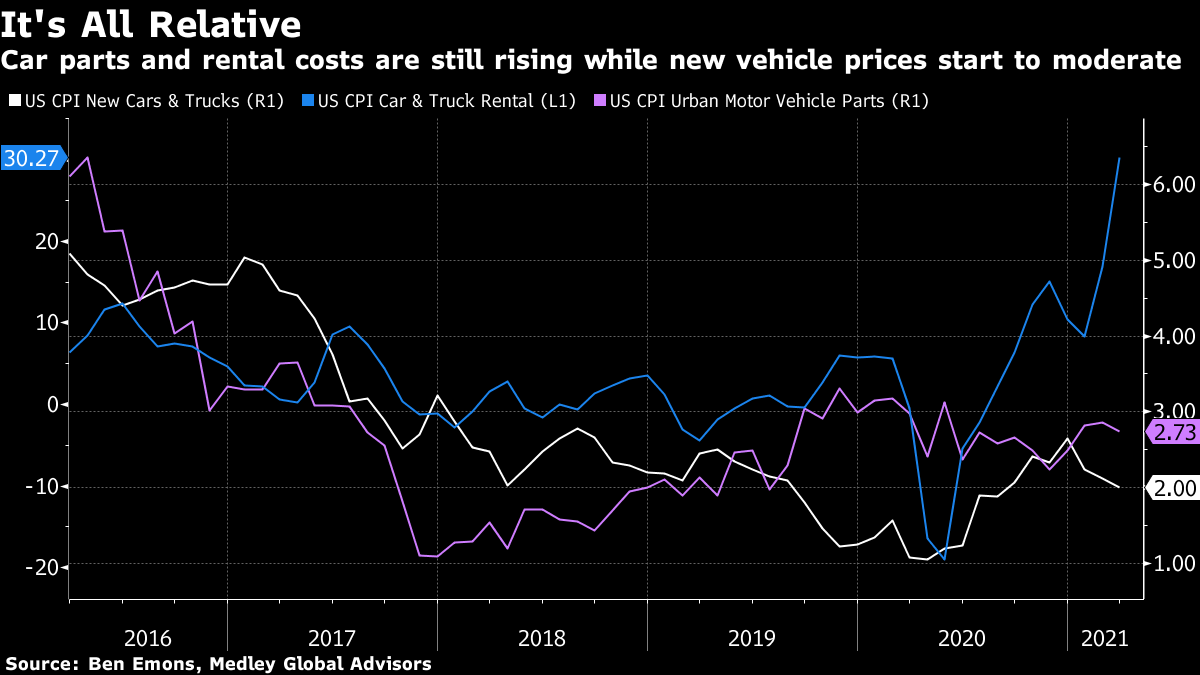

| Covid variant from India triggers WHO concern. Malaysia's 1MDB sues JPMorgan and Deutsche Bank. Wall Street is using old tricks in the brave new world of crypto. Here's what you need to know to start your day. The fast-spreading strain of Covid-19 first identified in India will be classified as a variant of concern by the World Health Organization. There are indications of "increased transmissibility" and that the mutant, called B.1.617, can evade key antibodies. Meanwhile, India's health authorities warned about mucormycosis, also called the "black fungus" infection. The rare but deadly infection found in some Covid-19 patients can disfigure facial features, damage sinuses and lungs and even kill. In the U.S. the Pfizer-BioNTech vaccine was cleared for use in children age 12 to 15, while the U.K. confirmed plans to allow indoor mixing from May 17. Malaysia tightened virus curbs and Philippine President Rodrigo Duterte said he will not compromise on South China Sea claims after accepting Chinese vaccines. And in the world's most vaccinated nation cases are continuing to surge. Stocks look set to drop at the open in Asia after a slide in U.S. equities, as surging commodity prices stoked concern about inflation. Treasury yields rose. Futures pointed lower in Japan, Australia and Hong Kong. Technology shares led U.S. stocks lower, with the Nasdaq 100 Index tumbling 2.6% amid the growing anxiety over inflation, which can threaten longer-horizon revenues typical of the sector. The benchmark S&P 500 Index fell from an all-time high, while the Dow Jones Industrial Average briefly topped 35,000 for the first time. Copper jumped to a record while iron ore futures surged more than 10%. Crypto newcomers are deploying systematic strategies like price arbitrage, futures trading and options writing in the booming $2.4 trillion world of digital coins. For every strategy in stocks, bonds or currencies rendered boring by low rates, regulation or market crowding, there's a lucrative trade in a token lying across the hundreds of exchanges out there. Or so the thinking goes. Ark Investment's Cathie Wood joined the board of cryptocurrency platform Amun Holdings after personally investing in the operator of 21Shares AG, which specializes in exchange-traded products. Hopes of regulatory approval for U.S. crypto ETFs have been doused by a string of comments from new SEC Chairman Gary Gensler. And Bitcoin's waning dominance stirs warnings of crypto market froth. Market contagion surrounding China Huarong is fading less than six weeks after credit investors reeled at the prospect of a default by one of the country's most important state-owned companies. But while the tentative recovery is good news for Beijing's attempts to instil more credit-market discipline without triggering a financial crisis, it could be a bad omen for any China Huarong bondholders still counting on a government bailout to make them whole. Some market watchers say the relative calm could embolden Beijing to impose losses on China Huarong's creditors. After successfully recouping more than $3 billion from firms including Goldman Sachs, Malaysia's 1MDB is casting a wider net. The state-owned investment fund is suing companies including JPMorgan and Deutsche Bank in an effort to recover assets worth more than $23 billion the country says are linked to the fund. 1MDB and a former unit filed a combined 22 civil suits against entities and individuals for various alleged wrongdoings including fraud and conspiracy to defraud the fund, the Finance Ministry said on Monday. The U.S. Department of Justice dropped a probe into Deutsche's role in the scandal, removing one potential legal headache. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayWith soaring commodities prices, transport costs and supply shortages, it's not hard to see inflation risks everywhere. But there is a way in which such inflation might actually result in deflation. Ben Emons at Medley Global Advisors points to the market's relative pricing of inputs versus final products. For instance, S&P's steel and copper indexes are trading at a much higher premium than its car or semiconductor index. "The implication is that rising steel and copper prices have a relative impact such that auto prices could eventually decline," Emons writes. "That is because higher input costs could slow down car production, and thereby moderate demand for cars which then puts downward pressure on car prices."  As he notes, there's some evidence that's already happening, with gauges of car prices starting to come down on a year-on-year basis and indexes of car parts and rental prices still rising. Because of the way the CPI indexes are constructed — steel and copper have a weight of less than 1% while autos and parts have triple that — rising input costs will end up mattering a lot less than falling car prices. That's one way inflationary pressure in commodities and other inputs could actually result in more deflationary pressure in official CPI. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment