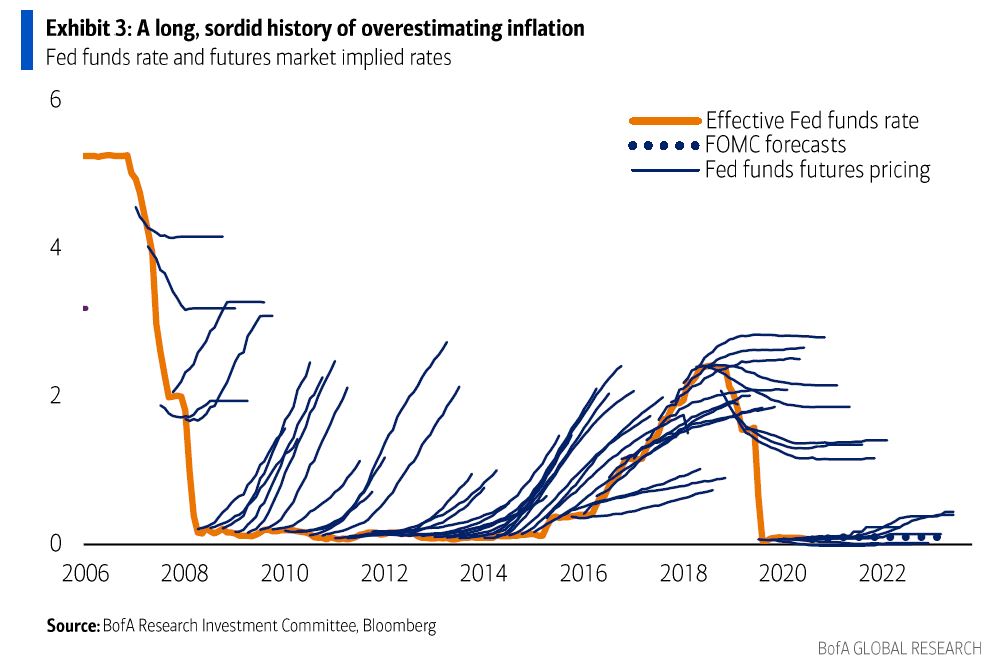

| Binance is under investigation, rounding out a very wild week for crypto. Sinagpore and Hong Kong risk being left behind in the race to vaccinate and re-open. Take a look at one of the world's greatest billionaire factories. Here's what you need to know to start your day. Binance is under investigation by the U.S. Justice Department and Internal Revenue Service, ensnaring the world's biggest cryptocurrency exchange in efforts to root out illicit activity that's thrived in the mostly unregulated market. Founded in 2017, the firm is incorporated in the Cayman Islands and has an office in Singapore but says it lacks a single corporate HQ. Blockchain forensics firm Chainalysis concluded last year that more funds tied to criminal activity flowed through Binance than any other crypto exchange it examined. Meanwhile, Coinbase shares fluctuated with revenue just below estimates, and Elon Musk doubled down on attacking Bitcoin. The coin tumbled as much as 15% on Thursday. Stocks in Asia look set to rally after U.S. benchmarks halted a three-day slide, with investors migrating to value from growth companies as signs of a strengthening labor market tempered inflation worries. Futures pointed higher in Japan, Hong Kong and Australia. Treasuries rallied from the prior session's weakness sparked by stronger-than-expected consumer price inflation data. Bitcoin remains under pressure despite paring losses. Oil slumped the most in over a month as growing inflation concerns raise the specter of a less accommodative Federal Reserve. Places like Singapore and Hong Kong, which have achieved astonishing success in containing the virus, now risk being left behind as better-vaccinated cities like New York and London re-open. "Covid Zero" nations have suffered few coronavirus deaths, but eliminating the virus requires stop-start lockdown cycles, near-blanket bans on international travel and strict quarantine policies. As other parts of the world begin to normalize, experts and residents are starting to question whether walling off from Covid is worth the long-term trade-off. Meanwhile, public health officials said fully vaccinated Americans can ditch their masks in most settings, even indoors or in large groups, and U.K. statistics showed the country's cases of a Covid variant from India more than doubled in the past week. Alibaba forecast better-than-expected revenue and pledged to invest in growth arenas like technology and community commerce. Jack Ma's flagship e-commerce firm posted a 5.5 billion yuan ($852 million) net loss, its first in nine years, after swallowing a $2.8 billion fine for monopolistic behavior imposed by Beijing. "There is still significant uncertainty in Alibaba," said Andy Halliwell, analyst at Publicis Sapient. "It remains to be seen how Jack Ma's behavior last year will have a lasting impact on brand and investor confidence." Here's what's behind China's tech crackdown. SoftBank keeps minting billionaires despite its WeWork-sized misses. Masayoshi Son's SoftBank Group forked out billions of dollars to Adam Neumann's firm, bet that Lex Greensill would revolutionize finance, and lent its backing to German payments company Wirecard. Despite those fiascos, Son has never been more successful. He's now worth more than $32 billion according to the Bloomberg Billionaires Index, and has predicted as many as 20 initial public offerings a year from his portfolio of roughly 160 startups. Here's a look at one of the world's greatest wealth factories. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayOne of the big ironies about the current moment in economics is that the Federal Reserve has basically done away with its inflation target just as it seems to be reaching it. As we saw this week, CPI came in much higher than expected and is now on course to get to 2% on a potentially sustained basis. But the Fed has revealed its new average inflation framework and also committed to pursuing a much more robust definition of "full employment," which means it can look through "transitory" periods of higher prices to keep interest rates low. Is this a good thing? If you think that most of the inflation we're seeing right now has to do with the reopening and recovery of the U.S. economy — things like used car prices, vehicle rentals, hotel stays and so on — then clearly you wouldn't want to raise rates just because a boom in demand for those things has temporarily exceeded supply. But more fundamentally, humanity as a whole has proved time and time again that it's not very good at making forecasts. In fact, you could trace the current economic predicament of supply shortages and transport bottlenecks to our collective inability to make accurate predictions. During the dark depths of 2020, when companies were making plans for the next year, no one expected huge demand for durable goods and so they cut down on production and orders for components like semiconductors. Car rental companies sold off their fleets in order to stay alive. Hotels converted into apartments, and so on. Fast forward to today and we're left with a reality that does not align with our 2020 expectations. In a similar way, it would seem bad if the Fed were to start raising rates based on forecasts for the trajectory of one of the weirdest business cycles in history. This is where I'd like to mention one of my all-time favorite charts, which is below. It shows the implied path of U.S. interest rates based on Fed funds pricing (i.e. the market's expectations) versus the actual path of interest rates. Even in relatively "normal" times, people have consistently and repeatedly been unable to predict the most basic component of the U.S. economy. So maybe it's best if the Fed doesn't risk destabilizing the recovery by trying to get ahead of one of the most unpredictable and unusual business cycles in U.S. history.  Bloomberg Bloomberg You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment