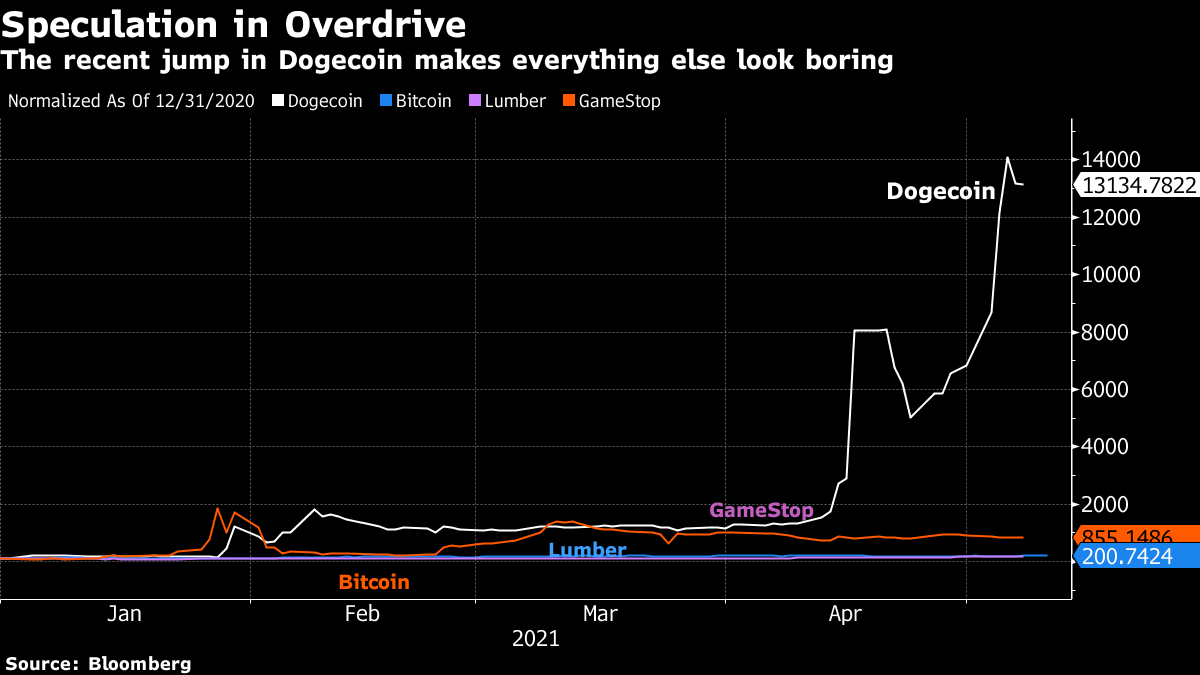

| Unused Covid shots are piling up in Hong Kong as millions refuse to get vaccinated. Singapore's stellar stock run hits a speed bump. Elon Musk's TV appearance erases Dogecoin gains. Here's what you need to know to start your day. New Delhi extended its lockdown for another week and adopted stricter restrictions to control a new wave of Covid-19 infections. India on Sunday found 403,736 new virus cases, reporting more than 4,000 Covid-19 deaths for a second day. Australian restrictions on gatherings are also being extended for another week in Sydney and surrounding areas after health officials said they were unable to identify how a man in the community caught Covid-19. In the U.S., new cases dropped to the lowest level since the end of September and deaths in the U.K. have slowed with more than a third of the adult population vaccinated. Meanwhile, the next global disaster is on its way and we aren't ready, writes Niall Ferguson. And in Hong Kong, where shots are easy to come by, millions of people are refusing to get vaccinated, striking a blow to the city. Dogecoin, the fifth most valuable cryptocurrency, retreated from an all-time high after billionaire Elon Musk jokingly called it "a hustle" on "Saturday Night Live," The altcoin had surpassed 73 cents on Saturday before dropping to 46.01 cents as of 8:08 a.m. in New York Sunday, a 35% decline in 24 hours, according to pricing from CoinGecko. Musk has been among the biggest boosters of Dogecoin, which has surged more than 16,000% in the past year. However some crypto purists fear the token is a distraction from the grand project of deploying blockchain technology to revolutionize modern finance. Elsewhere in crypto: Here's how to decide whether to invest in Bitcoin or Ether. Stocks are set to start the week steady in Asia after U.S. equities climbed to a record Friday as a weak jobs report eased fears about higher inflation and a cutback in stimulus. Energy markets will be in focus after the shutdown of a major pipeline following a cyberattack. Futures were modestly higher in Japan, while they earlier dipped in Australia and rose in Hong Kong. All major groups in the S&P 500 rose Friday, and technology stocks were also higher. Meanwhile, now is no time to doubt U.S. equities, JPMorgan strategists say — as long as Fed Chair Jerome Powell and President Joe Biden are in charge of the recovery. Investors are still piling in to the red-hot bull run in metals, staking billions of dollars that it won't run out of steam any time soon. Copper's already doubled in the past year to more than $10,000 a ton; Bank of America says $20,000 is possible and Goldman Sachs is also advising investors to load up in anticipation of a long-term rally fueled by the pandemic recovery and spending on renewable-energy and electric-vehicle infrastructure. Record amounts are flooding into some metal-focused exchange-traded products. Mining companies like Rio Tinto and BHP are surging as they generate supercharged profits, while investments in mining funds are also starting to swell. About 1,600 athletes, organizers and media got an early look Sunday at what the Tokyo Olympics will be like when they kick off on July 23, in a test event at the city's National Stadium. There was a full day of 100-meter heats, hammer throws and pole vaulting to make sure the Omega clocks, jumbo displays and robots on the field were working as they should. A key focus, however, was how such a large-scale event can be pulled safely off in the middle of a pandemic. Here's a look at how Tokyo plans to pull off one of the most unusual Olympics in the 125-year history of the modern games. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todaySo Dogecoin plunged after a certain late night comedy sketch, which begs the question of where money looking for a good time will go to next. So far this year we've had waves of successive meme stocks and assets taking the spotlight, with the ball of speculative money rolling from things like Tesla to GameStop, and from Bitcoin into the "coin that is much wow."  The combination of Dogecoin's drop and disruptions from the cyberattack on the Colonial Pipeline has me thinking about an odd combination this morning. What if the speculative swarm were to set their sights on commodities? It's one thing to sit back and watch a stock or cryptocurrency go to the moon, it's going to be a completely different experience — especially for regulators — if flash mob investing were to make its way into real world stuff like soybeans or corn. There's already a touch of speculative mania in lumber and new players are stepping in to provide more exposure for investors. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment