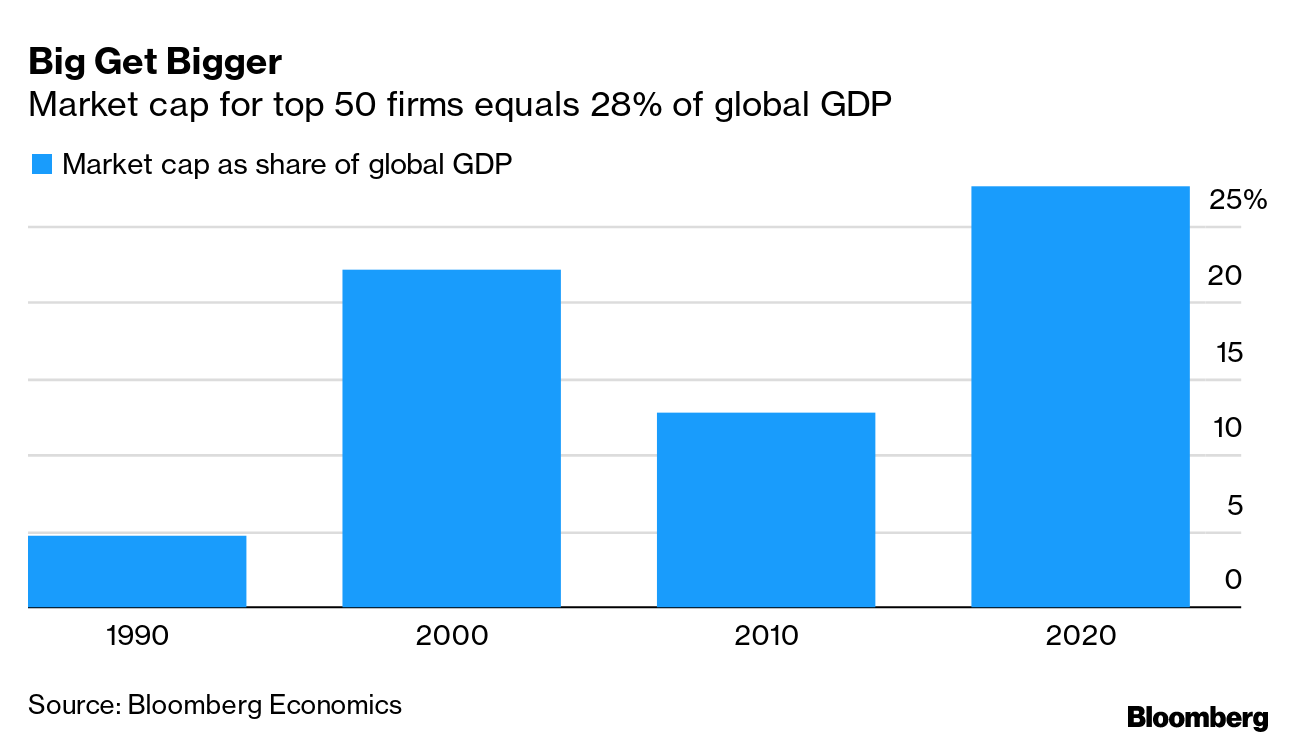

| Hello. Today we look at the rising power of megacompanies and the push to tax them more effectively, calls to dial back some U.S. unemployment benefits and how the synchronized global recovery is fanning inflation. Megafirms Lord It Over The world's biggest companies, already thriving before the pandemic hit, have become all the more successful thanks to Covid-19. That's one of the takeaways from a Bloomberg Economics study of the biggest firms around the world, measured by stock-market capitalization, over the past three decades. Among the findings for the top 50 from economists Tom Orlik and Justin Jimenez, with graphics by Cedric Sam: - Collective stock market cap surged to 27.6% of global GDP by 2020 from 4.7% in 1990

- Median profit margin fattened to 18.2% from 6.9% over the same period

- Effective tax rate dwindled to 17.4% from 35.5%

- Technology firms make up 21 of the 50, against just three back in 1990

- By 2020, they amassed a cash pile of $1.8 trillion — more than five times their annual spending on business investment

These data points explain why policy makers from Washington to Beijing to Brussels are crafting new measures to address what some argue is an accumulation of power that's counter-productive for the economy.

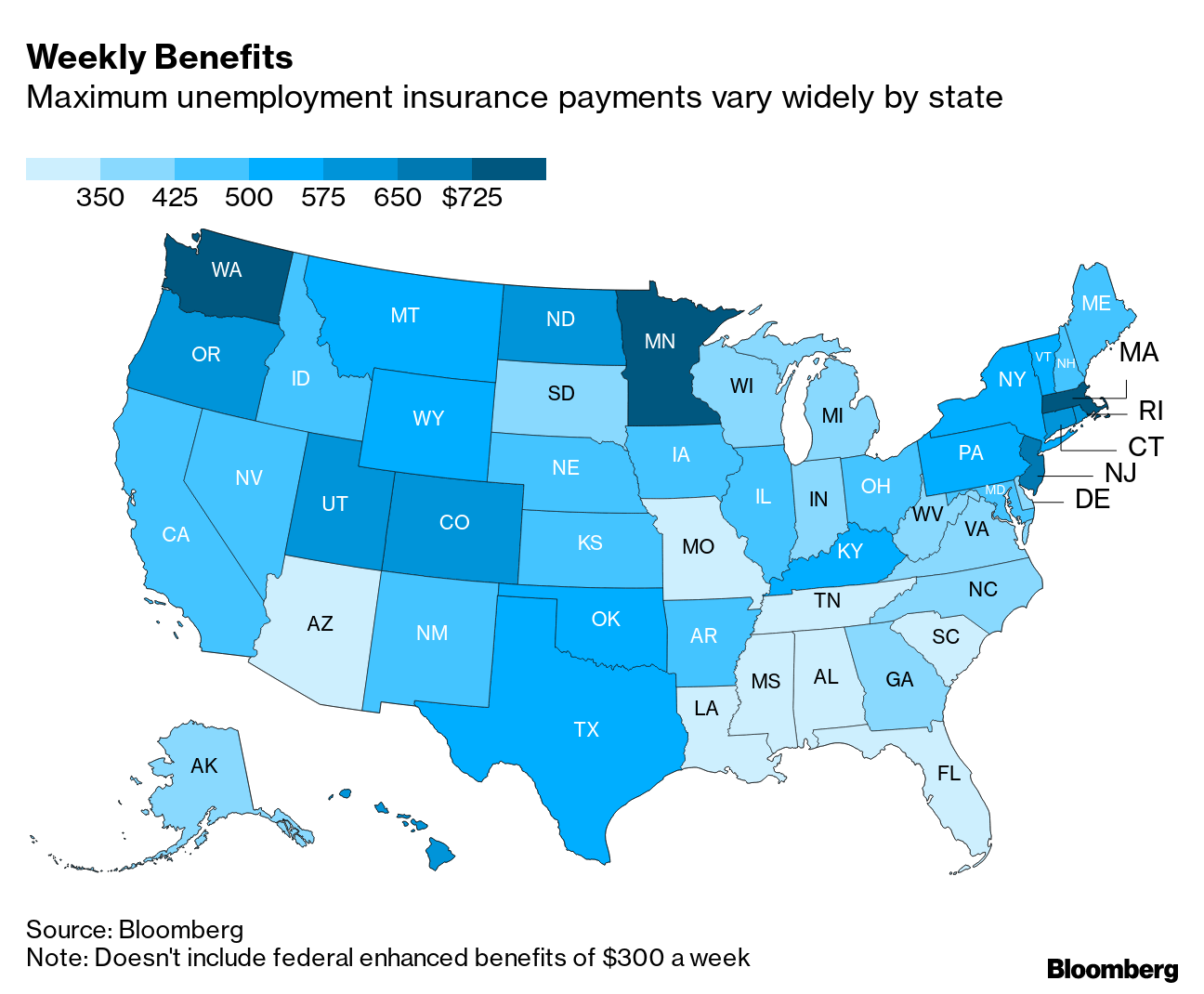

Among the risks posed by superstars: lower tax revenues, pressure on wages and the closure of small businesses. A long-stalled international effort to establish a global minimum corporate tax has had fresh impetus from a push by the Biden administration, which on Thursday pitched a 15% minimum rate. China has taken unprecedented steps to fine and restrict the operations of its tech champions, including Alibaba. Both Democrats and Republicans in Washington are advocating new strictures on American counterparts. It's all reminiscent of the era of trust-busting Theodore Roosevelt, when politicians worried that corporate wealth and power had become excessively concentrated. —Chris Anstey The Economic Scene About 20 governors — all Republicans — are inserting themselves in the middle of what has become the hottest debate surrounding the biggest economy in the world: Are the enhanced benefits, which can swell unemployed workers' monthly checks to near or even above their pre-pandemic wages, discouraging millions of Americans from looking for jobs as Covid-19 restrictions ease? The $300 weekly bonus payments need to be eliminated to keep the recovery humming along and to prevent labor shortages from fanning inflation, they say. Still, a study by the San Francisco Federal Reserve found that in early 2021, seven of 28 people got job offers they would normally accept, but just one of the seven declined the position due to the payments. The White House pushed back against the Republican governors' move: "There will come a day when we do not need these additional supports. There's no question, these were designed to get us to the end of the pandemic. But we're not there yet," Cecilia Rouse, Chair of the Council of Economic Advisers, said at a Bloomberg conference Thursday. Today's Must Reads - Exports surge. In a bullish sign for global commerce, South Korea's early trade data show exports are set to surge in May as vaccinations allow a broader reopening of major economies.

- Inflation watch. In sharp contrast with the rising pressures globally, Japan's key indicator for consumer prices fell for a ninth straight month. That puts the focus on policy makers and the yen. In Brazil, inflation expectations are going the wrong way as investors fear the central bank won't be bold enough to rein prices in.

- Strong showing. The euro area's economic recovery is increasingly being supported by a rebound in services as factories confront a supply squeeze that's pushing up costs. In the U.K., a measure of private-sector growth hit the highest since the index began in 1998, with hotels, restaurants and other consumer-facing services posting the strongest demand.

- Africa risks. A lack of access to vaccines threatens to impede Africa's recovery. Covid-19 plunged 30 million into "extreme poverty" last year. As many as 39 million more could follow in 2021.

- Crypto corner. The Federal Reserve will publish a research paper on whether to issue a digital currency. The Biden administration will require the reporting of transfers of at least $10,000 of cryptocurrency. Norway's central bank said that dramatic price swings in such assets could spell trouble for the banking system. But the tiny Bahamas has beaten global giants in the e-currency race.

- Arrested development. Across the U.S., house prices are skyrocketing, bidding wars are the norm and supply is scarcer than ever. Now the market is too hot even for homebuilders.

Need-to-Know ResearchThe fact major economies are recovering in lockstep may be behind the supply constraints fanning inflation, according to economists at Barclays. "For the world as a whole — unless we start trading with Mars — savings must equal investment and aggregate supply must equal aggregate demand," Marvin Barth and Christian Keller wrote in a report. "In prior global recessions and recoveries, the staggered cycles of various economies helped smooth this process as the faster recovering economies borrowed from the slower recovering economies." This time, the synchronized and bigger rebound in demand is straining the ability of savings to meet investment, they said. Prices and interest rates therefore have to likely rise to restrain investment and consumption and boost savings. That leaves three potential outcomes, according to Barclays: - a short-term interruption to the rebound,

- a longer-term brake on the recovery, or

- an inflationary shift which forces a response from central banks

On #EconTwitterWho to follow on finance Twitter.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment