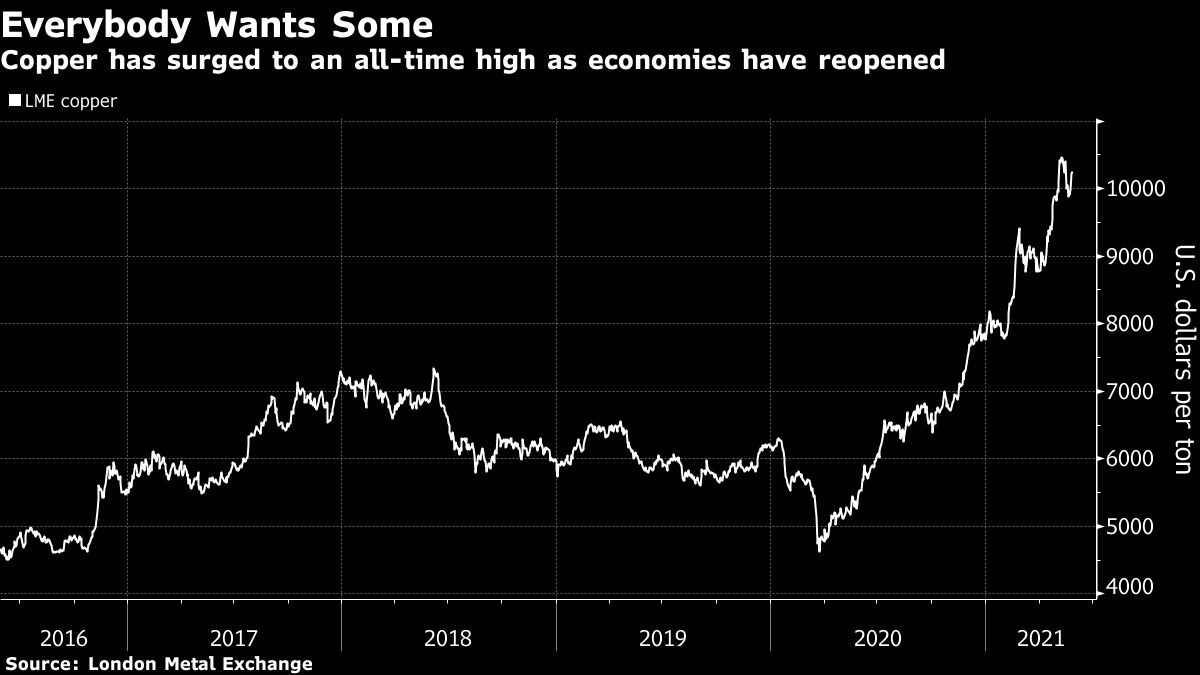

| U.S. experts say China must cooperate in the search for the origins of Covid-19. Hong Kong enlists the help of local business to boost vaccine rates. And the supply squeeze in China is escalating. Here's what you need to know to start your day. The world needs the cooperation of the Chinese government to trace the origins of Covid-19 and prevent future pandemic threats, according to leading U.S. disease experts. Information to support the theory that the SARS-CoV-2 virus may have escaped from a lab in Wuhan, China, has increased, said Scott Gottlieb, a commissioner of the Food and Drug Administration in the Trump administration, who now sits on the board of Pfizer. U.S. intelligence agencies have conflicting assessments of whether it was more likely the virus spread from wild animals to humans or leaked from the Wuhan Institute of Virology. China has denied the lab theory, and accused the U.S. of hyping it up. Asia stocks face a muted start to the week as traders await U.S. jobs data and Federal Reserve speakers to gauge the pace of the economic recovery. The dollar was steady in early Sydney trading. Holidays in the U.S. and U.K. on Monday are likely to keep trading subdued in Asia. Futures were little changed in Japan, Australia and Hong Kong. U.S. stocks notched their fourth-straight monthly advance as data signaling prospects for a sustained rebound outweighed inflation worries. Bitcoin was higher, trading above $36,000. China's factories, power plants and farms are fielding the worst effects of a surge in commodity costs that's yet to hurt the wallets of the nation's citizens. Electronic goods makers are now balking at the volatility in raw materials prices and are cutting orders for rods and pipes — a double blow for suppliers of metal parts that are already dealing with soaring refined copper prices. Rhetorical intervention by top politicians, state planners and exchanges to rein-in commodity prices have had some success in forcing prices lower from the all-time highs hit earlier this month. But for many in the supply chain, the money woes are mounting up, and the world now faces a prolonged supply shortage. When bar and nightclub owners in Hong Kong met with city officials this month, they were confronted with questions over what they were going to do to help boost one of the world's slowest Covid-19 vaccine takeups. It's a further sign that Carrie Lam's administration is increasingly leaning on local businesses and institutions to help get people vaccinated, amid an atmosphere of government mistrust following widespread anti-China protests in 2019. People have been so resistant to getting vaccinated that unused shots are piling up. Meanwhile, major companies, restaurants, and even colleges have started offering cash payouts, extra time off, even the chance to win a $1.4 million apartment. Australia's central bank is approaching a decision on whether the economy is strong enough for it to join Canada and New Zealand in signaling a move away from emergency mode. While no change in policy settings is expected at Tuesday's meeting, the Reserve Bank will likely hold preliminary discussions on whether to extend the three-year yield target and undertake further quantitative easing. Governor Philip Lowe said the board will make a call on both in July. Melbourne's latest Covid-19 outbreak is a reminder that a sluggish vaccine roll-out has the potential to jeopardize the recovery. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayLast week China announced a crackdown on commodities speculation in an effort to cool surging prices. But such a strategy only works when it's Chinese demand driving price increases, and Beijing's strategy might actually end up sending costs even higher. That's the warning from commodities analysts at Goldman Sachs, at least when it comes to copper. The problem, they point out, is that China is still acting like it's in control of the market, when in fact the country is "no longer the marginal buyer dictating price — as has been the case over much of the past two decades — but is now being crowded out by Western consumers." The danger is that China may be encouraging copper buyers to destock, or at least run down their inventories, at precisely the time other countries are scrambling for more.  The irony here is that Western buyers may be starting to act a lot more like China has historically, in attempting to build stockpiles of commodities and other vital components to prepare for any potential future shortages or protect from price spikes, right when China is telling its own buyers to back away from the market. As Goldman puts it: "We think the risk from current policies cutting both liquidity on exchange and supply chain inventory buffers, is that when China's consumers return to market, the upside pressures on price could be substantial." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment