| China sends dozens of aircraft close to Taiwan. Toshiba probe points to powerful figures. MacKenzie Scott gives away another $2.7 billion — and blasts the wealth gap. What you need to know to start your day. China's air force sent 28 aircraft close to Taiwan, the largest sortie this year, further ratcheting up military pressure on the government in Taipei as it seeks to strengthen ties with the U.S. The 28 People's Liberation Army aircraft, including 14 J-16 and six J-11 fighters, were detected in Taiwan's southwestern air defense identification zone Tuesday, Taiwan's defense ministry said in a statement. Taipei's military sent patrol aircraft, issued radio warnings and deployed air defense missile systems to monitor the activity. Washington and Beijing have been issuing warnings to each other regarding Taiwan since President Joe Biden took office in January, adding to tensions that increased steadily during the Trump administration. Asian stocks looked set to slip after their U.S. peers retreated from all-time highs amid mixed economic data and a two-day Federal Reserve meeting. Crude oil traded at the highest level since 2018. Futures pointed lower in Japan, Australia and Hong Kong. The 10-year Treasury yield lingered near 1.5% for most of the U.S. day after Commerce Department figures showed retail sales declined in May. Producer prices further stoked price pressures, rising more than expected in May. The dollar climbed versus major peers. Meanwhile in the crypto world, 80% of fund managers surveyed said they thought Bitcoin was still a bubble, even after May's crash. Some of Japan's most powerful bureaucrats, even the current prime minister, are the actors portrayed in a detailed description of how Toshiba allegedly tapped government allies to try to influence voting at its annual general meeting last year. Management at the more than 145-year-old manufacturer worked hand in hand with public officials in an attempt to sway the outcome, according to a 139-page report by three independent investigators elected by Toshiba stock holders to examine the issue. It's a rare public account of how Japan's bureaucrats allegedly coordinated with a private company to exert control over foreign shareholders. For 10 of the world's biggest banks, past transgressions in the European Union look set to cost them millions of dollars in fees. Firms including JPMorgan, Citigroup, Bank of America and Barclays have been frozen out of syndicating bond sales for the European Commission's roughly 800 billion-euro ($970 billion) NextGenerationEU program, which is expected to issue 80 billion euros of debt this year. The banks have been temporarily barred from the lucrative trades as the bloc assesses whether they've done enough to fix previous breaches of antitrust rules.

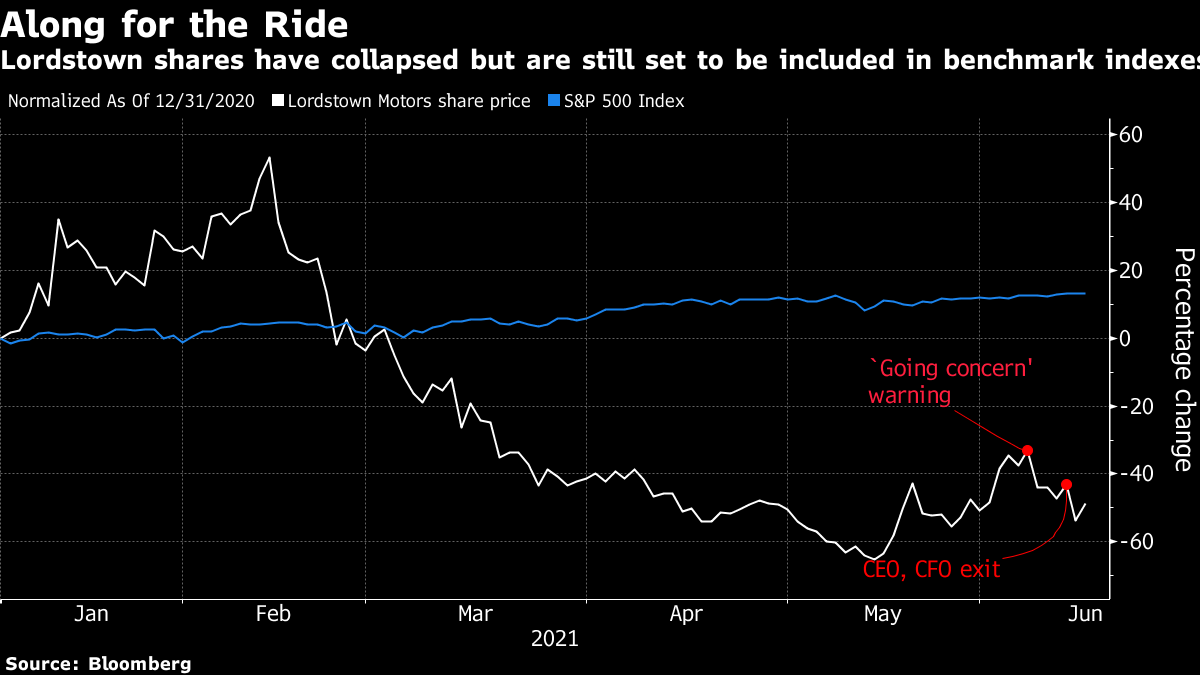

The move has the potential to reshape debt league tables for the region, hand hefty fees to smaller competitors and even weigh on bankers' bonuses. Asia's emerging economies have accumulated their highest level of foreign-exchange reserves since 2014, offering a powerful buffer against market volatility if the U.S. Federal Reserve changes course. Central bank holdings of foreign currencies in the region's fast-growing emerging economies hit $5.82 trillion as of May, their highest since August 2014. When China's cash pile is stripped out, emerging Asian central banks' reserves stood at an all-time high of $2.6 trillion. In 2013 a signal that the Fed would begin winding down asset purchases sent shockwaves through Asia, an episode that came to be known as the "Taper Tantrum." Foreign investors fled and bond yields shot up, forcing central banks to burn through their defenses to protect their currencies. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayI wrote last week, in our subscriber-only Odd Lots newsletter, about Lordstown Motors, an electric truck maker that went public through a SPAC last year and is fast on its way to meme stock status. In fact, there's so much going on with this company that it's sometimes hard to keep track. On Monday, Lordstown shares dropped by as much as 22% after two of its top executives stepped down and its board found evidence of inaccurate statements. Then on Tuesday the stock jumped 15% after Lordstown announced it has enough money to make trucks until May of next year.  One thing that is certain is that Lordstown is set to join the Russell indexes, triggering a flood of fresh money as passive investors align themselves with the stock. That hasn't gone unnoticed by the retail trading crowd on WallStreetBets, some of whom are pointing to index inclusion as the next catalyst for the stock to rocket. We're now used to meme investors trying to push up prices through short or gamma squeezes, engineering a situation where certain big buyers like hedge funds or dealer-banks have to buy the stock at any price. Companies like Lordstown raise the question of whether index inclusion could also be weaponized to create a new type of bagholders: passive investors. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment