| Hello and happy Friday. Today's Newsletter is all about inflation. The Inflation LineOne is leading the world's grandest monetary experiment to revive prices; the other heads the central bank that pioneered inflation targeting. Both spoke exclusively to Bloomberg News and each has the same message for jittery markets worried about inflation: relax already. First up, Bank of Japan Governor Haruhiko Kuroda told us that inflation concerns were most relevant in the U.S. and cited Federal Reserve Chair Jerome Powell's view that price pressures will prove transitory and stimulus should stay in place for longer. "That policy stance is based on the recognition that it will take time to overcome low inflation once it is entrenched," Kuroda said. "That is the lesson learned from Japan's experience of prolonged deflation."

Haruhiko Kuroda Photographer: Stefan Wermuth/Bloomberg Meantime, Reserve Bank of New Zealand Governor Adrian Orr said inflation is a very different beast today than it was in the 1970s, giving central banks the confidence to look through a short-term spike in prices. "The fear of the 70s, the 80s, stagflation, it is such a different world," Orr said in an interview with Bloomberg Television on Friday. Central banks today are "prepared to wait longer because they're more confident that we have stable inflation expectations, we have a much more flexible set of pricing, we have less of that generalized inflation," he said.

Adrian Orr Photographer: Birgit Krippner/Bloomberg The RBNZ this week became one of the first to project it will start raising interest rates next year, following Canada and a few others in tip-toeing away from emergency settings. As for Kuroda, it's looking unlikely the BOJ's 2% inflation target will be met under his tenure, which is due to end in April 2023, meaning its rock bottom rates aren't going anywhere. Europe's policy makers appear set to follow the Kuroda ethos of ongoing stimulus. Economists and investors expect the European Central Bank will extend the elevated pace of its emergency bond purchases at its next meeting, even as the economy rebounds.

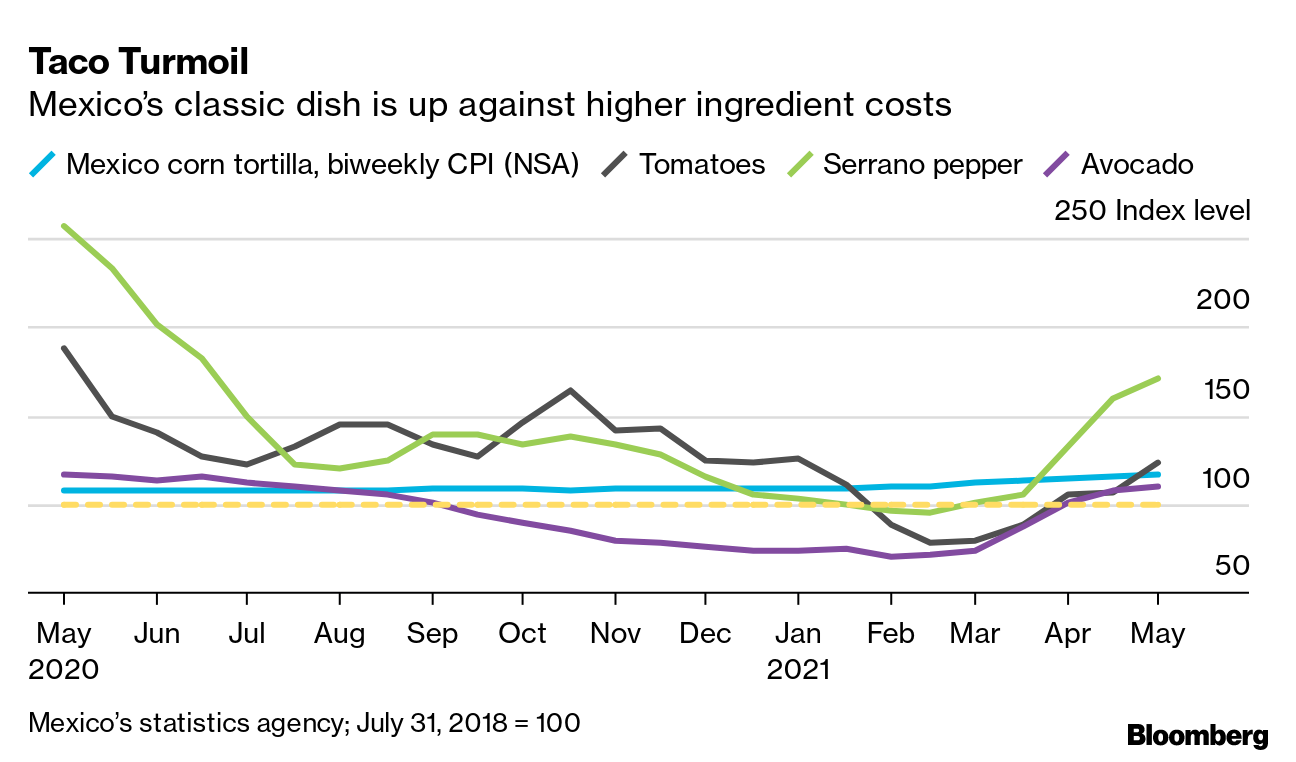

Central banks across much of the globe spent years predicting inflation would pick up, only to be disappointed. We'll have to wait and see how their chorus of calls that a pick up in prices will be transitory turns out. — Malcolm Scott The Economic Scene Surging prices of tortillas and other ingredients of Mexico's widely-consumed tacos are squeezing consumers and becoming a headache for policy makers. President Andres Manuel Lopez Obrador — with an eye on next month's midterm elections — has called for prices to be kept in check. Meanwhile, the country's central bank points to a historic drought as the major cause of the sticker shock, while debating ways to alleviate it. "The spike we've seen in fresh food as a result of climate change should remind us that central banks also have a role to play in sustainable financing and reducing the risks of climate change," Deputy Central Bank Governor Irene Espinosa said in an interview last week. "This can turn into a snowball that generates bigger inflationary pressures." Today's Must Reads - Chrystia Freeland Q&A. Click here to read Stephanie Flanders' interview with Canada's Finance Minister for Bloomberg Markets.

- U.S. small business lifeline. The U.S. government's sprawling Paycheck Protection Program officially wraps up its 13-month existence on Monday. We review the debate over how successful it's been, here.

- Teton reunion. The Fed's prestigious annual Jackson Hole policy symposium will be held in person this year, albeit in a modified form.

- Tax plan salesman. As President Joe Biden prepares to publish his first budget, meet the congressman tasked with trying to pass the administration's tax increases through a narrow Democratic margin.

- China rivalry. The U.S. Senate is moving slowly toward passage of an expansive bill to bolster economic competitiveness and confront China's rise, debating some last amendments before a final vote.

- Expensive shipping. The cost to move goods in a container to Europe from Asia shot above $10,000 for the first time, underscoring the pain of exporters and importers struggling with stretched supply chains.

- India disconnect. Financial professionals across India are grappling with an increasingly surreal disconnect between the epidemic's devastation and a record-breaking boom in local markets.

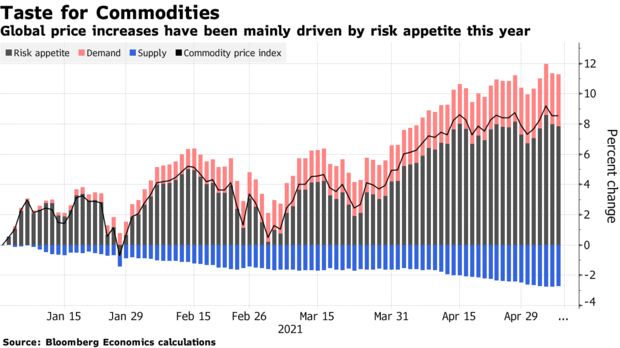

Need-to-Know Research A new Bloomberg Economics' model shows movements in commodity prices this year have been mainly driven by risk appetite, not fundamental demand or shortages of supply. In the great inflation debate, the rally in everything from copper to soybeans to lumber has been a point in favor of the reflation hawks.

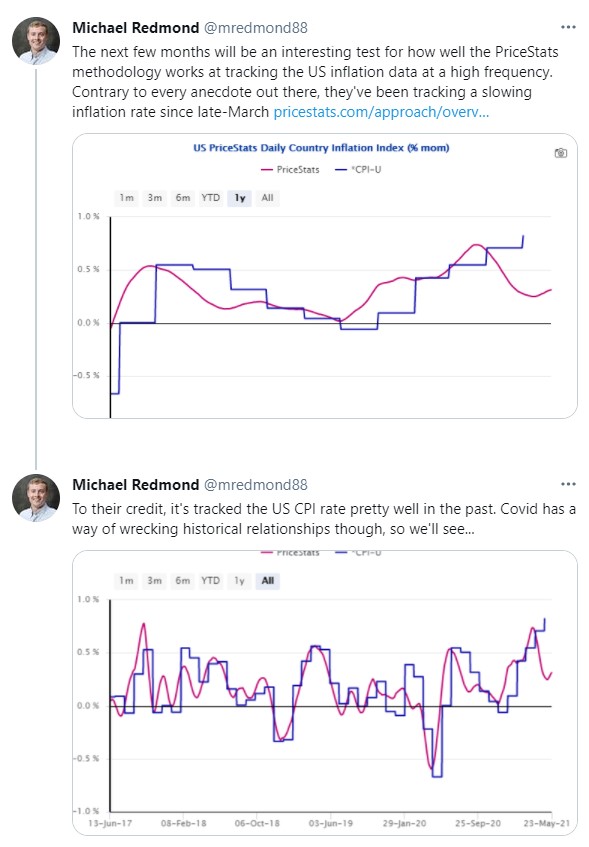

As the recent fall from the peak suggests, a rise in commodity prices driven primarily by speculation is also prone to a sudden reversal, so the hawks' argument is not as strong as it first appears, though the debate is far from over. Read the full research on the Bloomberg Terminal On #EconTwitterA test for early inflation indicators:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment