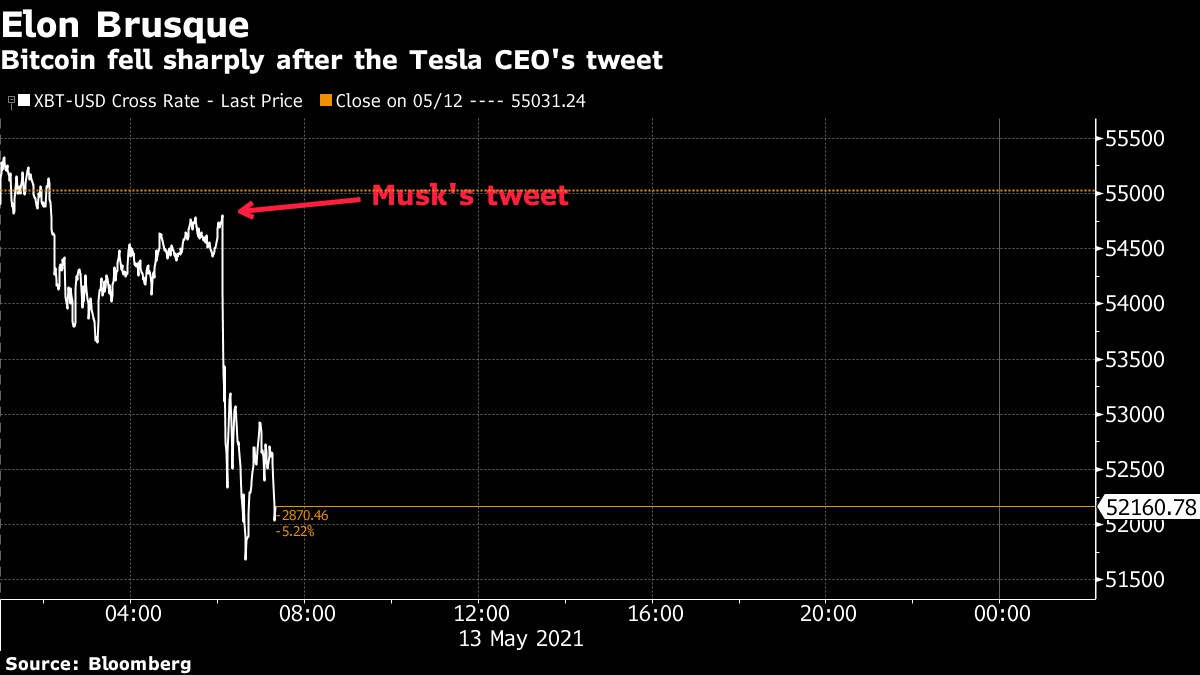

| U.S. stocks tumble the most since February on renewed inflation fears. Beijing deploys more ships to a disputed part of the South China Sea. Elon Musk halts Tesla purchases with Bitcoin. Here's what you need to know to start your day. Asian stocks are set to extend a selloff after a U.S. inflation reading saw the S&P 500 drop the most since February and bond yields jump on concern that price pressures could stifle the economic recovery. Futures pointed lower in Japan, Australia and Hong Kong. U.S. contracts were steady after the technology sector paced a 2.6% decline in the Nasdaq 100. The S&P 500 dropped more than 2% in a third-straight day of declines, though the energy sector climbed as commodity prices continued to rally. Treasury yields rose the most since March despite strong demand for 10-year notes in a monthly auction. The dollar jumped. Oil retreated back below $66 a barrel. The more-infectious Covid-19 strain driving India's crisis has been detected in 44 countries, according to the World Health Organization. The EU is pushing for a ban on all non-essential travel to and from the country, and with healthcare facilities running short of oxygen tanks and beds, Indians are on a global hunt for oxygen concentrators to assist patients with low blood-oxygen levels. Here's how the nation's Covid catastrophe highlights the dangers of complacency. Meanwhile, China's Sinovac has become the world's second-most widely distributed vaccine. But the company still hasn't published any data in an academic journal and its contradictory efficacy rates are triggering concerns among scientists. China has deployed more ships in a disputed area of the South China Sea even after the Philippines' repeated protests, according to President Rodrigo Duterte's top diplomat who's pledged to take up the issue with his Chinese counterpart. The Southeast Asian nation is considering another protest after Beijing increased the number of Chinese vessels in the contested waters to almost 300 from just over 200 in March, Foreign Affairs Secretary Teodoro Locsin said. Tensions between the two nations have been escalating over the past months, with the U.S.-backed Philippines repeatedly protesting. Duterte has however maintained a friendly stance toward Beijing, recently calling it a "benefactor." The largest gasoline pipeline in the U.S. is returning to service, recovering from a cyberattack that sent pump prices surging and triggered shortages across the Eastern U.S. The Colonial Pipeline — a critical source of gasoline and diesel for the New York area and the rest of the East Coast — began to resume fuel shipments around 5 p.m. Eastern time Wednesday, the Alpharetta, Georgia-based operating company said in a statement. It's unclear how long it will take for supplies to come back to normal, though, and Colonial warned the line may go down again from time to time while it's in the process of restarting. The news came as gasoline stations were running dry from Florida to Virginia. The cryptocurrency that shot to a valuation of more than $45 billion since it began trading on Monday hopes to remake how people interact with the world wide web. The goal of the token, dubbed Internet Computer Price, is twofold: to improve the slow pace of most blockchain technology and remove the centralized, for-profit gatekeepers like Amazon Web Services that both blockchain and websites rely on. The problem ICP's creator Dfinity is addressing extends beyond just blockchain technology, according to a research note from analysts at Messari: "It's addressing the issues plaguing traditional internet, such as relatively low data security and an oligopoly consisting of big tech companies." Meanwhile Facebook is rebooting its crypto project, Masayoshi Son has doubts about Bitcoin, and crypto's anonymity has U.S. regulators circling. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayProponents of Bitcoin say it thrives on independence. It's the ultimate inflation hedge. It cannot be manipulated. It's divorced from the vagaries of traditional finance, governments and central bankers, and so on, and so on. Enter Elon Musk's sudden and unexpected decision to suspend the ability to pay for Tesla vehicles with Bitcoin. The Tesla CEO announced on Twitter that: "We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel. Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment."  Bitcoin prices immediately dropped, falling by about $2,500 according to CoinDesk prices. Bitcoin is still up massively on the year given its big run, but there is a certain amount of irony that one decision from a CEO can knock the price in this way. It's no secret that the cryptocurrency community has been taking its cues from the "Dogefather." In that way, Elon Musk is kind of like the central banker of crypto — able to move sentiment in either direction with single joke on Saturday Night Live or a single tweet. You can follow Tracy Alloway on Twitter at @tracyalloway. Some big news: We've launched a new section called Odd Lots, an expansion of our popular markets podcast with Bloomberg News Executive Editors Joe Weisenthal and Tracy Alloway. Become a Bloomberg.com subscriber to get access to Odd Lots stories on the latest market crazes, Joe and Tracy's weekly newsletter and more. Five Things subscribers get 40% off. |

Post a Comment