| Hello. Today we look at how global central bankers are becoming increasingly worried about financial risks, President Joe Biden's efforts to revive America's rustbelt, and China's rising number of millionaires. Central Bank Worries Bitcoin's wild swings are generally assumed to come with the territory of crypto investing, with little significance for the real economy.

But after more than a year of unprecedented monetary and fiscal stimulus gushing into the global economy and inflating asset prices from stocks to real estate to commodities and crypto, there's a concern that the search for yield that's inflating assets such as Bitcoin may be a "warning sign." From Washington to Frankfurt to Beijing, what started as a murmur of concern has morphed into a chorus as officials worry the risk-taking binge across asset markets that their policies have triggered might presage a destabilizing rout that could derail the global recovery, writes Craig Stirling. While officials such as Federal Reserve chief Jerome Powell argue any threats remain contained, some are already taking action to cool things off. Iceland last week delivered the first policy tightening in Western Europe to contain inflation and a rampant housing market while the Bank of Canada is also dialing down some of its support. European policy makers are also recognizing mounting threats, but remain wedded to stimulus for now. In China, where the recovery cycle is more mature, soaring home prices are reviving talk of a property tax while surging commodity prices have spurred action to boost supply and crack down on speculation. Authorities there are hoping they can reduce risks and deflate bubbles with targeted measures while keeping broader borrowing costs steady. The big central bank switch from fretting about plunging economies to starting to sweat over soaring asset prices is positive in one way: It shows their emergency measures have at least revived markets. For those market gains to hold up, the real economies underlying them need to power ahead without spiking inflation and prove resilient enough to withstand the withdrawal of fiscal and monetary support. If the global economy can do that, then central bankers can continue to dismiss Bitcoin's gyrations as a sideshow rather than harbinger of exuberance. — Malcolm Scott The Economic Scene America Makes exterior Photographer: Photograph by Ross Mantle for Bloomberg Markets For decades, Youngstown, Ohio, has been held up by everyone from Bruce Springsteen to Donald Trump as an emblem of industrial decline and what's gone wrong in America. A succession of presidents promised — and failed — to turn it around.

Now comes Joe Biden with his plans for $4 trillion in new Big Government spending. His biggest long-term economic bet is that an industrial pivot from an economy driven by internal combustion engines and fossil fuels to one powered by electric vehicles, wind turbines, and solar cells will generate enough jobs to make up for those lost when older industries faded away.

In Youngstown, they've been making that bet for a while now, as Shawn Donnan writes in this story for Bloomberg Markets. Today's Must Reads - German flux. The German economy is enduring a moment of flux just as the era of Chancellor Angela Merkel draws to a close.

- Vaccine confidence. The plan to unlock the U.K. economy appears on track as Covid vaccines prove effective against a worrying variant.

- Nigeria recovers. Economic growth quickened in the first quarter as oil output started to recover and manufacturing production increased.

- China warning. One pillar of the commodities rally — Chinese demand — may be teetering as Beijing seeks to temper prices. Beijing also intensified its campaign to cool a raw-materials boom.

- Brazilian bets. Inflation expectations are going the wrong way as investors fear the central bank won't be bold enough to rein prices in.

- Chip supply. The world's supply of semiconductors may see further disruption unless Taiwan can get more Covid-19 vaccines.

- Travel plans. Three top economists — OECD's Boone, LSE's Shafik, and Nobel Laureate Spence — tell Bloomberg Markets what they've been doing and where they want to go.

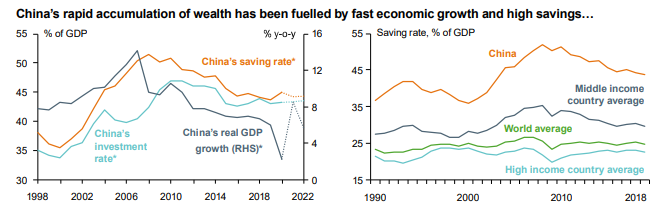

Need-to-Know Research Source: HSBC China will more than double the number of millionaires in the next five years and boost the size of the middle class by almost half, spurring consumption in the economy, according to HSBC. The number of high-net-worth individuals — those with the equivalent of at least 10 million yuan ($1.55 million) in investable assets — will likely increase to 5 million by 2025 from more than 2 million currently, the bank estimated. The middle class, which numbers about 340 million now based on the narrowest definition, will grow by more than 45% to over 500 million in the period, it said. On #EconTwitterTaking a closer look at Europe's national recovery and resilience plans.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment