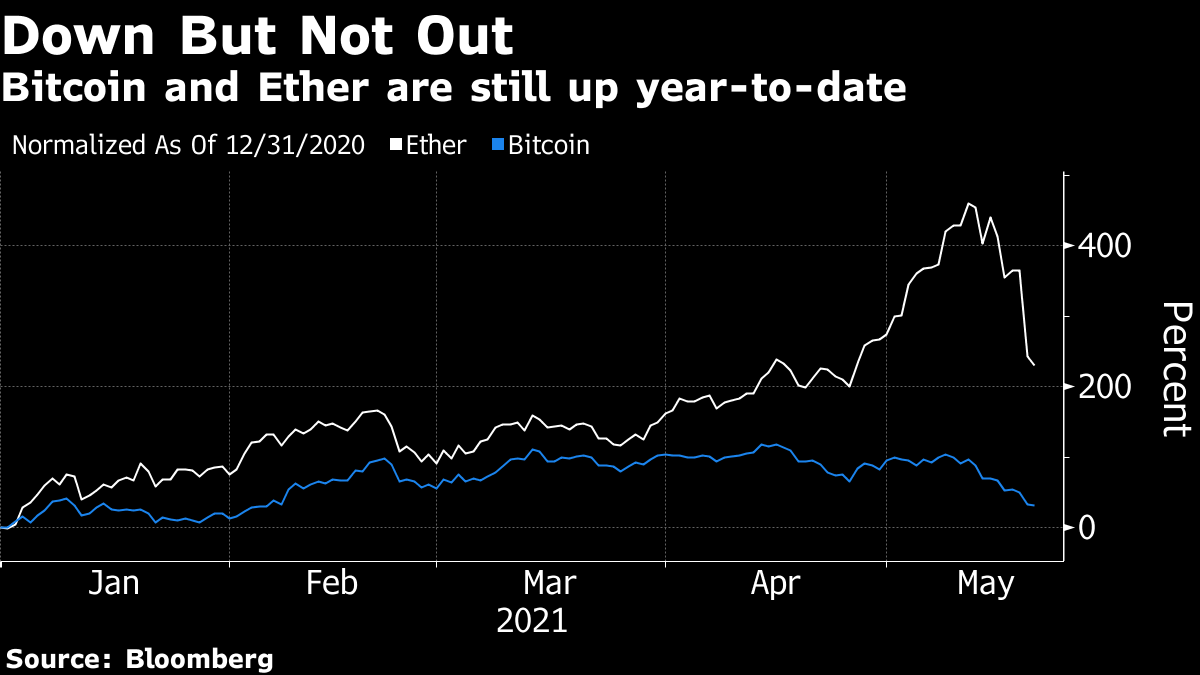

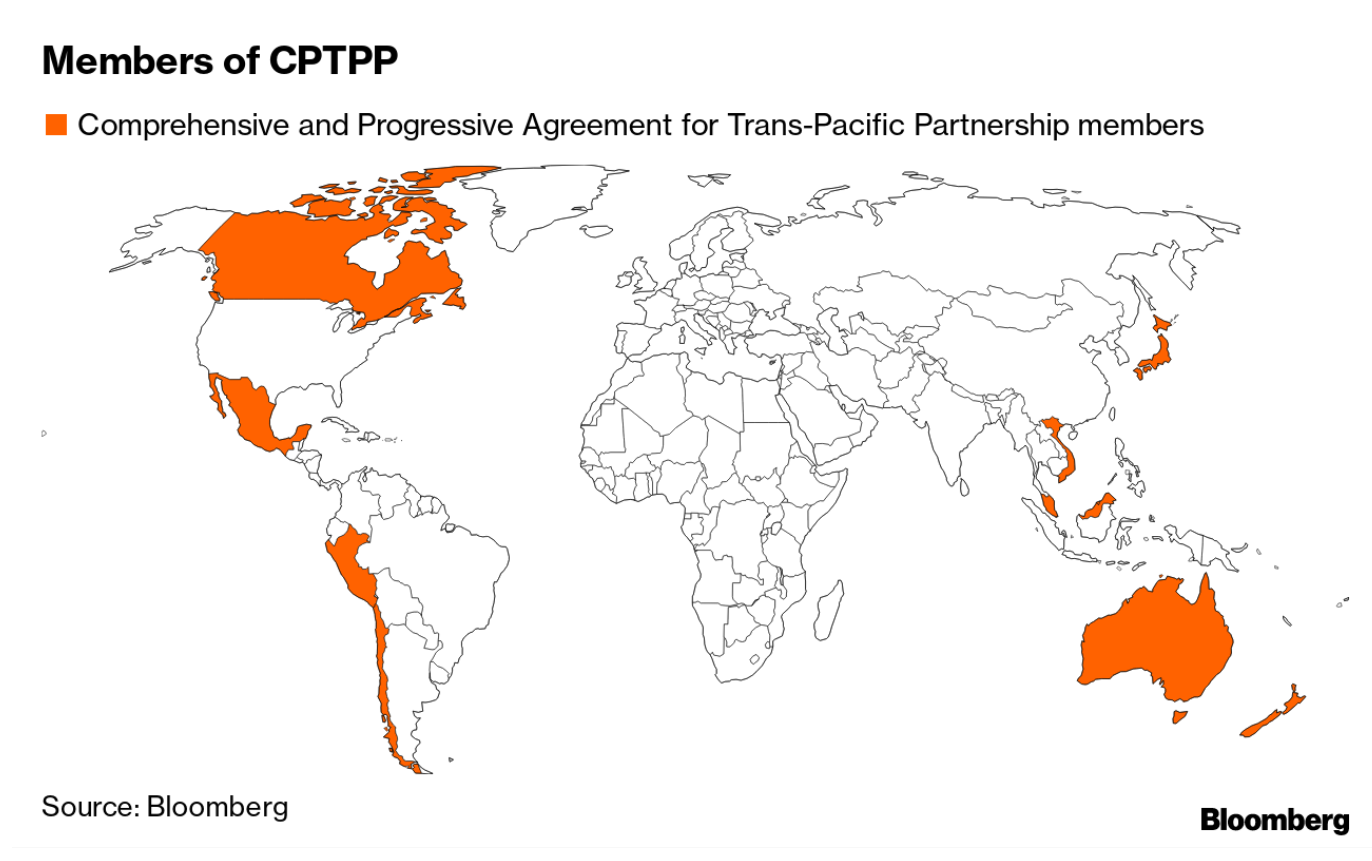

| Taiwan has been applauded throughout the pandemic as a success story, with its economy booming and people going about their lives without needing to worry about Covid. But this week, all of that suddenly changed. Daily infection counts have surged to triple digits for each of the past six days, after having rarely exceeded 10 earlier during the pandemic. While the absolute number of cases, which hit a daily high of 335 this week, are small compared with places such as India and Brazil, they have nonetheless shocked a population that had come to see the coronavirus as an issue for the outside world. It was that complacency that led Taiwan in April to shorten the quarantine requirement for airline crews to just three days. The action was taken to help carriers struggling to operate their cargo lines. But it also allowed infected pilots to spread the virus locally. The sudden spike from zero local infections to more than a thousand reported this week also suggests the virus has been spreading undetected for some time. That's not surprising given that testing in Taiwan has become infrequent. Making the situation worse has been the relatively slow pace of immunizations and lack of vaccines.  A deserted road in Taipei on May 17. Photographer: Billy H.C. Kwok/Bloomberg Authorities on Wednesday imposed social-distancing measures across the island, closing recreational venues and entertainment business, and urging companies to let staff work from home. If daily cases average 100 or more for 14 consecutive days, and the source for half is unidentified, an even stricter lockdown would be triggered. Having been lauded throughout the pandemic as a paragon of success, Taiwan has now become an example of how easily things can go wrong. Cryptocurrencies have been hot, to put it mildly — enough so that China's central bank chimed in this week with a blunt warning. Virtual currencies cannot be used for payments, the People's Bank of China said Tuesday in a statement that began by noting a recent increase in speculative activity. The notice also added that financial institutions are barred from providing crypto products and services. While this was largely a reiteration of China's position — Beijing banned its banks from handling Bitcoin in 2013 and outlawed crypto exchanges in 2017 — it was still enough to drag digital currencies lower. But the PBOC wasn't the only factor weighing on prices. This week also saw Elon Musk complain about Bitcoin's fossil-fuel usage and decision to no longer accept it as payment for Tesla cars. Of course, the market for digital tokens is no stranger to volatility. Bitcoin plunged 31% in U.S. trading on Wednesday morning and then surged 33% that very afternoon. It's well within the realm of possibility that this week would have been just as bumpy if the PBOC had stayed quiet.  A lot has changed for the trade deal formerly known as the Trans-Pacific Partnership. Championed by former U.S. President Barack Obama, it was originally seen as a way for Washington to build leverage against Beijing by binding America's economy with those of China's neighbors. That was all for naught, of course, with Donald Trump withdrawing from the accord soon after taking office as president. This week it was revealed that China has been holding technical talks with Australia, New Zealand, Malaysia and possibly other nations that affirmed the pact to become a member. While China's ultimate inclusion is far from certain, it would represent quite the plot twist. A deal conceived as a way to pressure Beijing could now see the Chinese economy become the accord's cornerstone. And with many in Washington still opposed to trade deals, it could also end up being the U.S. that is disadvantaged by its exclusion.  Whatever form of participation the U.S. will have in the Winter Olympics in Beijing next year is looking increasingly limited. U.S. House Speaker Nancy Pelosi this week threw her support behind a "diplomatic boycott" of the games. That came as American lawmakers are considering a bill aimed at enhancing competitiveness against China, which includes among its measures a ban on federal funding for any delegation of attending U.S. officials. While such a step would no doubt annoy Beijing, it would also make it less likely that Congress stops American athletes from competing by forcing a full boycott. What's far less clear is how much participation there will be by U.S. corporations. With prominent voices such as Senator Mitt Romney having already called on American executives to skip the event, companies will certainly have a tricky decision to make. A Tesla car was involved in a crash this week in China that killed one policeman and injured another. The company was quick to express its sympathies and pledged to cooperate with an investigation. While it's too early to know exactly what happened, accounts of the incident have already been widely circulated in Chinese press and social media. That threatens to compound concerns about the company's growth in China, especially after data showed a sharp deceleration last month. In April, there were 11,949 China-built Tesla cars registered in the country, a sharp drop from the 34,714 registered in March. Figures for a single month don't necessarily signal any broader trends, but these numbers also don't do much for confidence.  What We're ReadingAnd finally, a few other things that caught our attention: Some big news. We launched a new section called Odd Lots, an expansion of our popular markets podcast with Bloomberg News Executive Editors Joe Weisenthal and Tracy Alloway. Become a Bloomberg.com subscriber to get access to Odd Lots stories on the latest market crazes, Joe and Tracy's weekly newsletter, and more. Next China subscribers get 40% off. |

Post a Comment