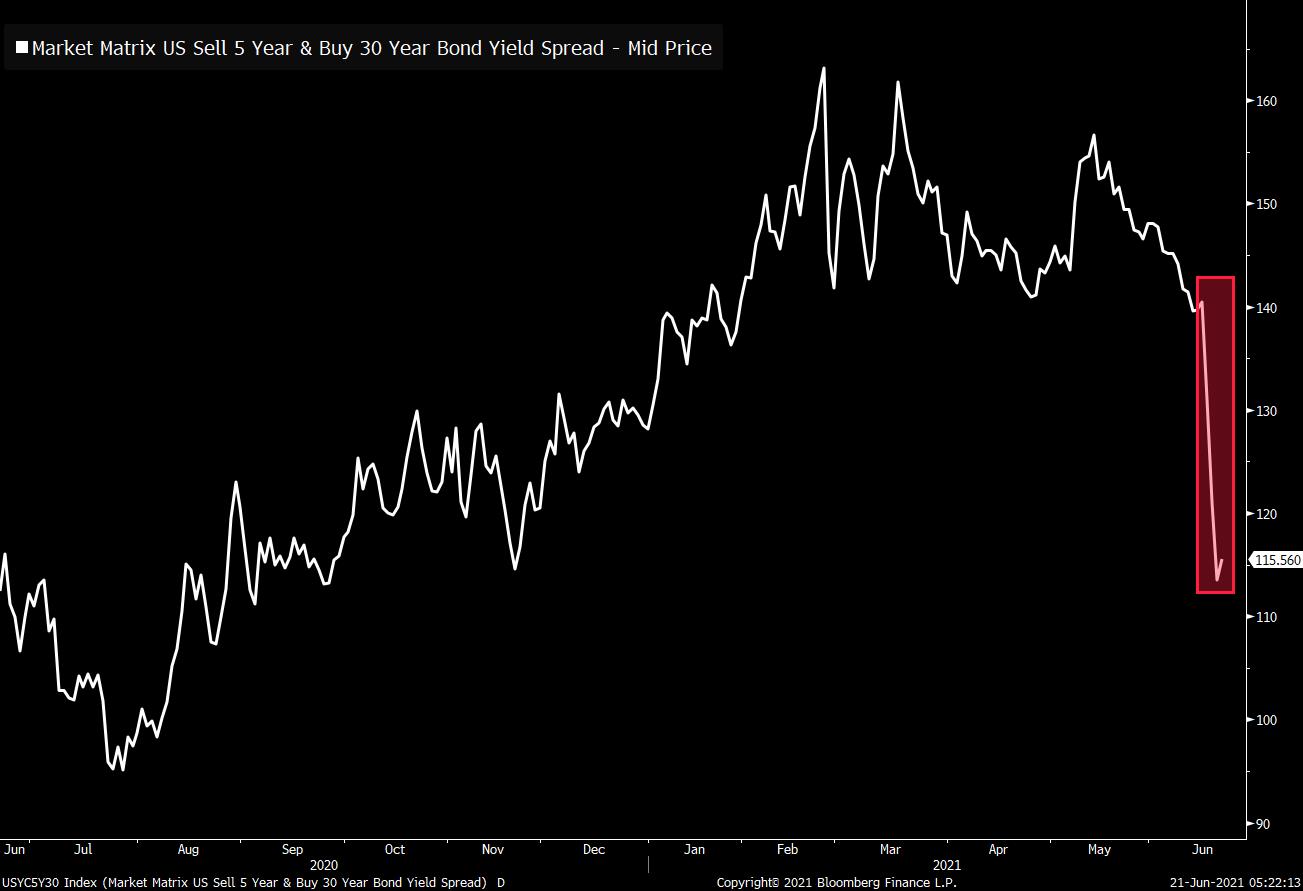

| Treasury yields drop, Bitcoin hit by China again, and Iran talks get trickier. Inflation? What inflation? The reflation trade remains firmly out of favor this morning, with the yield on the 30-year Treasury dipping below 2% for the first time since February during the Asia session. The five- to 30-year yield spread narrowed to the smallest gap since December as investors continue to react to last week's hawkish Fed. Those investors will likely be kept on their toes this week as there is a raft on Fed speakers scheduled to share their thoughts, with Chair Jerome Powell due to testify to Congress tomorrow. China crackdownBitcoin tumbled more than 10% after moves against cryptocurrencies in China intensified. The country's central bank said banks and payment firms must not provide payment services for crypto-related transactions. Earlier, authorities in the southern city of Ya'an stepped up action to rein in digital mining in the hydropower-rich region. Ethereum traded below $2,000 while DeFi coins remained under pressure. Nuclear standoff The victory in Iran's election of conservative cleric Ebrahim Raisi is likely to delay the resolution of nuclear talks, and therefore the return of the country's oil to the international market. Raisi, who himself is subject to U.S. sanctions, is set to take over as president in August. The lack of progress in talks, and possibly greater difficulty in reaching an agreement, has helped oil hold near $72 a barrel this morning. Markets mixedGlobal equities are having a relatively volatile start to the week, with the selloff which dominated early trading reversing. Overnight the MSCI Asia Pacific Index dropped 1.5% while Japan's Topix index closed 2.4% lower. In Europe the Stoxx 600 Index recovered from losses at the open to trade 0.4% higher by 5:50 a.m. It's been a similar story with S&P 500 futures which now firmly point to a jump at the open, the 10-year Treasury yield is at 1.436% and gold gained. Coming up... The Chicago Fed National Activity Index for May is at 8:30 a.m. European Central Bank President Christine Lagarde speaks at 8:30 a.m. and 10:15 a.m. St. Louis Fed President James Bullard and Dallas Fed President Robert Kaplan kick off the busy week for Fed speakers at 9:45 a.m., with New York Fed President John Williams up later. Amazon.com Inc. holds its Prime Day. What we've been readingHere's what caught our eye over the weekend. And finally, here's what Joe's interested in this morningThere was a truly extreme reaction in the Treasury markets after the FOMC meeting in the middle of the last week. The spread between 30-year and 5-year Treasuries plunged to its lowest levels since late last year, fully erasing several months of reflationary steepening.  At first glance it's not so obvious why there was such a reaction to the news. Today is only the second day of summer 2021, and yet people are anxious about possible rate hikes in 2023? Not only is 2023 a long time from now, but Federal Reserve Chair Jerome Powell once again reminded everyone during the press conference that the dots aren't some hard forecast. And beyond that, there's a good chance that a lot of the more aggressive dots are from the more hawkish regional Fed presidents, who don't necessarily reflect the center of gravity on the FOMC. So it all seems like a lot. That being said, all last week I kept thinking about this meme as it pertains to the Fed.  There is a sense in which the recent months of data have activated the inflation-fighting red blood cells at the Fed. During the press conference, Powell was largely optimistic about the trajectory of the economy. But in terms of risks, he's clearly more concerned about an inflation overshoot than an employment undershoot. This is a change after months and months of being more concerned about weak labor markets. And now there's some debate about whether the new dots fit with the framework set out at Jackson Hole last year, where the Fed indicated plans to wait to see signs of sustained inflation before raising rates. Either way, the point is not just the 2023 dots, but the broader trajectory of the Fed itself. For awhile it felt like the message coming from the Fed was "full employment above all else" but after a few hot inflation readings, some of the old thinking about the risk of temporary inflation turning to undesirable higher inflation via the expectations channel is back. That feels more like the Fed we've come to know all these years. The Fed that raised rates multiple times in 2018. Nobody directly thinks this way, but when you're talking about a 30-year Treasury bond, you're implicitly working out how the Fed is going to react to multiple downturns and recoveries through the year 2051. And if the Fed is going to wind up back in its standard approach to pre-empting inflation, then you can start to see why the curve had such a powerful move. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment