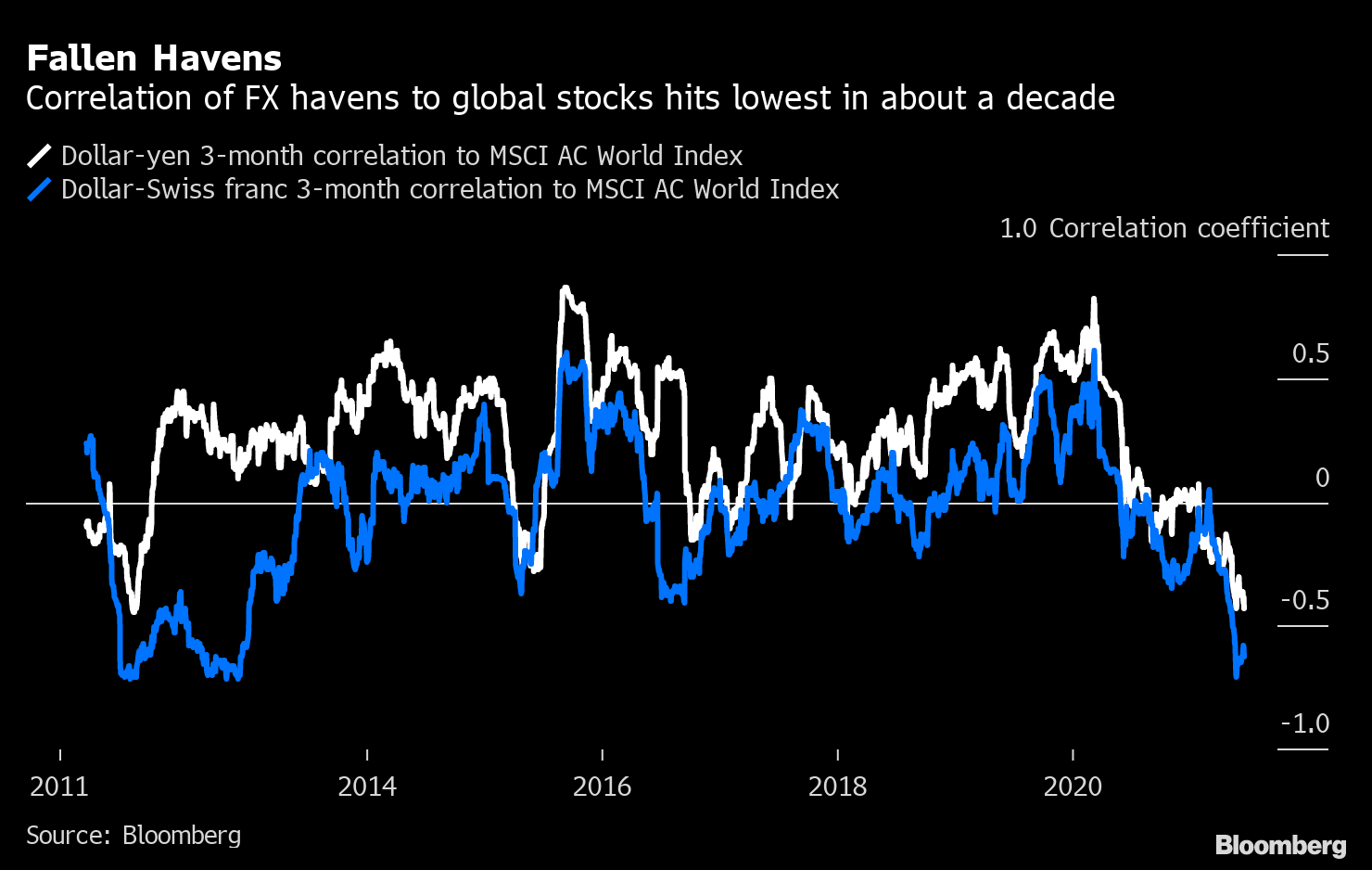

| Good morning. A possible easing of U.K. travel curbs for the vaccinated, soothing words on inflation and a tightening oil market. Here's what's moving markets. Travel HopesJust as U.K. officials were pouring cold water on Brits' hopes for a post-Covid summer, the Times reported that the government is set to announce looser travel restrictions for people who've been fully vaccinated. An overhaul of rules, to be announced on Thursday, won't add many destinations to the quarantine-free "green list," but is likely to exempt the vaccinated from a 10-day quarantine when returning from amber-list areas starting in August, the paper said. Despite the spread of the delta variant, Prime Minister Boris Johnson said on Monday that England is on track to lift domestic limits on social gatherings as planned on July 19. Limited ContagionECB President Christine Lagarde said accelerating U.S. inflation that prompted the Fed to shift its view of price risks will have only a limited impact in the euro area. Spillovers can occur "through the direct channel of imported goods originating in the U.S. and through several indirect trade or expectations mechanisms," she told lawmakers in the European Parliament on Monday. Still, the overall effects on euro-area inflation "are expected to be moderate." Tight SuppliesBrent oil just hit $75 a barrel for the first time in more than two years amid signs of a rapidly tightening market. One such sign is the price gap between September and October WTI contracts, which hit the highest level since 2014, when crude cost well over $100 a barrel, suggesting that traders expect a further tightening of U.S. inventories. Bank of America Corp. has now forecast that oil may surge to $100 a barrel next year as travel demand rebounds, making the strongest call yet among major forecasters for a return to triple digits. Death CrossBitcoin has come under pressure recently by China's cryptocurrency clampdown and concerns about the environmental impact of the energy-hungry computers that underpin it, after the People's Bank of China said it called top banks to a meeting to discuss prohibitions on crypto-related activity. The currency's slide toward $30,000 amid China's crackdown is stoking fears of a deeper selloff. Overnight, Bitcoin fell below $32,000 while Ethereum dropped below the $2,000 mark for the first time in about a month. Coming Up…European stocks are set to track the rebound in U.S. and Asian equities after investors' concerns over possible Fed tightening eased. One place that is likely to tighten policy however is Hungary, with the central bank likely to raise rates today to curb inflation, which would make it the first EU nation to do this year. Traders will be waiting to hear from Fed Chair Jerome Powell, who testifies at a House Subcommittee today. Elsewhere, Iceland's biggest-ever IPO, Islandsbanki, starts trading after its 55.3 billion kronur ($457 million) offering was oversubscribed. Packaging firm DS Smith reports earnings, as does fuel cell firm Plug Power in the U.S. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningEven though investors have a love/hate relationship with the dollar, it has clearly become the go-to currency haven, brushing aside the challenge of the yen and Swiss franc, the traditional holders of that role. Three-month correlations of the dollar-yen and dollar-franc to the MSCI AC World Index have slumped into negative territory to the lowest in about a decade, according to data compiled by Bloomberg. Of course the greenback as a haven is not a new phenomenon -- Stephen Jen's dollar smile theory showed how it tended to thrive in both risk-on and risk-off scenarios. But as RBC's Adam Cole pointed out Japan and Switzerland still have the properties that define safe havens, most notably the strongest net external asset positions in the world. The yen and Swissie are the worst performing Group-of-10 currencies year-to-date -- down about 6% and 4% respectively. And markets look set for a period of higher volatility as they become ever more dependent on upcoming economic data releases and second guessing what they mean for monetary policy. That suggests the yen and the franc may get another chance soon to take back their haven crowns.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment