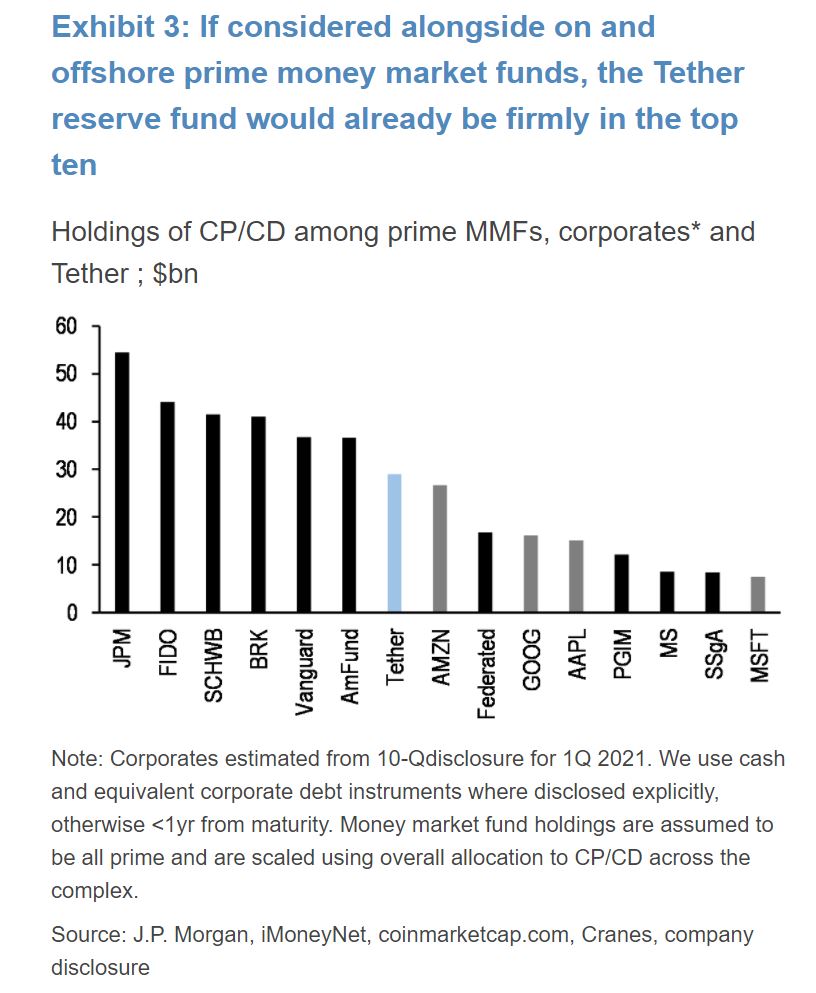

| WHO authorizes Sinovac for wider global use. Xi urges a friendly China image. And a cyberattack on the world's largest meat producer is causing havoc. Here's what you need to know to start your day. China's Sinovac received long-awaited World Health Organization authorization of its Covid-19 vaccine, paving the way for a wider rollout of the controversial shot in countries scrambling for a supply of immunizations. It's the second emergency use permission given to a Chinese Covid vaccine, after state-owned Sinopharm secured WHO's nod in early May. More than 1.94 billion vaccine doses have been administered across 176 countries, according to Bloomberg's vaccine tracker. Meanwhile, even as China rolls out a world-leading 20 million Covid-19 vaccine doses a day, it's in no hurry to reopen to the world. Asian stocks look set for a steady open after U.S. equities inched lower as the tussle between economic optimism and inflation concern continues to play out in markets. Futures edged up in Japan and Australia but dipped in Hong Kong. The S&P 500 and Nasdaq 100 closed with small losses. Crude oil rose to its highest in more than two years, with the OPEC+ alliance forecasting a tightening global crude market and a nuclear deal with Iran still up in the air. Treasury yields edged up. The dollar was steady in early Asian trading. President Xi Jinping urged Chinese officials to create a "trustworthy, lovable and respectable" image for the country, in a sign that Beijing may be looking to smooth its hard-edged diplomatic approach. Xi told senior Communist Party leaders Monday that the country must "make friends extensively, unite the majority and continuously expand its circle of friends with those who understand and are friendly to China," according to the official Xinhua News Agency. China's has been accused of "Wolf Warrior" diplomacy because of its track record of hitting other countries with trade measures, travel bans and diplomatic protests, but Beijing thinks that label is unfair. Meanwhile, China is using never-ending Covid rules to crack down on the majority of protests in Hong Kong. A cyberattack on JBS SA, the largest meat producer globally, forced the shutdown of all its U.S. beef plants, wiping out output from facilities that supply almost a quarter of American supplies. All of the company's fed-beef and regional beef plants were forced to shutter, and all other JBS meatpacking facilities in the country experienced some level of disruption to operations, according to an official with the United Food and Commercial Workers International Union. Slaughter operations across Australia were also down, according to a trade group, and one of Canada's largest beef plants was idled. Construction startup Katerra is shutting down — a dramatic collapse for a company that raised about $2 billion from investors including SoftBank. Katerra, founded in 2015, had promised to shake up the construction industry with its efficient factories, prefab parts and modular construction units. The company has said it was working in countries including the U.S., India and Saudi Arabia. With major cash infusions from SoftBank and others, Katerra grew quickly, in part by acquiring smaller construction companies, but integrating those businesses proved difficult. In February of last year, Katerra's marketing materials touted 8,000 employees across the globe What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayCrypto proponents like to point out that the market has been surprisingly resilient despite periodic bouts of massive volatility. But there's more and more focus on a potential Achilles heel for the $2 trillion market: Tether. At issue is the role being played by the stablecoin in the wider world of crypto, with Tether often being described as a "key piece of plumbing" that allows crypto traders to more easily move money between exchanges and cryptocurrencies including Bitcoin, without having to worry about big swings in price. Each Tether token is pegged to a value of $1, based on assets that Tether is supposed to hold in reserves. In that, it's not too different from a money market fund — a theme that's been picked up by former Commodity Futures Trading Commission Chairman Timothy Massad in a Bloomberg Opinion column, as well as JPMorgan analyst Josh Younger, in a recent research note. The concern is that with little transparency over what's backing the tokens, there's a risk that Tether breaks the proverbial buck in a similar way to what happened to the Reserve Primary back in 2008, when its net asset value suddenly dipped below $1 thanks to a mix of huge outflows and the bankruptcy of Lehman Brothers, which rendered its commercial paper suddenly worthless. That sent a shockwave through the wider market as it grappled with the idea of potential losses on money market funds which had always been assumed to be safe and money-like.  Bloomberg Bloomberg Tether says its tokens are 100% backed by its reserves, but there remains a lot of skepticism over what those reserves are exactly. (Tether, as part of a settlement with the New York District Attorney, recently disclosed figures showing only 7% of its assets were in "ultra-safe" instruments such as cash and U.S. Treasuries. The vast majority — 65% — is in unspecified commercial paper). By Younger's calculations, Tether is so big that it could now easily sit alongside the world's largest prime money market funds. And if "Tetherus Prime" were to break the buck, he says, it "would likely generate a severe liquidity shock to Bitcoin markets." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment