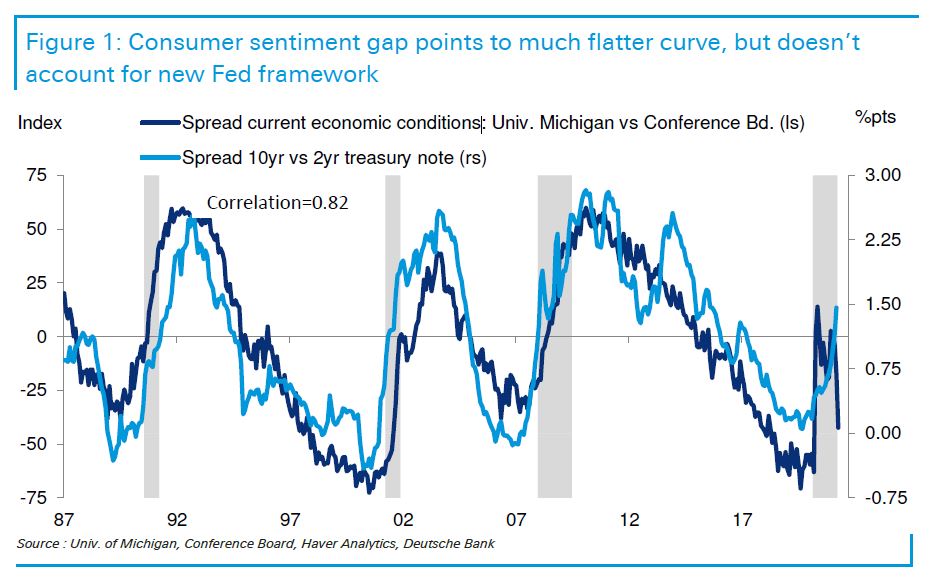

| The U.S. proposes G-7 coordination to counter China. Commodities jump to their highest level in almost a decade. Crypto frenzy crashes Robinhood's trading app. Here's what you need to know to start your day. The G-7 is considering a U.S. proposal to counter what the White House sees as China's economic coercion. The U.S. wants a consultation mechanism to ensure a coordinated response to China's moves, according to a diplomat who asked not to be identified. While the U.S. is still more hawkish than the EU on China, Germany, Italy and France are hardening. The U.K. is in a trickier place. As host of the G-7 it is seeking to strike a balance, so the challenge for Boris Johnson's government is to avoid framing the group as anti-China. Also on the agenda for an upcoming two-day meeting is a proposal to set up a group called "Friends of Hong Kong." Meanwhile, China's UN envoy called on the U.S. to ease the pressure on North Korea. Commodities jumped to their highest in almost a decade as major economies rebound from the pandemic. Demand for metals, food and energy is surging, while poor weather harms crops and transportation bottlenecks curb supplies. The Bloomberg Commodity Spot Index, which tracks prices for 23 raw materials, rose 0.8% Tuesday to its highest since 2011 and has climbed more than 70% since March 2020. Commodities may jump another 13.5% in six months, with oil reaching $80 a barrel and copper reaching $11,000 a ton, Goldman Sachs said in a recent report. However, the jury is out on whether this is the start of a supercycle — an extended period during which prices are well above their long-term trend. U.S. equity futures wavered and Asian stocks were set for a volatile open after a selloff in technology shares, amid comments from Treasury Secretary Janet Yellen that rates will likely rise as government spending ramps up and the economy responds with faster growth. In a subsequent interview, the former Federal Reserve Chair clarified her remarks, saying she wasn't predicting or recommending rate hikes. The S&P 500 pared tech losses with gains in the commodity, financial and industrial sectors. Australian and Hong Kong futures declined. Holidays in major markets including Japan, China and South Korea will limit trade in Asian hours. The impact of the Covid-19 variant first identified in India is starting to be felt in other parts of Asia. Singapore is limiting social gatherings to five people and tightening border curbs. Vietnam is keeping people in quarantine centers who have completed the mandatory 14-day isolation after three cases of the India variant were found. And India's cricket regulator suspended the Premier League indefinitely after multiple players contracted the virus. Elsewhere, the world's biggest economies agreed to back plans for "vaccine passports." And grim news from the most vaccinated nation, which has just had to reintroduce curbs as cases surge, despite more than 60% of its adult population having had two shots. The cryptocurrency frenzy has sent Dogecoin surging as much as 50% again and crashing Robinhood's trading app. Other so-called altcoins also took off, with Dash spiking as much as 14% and Ethereum Classic jumping more than 30%. The rallies defied easy explanation and continued a trend that's seen the value of all digital tokens surge past $2.25 trillion. Bitcoin slumped as much as 5.7% to $53,560, the third straight decline. The Robinhood app, which is among the top 10 U.S. downloads at the Apple App Store, says it has now resolved the issues with crypto trading on its platform. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todaySo Janet Yellen didn't get the memo about the Fed's new reaction function. On Tuesday she spooked markets by commenting that, "It may be that interest rates will have to rise somewhat to make sure our economy doesn't overheat." Later that day she had to walk back the comments, clarifying that she wasn't actually predicting rate rises anytime soon. Snark aside, the Fed and markets have a delicate relationship right now, with investors and traders still trying to understand and test the central bank's new and expanded reaction function. Just how dovish is it willing to be in the face of inflation and an improving economy? What exactly does an "inclusive and broad-based employment" framework actually entail? There are a bunch of ways to follow just how the market feels about the reaction function at any given time, but Deutsche Bank strategists point to a new and fun one. It's the gap between two consumer confidence surveys (the University of Michigan's Current Conditions economic index and the Conference Board Consumer Confidence Survey) versus the spread of 2- and 10-year U.S. debt, a measure of the U.S. yield curve. According to Deutsche Bank analysts led by Matthew Luzzetti, the two have historically tracked each other pretty well, with a bigger gap in consumer sentiment generally tracking a flatter yield curve. "The logic for this flattening in the past has been that as lagging indicators outperform leading variables, or as the labor market improved, the Fed would tighten policy and flatten the yield curve," they explain.  Bloomberg Bloomberg But if the market is buying into the Fed's new reaction function — believing that it won't raise rates even with inflation above 2% and despite improvements in the labor market — that historic relationship should break down. As the Deutsche analysts put it: "Whether or not this tight relationship corrects will be one test of whether or not the market believes the Fed's new reaction function." You can follow Tracy Alloway on Twitter at @tracyalloway. Want the latest on the fast-changing world economy and what it means for businesses, policy makers and investors? Sign up here to get The New Economy Daily in your inbox. |

Post a Comment