| Welcome to the Weekly Fix, the newsletter that's trying to clean up its capital structure. I'm cross-asset reporter Katie Greifeld.

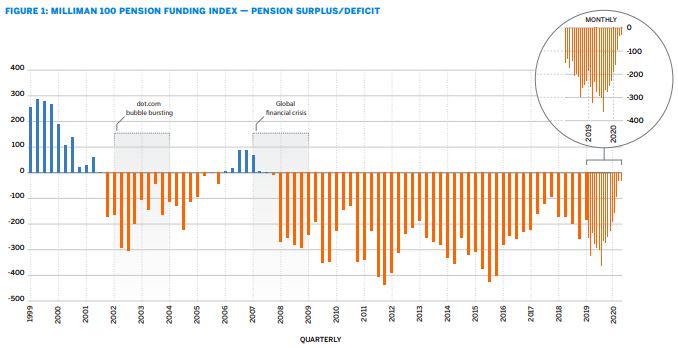

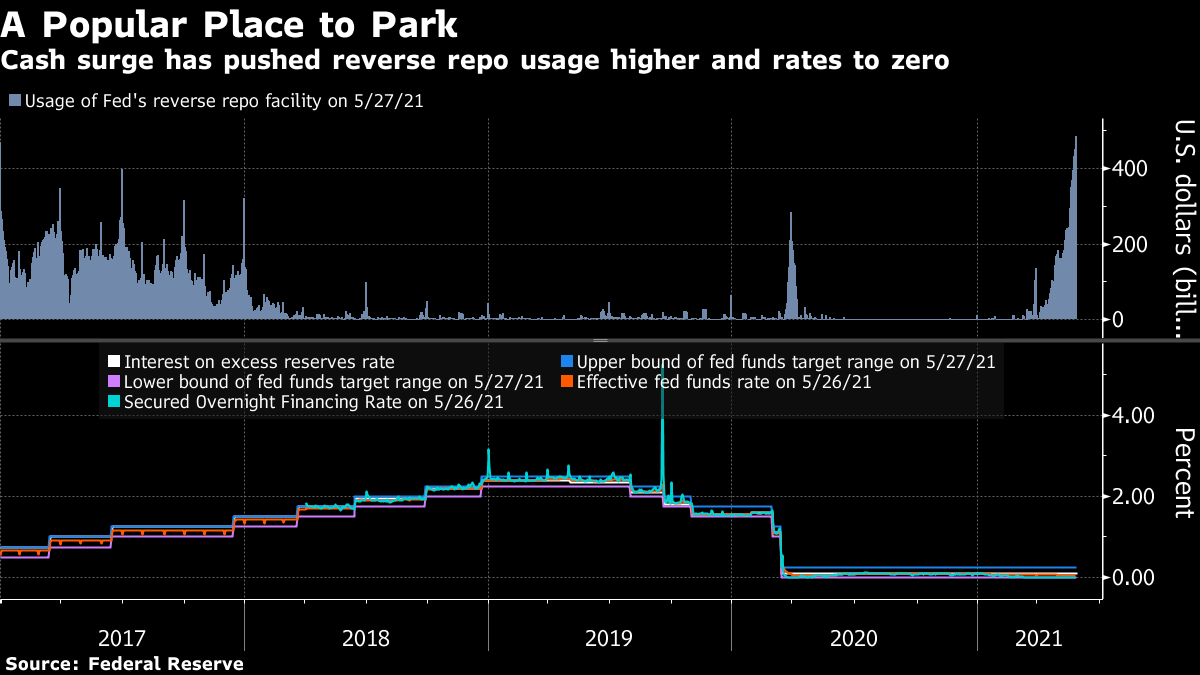

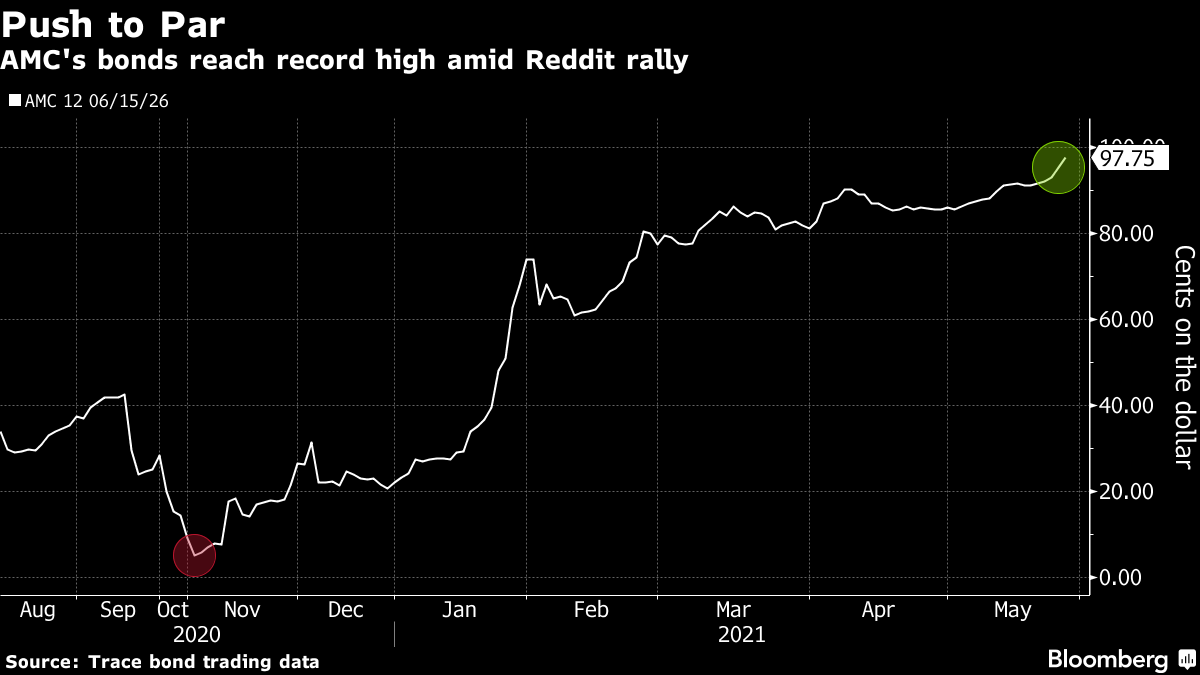

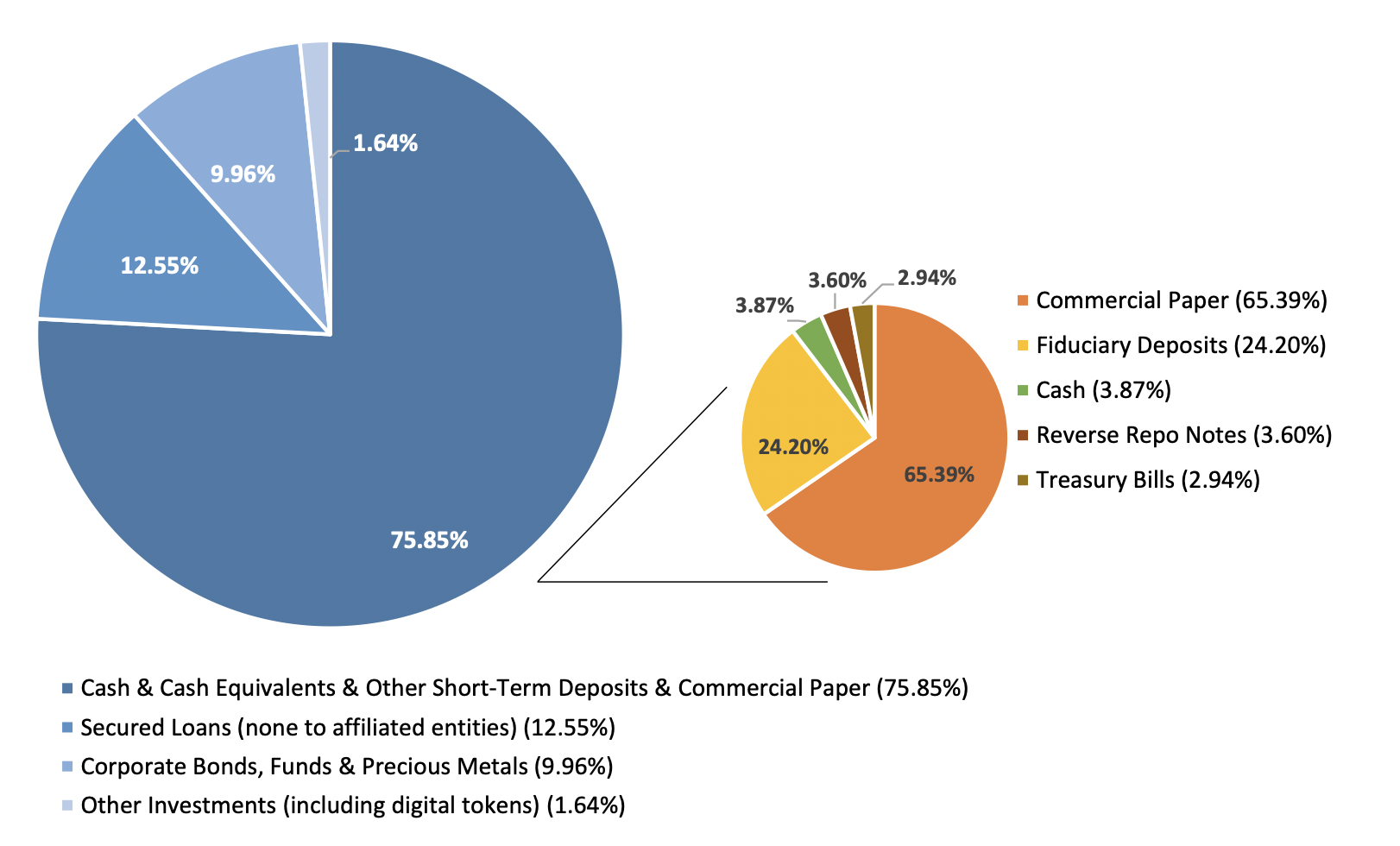

Just Resting My Eyes

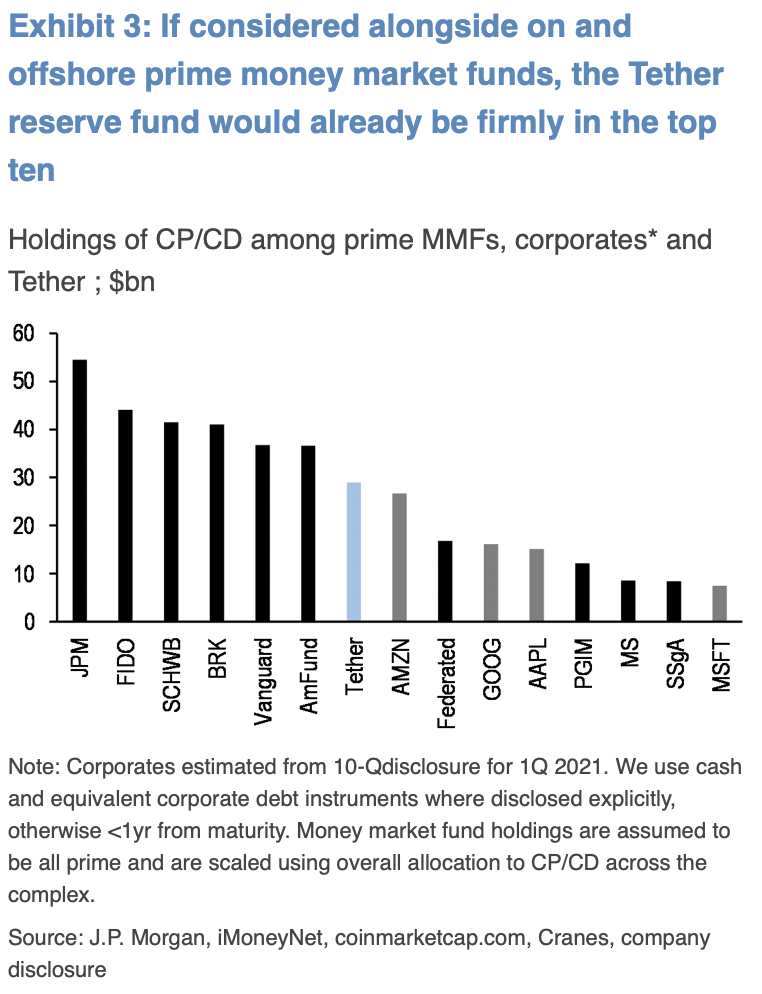

Markets are exciting right now. Meme stocks are reigniting, cryptocurrencies are an on-again, off-again dumpster fire and the lumber shortage is crunching chicken supply. And then there's the Treasury market. Treasuries have been exceptionally boring. The 10-year Treasury yield -- the benchmark rate -- is virtually unchanged since early March, with 1.6% acting like a magnet. It's the same story if you look at the 2-, 10-year yield curve -- it's been hanging out around 145 basis points for almost three months. It's remarkable that Treasuries are as dull as they are, because there's actually a lot going on. Supply chains are choking, driving up the price of everything physical. Despite surging demand, there's anecdata out there to suggest that firms are reluctant to ramp up capacity -- which could keep prices higher for longer. Factor in a Federal Reserve intent to let the economy run hot for some period of time, and oh, they might talk about talking about tapering asset purchases sometime soon.  You'd think bond bears would be thriving, but evidently they all withered away. I asked George Pearkes from Bespoke Investment Group what gives, and his answer makes a lot of sense -- we saw the big move in the first quarter. With Treasuries, a market with built-in buyers, dramatic moves like that can be sustained for only so long. In such a big, liquid market "you can only see price action go one way for so long," said Pearkes, the firm's global macro strategist. "Everyone who had bonds to liquidate did so. We ran out of marginal sellers, it's that simple." Marginal sellers might include, for example, foreign central banks that have been eager to accumulate Treasuries, he said. Additionally, currency-hedged 10-year yields for Europe- and Japan-based investors are near the highest levels since 2016 and 2015, respectively.  Bloomberg Bloomberg There's homegrown demand to consider as well. As chronicled by Bloomberg Opinion columnist Brian Chappatta this week, the funded status of the 100 largest U.S. corporate pensions reached 98.3% at the end of April -- meaning that the $3.5 trillion industry is almost fully-funded for the first time since the 2008 financial crisis. Meaning that now would be the time for those pension funds to consider "taking profits and rotating into stable, low-risk alternatives" -- such as Treasuries. Between a Rock and the Fed's Overnight Reverse Repo FacilityIf you're looking for some Treasury-flavored drama, look no further than the front-end. As detailed by Alex Harris of Bloomberg News, fifty participants parked more than $485 billion with the Federal Reserve via its overnight reverse repurchase facility on Thursday. The offering rate on the facility is a whopping 0%, and usage has never been higher. Regular readers of this newsletter know why. The Treasury Department has been whittling down its monstrous general account -- which swelled to $1.8 trillion during the pandemic -- to $500 billion by the end of June, at the same time as the Fed is conducting an enormous bond-buying program, spitting reserves into the system. That all adds up to a glut of dollars with nowhere to go. Some of that has been funneled into commercial bank deposits, while the rest has been cycled into money-market funds.  But those money-market funds are in a bind, because there's just not a lot of supply. As part of its plan to reduce its general account, the Treasury has been issuing fewer bills as the old ones mature. That's put tremendous pressure on front-end rates, some of which have flipped negative, making it increasingly difficult to find places to safely stash cash for a very short time. With that in mind, 0% doesn't look so bad. "They can't buy bills that have negative rates and bills are negative since there aren't enough," said Subadra Rajappa, head of U.S. interest rates strategy at Societe Generale. "It's the only alternative at this point because they have exhausted all others — repo, bills, short coupons, et cetera." But even if overnight general collateral rates are close to zero or slightly negative -- and they are -- there are reasons to keep tapping that market, according to Bespoke's Pearkes. For example, you may want to keep up your relationships with your dealers or other counterparties, or it might simply be easier to keep doing what you're doing. But that said, turning to the Fed to park your cash makes sense, he said. "If you're investing in the repo market right now, big chunks are trading at substantial discounts to what you're going to get facing the Fed," Pearkes said. "There's a direct return incentive." Memes Are ForeverMeanwhile, so-called meme stocks are back from the dead (again), with debt-laden cinema chain AMC Entertainment Holdings Inc. leading the charge. AMC has more than doubled so far this week, bringing this month's gain to an astonishing 164%. There doesn't seem to be a good reason why, other than the collective enthusiasm of Twitter traders -- #AMCSTRONG and #AMC100k have been trending all week. While that may seem like an equity market oddity, the Reddit rally is making waves in debt land as well. While AMC shares have only returned to 2017's heights, the company's junk bonds hit all-time highs this week. AMC debt due in 2026 rose to 97.17 cents on the dollar Thursday -- almost par! -- after trading as low as 5 cents in November, according to Trace trading data. The notes carry a coupon of 12%.  But what's amazing here is that this meme stock revival might actually help AMC clean up its capital structure. Chief Executive Officer Adam Aron said in March that AMC "will carefully examine the raising of additional capital in whatever form we think is most attractive" and is focused on de-leveraging its more than $10 billion debt load. Investors have suggested that the company should strike while the iron's hot and sell more shares to either pay down or refinance that debt. Bloomberg Intelligence media analysts Geetha Ranganathan and Amine Bensaid certainly agree. The company recently raised $428 million by selling shares, which should give the movie-theater chain a "cushion through year-end to weather a $120 million monthly cash burn," the pair wrote in a report this week. However, AMC should capitalize on this moment and go even further, they wrote. "Business fundamentals remain weak and uncertain at best as movie going is yet to kick off in a big way," Ranganathan and Bensaid wrote. Crypto Crashes the Commercial Paper Market You probably haven't heard of one of the biggest money-market funds out there: Tether. It's a stablecoin, which means it trades on a public blockchain and is supposedly backed one-for-one by fiat currencies. It released a breakdown of its reserves earlier this month (and it settled a legal dispute with the New York Attorney General's Office in February and paid a fine of $18.5 million), which revealed that it holds a large portion in unspecified commercial paper.  Bloomberg Bloomberg Sure, commercial paper is pretty close to cash, but it's not the same thing. Anyway, that breakdown caught the eye of JPMorgan rates derivatives strategist Josh Younger. He wrote last week that Tether, which currently has a market cap of about $61 billion, ranks among the 10 largest prime money market funds. That's nuts, and given how rapidly Tether's market cap has exploded over the past couple months, it could eventually be a problem for the commercial paper market. My colleague Vildana Hajric and I spoke with Jonathan Macey, a professor at Yale Law School, about what it might look like if Tether were to rapidly depreciate in value. He posits that: What they're going to do is start going into the market themselves and buying the currency in order to prop it up. And in order to do that, they'll have to sell assets to get the cash necessary to effectuate these repurchases. And in order to do that, they'll have to start dumping commercial paper because that's like 50% of their assets. Then we're going to see downward pressure on the commercial paper market. Commercial paper goes down in value, real companies that issue commercial paper in order to finance their short-term operations are going to be competing with Tether and commercial paper goes down in value, financing becomes more expensive.

Bloomberg Bloomberg Others aren't as concerned. "The only way that I can conceive of this becoming a material issue for the commercial paper market is in the event that there is a forced liquidation of the portfolio and any such forced liquidation of the portfolio would need to occur in a condensed time-frame because it's commercial paper," BMO Capital Markets strategist Ian Lyngen said. "$30 billion, that's a drop in the bucket in the commercial paper market." Which is a more than fair point! But Tether has seen truly astronomical growth -- its market cap was $21 billion coming into 2021. That makes this worth watching, Younger says: This may seem an extended discussion for what essentially amounts to a modest segment of the commercial paper market. It is worth bearing in mind, however, that this market has the potential to grow significantly.

Bonus PointsBill Gates's Carefully Curated Geek Image Unravels in Two Weeks Libor Replacements Multiply in Shift That Could Fracture Markets Cathie Wood's Bad Spring Is a Blip When Future Is So Magnificent |

Post a Comment