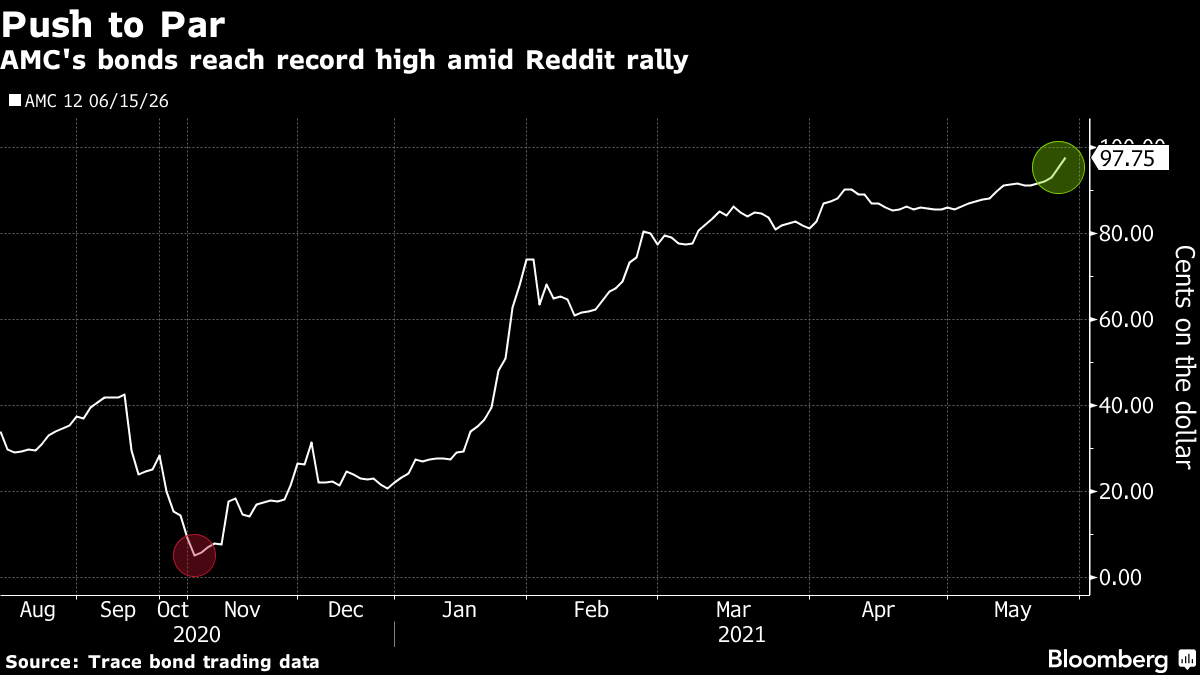

| Biden's budget, too late to stop Bitcoin, and vaccine distribution's still uneven. Big spenderPresident Joe Biden's budget, which is set to be released today, will increase federal spending to $6 trillion in the coming fiscal year, rising to $8.2 trillion by 2031, according to documents cited by the New York Times. While the document is mostly aspirational, it will give a clear picture of the president's ambitions to boost the size and scope of the federal government. The budget sees unemployment holding below 4% for most of the next decade, and inflation remaining stable. No endCathie Wood said it would be "impossible" to shut Bitcoin down and that regulators will eventually turn a little more friendly toward the digital asset. Wood, speaking at the Consensus 2021 conference, said that environmental concerns likely led to a pause in institutional buying. Speaking to Congress yesterday, Jamie Dimon of JPMorgan Chase & Co. and David Solomon of Goldman Sachs Group Inc. said they personally remained dubious about crypto-investing, and that Washington should be working on setting rules for digital tokens. Bitcoin is not having a great Friday, trading down more than 7% to $35,500. VaccinesThe death toll from Covid-19 has passed 3.5 million, while the uneven distribution of vaccines globally continues to mean some economies are opening while others remain in lockdown. Taiwan's death toll has surged, and Japan is struggling to ensure the Olympic Games can proceed as planned. In India there are rising concerns about a huge number of Covid orphans. Vaccine drives in Europe continue, while American states are getting more creative in how they incentivize people to take their shots. Markets mixedCyclical shares are among the best performers ahead of the holiday weekend, helped higher by Biden's federal spending plans. Overnight the MSCI Asia Pacific Index added 0.8% while Japan's Topix index closed 1.9% higher. In Europe the Stoxx 600 Index was up 0.4% by 5:50 a.m. Eastern Time, pushing the gauge to a fresh record high. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 1.61%, oil was over $67 a barrel and gold was slightly lower. Coming up... The U.S. April PCE report and advance goods trade balance are at 8:30 a.m. May Chicago PMI is at 9:45 a.m., with University of Michigan sentiment for the month at 10:00 a.m. The Baker Hughes rig count is at 1:00 p.m. President Biden will unveil his budget today. G-7 finance ministers and central bankers will have a virtual meeting. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Katie's interested in this morningMeme stocks are back from the dead (again), with debt-laden cinema chain AMC Entertainment Holdings Inc. leading the charge. AMC has more than doubled so far this week, bringing this month's gain to an astonishing 164%. There doesn't seem to be a good reason why, other than the collective enthusiasm of Twitter traders -- #AMCSTRONG and #AMC100k have been trending all week. While that may seem like an equity market oddity, the Reddit rally is making waves in debt land as well. While AMC shares have only returned to 2017's heights, the company's junk bonds hit all-time highs this week. AMC debt due in 2026 rose to 97.17 cents on the dollar Thursday -- almost par! -- after trading as low as 5 cents in November, according to Trace trading data. The notes carry a coupon of 12%.  But what's amazing here is that this meme stock revival might actually help AMC clean up its capital structure. Chief Executive Officer Adam Aron said in March that AMC "will carefully examine the raising of additional capital in whatever form we think is most attractive" and is focused on de-leveraging its more than $10 billion debt load. Investors have suggested that the company should strike while the iron's hot and sell more shares to either pay down or refinance that debt. Bloomberg Intelligence media analysts Geetha Ranganathan and Amine Bensaid certainly agree. The company recently raised $428 million by selling shares, which should give the movie-theater chain a "cushion through year-end to weather a $120 million monthly cash burn," the pair wrote in a report this week. However, AMC should capitalize on this moment and go even further, they wrote. "Business fundamentals remain weak and uncertain at best as movie going is yet to kick off in a big way," Ranganathan and Bensaid wrote. Follow Bloomberg's Katie Greifeld on Twitter at @kgreifeld

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment