| Hello. Today we look at the long road back for the global tourism sector, how the Fed and BOE are pushing back against inflation concerns, and new research showing a surge in startups in predominantly Black communities in America during the pandemic. Flight Status: Delayed. Sick of working from home and dreaming of an island getaway? Looks like you'll need to keep dreaming.

Thailand, which relied on tourism for about one-fifth its economy before the pandemic, isn't expecting a return to normal until 2026. The delayed return — which some analysts had expected within two years — will impact more than seven million workers, some of whom may need to find jobs in other fields, the nation's economic planning agency said Monday.  Almost a year and a half of Covid-19 has decimated travel and leisure industries globally, with airlines, cruise operators and hotels reduced to operating at a fraction of pre-pandemic capacity, if at all. Emerging markets have been especially hit and millions of minority, women and young workers have lost their jobs in tourism-related industries, fueling inequality even as some economies recover.

The travel and tourism sector is said to make up around 10% of global output. The United Nations estimated at the start of the year that its woes had robbed the world of $1.3 trillion and threatened up to 120 million jobs. While travel within countries is picking up as vaccination rollouts gather pace, a return to pre-pandemic levels could take years as the virus mutates and governments take different approaches to opening borders. The sector, which "felt the most immediate and severe impacts from the pandemic, will likely be the last to show recovery," economists at Barclays said in a report today. "Economic scarring in tourism-dependent economies is likely to be more acute than in other countries."

If you think that all makes planning a family vacation tough, spare a thought for Japanese Prime Minister Yoshihide Suga — he's trying to host an Olympics. The Tokyo games were meant to be the crowning achievement of Abenomics, as the previous Prime Minister Shinzo Abe's multi-year quest to reignite Japan's economy was known. But just as the goal to revive inflation remains as distant as ever, the Olympic dream is faltering too. Some 600,000 fans from abroad had been projected to attend the delayed games, but organizers ruled out that in March. They are set to decide soon if even local spectators will be allowed to watch the competitions in person and have reduced the number of officials and others expected to attend from overseas to about 78,000, not including athletes. Now, there's a fresh blow: The U.S. State Department raised its travel advisory to level four on Monday, putting Japan in a category of nations that Americans are urged to avoid due to virus concerns.

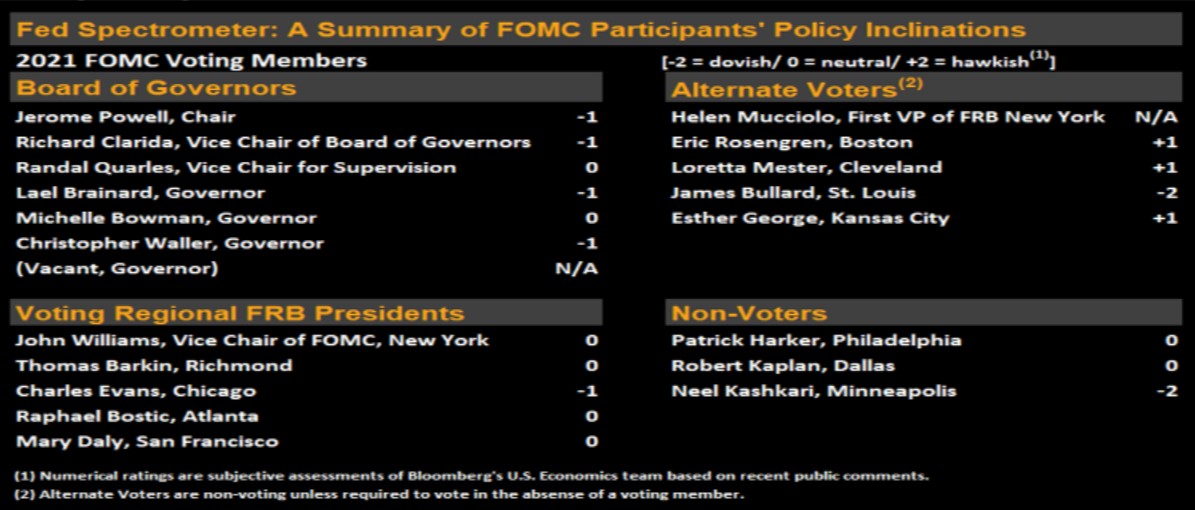

The worst case would be a cancelation of the games. Bloomberg Economics says today that would depress growth this year to 0.6% from the forecast 2.3%. While it's a long road back to pre-pandemic levels for economies as a whole, for international tourism a recovery is looking far more distant. — Malcolm Scott The Economic Scene Federal Reserve officials pushed back against the threat that a spike in price pressures will prove lasting as the U.S. economy reopens. Several said they would not surprised to see bottlenecks and supply shortages push prices up in coming months as the pandemic recedes and pent-up customer demand is unleashed, but much of those price gains should prove temporary. Bank of England policy makers are also downplaying concerns that the U.K.'s rapid rebound will lead to a damaging wave of inflation. Today's Must Reads - Bond market review. Nellie Liang, President Joe Biden's pick to oversee the $21 trillion market for Treasury securities, signaled that one of her top priorities will be to scrutinize the market following last year's brief investor panic and consider changes that will help it better withstand turmoil.

- U.S. housing. States and cities are cracking down on a niche in house-flipping known as wholesaling conducted by largely unlicensed middlemen lured in by YouTube tutorials and hot demand.

- Out of ammo. Asia's surging coronavirus infections and slow pace of vaccinations is testing the limits of what central banks can do to support what had been the world's stand out economic recovery.

- India aid. The government is preparing a stimulus package for sectors worst affected by a deadly virus wave, aiming to support an economy struggling with a slew of localized lockdowns. The U.K. began formal preparation for a free-trade agreement with India.

- Poland position. The country has "undoubtedly" emerged from its first economic slump in three decades, Deputy Prime Minister Jaroslaw Gowin told Bloomberg.

- Turkey revamp. President Recep Tayyip Erdogan appointed a new deputy governor at Turkey's central bank, tapping an economist and long-serving member of the institution in his latest leadership rejig.

- Going positive. For the first time in years, the global supply of debt with a negative yield is in meaningful decline, led by Europe.

- Swiss showdown. Companies in Switzerland are caught in a Brexit-like standoff with the European Union over a framework agreement.

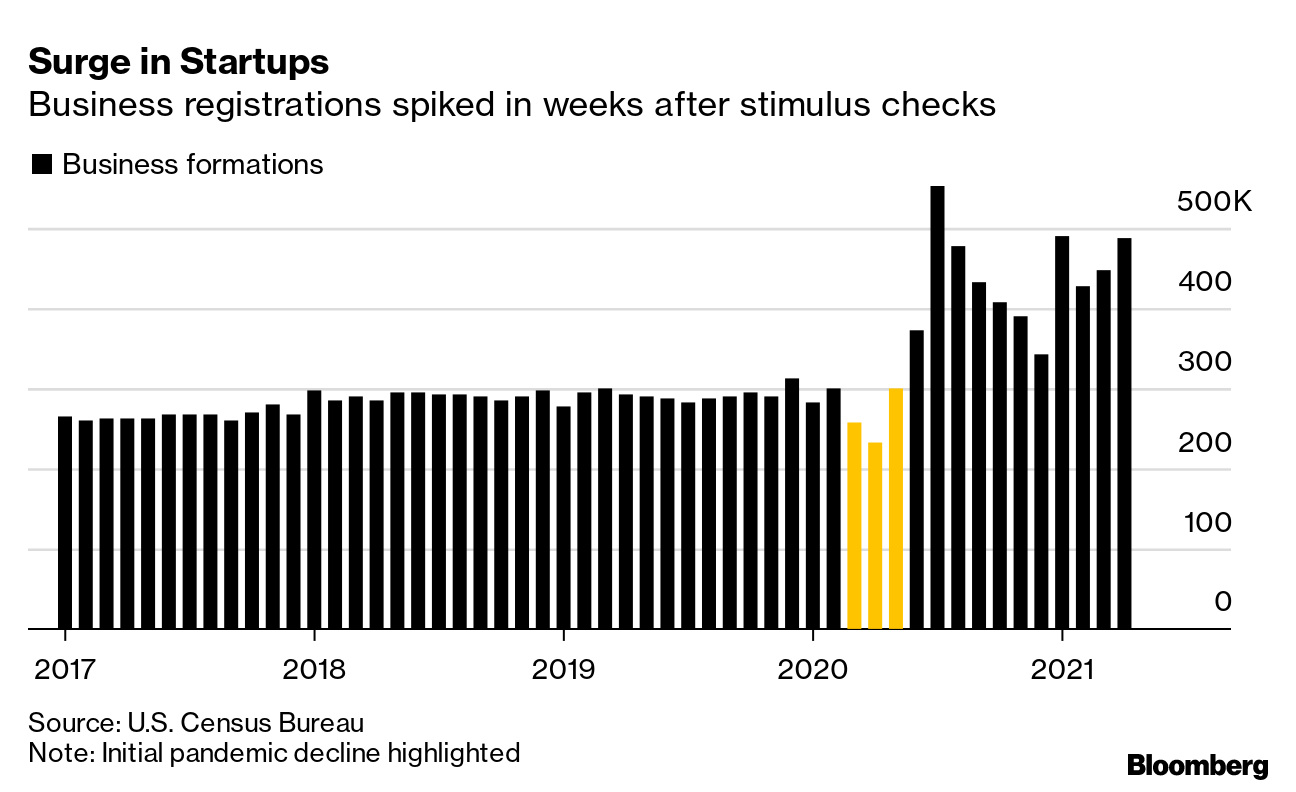

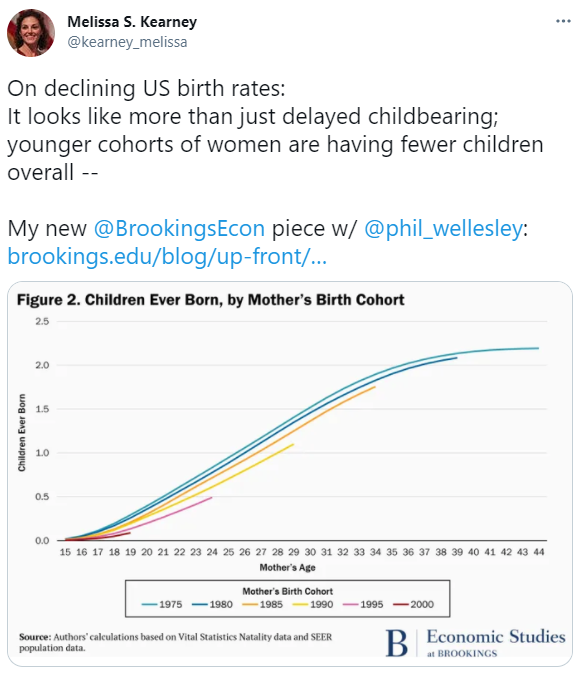

Need-to-Know Research Predominantly Black communities, especially in higher-income neighborhoods of cities including New York City, Houston and Atlanta, saw the strongest growth in new U.S. startups during the pandemic, according to a study from the Startup Cartography Project. The research, using data from eight states, also found that economic relief packages passed last year were followed by a surge in business formations in the following weeks — even though the aid wasn't specifically aimed at encouraging startups. The correlation is "striking," the paper's authors said. On #EconTwitterMore data suggesting the baby bust isn't just temporary:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment