| Hello. Today we look at the future of work, Brazil's recovery and what surging copper prices tell us about the global economy.

The Jobs of Tomorrow

There was good news for American workers this week as McDonalds and Chipotle raised wages and Amazon detailed plans to boost hiring. The announcements came amid the intensifying debate over why companies are struggling to find staff despite elevated unemployment and what that means for inflation. Questions over social justice and income inequality are also increasingly being asked of corporations. Beyond the here and now, strategists at Bank of America are looking at the longer-termfuture of work. Their call, made in a report to clients this week, is that the labor markets of tomorrow won't be driven by traditional white- or blue-collar work given technologies will advance and societies will have different needs. Instead, there will be "new collar" jobs in technology, cyber and coding as our economies embrace robots. Much will also depend on "pink" positions in the so-called care economy, such as nurses, carers and teachers. "Green" jobs include solar engineers, wind technicians and battery experts. The BofA team give three reasons for that shift: - Each career represents high-quality work with long-term stability

- Such jobs are hard to automate as they rely on emotional intelligence or dexterity.

- They are exposed to the hot sectors of healthcare and renewables

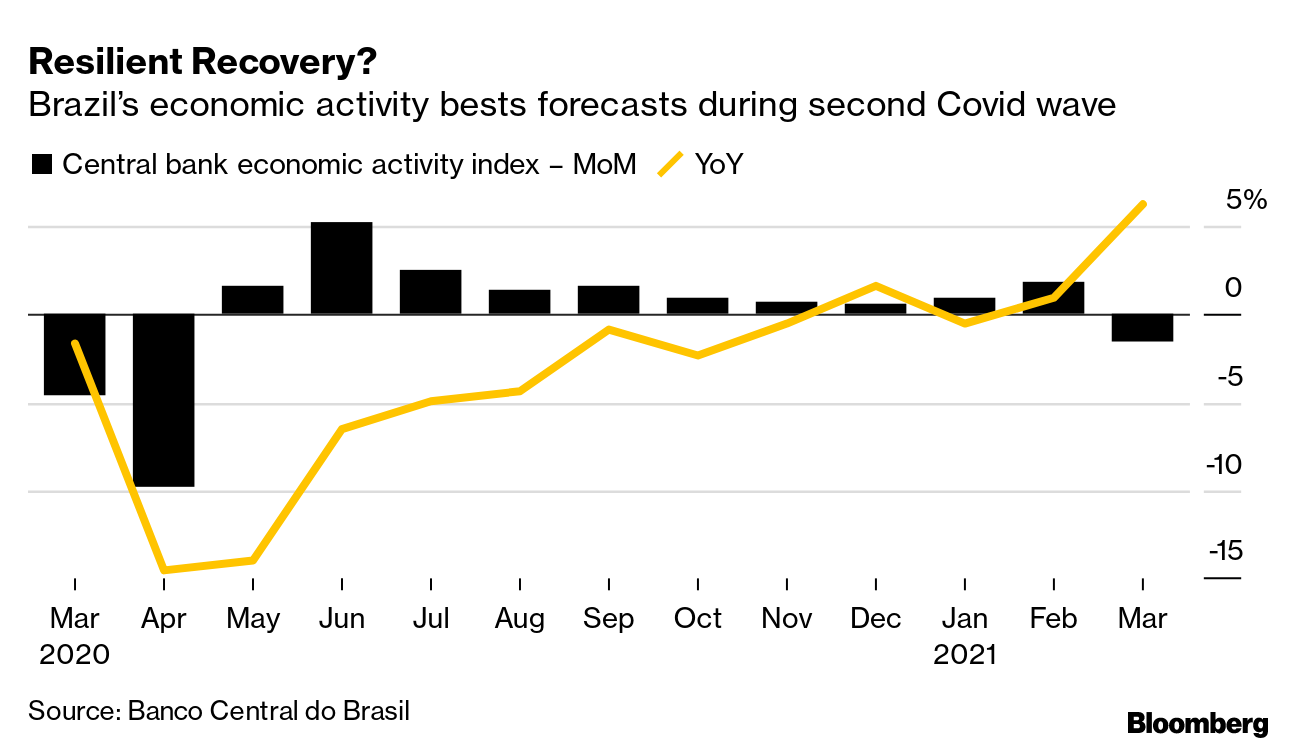

With U.S. employment projected to increase by 6 million to 168.8 million by 2029, healthcare jobs are tipped to account for 13 of the 30 fastest growing jobs, the Wall Street bank said. The two quickest will be solar PV installers and wind turbine service technicians. As for Europe, the BofA team said 70% of job growth this decade will be in health and social work, professional, scientific and technical services and education. Other industries set to expand: creative jobs such as theater directors an fashion designers, whose work can't be replicated by robots. And as technology generates more time for leisure, occupations such as yoga teachers and sommeliers could surge. The report provides a counter-point to those worried they're about to lose their jobs to robots. "Ultimately we think the future of work is humans and robots not humans versus robots as we believe net-net innovation will continue to offset the risk of mass job automation," the strategists said. —Simon Kennedy The Economic Scene Brazil's real will strengthen and the economy will beat expectations as privatizations, investment and reforms drive the recovery, according to the economy minister. Paulo Guedes told Bloomberg News that proposals to overhaul the tax system and curb public-sector costs will also be approved this year.

He also gave a candid assessment of his relationship with President Jay Bolsonaro, whose support for his minister's pro-market agenda has waned. Today's Must Reads - Argentina spared. The group of rich government creditors known as the Paris Club is willing to delay a $2.4 billion debt payment from Argentina due this month if the nation meets certain conditions, potentially averting a damaging default, according to people with direct knowledge of the negotiations.

- Canada outlook. Bank of Governor Tiff Macklem is indicating he won't be in any rush to hike interest rates even if the economy makes up pandemic losses and he said the bank is closely monitoring the currency's gains to ensure further appreciation doesn't create economic headwinds.

- BOJ restraint. The Bank of Japan, which has helped to prop up the country's equity market for over a decade, refrained from buying stock funds this week despite some big losses, forcing investors to rethink assumptions about when the central bank will step in.

- Powell again? Progressives are starting to divide on whether Fed Chair Jerome Powell should be renominated by President Joe Biden for a second term, with some demanding a stronger climate leader at the head of the central bank.

- Go crypto. Governments should embrace digital currencies or risk private firms taking control of money people use, a Bank of England official said.

- Vacation plans. Greece will open to international tourists this week, as the government tries to kick-start an economic recovery. Yet Portugal held off on lifting entry restrictions on arrivals from the U.K.

- China strength. China's production, investment and retail sales are due in the week ahead as Bloomberg Economics says the data should show the recovery extending into the second quarter.

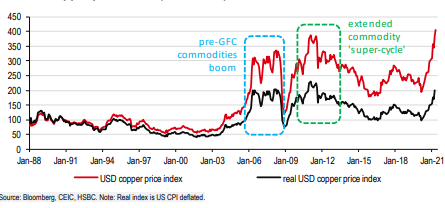

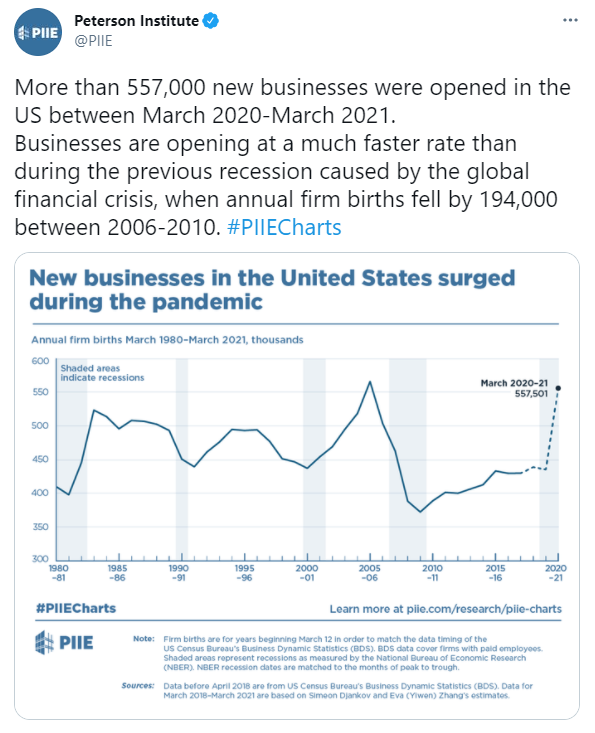

Need-to-Know Research 'Dr. Copper' has long been read as a proxy for the health of the world economy, with gains signaling a pick-up in industrial activity and declines the reverse. HSBC's co-head of Asian research Frederic Neumann says its latest surge may be foreshadowing a rise in industrial activity once again, especially outside of China, but cautions against reading too much into the latest price surge. "Not that Dr. Copper is wrong, but occasionally he does get carried away," Neumann writes. On #EconTwitterNew businesses in the U.S. surged during the pandemic.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment