| The U.S. says China risks isolation if it doesn't support a home soil probe into Covid origin. World leaders fail to revive a nuclear deal with Iran after sixth round of talks. Bitcoin slumps as China cracks down on mining. Here's what you need to know to start your day. China will risk international isolation if it fails to allow a "real" investigation on its territory into the origins of the virus that caused the Covid-19 pandemic, U.S. National Security Adviser Jake Sullivan said. Sullivan's comments follow last week's call by Group of Seven leaders including U.S. President Joe Biden for another probe into how the virus originated. Biden last month ordered the U.S. intelligence community to "redouble" efforts to determine where the coronavirus came from and to report back in 90 days. China has rejected the theory that the virus originated in a lab in Wuhan. Meanwhile Japan is enlisting the help of big corporations to help get vaccines into employees' arms, Hong Kong is "carefully-examining" the possibility of easing its strict virus curbs, and Covid booster shots may not be necessary, a WHO scientist says. Asian stocks are set to start the week lower as investors assess whether last week's post-Federal Reserve rotation away from the reflation trade will continue. U.S. stocks tumbled for a fourth day on Friday after the central bank's surprise hawkishness, and commodities such as copper slumped while the dollar touched a two-month high. The S&P 500 had its worst week since February. Bonds advanced, sending 10-year yields down around 1.44%, oil gained and gold retreated. Futures were lower in Japan, Australia and Hong Kong. Bitcoin dropped over the weekend amid a focus on Chinese mine closures and potential regulatory scrutiny. The digital coin was trading just below $36,000 early Monday. World powers and Iran failed after a sixth round of negotiations in Vienna to revive a nuclear deal that would lift U.S. sanctions in exchange for Iran scaling back atomic activities. A day after hardline cleric Ebrahim Raisi was declared the winner of Iran's presidential election, diplomats adjourned their sixth round of meetings with significant gaps remaining to mend the six-year-old accord. The president-elect is himself subject to sanctions imposed by the Trump administration in 2019. Iran said one of the "serious issues" raised in the latest round of talks to revive the 2015 nuclear deal was the need for a guarantee from the U.S. that it won't exit the accord and reimpose sanctions again in the future. Iran has said all documents needed to revive the deal are ready. Raisi's victory will probably hold up the lifting of U.S. sanctions on energy exports, analysts say. Taiwan said it recalled seven representative officials from Hong Kong, citing "unreasonable political preconditions" for its personnel to operate in the city. Hong Kong has been requesting since July 2018 that Taiwan's representatives sign a "one China principle" commitment letter as part of visa requirements, according to Taipei's Mainland Affairs Council. China cautioned Taiwan to immediately stop meddling in Hong Kong's affairs or it will face "severe" punishment. Meanwhile, Hong Kong's pro-democracy Apple Daily newspaper has enough cash on hand to continue operating as normal for only a couple more weeks. China's crackdown on crypto mining looks to be widening. Ya'an, a city with abundant hydropower, is said to have begun a sweeping clampdown on crypto mining firms this week, in the wake of deadly coal accidents. At least one Bitcoin miner was told by an official with the Ya'an city government that it promised provincial authorities it would root out all Bitcoin and Ether mining operations within one year. Meanwhile, China Business News reported Friday that government-owned power companies in Sichuan must immediately stop supplying electricity to crypto mining projects. The news saw Bitcoin and Ether both slide at the weekend. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayBehold! One of the newest subreddits is r/shortages, a community intended "to share information on post Covid supply shortages and to share knowledge of things in short supply in your area or line of work." The board was created on Sunday and is already full of anecdotal stories of shortages in things like boats, tennis balls, chlorine, spaghetti sauce, micropipette tips, acetone, sodium citrate tubes, houses and so on. While a dedicated subreddit might normally be a sign of the top in an emerging trend, things could end up being a little different when it comes to concerns over supply shortages. Here, there's always the question of whether those fears create their own momentum and lead to something like a retail "bullwhip effect" as people scramble to load up on jars of spaghetti sauce or tennis balls whenever they manage to find them.  It's worth noting a massive difference between items in short supply as well. While you can build your personal doomsday supply of tennis balls and pre-made spaghetti sauce, it's going to be pretty difficult to stock up on things like houses (unless, of course, you happen to be a large institutional buyer). In other words, there may be supply shortages that are more prone to self-correct rather than reverberate for a long time.

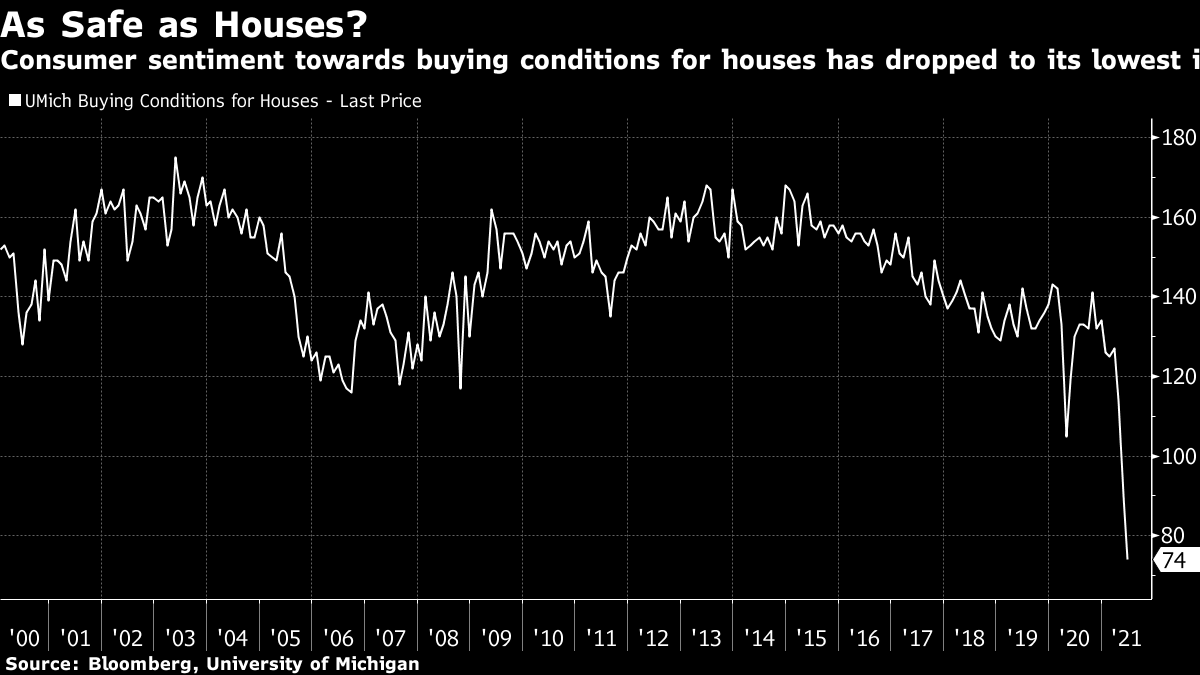

That could be one reason why we're starting to see individuals' attitudes towards buying homes change, with the University of Michigan survey showing sentiment on "buying conditions for houses" dropping to its lowest level since the 1980s — worse than in the aftermath of the bursting of the subprime bubble! It's a good reminder that not all supply shortages are created equal, even if they all sit on the same subreddit. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment