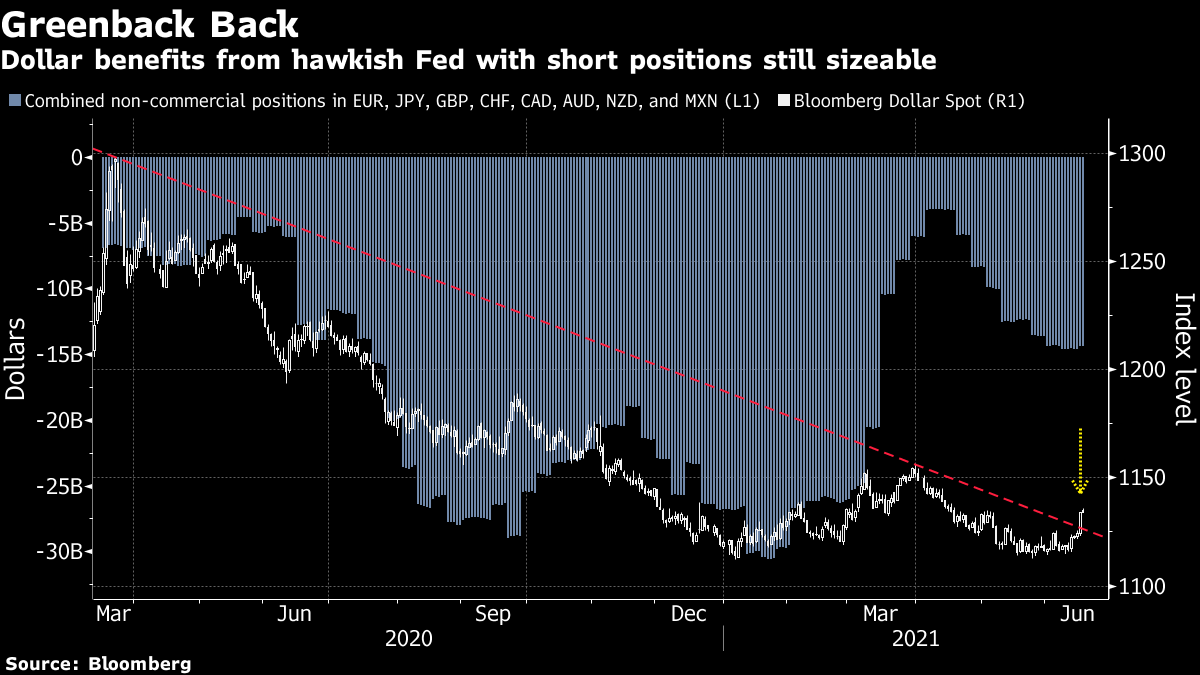

| Good morning. A hawkish Fed, Biden-Putin "victory," Westminster drama and a vaccine maker's plunge. Here's what's moving markets. Talking About TalkingU.S. interest-rate-setters have begun a discussion about scaling back bond purchases, kind of. "You can think of this meeting as the talking-about-talking-about meeting, if you like," Federal Reserve Chair Jerome Powell said at a press conference after the central bank released forecasts that show it anticipates two rate increases by the end of 2023, projecting a faster-than-anticipated pace of tightening. The U.S. dollar jumped as much as 0.9% in its biggest daily gain of this year. Stock investors, meanwhile, worry the update could weigh on more pricey areas of the market. Victory of SortsU.S. President Joe Biden said he handed Vladimir Putin a list of of critical infrastructure that should be off limits from hacking, and also confronted the Russian leader about human-rights violations at a summit in Geneva on Wednesday. Still, Biden said he saw the possibility of improving bilateral relations. In turn, Putin said the U.S. and Russia would return their ambassadors to their posts, and the two sides have agreed to hold talks on arms control, cyber-security and diplomatic ties. While there was never any expectation that the summit would solve the two nations' many problems, Putin shared Biden's assessment that the summit alone was a victory of sorts. I Don't Think SoThe Westminster soap opera continues after Dominic Cummings, former aide to Boris Johnson, released WhatsApp messages showing the U.K. prime minister branded Health Secretary Matt Hancock "totally f---ing hopeless," during the early stages of the pandemic. While making for entertaining reading, it'll be unwanted drama for a government that's just pushed back its plan to lift coronavirus restrictions as a more infectious variant spreads rapidly. Asked by reporters whether Johnson had "full confidence" in Hancock, a spokesman replied: "Yes." Asked whether he was hopeless, Hancock said: "I don't think so." CureVac PlungesA vaccine maker touted by Tesla boss Elon Musk lost almost half its value in after-hours U.S. trading, as a preliminary analysis found its Covid-19 vaccine was just 47% effective — well short of the high bar set by other messenger RNA shots. The interim results from the CureVac study, which was muddied by the proliferation of virus variants, throw the future of the vaccine into question. However, CureVac will finish its trial and plans to secure approval. The spread of variants is also testimony to how the pandemic has changed since the first large vaccine clinical trials last year. Coming Up…European stocks are set to open lower, amid focus on the Fed. Today features rate decisions from Switzerland and Norway, as well as earnings from shoemaker Dr. Martens, and auto parts retailer Halfords. In the U.S., Treasury Secretary Janet Yellen will testify about the proposed 2022 federal budget while software giant Adobe and retailer Kroger give earnings. One thing that won't be on the agenda is the Securities and Exchange Commission's long-awaited decision on whether to approve a Bitcoin ETF, after the regulators delayed the ruling, which was expected today. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningAs investors debate just how much of a hawkish pivot came from U.S. policymakers last night — did markets just fight the Fed and win? — the clearest consensus was that it meant a boost for the dollar. The Bloomberg Dollar Spot Index closed up almost 1%, its biggest move in about a year. The hawkish turn prompted both Goldman Sachs and Deutsche Bank to abandon their calls that the euro will rally against the greenback and TD Securities suggested a broad dollar rally through the summer months. While many dollar bears cut back short bets this week amid speculation the Fed could surprise, a quick look suggests there is more to go. From a year-to-date low of about $4 billion in April, speculators have built back up net short dollar bets to around $14 billion, according to the latest aggregate Commodity Futures Trading Commission data. The gauge has (once again) broken out of its downtrend from last year's March peak. Of course much will now depend on the direction of real yields — which moved higher overnight — but the Fed has just reopened the door for a period of dollar strength.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment