| Welcome to The Weekly Fix, the newsletter that's been known to get fast and loose with its covenants. I'm cross-asset reporter Katie Greifeld.

Don't Even Say It

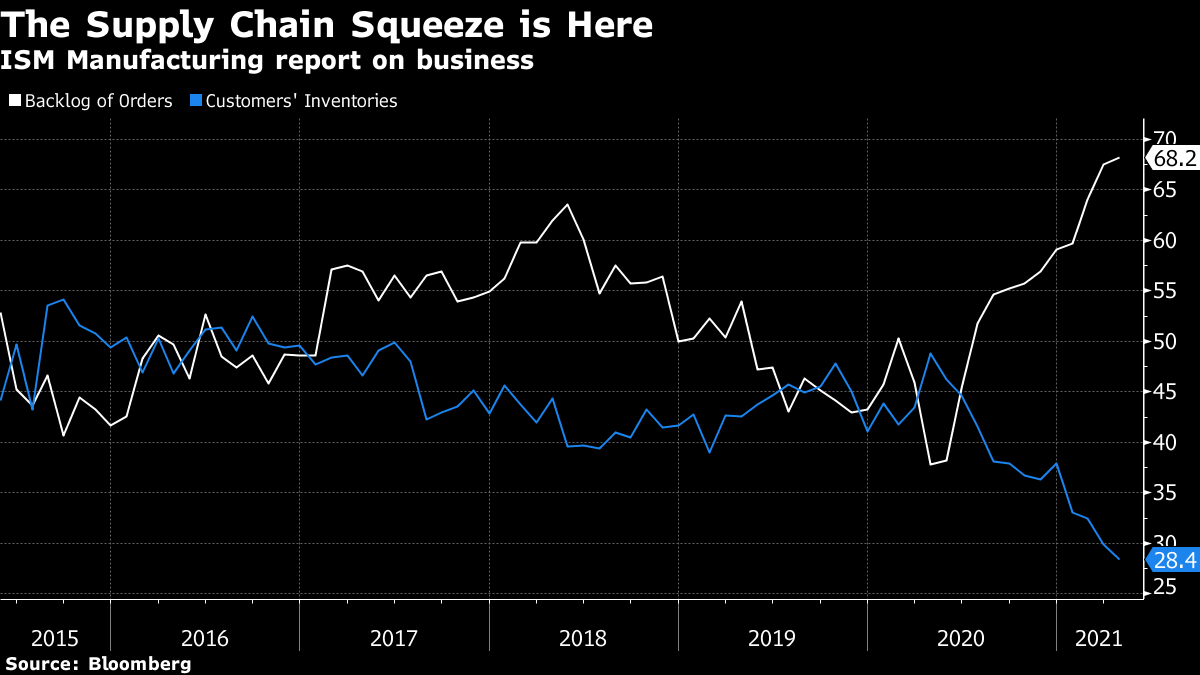

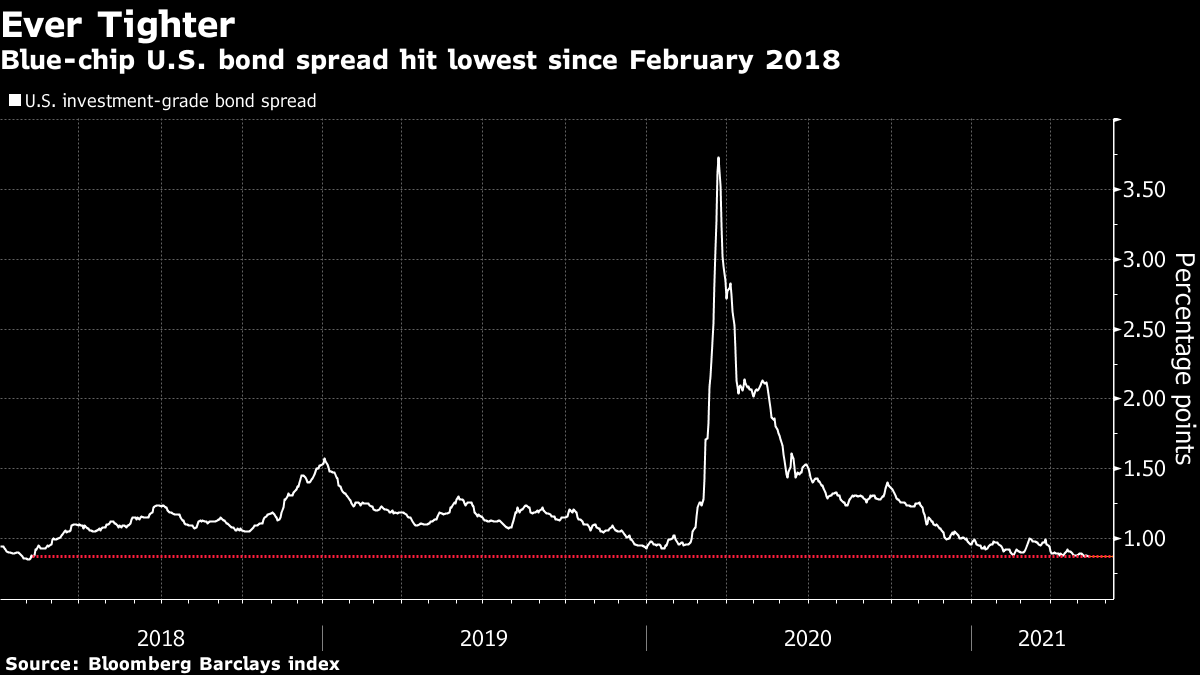

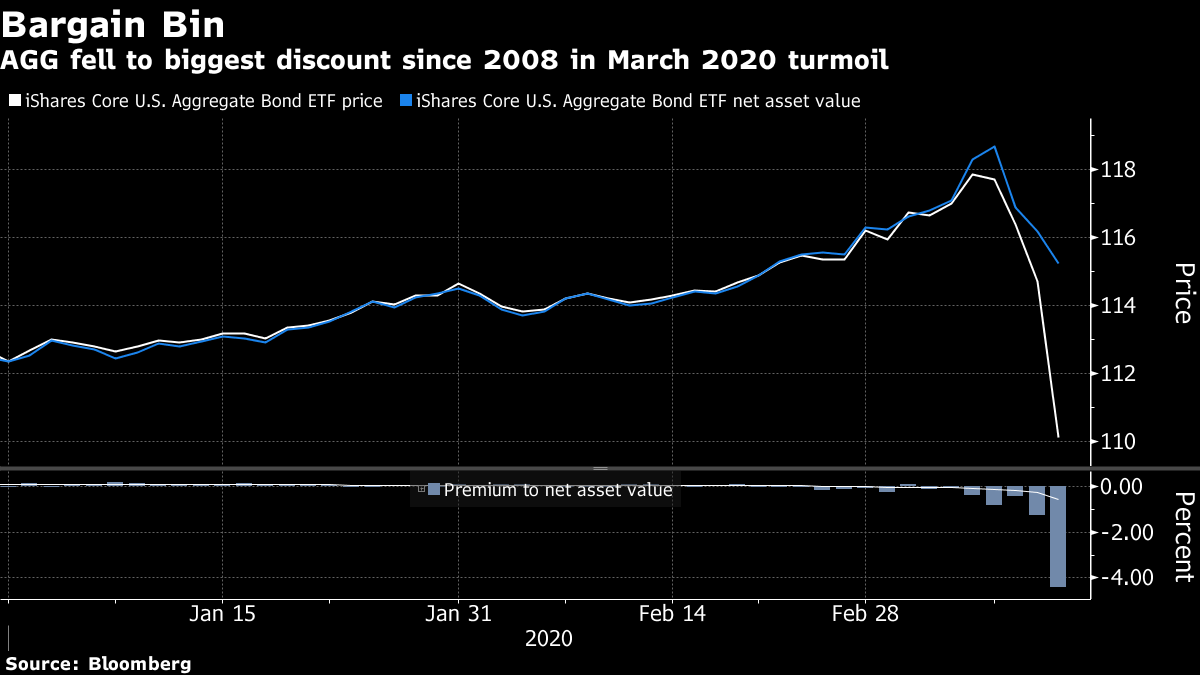

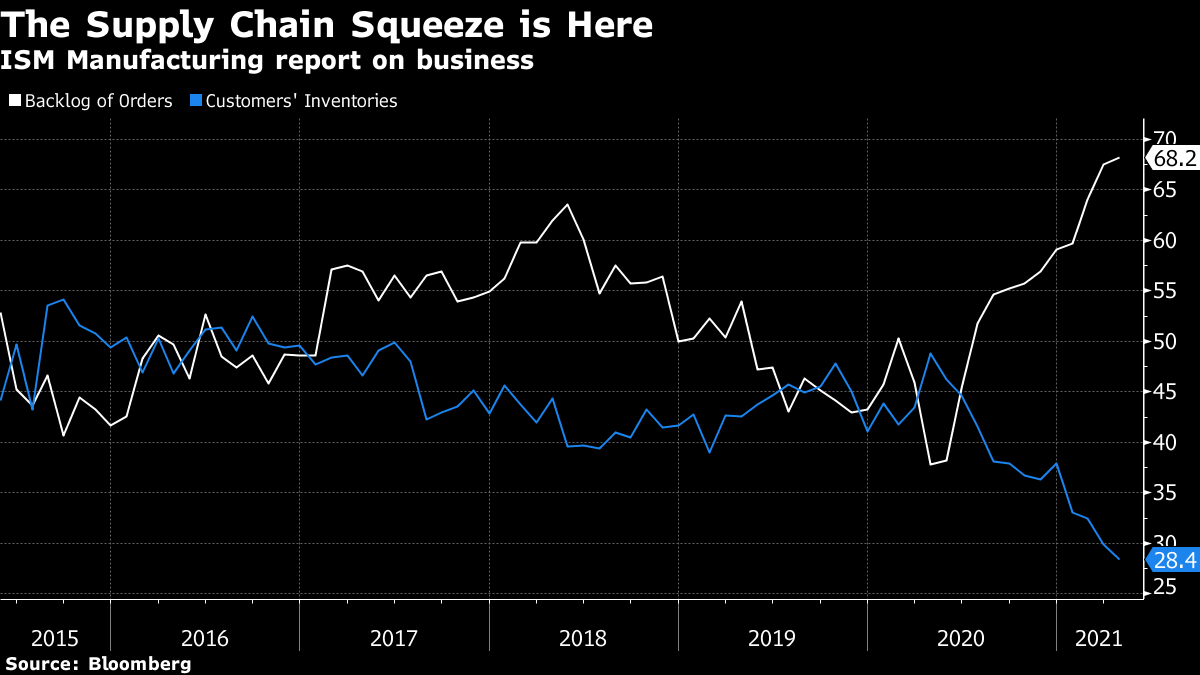

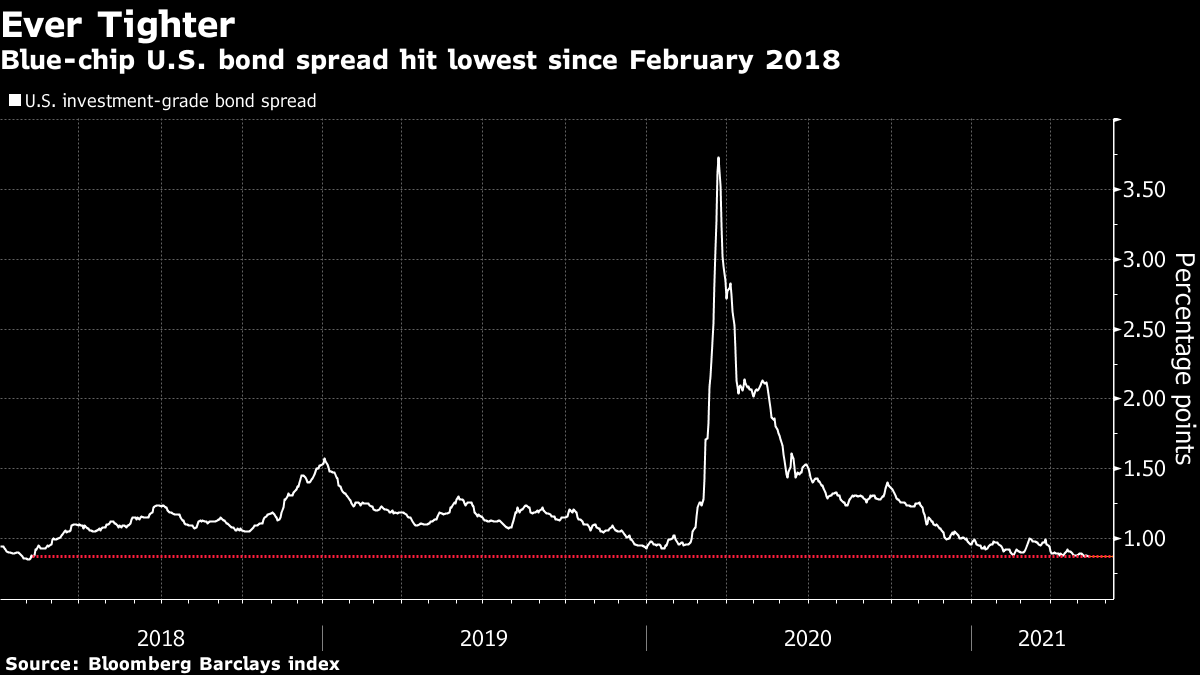

A somewhat taboo phrase has started to creep into the market narrative. Inflation expectations are sky-high, and the data are starting to deliver. Meanwhile, 'peak growth' warnings are starting to ring, and have only grown louder after last week's shockingly large U.S. payrolls miss. You guessed it: Stagflation. Before you angrily close this newsletter, let me explain myself. Obviously stagflation is a loaded word: it evokes images of mile-long lines at gas stations in the 1970s, double-digit CPI and painfully high unemployment rates. Recently, the term's been co-opted by the Republican Party to criticize the Biden's administration's multi-trillion dollar spending proposals. This is not the 1970s, and it would be wrong to describe what's happening in the economy right now as stagflationary, as Grant Thornton LLP's chief economist Diane Swonk laid out in a masterful Twitter thread last week. But there are some interesting dynamics at play in the bond market that are worth examining.  Five-year breakeven rates jumped to the highest level since 2005 this week, while five-year real rates -- which strip out the effects of inflation -- sank to all-time lows. That gap between those two gauges has never been greater. Other measures tell a similar, if less dramatic story: The rate on the five-year, five-year forward swap contract is at the highest since 2017. Much of the growing anxiety around inflation can be blamed on the severe and distinct choke points in global supply chains, with everything from semiconductor chips to corn in high demand. It feels like everything physical is on fire right now, and that's a problem for companies contending with surging input costs -- if you can't build it, you can't sell it. Which, in turn, is weighing on growth expectations. "Could this inflation scare turn into a growth scare? One way to connect the dots is to look at the supply chain challenges," said Emily Roland, co-chief investment strategist at John Hancock Investment Management. "How persistent are these supply chain constraints going to be, how soon can these bottlenecks be worked out, in order for suppliers to come back online and prevent us from having a challenge to growth?" A bevy of survey-based data highlight the crunch, perhaps none as clearly as the Institute for Supply Management manufacturing numbers. In April, the U.S. factory backlog orders index jumped to a record 68.2, while an index of customer inventories hit an all-time low for the data series.  Charts such as those neatly illustrate that the supply side of the economy is still racing to catch up with booming demand as a weary world starts to emerge from this pandemic. Consensus tells you that those crunches will be worked out, and the price pressures we're dealing with will be -- as Fed policy makers have sung in unison for months -- transitory. And as those knots get ironed out, breakeven and real rates should start to gradually gravitate towards each other. "You would expect to see if you had supply constraints that production would go down and prices would go up, and that's what you're seeing the market reflect to some degree," said Matt Nest, portfolio manager and global head of active fixed income for State Street Global Advisors. "As those supply pressures ease, then you'll probably see a reversal of that dynamic." Who's Gonna Stop Me?While lumber might be difficult to come by right now, there's no shortage of corporate debt. Readers of this newsletter know the story well by now: cheap borrowing costs and wide-open bond markets fueled a record flood of issuance in 2020, and the pace hasn't let up so far this year. Amazon.com Inc. is just the latest example. The online retail giant came to market this week with a jumbo $18.5 billion offering -- its biggest bond sale ever. For anyone asking why, the answer is, why not? Even though the company already has tens of billions of dollars worth of cash, if you're able to sell 40-year bonds at a yield just 95 basis points over Treasuries, why wouldn't you? "They can grow into this leverage," Matt Brill, head of North America investment grade at Invesco Ltd., told Bloomberg Television on Monday. "If you're able to borrow for reasonably cheap, and then you're able to get the operating leverage to go with it, it results in a lot of earnings."  On the receiving end of this supply firehose is a seemingly unquenchable appetite. The hunt for yield -- any yield -- has pushed high-grade credit spreads to three-year lows of just 87 basis points, a level reached just a handful of times since 2008. While junk spreads have widened the past couple days, they're still hovering near the tightest levels since 2007. In fact, the high-yield market is so hot, investors have been content to look the other way and let borrowers drop the protections that typically differentiate junk bonds from leveraged loans. While bonds make fixed interest payments, loans usually float, and borrowers have often favored them for being easier to refinance. But now, borrowers are increasingly omitting what's known as the make-whole safeguard, as explained by Lisa Lee of Bloomberg News. This provision mandates that issuers pay up for future missed interest payments should the debt be retired early. It's become so common to ditch make-whole requirements that over 35% of the secured bonds issued in the past three quarters didn't include such a provision, according to Moody's Investors Service. That's up from 12% in 2015.  But it's not just high yield -- investor protections are weakening "across the credit landscape," according to SSGA's Nest. That deterioration, along with increasingly stretched valuations, has lead the money manager to reduce overall credit exposure over the past three months. "It's always a trade-off with respect to the underlying fundamentals and the lower expected default rates. It's worrisome," Nest said. "All of that does lead to increasing concern about when and if we do get a bump in the road, there will be less protection. You're not playing for a whole lot here in a sense and the downside risks are increasing." Speak For YourselfThe Bank of International Settlements made waves in the typically staid world of fixed-income market structure back in March with a report titled "The anatomy of bond ETF arbitrage." The conclusion was borderline scandalous. In times of market stress, the authors posited, exchange-traded fund issuers may deliver authorized participants -- the specialized traders tasked with keeping an ETF's price in line with its net-asset value -- baskets of less-than-desirable, possibly-illiquid bonds in order to discourage redemptions. As this newsletter discussed at the time, ETF advocates quickly panned that verdict. This week, BlackRock Inc. -- the world's largest ETF issuer -- delivered another rebuttal. Strategically selecting a redemption basket of bonds that aren't representative of the portfolio wouldn't be in the best interests of the ETF, and could widen the fund's tracking error, the paper said.  And perhaps even more importantly: "Further, such actions could create reputational risk for and uncertainty around intentions of the fund sponsor within the AP community which could potentially impact the fund's liquidity." It can be difficult to disentangle any argument, let alone one steeped in the minutiae of the ETF creation-redemption mechanism, but BlackRock probably has a point, according to ETF industry veteran Elya Schwartzman. "There's nothing preventing you from doing that. You can do that exactly once, and then you can say bye-bye to your APs," said Schwartzman, who spent nearly a decade at BlackRock before founding ES Investment Consulting LLC. "APs would know right away and you're relying on these partners to trade the fund. It's a two-way street." So there's nothing technically incorrect with the BIS paper -- it's just highly unlikely that an ETF issuer would tinker with their redemption baskets, nuking their AP relationships and blowing up the ETF's tracking error, just to discourage outflows. And there's a silver lining. To illustrate their point, BlackRock included redemption basket data for two of their biggest bond ETFs from February 18, 2020 to March 12, 2020 -- the height of the pandemic-fueled market mayhem. This is the first time the firm has ever published such data. "It spurred BlackRock to write this paper, that's a redeeming quality," Schwartzman said. "It's great, it's more disclosure in the ecosystem." Bonus PointsCoinbase will list Dogecoin in the next six- to eight weeks Animals laugh too, analysis of vocalization data suggests Juliet, last wild macaw in Rio, visits zoo every morning to canoodle companions, quell loneliness |

Post a Comment