| Biden shifts his focus from Vladimir Putin to Xi Jinping. Expats in Singapore and Hong Kong are green with envy. There's no stopping the world's most expensive property market. Here's what you need to know to start your day. With his meeting with Russia's Vladimir Putin behind him, Joe Biden's focus is shifting toward Xi Jinping. U.S.-China ties are far more complex and consequential for the American economy than the relationship with Russia, and Biden's window to meet and establish a productive relationship with Xi for the years ahead is closing. U.S. National Security Advisor Jake Sullivan on Thursday confirmed planning is now underway for extensive talks with Beijing. No date has been confirmed, though one possibility is during the G-20 summit in Rome in October. Meanwhile, U.S. regulators proposed a ban on products from Huawei and four other Chinese electronics companies, stepping up pressure on tech suppliers alleged to be security risks. And Xi picked one of his top lieutenants to lead China's chip battle against the U.S. Asian stocks look set for gains after U.S. technology shares rallied and Treasuries advanced, with investors unwinding some of this year's dominant reflation trades. The dollar climbed and commodities slumped. Futures pointed higher in Japan, Australia and Hong Kong. The tech-heavy Nasdaq 100 rose to a record high as investors rotated from cyclical stocks, while the benchmark S&P 500 ended little changed. Treasury yields tumbled amid speculation investors were unwinding curve steeping trades after Federal Reserve officials signaled monetary policy tightening could start earlier than expected, helping to rein in the risk that inflation might get out of hand. Gold tumbled to below $1,800 an ounce and oil fell. Singapore and Hong Kong have practically shut their doors for more than a year to keep Covid-19 in check. But as the U.S. and Europe emerge from the pandemic, the cities' businesses and expatriates are starting to question whether they've been too slow to reopen, and can only watch with envy as life returns to normal elsewhere. At stake are the cities' reputations as Asia's top business and finance hubs. Then there's the human toll for families kept apart by strict travel measures and lengthy, impractical quarantines. That's making many question their decisions to stay. But there is a glimmer of hope on the horizon for some. Hong Kong just announced it would shorten hotel quarantine for fully vaccinated travelers from most places to seven days as long as they pass an antibody test. In other Covid news, life-saving double-lung transplants are on the rise for severe cases; the U.S. is investing $3.2 billion into developing antiviral medicines to combat Covid-19; and the U.K. recorded the most cases in a day since mid-February. The world's most expensive property market is unstoppable. Despite a struggling economy and a wave of emigration following years of political turmoil, demand for homes in Hong Kong — ranging from luxury mansions to shoebox apartments — remains unquenched, with property prices hovering near an all time-high set in mid-2019. Hong Kong's average property value was a world-beating $1.25 million as of June 2020, according to CBRE. One of the main reasons for sky-high prices? In a city of 7.5 million where space is precious, demand for homes continues to outweigh supply. In April, officials from China's economic planning agency began probing Chinese oil refiners for suspected violations of tax and environmental rules. The investigation has recently escalated in the small seaside city of Panjin with the arrival of senior officials from national tax and prosecution departments. Some refiners may face significant punishments such as losing access to imported crude. The question hanging over Chinese refiners, the cities where they operate and the global network of traders who supply them, is how far the crackdown will go. The future of China's vast oil-refining industry may hinge on what government investigators find in the little known energy hub by the sea. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayThere are a lot of interesting things going on with central banks right now, in particular divergent approaches to potential inflation and different speeds of exit from 2020's extraordinary stimulus efforts. However, one of the most interesting — and potentially market-moving — developments is now underway in Asia, with China slowing the expansion of credit that helped its economy not just weather last year's coronavirus pandemic, but get through it while maintaining envious reported levels of growth.

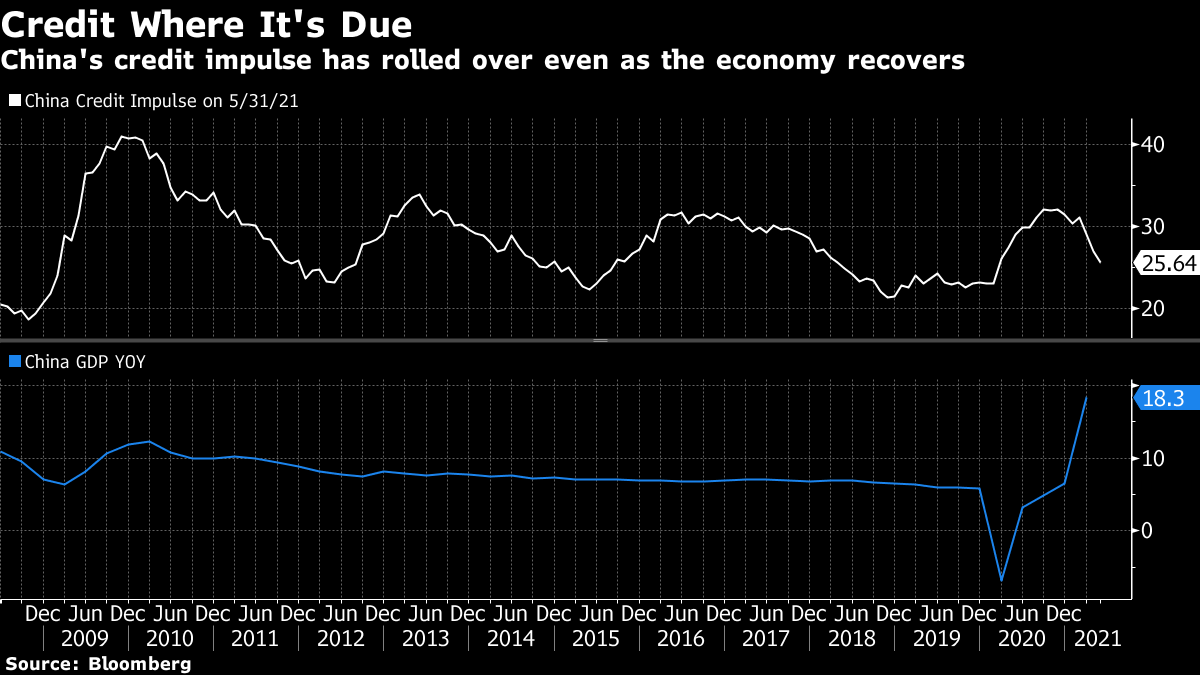

China's credit impulse — which tracks new financing as a share of GDP — keeps falling and last month recorded its first negative reading since August 2019. Normally a rollover in the credit impulse would be a bad signal for China's debt-driven economy, and by extension for things like commodities and risk assets. (Citigroup Strategist Matt King famously enjoys overlaying charts of global credit expansion with the MSCI World Index, the implication being that stocks will follow credit expansion up or down. For the past year, China has been a major driver of global credit expansion).  But there are always arguments that this time is different, and today Bloomberg reports that China's economic growth has decoupled from credit as its economy matures and has started moving away from credit-dependent sectors. That would suggest that a tightening of financing might not necessarily lead to as much of a slowdown in the Chinese economy, or in turn impact the rest of the world quite so much. One to watch. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment