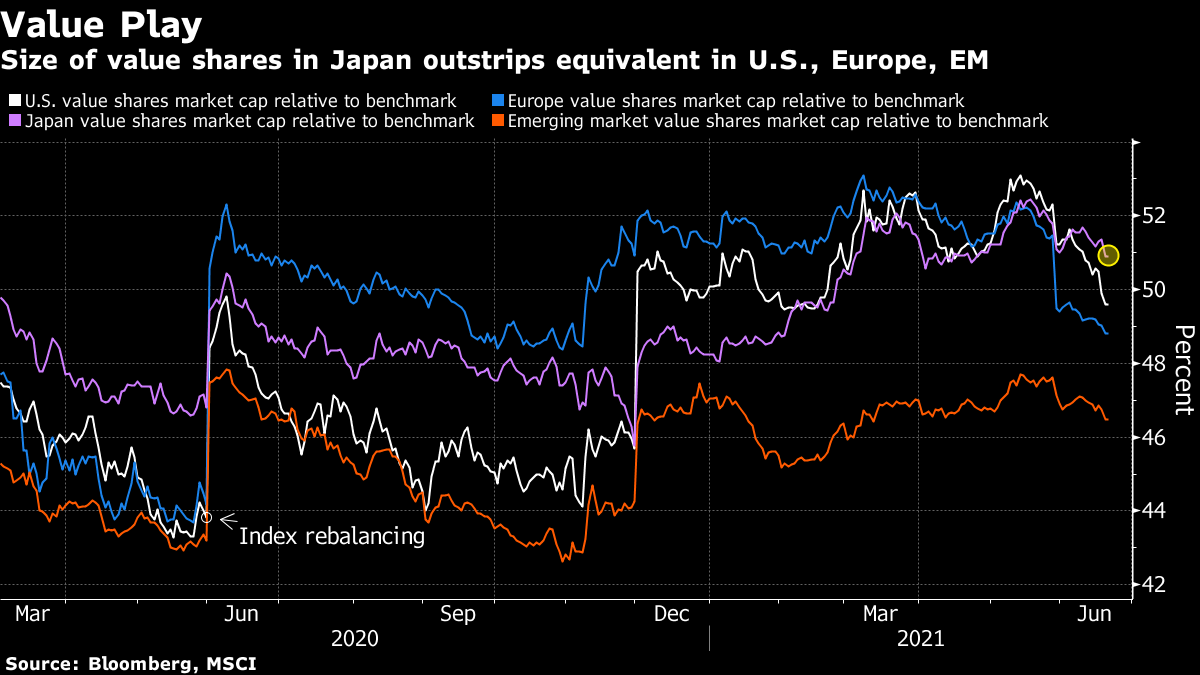

| Good morning. New U.S. sanctions against Russia, a hard-line shift in Iran and bad news for Brits' summer plans. Here's what's moving markets. Hardliner WinUltraconservative cleric Ebrahim Raisi won Iran's presidential election, potentially complicating world powers' efforts to revive a nuclear deal that could see the Islamic Republic return to global oil markets. While Raisi has previously said he would preserve the nuclear deal that outgoing President Hassan Rouhani helped seal, he has also indicated he doesn't want to make it Iran's central foreign policy concern. A day after Raisi was elected, diplomats adjourned their sixth round of negotiations in Vienna with significant gaps remaining to mend the six-year-old accord. Worse Than ExpectedExit polls showed President Emmanuel Macron and far-right leader Marine Le Pen fared worse than expected in the first round of France's regional election in a disappointing twist for the two main contenders in the country's 2022 presidential race. Turnout was at an all-time low, estimated at 32% on Sunday, with one recent survey showing many citizens didn't even know what the elections were for. While results might not translate into national politics when voters head to the polls again next April to choose a president, they could help left-wing movements unite behind a candidate, something they've so far failed to do. Devastating ConsequencesThe U.S. is preparing additional sanctions against Russia for the poisoning of opposition leader Alexey Navalny. That comes days after President Joe Biden said he confronted Russia's Vladimir Putin about human-rights violations and made it clear to him that Russia would face "devastating" consequences if Navalny died in prison. The Biden administration announced its first sanctions against Russia in March, targeting senior law enforcement officials in response to Navalny's poisoning and arrest. Reality CheckThe U.K. government signaled it will keep restrictions on overseas travel in place, with Justice Secretary Robert Buckland saying "normal" holidays were "never going to be the case" this year because of increasing Covid-19 cases. Buckland's comments indicate increasing concern about a third wave of cases in the U.K. despite one of the world's most aggressive vaccination programs. The remarks are a blow to airlines and a growing number of members of Parliament in the ruling Conservative Party pressing for the government to loosen restrictions. Coming Up…European stock markets are set to join a selloff as Treasury yields tumbled. Markets in Asia plunged, with Japan being sold especially hard after a slide in U.S. stocks on Friday and as the 30-year Treasury rate fell below 2% for the first time since February. That was prompted by hawkish comments from St. Louis Fed President James Bullard, who speaks again today at a virtual event, along with Dallas Fed President Robert Kaplan. Prosus and its parent Naspers both report earnings on an otherwise quiet day. The Qatar Economic Forum, powered by Bloomberg, kicks off today, and speakers include Ray Dalio as well as former Treasury Secretaries Lawrence Summers and Steve Mnuchin. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningAs the global reflation trade goes into reverse, a quick look at equity markets shows that Japanese shares are under the most pressure. The Topix index is the worst-performing major benchmark over the last 5 days, down about 3%. That makes sense when you remember how much of a value trade Japan is perceived to be -- a view that's borne out in the numbers too. The market capitalization of value stocks is about 51% of the MSCI Japan Index, a higher proportion than seen in the U.S., Europe or emerging-market equivalents, according to data compiled by Bloomberg. It had exceeded 52% in May. Unfortunately for Japan investors, the reflation reversal is outweighing a number of positives such as an accelerating vaccination rate, a weaker yen and a very accommodative central bank. Japanese shares are cheap too -- trading on about 16 times forward earnings, compared to around 20 times for the MSCI AC World Index ex-Japan. But low valuations didn't save value shares from more than a decade of underperformance against their global peers before the pandemic. And Japanese shares were lagging since at least 2015 before this year's reflation excitement gave them a boost. Japan bulls will be hoping that's a trend that's not going to reassert itself once again.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment