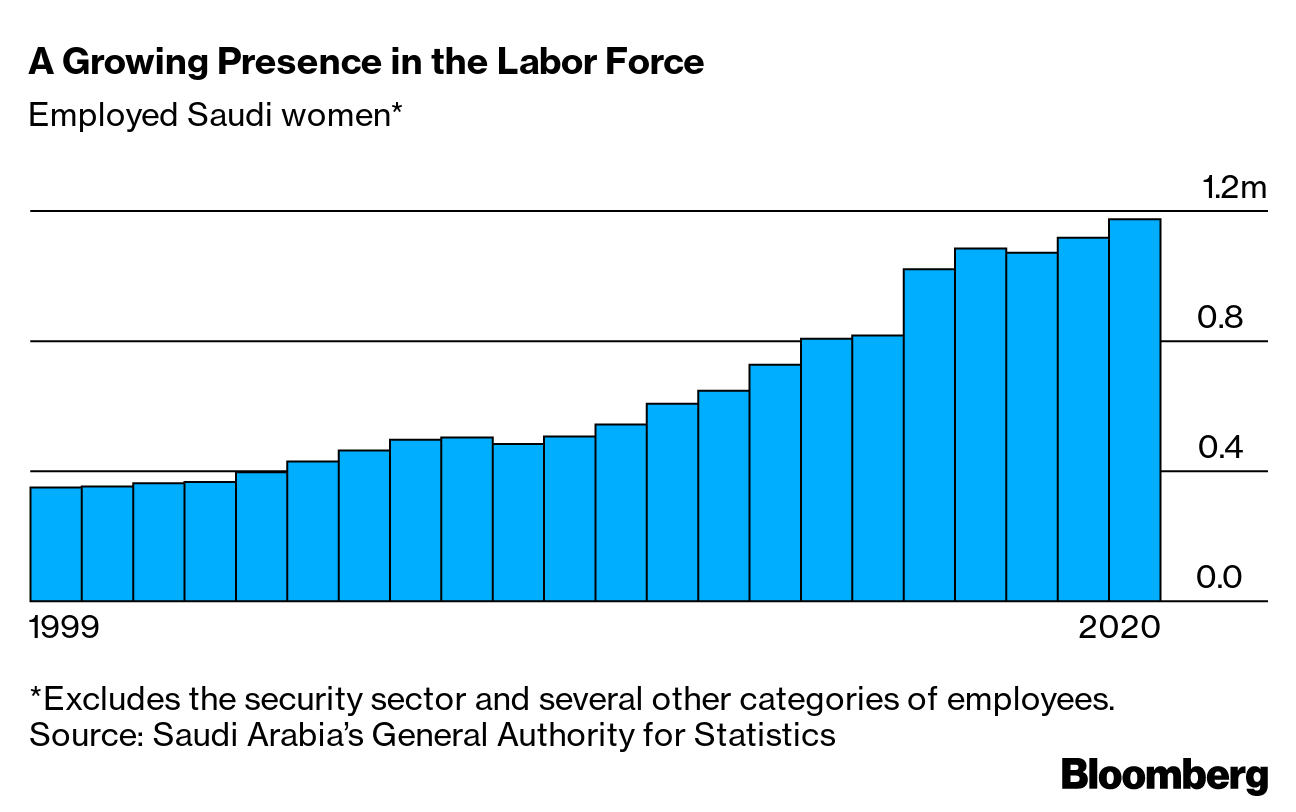

| Hello. Today we look at how more women are finding work in Saudi Arabia, the outlook for China's economy and examine if greater inequality erodes job creation at small firms. Saudi Arabia Shifts It hasn't been a women's world in the past year with the coronavirus inflicting a greater economic cost on female workers than their male counterparts. Ironically given its track record on gender, one place that doesn't hold true is Saudi Arabia, Vivian Nereim writes in Bloomberg Markets. Getting women into jobs is one of Crown Prince Mohammed bin Salman's main successes as he looks to overhaul the economy of the world's largest oil exporter and wean it off hydrocarbons. Female participation in the workforce increased from 19% in 2016 to 33% last year, according to the Saudi statistics authority. Households struggling with rising costs increasingly rely on income generated by women.  It's a phenomenon on display from the big cities to more conservative provinces, with women working as cashiers, waitresses, sales assistants, even police officers. The changes haven't been welcomed by all, with some locals worried they'll erode men's traditional role as breadwinners and guardians of their families. Progress has also been uneven. Many typically male-dominated industries such as manufacturing and construction remain so. There are roughly 18 Saudi men in the mining sector for every Saudi woman, though it narrows to 1 for 1 in fields like health, arts and hospitality. Many of the jobs opening up for women are also lower paid. They earn 57 riyals for every 100 riyals earned by men. The gap is starkest at the top, where few women sit on company boards. None sit in the Cabinet.  Noha Kattan is a deputy minister at the Ministry of Culture. Photographer: Maya Anwar Siddiqui for Bloomberg Markets Still, it's progress from 2016, when Noha Kattan became among the first women to work at what's now the Ministry of Sports. There wasn't even a women's bathroom in the building back then. Now she's a deputy minister at the Ministry of Culture, where 49% of the 667 employees are women. To go from having no bathroom to "to having this conversation now," Kattan says, is "mind-blowing." — Lin Noueihed - Got tips or feedback? Email us at ecodaily@bloomberg.net

- For the latest on how companies and institutions are confronting gender, race and class, subscribe to the Equality newsletter

- Check out the latest Stephanomics podcast, which digs into the decades-long economic slide in Youngstown, Ohio, and the flailing attempts to revive it

The Economic Scene Huizhou Baizhan Glass Co. factory in Guangdong. The combination of higher input prices, uncertainty about export prospects and a weak recovery in domestic consumer demand meant Chinese manufacturing investment from January to April was 0.4% below the same period in 2019, according to official statistics (comparing to 2019 strips out the distortion of last year's pandemic data). Due to the vast size of China's manufacturing sector, that poses a risk both to the nation's growth — which is currently predicted to reach 8.5% in 2021, according to a Bloomberg tally of economists' estimates — and to a global economy that's grappling with supply shortages and inflation. Today's Must Reads - Talking again. U.S. Trade Representative Katherine Tai and China's Vice Premier Liu He had a "candid" first conversation as the two sides try to resolve some of their differences on trade. Separately, the White House's top official for Asia said the U.S. is entering a period of intense competition with China.

- Olympic risk. Scrapping the Tokyo Olympics would inflict further damage on a Japanese economy already teetering on the brink of a double-dip recession

- Baby steps. Central banks are beginning to tip toe away from their emergency monetary settings, with New Zealand following in the footsteps of Canada to flag a potential interest-rate increase. South Korea is the latest to discuss preparing for an "orderly exit."

- Taper talk. Fed Vice Chairman for Supervision Randal Quarles said on Wednesday that it will be important for the central bank to begin discussing in coming months plans to reduce its massive bond purchases if the economy continues to power ahead coming out of the pandemic.

- Central Americas. Economic deprivation, unprecedented natural disasters and powerful human smuggling rings are doing far more to fuel a record surge of migrants to the southern U.S. border than anything said by President Joe Biden.

- Uruguay interview. The central bank still need to work on gaining credibility around its inflation fighting despite recent the recent slowing in inflation, chairman Diego Labat said.

- Spy games. South Africa's spy agency is beefing up its economic intelligence unit so it can play a proactive role in supporting the nation's companies as they expand beyond their home base.

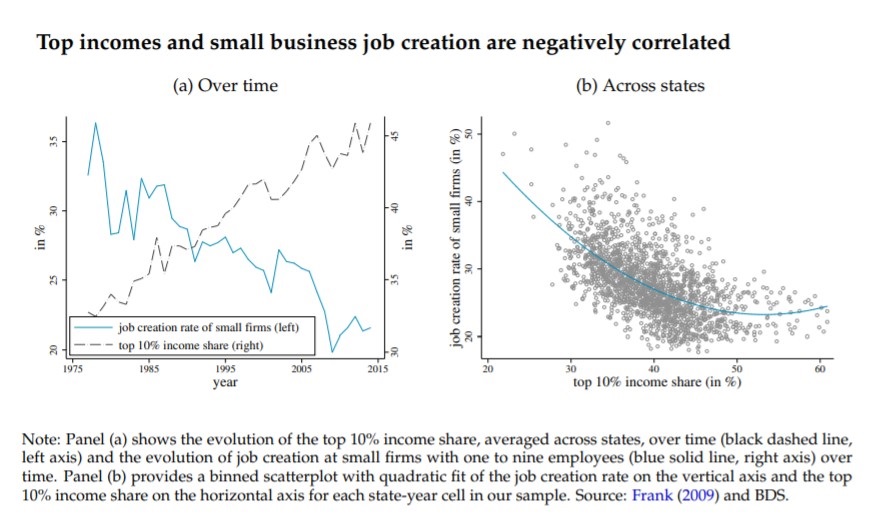

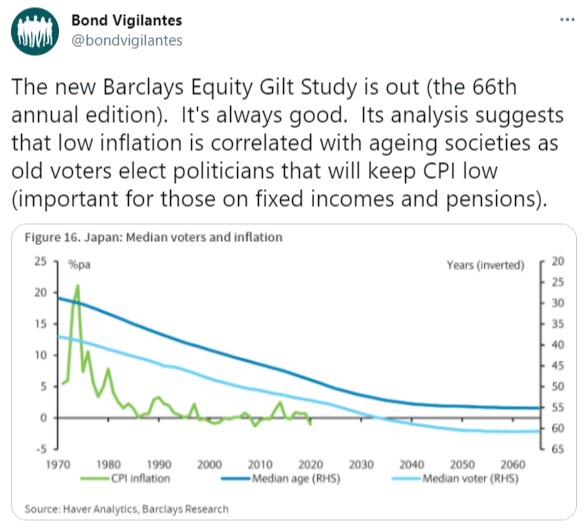

Need-to-Know Research Source: BIS Income inequality reduces the number of jobs created by small businesses, according to a new study by the Bank for International Settlements. Using four decades of U.S. data, the research concluded rising inequality reduces employment by small firms relative to larger counterparts. The reason? High-income households put relatively less money in banks than low-income families. So when incomes rise at the top, there is less money put in banks, undermining their ability to lend. As small companies depend more on bank financing than large firms, the contraction in lending hinders their job creation, the report said. On #EconTwitterPensioners don't care for inflation:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment