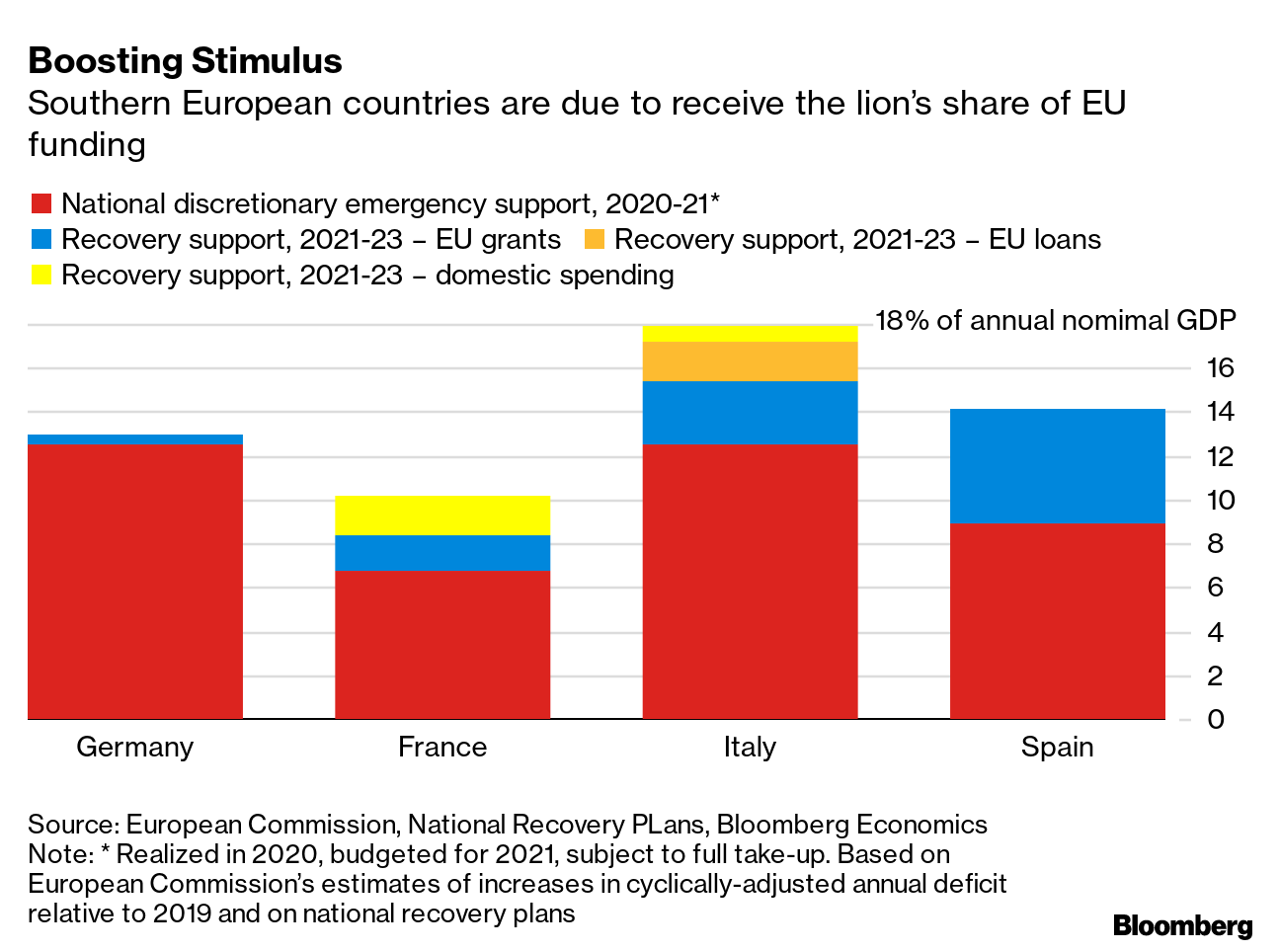

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. After months of drama, blackmail and the occasional political crisis, the EU's 27 national parliaments have all given their backing for the bloc to finance its pandemic stimulus package. That's ahead of schedule and means the Commission can already shift its attention to debt issuance in June, with a first taste of what's to come next week when it signs off on borrowing plans for the year. And while any disbursements still hinge on the countries' recovery plans being deemed good enough, passing this key hurdle with time to spare may give the EU ample room to issue as much as 100 billion euros by September, according to one official, allowing it to better prepare to deliver on the first tranche of the much-anticipated funds from late July. — Nikos Chrysoloras and Viktoria Dendrinou What's HappeningDefense Meeting | EU defense ministers hold an informal meeting in Portugal today, after their foreign-affairs colleagues moved toward enforcing harsher sanctions against Belarus and pointed a finger at Russia's ties to its neighbor. Preparations for sanctions against individuals are at a very advanced stage. Bond Splurge | The ECB is increasingly expected by economists and investors to extend the elevated pace of its emergency bond-buying at its next meeting, despite a likely economic rebound. Top officials have pushed back against the idea that they're ready to slow purchases, and with more-hawkish colleagues relatively quiet on the matter, the scene is set for yet more ultra-loose policy. Greening Greece | Greece's plan for using EU funds to combat the effects of the pandemic will accelerate the nation's transition from fossil fuels to a greener economy. That's according to a government adviser, who sees many opportunities in lignite-dependent regions, providing a chance to curb their dependence on the power-plant fuel for jobs. Capital Clash | Top banking watchdogs are warning EU lenders to stop resisting new rules or risk weakening the financial system and undermining the bloc's role defending global accords. The clash comes as negotiations on stricter global capital rules move into a decisive phase, with the Commission gearing up to propose how to implement the new standards in the fall ahead of their slated start in 2023. In Case You Missed ItCorporate Levies | The Group of Seven meeting of finance officials in London next week must strike an agreement to corral the rest of the world into changing how much and where multinationals pay tax, according to French Finance Minister Bruno Le Maire. European governments are increasingly optimistic that the G-7 could mark a breakthrough in global taxation. Erdogan's Woes | Turkey's President Recep Tayyip Erdogan is facing an uncomfortable truth: his governing party is now dependent on a marginal coalition ally to maintain its dominance. And a slew of dramatic corruption allegations from a fugitive mafia boss could further dent his flagging popularity. Taiwan Tension | The leaders of Japan and the EU's institutions referred to the importance of peace and stability in the Taiwan Strait in a joint statement following a virtual summit, a move indicating their concern over China's assertive push in regional affairs. Although China's Communist Party has never ruled Taiwan, it views control over the island as essential to completing its goal of reversing China's "century of humiliation" by colonial powers. Reporting Rules | The Commission is examining how it can improve rules for ensuring that companies report reliable financial information after Wirecard's collapse served as a "wake-up call." Investors lost about 20 billion euros when the company imploded last year, and the scandal exposed shortcomings at auditors and regulators who failed to catch Germany's biggest corporate fraud in decades. Chart of the Day The Next Generation EU program is poised to get underway, with Southern European countries due to receive the lion's share. Bloomberg Economics estimates the program will deploy funding equivalent to almost 1% of euro area GDP every year from 2022 to 2024, with spending building up gradually from the second half of this year. Today's AgendaAll times CET. - 3 p.m. European Medicines Agency news conference on Covid-19 vaccines

- Germany's Merkel, Italy's Draghi, Economy Commissioner Gentiloni, Financial Services Commissioner McGuinness taking part in Global Solutions Summit

- EU defense ministers meet in Portugal

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment